Fractal IPO: Turning Point For Indian Deeptech Or More AI Hype?

It’s been billed as India’s first AI IPO. Fractal, a veteran in the Indian tech landscape, is all set for its public listing.

Over the last 18 months, the Indian ecosystem has seen dozens of new-age tech IPOs — some very successful, some a little muted. But a majority of these were consumer-facing tech companies.

Over in the West, AI is the single biggest attraction for public market investors, so naturally, there’s a great deal of buzz around an Indian AI company entering the fray.

Fractal Analytics, is looking to raise close to INR 5,000 Cr from the market through a mix of a fresh issue of up to INR 1,279.3 Cr and an offer-for-sale (OFS) component of up to INR 3,620.7 Cr. This makes it one of the biggest enterprise tech listings from India’s SaaS and AI sector.

Along with Fractal, another SaaS startup, Amagi Media Labs, which provides a full-stack SaaS platform for broadcasters, streaming platforms, and content owners to create, manage, distribute, and monetise video content globally, has also received SEBI’s nod for a public listing.

This comes close on the heels of SaaS major Capillary Technologies, which made its debut on the exchanges in late November. Although it was a muted debut, the company’s shares got listed at INR 560 apiece on the BSE, a discount of 2.9% to the issue price.

Earlier in November, Pune-based powertrain controls and automotive components maker Sedemac Mechatronics also filed draft documents with SEBI for IPO.

These developments mark a major moment for India’s deeptech ecosystem. After a 20–25 year journey of deep research, product development, and slow but sustainable growth, many of India’s deeptech companies are finally waking up to the public market opportunity.

Although investors may not see Fractal as a pure-play deeptech IPO, the fact that others such as IdeaForge and Ather have already gone public shows that the AI and deeptech segment is steadily gaining momentum when it comes to such exits.

But like we mentioned above, AI mania — or what many call a bubble — has gripped markets abroad. Is India about to follow suit?

