Two-Wheeler EV Sales In 2025: Bajaj, TVS Gain Ground; Ola Electric’s Share Halves

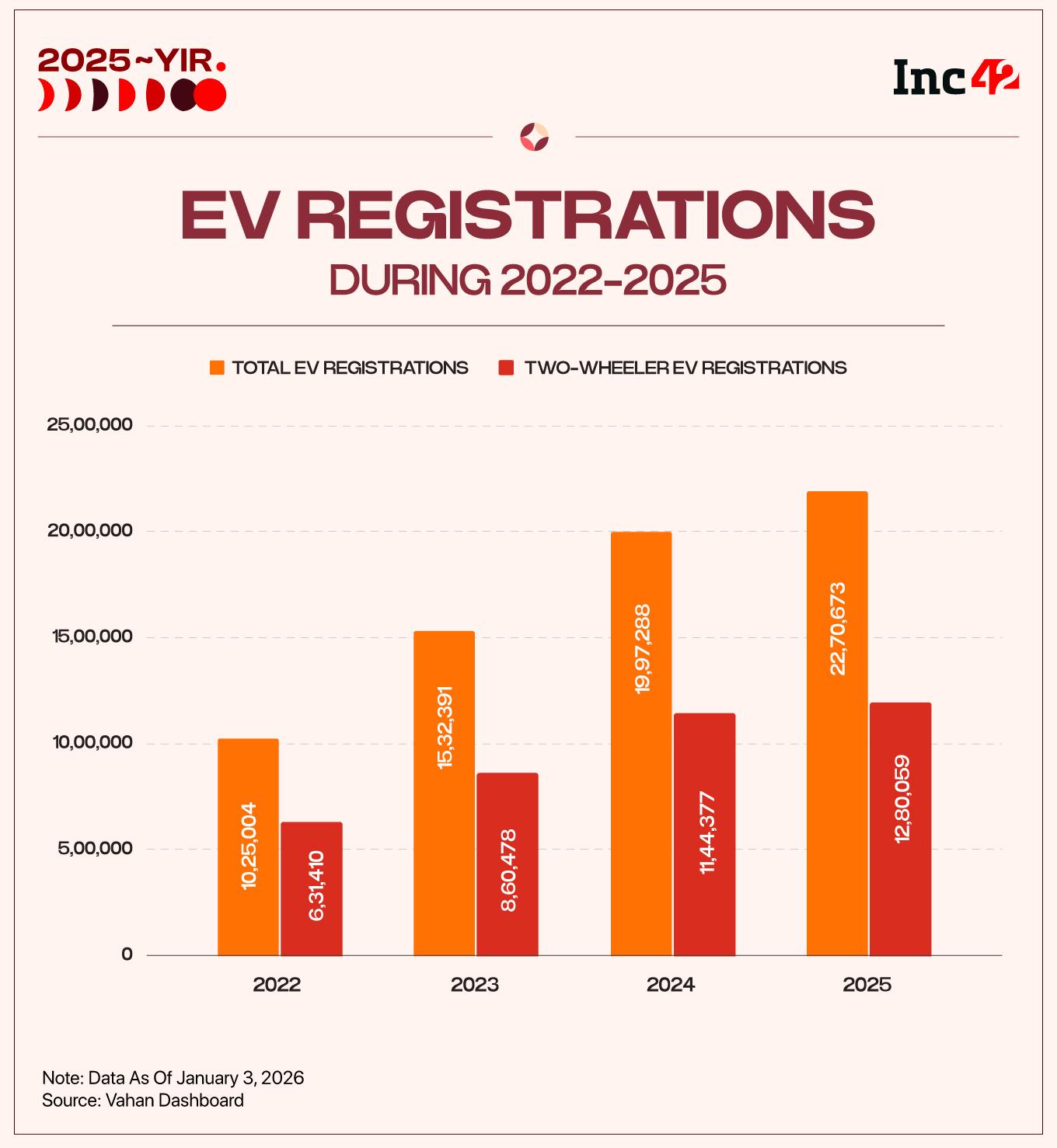

With a rising base, the growth in two-wheeler electric vehicle (2W EV) registrations saw a sharp slowdown in 2025. Industry growth declined over 20 percentage points to 11.9% last year from 33% in 2024, according to the Vahan portal. Total 2W EV registrations stood at 12.80 Lakh units in 2025 as against 11.44 Lakh units in the previous year.

