OYO, PhonePe, Zepto: India’s Biggest Startup IPO Year Is Here

India’s startup ecosystem is entering a phase it has been awaiting for a long long time. Ever since the first wave of IPOs in 2021. After a funding peak, a period of sharp correction, and two years of hard reset, the market is now moving towards liquidity. If 2025 reopened the IPO window, 2026 is likely to throw it wide open.

Over the next 18 months, more than 48 Indian startups are set to enter the public markets. The list cuts across sectors — fintech, ecommerce, enterprise tech, consumer internet, logistics, foodtech, and even advanced hardware and deeptech startups are here .

The 2026 IPO pipeline is notable not just for the names, which do include startups like Zepto, InMobi, PhonePe, OYO, B2B giants Infra Market and Zetwerk, and potentially even Razorpay. These are some of the biggest startups in their domain, and for this reason alone, 2026 is going to be a year unlike any other.

Unicorn Parade To The Public Markets

Collectively, the IPO batch of 2026 will likely surpass 2025’s tally of 18 listings, and even smaller companies are coming out of nowhere to go for public listings, which could completely change the equation.

While exact totals are difficult to calculate due to confidential DRHPs and pending filings and the early nature of things at this point of time in , available data suggests that key players like Flipkart, Zepto, OYO, InMobi, Fractal and Zetwerk alone could raise over INR 50,000 Cr, making it one of the largest year for startup IPO.

And not just above mentioned startups, more than 190 companies have either received approval from the Securities and Exchange Board of India (SEBI) or have draft red herring prospectuses under review, with a combined fundraising target of INR 2.5-2.65 Lakh Cr.

IPOs worth approximately INR 1.25 Lakh Cr have already received SEBI approval, allowing them to tap the market once issuers and bankers finalise timing.

“A large part of this pipeline consists of consumer and consumer-tech businesses that already operate at a national scale, with several generating multi-thousand Cr revenue runrates,” said Sayan Ghosh, founder and managing partner of Ortella Global Capital.

Per Ghosh, what is different this time is the growing role of domestic institutional and retail capital, which has improved liquidity and reduced dependence on global risk sentiment. This suggests the market is open, but with clearer filters than before.

Motiwal Oswal also expects 2026 to be a year of recovery and steady growth. Per its note, improvement in corporate earnings, supportive domestic policies and a revival in private sector investments are likely to drive market performance through the year.

However, Prashasta Seth, founder of Prudent Investment Managers believes otherwise. Per Seth, there has been a clear disconnect between the IPO market and the broader listed markets over the past year.

“Several IPOs have been priced at valuations meaningfully higher than those of comparable listed peers, yet have still seen strong oversubscription and, in some cases, delivered returns from those levels,” he said.

According to him, promoters and institutional investors have taken note of this gap, which has contributed to a surge in IPO activity, with a growing share of issues skewed towards secondary sales rather than fresh capital raising.