Why Fractal’s IPO Feels Different From The Rest

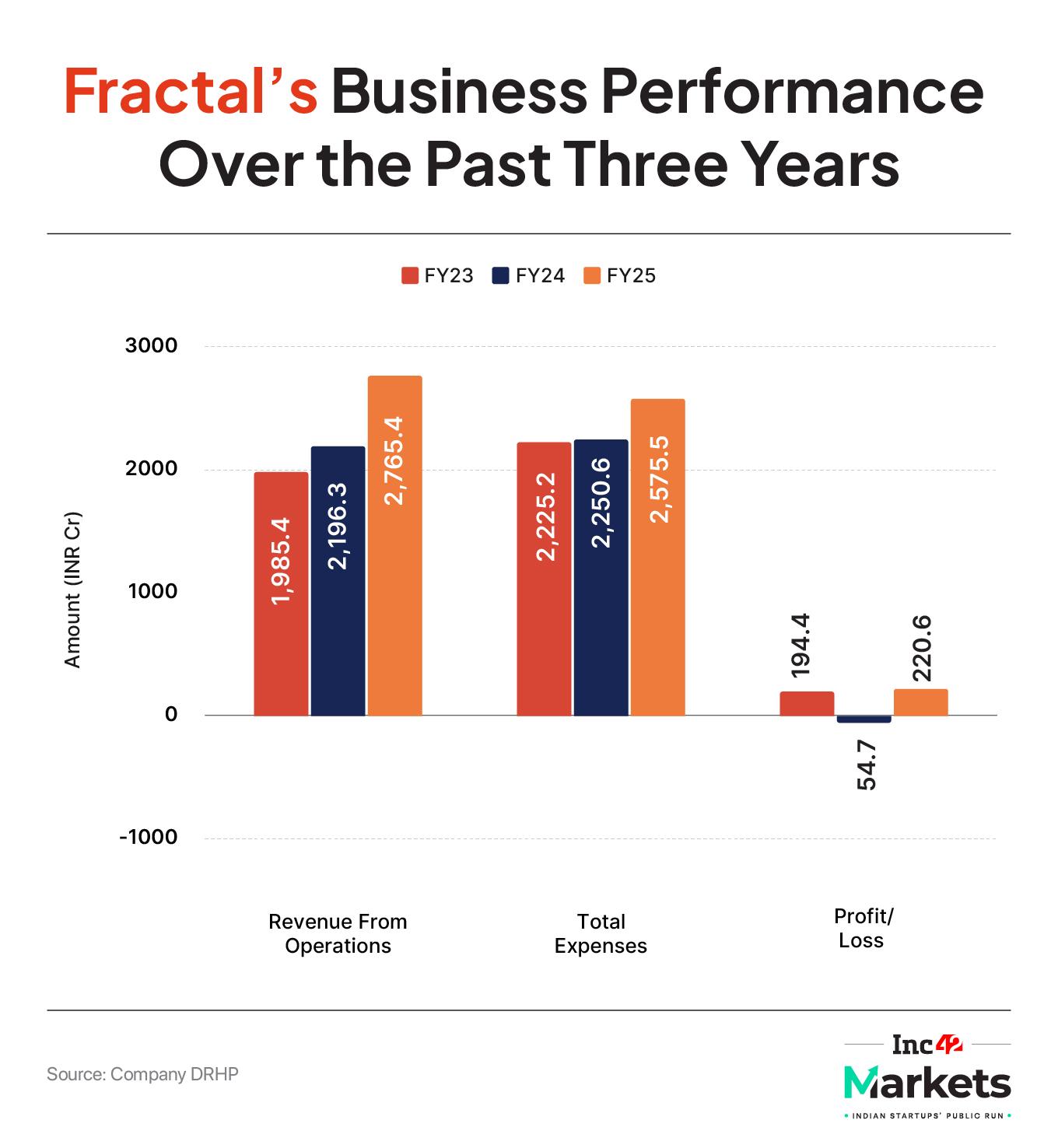

Founded 25 years ago, Fractal genrated profit in FY25, and this wasn’t a small turnaround. The company reported a consolidated net profit of INR 220.6 Cr, compared to a loss of INR 54.7 Cr in FY24.

Revenue grew to INR 2,765.4 Cr in FY25 from INR 2,196.3 Cr the previous year, while EBITDA margin rose to 17.4% in FY25 from 10.6% in FY24 — a huge 68% boost.

The fundamentals are robust, but according to market analysts, Fractal stands out for a different reason.

Until now, India’s public markets have been missing one important piece of the tech puzzle, a truly AI-native company. Despite all the talk around artificial intelligence and its growing presence across industries, no company built primarily on AI has made it to the Indian stock exchanges.

Traditional IT services firms may use AI in their offerings, but they remain services-led businesses. Fractal, on the other hand, is fundamentally different. Its core identity is built around AI, analytics. not as a supporting function, but as the product itself.

This difference is exactly what makes Fractal stand out. Investors around the world are shifting their focus toward companies that build scalable software products rather than sell services by the hour. In that context, Fractal doesn’t just represent another IPO rather it represents a new category for India’s public markets.

“Given that this is an AI startup, there will naturally be both interest and some amount of doubt. People have seen what’s happened in the US, so curiosity is definitely there. However, much of it is also driven by speculation. While it is a profitable business, valuation-wise it appears expensive. In markets like this, hype often carries more weight than actual fundamentals,” independent market analyst Ambareesh Baliga said.

Is Deeptech Maturing?

But deeptech maturity is not just about a few companies going public. What’s more significant is the signal this sends. For years, deeptech startups in India have largely remained in the private domain, supported mainly by development capital and long-term institutional backers.

An IPO represents both a psychological and structural shift. Deeptech is no longer seen as an experimental or purely research-driven segment; it is now viewed as a business category capable of scale, profitability, and public market accountability.

One of the most important consequences of deeptech IPOs is a change in investor mindset. Traditionally, deeptech in India has relied heavily on development capital such as government grants, institutional funds, and patient investors focused more on nation-building and long-term innovation than on immediate financial returns, Ashwin Raghuraman, cofounder of Bharat Innovation Fund, said.

Plus exits for investors have been largely limited to two routes: acquisitions and secondary share sales. The emergence of IPOs creates a third, powerful exit channel, increasing confidence among both founders and investors.

On one end, liquidity from public markets allows investors to recycle capital, raise larger successor funds, and continue the investment cycle. Previously, the ecosystem was heavily dependent on M&A, and Indian corporates, often seeking bargain deals rather than strategic value, tended to acquire companies at low valuations.

The IPO wave has delivered two important proofs. “First, it demonstrates that deeptech can generate strong returns. Second, it challenges the long-held belief that deeptech companies take far longer to reach successful outcomes. In fact, a direct comparison shows that Ather has not taken significantly longer than consumer or fintech companies such as Paytm to reach scale or exit milestones,” said Ravi Jain, investment director at TDK Ventures India, which invested in Ultraviolette recently.