A key driver of the slowdown was the exhaustion of the first wave of experimental buyers – early adopters who purchased EVs out of curiosity, subsidy benefits or enthusiasm for new-age mobility.

Industry executives say the early-adopter cohort is largely saturated, with the next wave of demand expected from everyday commuters. However, adoption among these buyers is likely to be slower, as expectations around reliability, range consistency, servicing and resale value are significantly higher.

At the same time, the policy environment has also shifted. The government tapered off the high subsidies offered under FAME-II and moved to the new PM E-DRIVE scheme with much lower per-vehicle support.

Under FAME-II, 2W EVs received incentives of up to INR 15,000 per kWh, covering as much as 40% of the vehicle cost. Under the PM E-DRIVE scheme, the incentives dropped sharply to INR 5,000 per kWh (capped at INR 10,000 per vehicle) for FY25, and will fall further to INR 2,500 per kWh (capped at INR 5,000) in FY26. The incentives similarly halved for electric three-wheelers.

Additionally, the Ministry of Heavy Industries has set a sunset date of March 31, 2026 for subsidies on 2W and 3W EVs, even though the broader PM E-DRIVE framework extends to 2028 for buses and commercial vehicles.

The cuts lifted the effective price of EVs, pushing OEMs to absorb higher costs or fast-track localisation to defend margins. While the government sees tapering incentives as a step towards a structurally healthier, subsidy-light sector, the near-term impact has been clear: slower adoption, cautious buyers and tighter finances for manufacturers.

It is also pertinent to note that many OEMs were hit by shortage of rare earth magnets last year, which caused temporary production delays. If not for it, the 2W EV registrations could have been higher in 2025.

With that said, let’s take a look at the performance of the 2W OEMs last year.