The Promise Of Profits

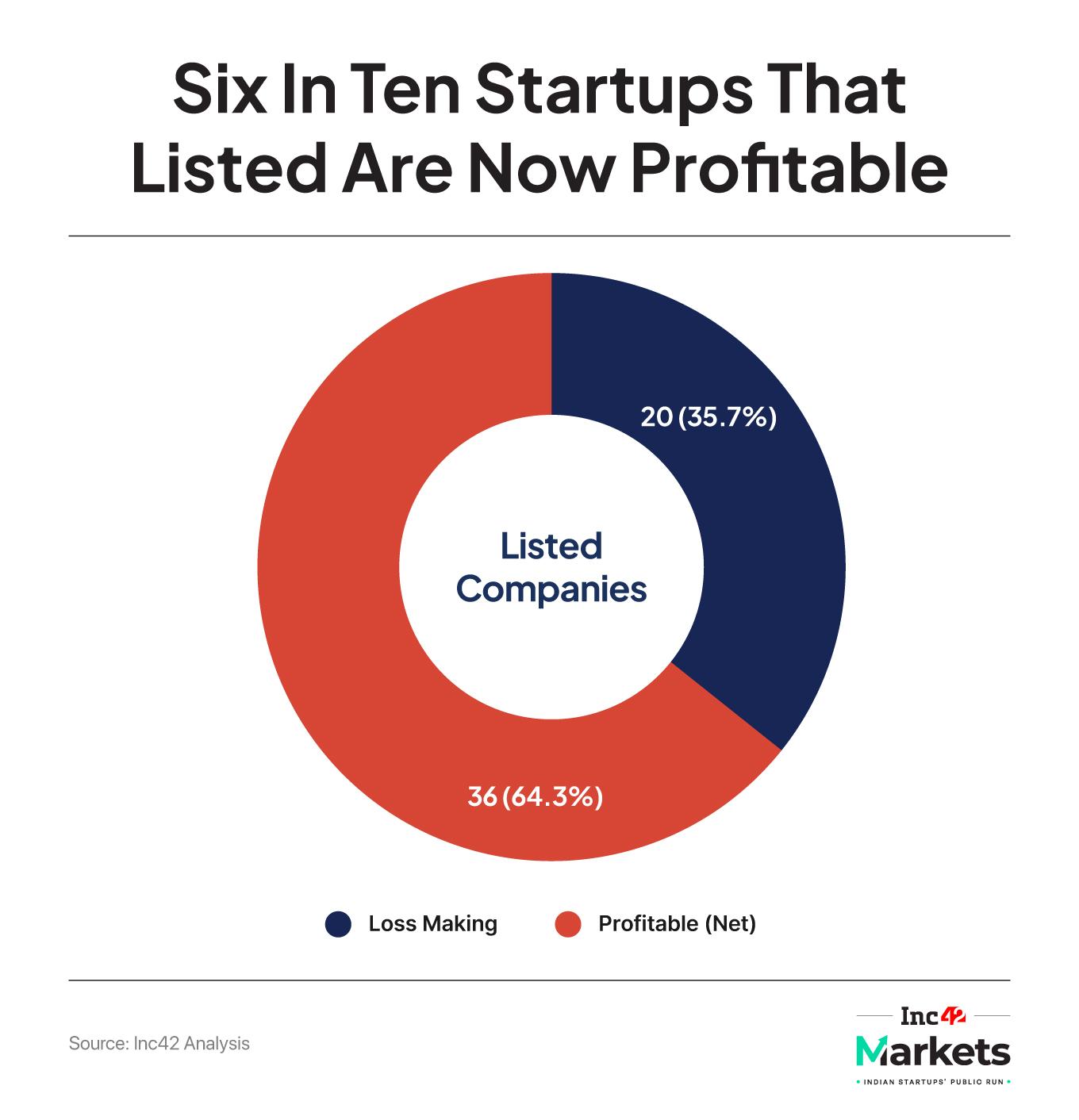

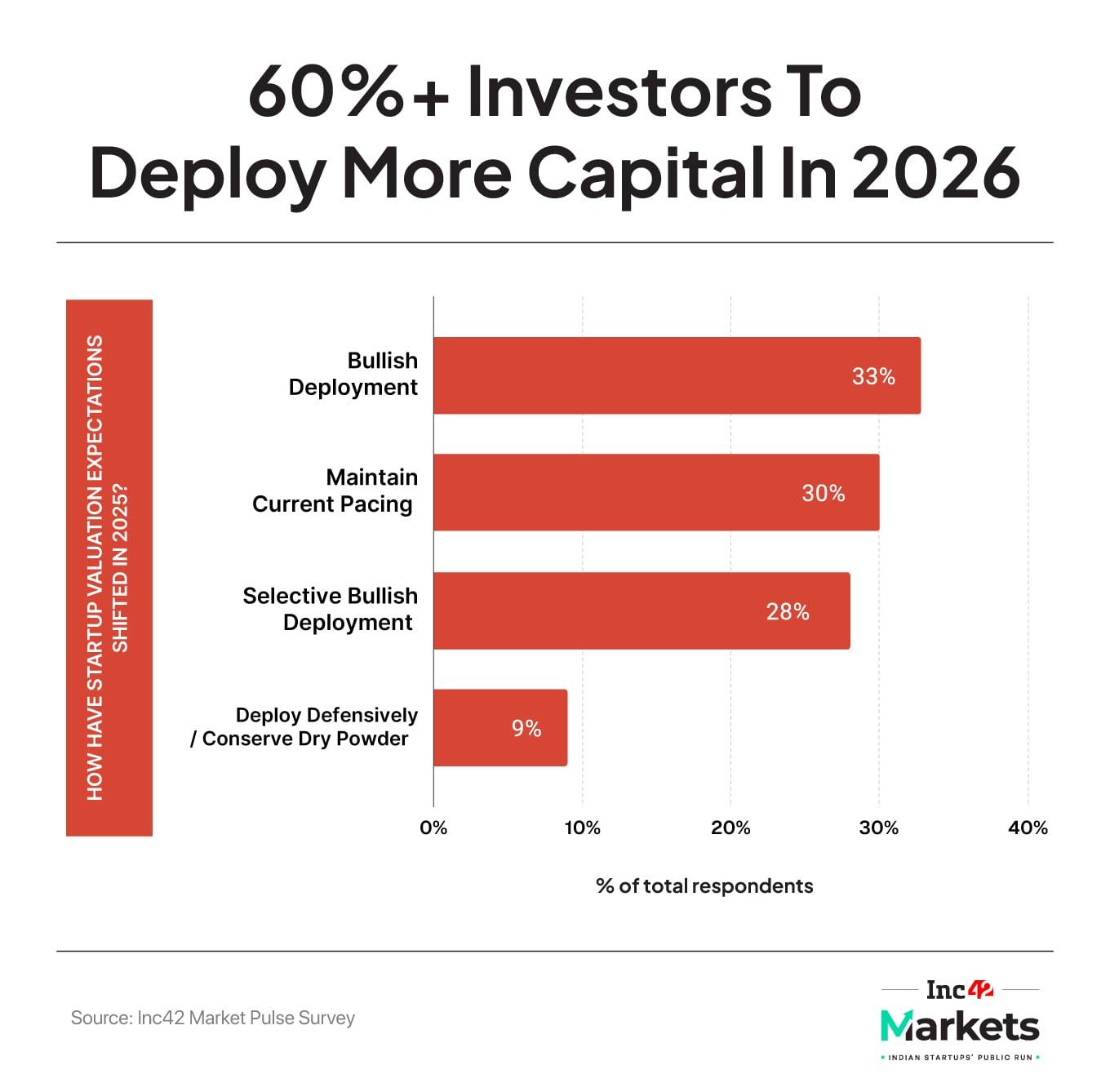

Another major shift shaping the 2026 IPO market is the changing mindset of investors. Inc42 survey data says that 48% of investors now cite stronger startup fundamentals, profitability and lower cash burn, as the primary trigger for backing tech IPOs.

Meanwhile, retail participation is seen as a key factor by 18%, while 13% point to an expanding domestic investor base.

This represents a stark departure from the pre-2022 era, when listings were largely driven by growth narratives and future potential for profits and value rather than demonstrated performance.

Today, the public market increasingly demands proof that a business can survive and scale without constant capital infusion. It is this shift that explains why many startups approaching IPOs in 2026 will look fundamentally different from their earlier incarnations: leaner, operationally disciplined, and far more measured in their expansion and discounting strategies.

Prudent’s Seth, summing up the caution, said that from the perspective of a private market investor, companies that are operationally ready would be well advised to capitalise on this window and list while conditions remain favourable.

“At the same time, from a listed-markets investing standpoint, we have largely stayed away from both pre-IPO placements and IPOs over the past year, given the valuation mismatch,” he quipped.

According to him, if retail participation cools over the course of the year, it could lead to a healthier environment where stronger companies are able to raise capital at more reasonable valuations, rather than the stretched pricing seen over much of the last 12 to 18 months.

What To Expect From 2026 Startup IPOs?

In contrast to the unrestrained exuberance of the 2021–22 era, the emerging IPO landscape for 2026 is increasingly shaped by realities and recalibration.

The exuberance that drove valuations skyward in 2024 and early 2025 has shown early signs of moderation. A growing number of recently listed companies have failed to deliver meaningful post‑listing returns, suggesting that some of the excesses of the last cycle are indeed correcting themselves.

Notably, while 2025 saw record fundraising figures, with more than 100 mainboard IPOs raising approximately INR 1.75–1.76 Lakh Cr, nearly half of these listings are now trading below their issue price, even as they generated strong subscription numbers at launch.

Part of the moderation in the IPO market stems from how recent listings have been structured. A notable portion of large deals in 2025 leaned heavily on offer for sale (OFS) components, where existing shareholders sell stock rather than companies raising fresh capital for growth.

OFS accounted for roughly 63% of the INR 1.54 lakh Cr raised in IPOs last year, highlighting that many listings were primarily liquidity events for early investors rather than capital-raising exercises for expansion. Like in the case of the PhysicsWallah IPO, where a majority of the INR 3,480 Cr issue was OFS or even Groww.

Such structures reduce the incentive for strong post-listing performance, since the listing becomes as much about unlocking shareholder value as financing future growth.

At the same time, retail investor behaviour is evolving. After two years of spectacular primary-market engagement, retail participation in 2025 shows early signs of selectivity.

The average number of retail applications fell to about 14.99 Lakh, down from 18.87 Lakh in 2024, while the proportion of IPOs oversubscribed more than ten times declined from 72% to roughly 60%.

Average retail subscription rates also moderated, dropping from 34.15x in 2024 to 26.42x in 2025. These figures suggest that retail investors are no longer chasing hype indiscriminately and are increasingly evaluating pricing, fundamentals, and long-term potential.

Institutional participation mirrors this trend. Foreign institutional investors (FIIs) pulled back, investing around 55% less in IPOs compared with 2024, reflecting caution amid high valuations and muted secondary market performance.

In contrast, domestic institutional capital, including mutual funds, has become more stabilising, now accounting for over half of anchor allocations and providing a reliable foundation to the market. The growing backing from domestic institutional investors is a big positive change in recent months and has spurred several startups to launch IPO plans.

In our conversations with CEOs of listed companies, we were told that domestic funds typically show long-term faith in a stock and which is why their stamp of approval is vital. And with domestic fund interest in new-age IPOs growing, there’s a virtuous cycle at play.

The likes of Zepto, PhonePe, OYO, Razorpay and even Flipkart by 2027 will also be attractive for domestic funds as these are all long-term bets with a high profitability upside and deep moats.

Markets Watch: New Issues, Deals & More

- Zappfresh Scoops 51% In Avyom Foodtech: Recently listed Zappresh is acquiring 51% stake in RTC meat brand Avyom Foodtech for INR 7.5 Cr, marking its entry into the ready-to-eat and ready-to-cook segment.

- Ola Electric Pops 8%: Ola Electric’s shares jumped 8% as the company reported a sharp rise in December two-wheeler EV registrations. In the month, its market share climbed to 9.3%, after a bruising 2025.

- OYO’s Third Shot At Dalal Street: OYO has pre-filed its draft papers for an INR 6,650 Cr IPO, making its third attempt at going public. The issue will include a fresh as well as an OFS component, with the valuation of about $7-8 Bn.

That’s all this week. We’ll be back next Sunday with another edition of Inc42 Markets

Till then,

Lokesh Choudhary

The post OYO, PhonePe, Zepto: India’s Biggest Startup IPO Year Is Here appeared first on Inc42 Media.

No comments