Ather Energy Overtakes Ola Electric

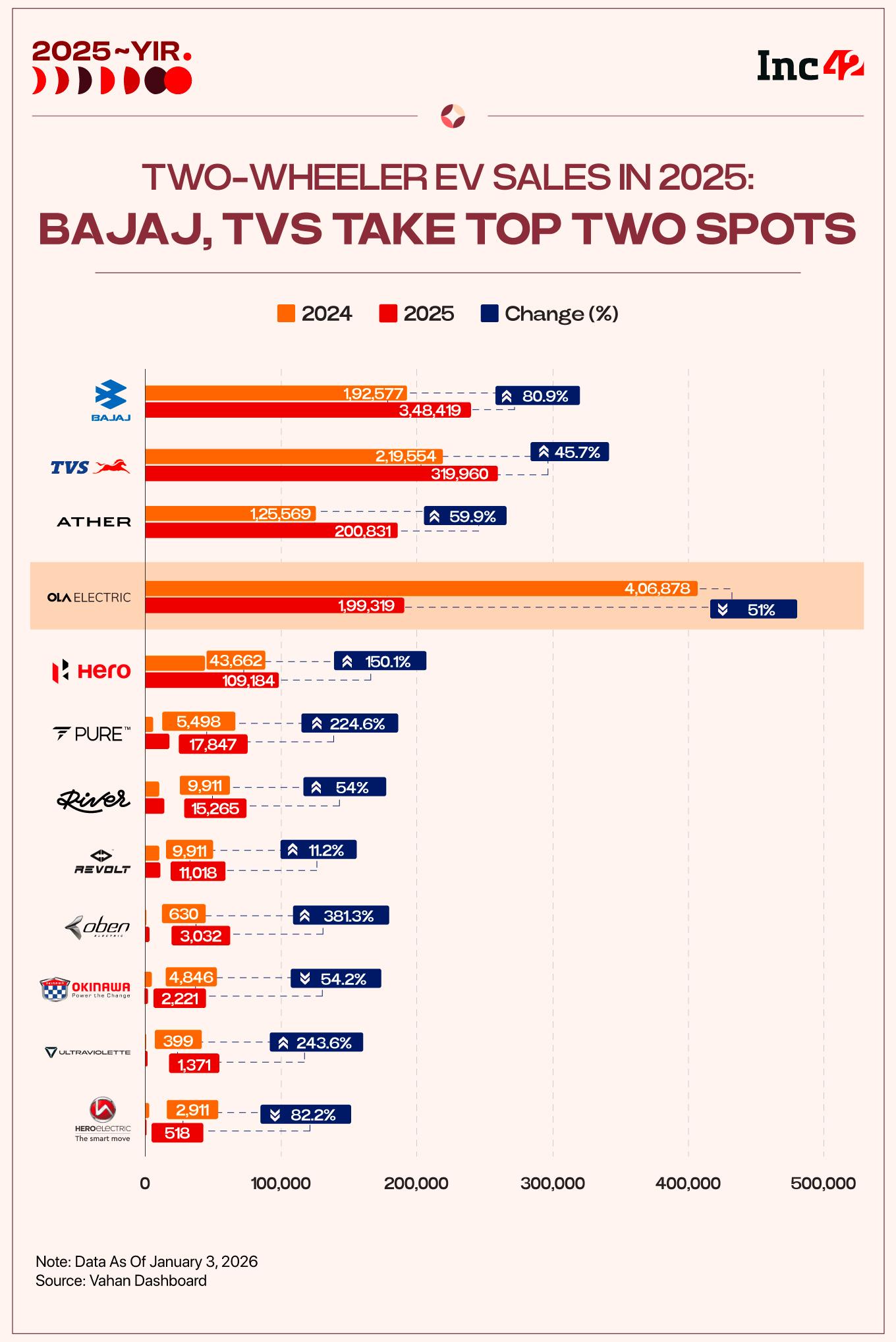

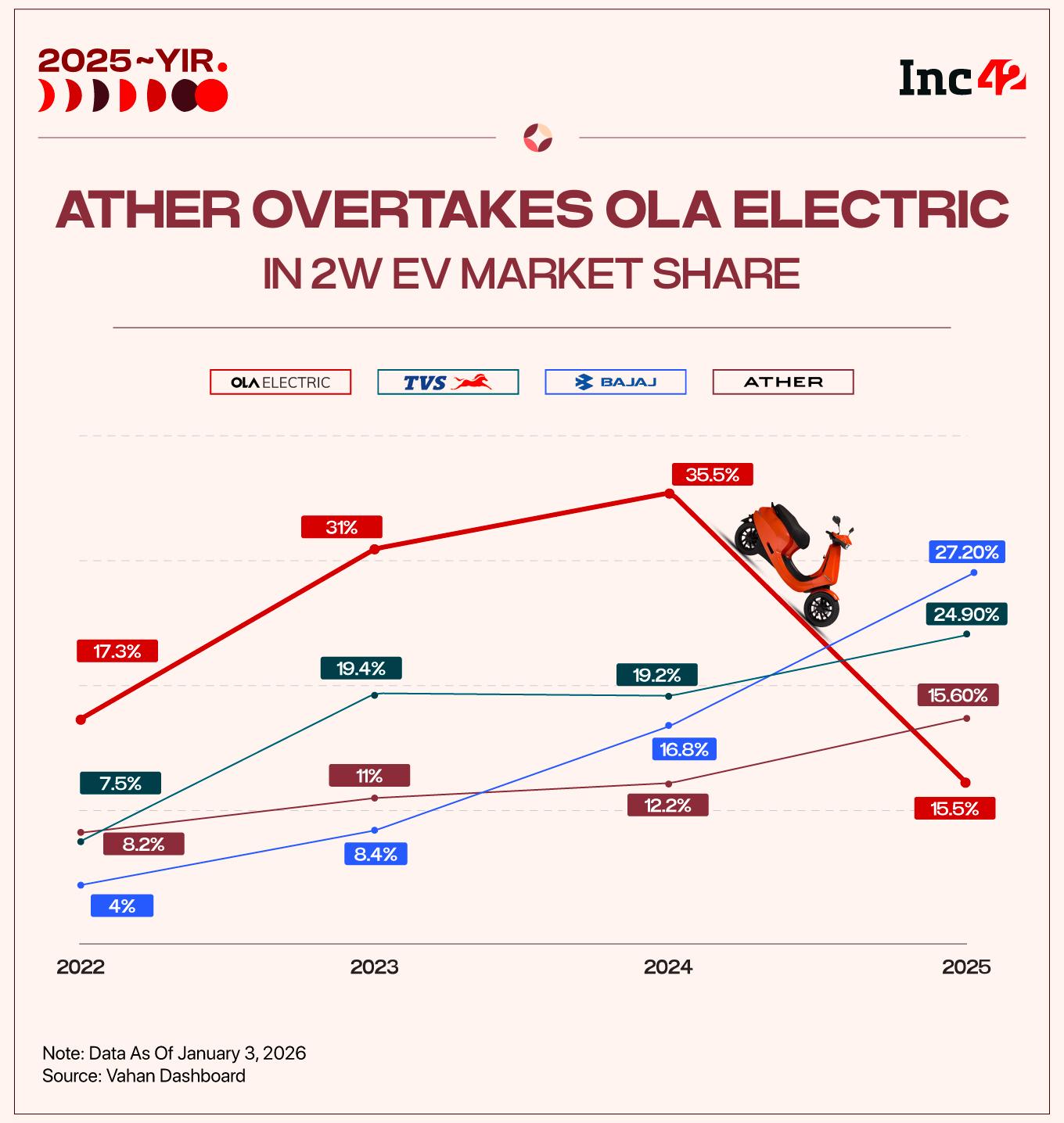

As the 2W EV market matured and competition intensified, the market-share leaderboard saw significant shifts in 2025. Bajaj Auto and TVS Motor took the top two spots in terms of market share, respectively, last year. Notably, the two legacy OEMs, which held a single-digit market share in 2022, accounted for over 50% market share in 2025.

Bajaj and TVS together held about 36% market share in 2024, which jumped to 52.1% last year.

While Bajaj’s registrations jumped 81% YoY to 3.48 Lakh units, TVS saw a 46% rise to 3.19 Lakh units.

This came on the back of their well-established dealer and service networks and brand awareness. The companies also appear to have benefited from customer complaints surrounding Ola Electric.

The Bhavish Aggarwal-led company, which was the market leader in 2024 with 35.5% market share, saw its market share fall to a little over 15%. Ola Electric’s vehicle registrations plummeted over 51% YoY last year to 1.99 Lakh units and was the only player among the top five OEMs to see a decline. Behind this fall was customer complaints about its vehicles and after-sales service.

Ola Electric’s loss was Ather Energy’s gain, with the latter overtaking the former in terms of market share. Ather Energy’s registrations zoomed nearly 60% to 2 Lakh units in 2025.

Hero MotoCorp also emerged as an unexpectedly strong performer, posting one of the highest growth rates of the year. Its EV brand, VIDA, which initially appeared slow, began showing breakout momentum by mid-2025.

In August 2025, Hero MotoCorp overtook Bajaj in monthly EV sales for the first time amid a shortage of rare earth magnets. Hero MotoCorp’s deep penetration in semi-urban and rural regions helped the brand. As a result, its registrations zoomed over 150% to 1.09 Lakh units last year.

Meanwhile, several older EV-first players such as Okinawa and Hero Electric continued to see contractions in vehicle registrations, underscoring the consolidation underway in the segment.

Total EV registrations across categories rose 13.7% to 22.70 Lakh units in 2025 from 19.97 Lakh units in the previous year.

Bajaj, TVS Emerge As Anchor Players

Last year made it clear that TVS and Bajaj are now the anchor companies of India’s two-wheeler EV market.

Bajaj saw high demand for its Chetak portfolio. The brand benefited from leveraging its deep dealer network and the familiarity of Chetak as a household name. Its steady performance across festive and non-festive months contributed to its market share rising to 21.9% in 2025.

TVS’ iQube was also one of the most consistent performers of the year, giving the company the number one spot in several months last year in terms of registrations. This was supported by the rollout of more affordable variants and an aggressive push into smaller towns, where the brand already enjoys strong equity built over years of petrol scooter dominance.

The year also brought new international competition. Japanese OEMs – Yamaha, Honda and Suzuki – entered the 2W EV space in 2025, raising expectations around product refinement and reliability.

All these sets the stage for an exciting 2026 in the 2W EV market, with legacy OEMs defending their turf, Ather and Ola Electric vying for growth, and new entrants raising the competitive stakes.

Edited by Vinaykumar Rai

The post Two-Wheeler EV Sales In 2025: Bajaj, TVS Gain Ground; Ola Electric’s Share Halves appeared first on Inc42 Media.

No comments