This also reveals a different growth pattern: while the first signs of monetisation in deeptech may appear later, once they do emerge, the scale-up tends to be rapid. This further erodes the myth that deeptech is too slow or too risky to be a viable investment category.

All of these factors are exactly what limited partners look for: proof of returns, clarity on exit pathways, and predictable timeframes. As a result, LP confidence is likely to increase, encouraging fund managers to gradually raise their allocation to deeptech investments, the venture capitalists said.

Overall, this marks a highly positive shift for funds that are actively exploring or specialising in deeptech, as the sector is now seen not only as innovative, but as both investable and capable of monetisation at scale.

What Deeptech Startups Must Navigate After Listing

On the other side, going public puts deeptech companies under intense pressure to deliver quarterly performance, from revenue growth to profitability and transparency, all under constant public and investor scrutiny.

Newly listed companies, in particular, are under the microscope. “After initial excitement fades, it’s important to take a cold look. If we look at the IPOs launched after April, nearly 45 of them are currently trading below their issue price, including those on the SME platform. This highlights the risk of inflated valuations driven more by market sentiment than by underlying fundamentals,” Baliga said.

The challenge post-IPO is balancing this long-term focus with short-term market expectations. Founders need strong management capabilities to maintain R&D depth while delivering near-term traction, and the class of investors they attract plays a critical role, Jain said. Long-term investors understand the value of intermediate milestones, even if they are non-monetary, while short-term investors may push for immediate financial results.

A useful parallel comes from India’s pharmaceutical sector, where listed companies invest heavily in R&D but communicate progress through regulatory approvals, clinical milestones, and research breakthroughs.

“These updates keep investors engaged and informed, demonstrating value even before financial returns materialise. Similarly, deeptech IPOs can manage market pressure by sharing R&D milestones, educating investors, and building a long-term-focused shareholder base,” TDK’s Jain added.

However, Bharat Innovation Fund’s Raghuraman thinks the balance of short term traction and R&D may not be very difficult for deeptech startups. Unlike consumer startups, which often prioritise growth first and technology later, deeptech companies are built on R&D from day one. By the time they reach the IPO stage, their technology is typically mature, tested, and market-proven, making innovation the foundation of both product and culture.

Can Investors Trust The Hype Around AI?

Can Investors Trust The Hype Around AI?

Yet, despite this strong technological base, evaluating companies like Fractal using traditional valuation methods is far from straightforward.

“In the short term, however, strong market sentiment could still translate into solid listing gains for Fractal and possibly even outperforming many recent consumer tech IPOs. A premium debut wouldn’t come as a surprise, especially given the momentum seen across new listings in recent months,” Baliga added.

This is why IPOs like Fractal should not be viewed as simple buy-and-forget opportunities, he added. Instead, retail investors should keep a close eye on technology cycles, global innovation trends.

“What is presented at the IPO stage can often look very different just one or two years down the line. Most people don’t fully understand the complexity of these technologies, and in that knowledge gap, hype tends to take over rational evaluation,” market analyst at a top brokerage firm said.

Traditionally, investors stayed away from businesses they couldn’t clearly understand. Today, however, many retail participants are simply chasing returns, which significantly increases risk.

From this perspective, tech IPOs, especially deeptech and AI are currently viewed more as trading opportunities than long-term bets. And even as short-term plays, they demand close monitoring. Unlike traditional industries, where investors can occasionally “buy and forget,” the pace of technological change makes that strategy almost impossible in this space.

Global developments also have an outsized influence. International breakthroughs, policy changes, and successes or failures of similar companies abroad can directly shape sentiment and valuations in India. A few years ago, few could have predicted the scale of AI’s impact. Today, it is impacting what investors are willing to bet on.

Markets Watch: New Issues, Post-IPO Journey & More

- Aequs Datalabs Sets IPO Price Band: Aequs Datalabs has fixed its IPO price band at INR 118– INR 124, with the issue opening on December 3 and listing expected on December 10.

- Meesho Targets Valuation Of Up To INR 50,096 Cr In Upcoming IPO: Meesho has fixed its IPO price band at INR 105–INR 111, valuing the company at up to INR 50,096 Cr ($5.6 Bn) at the upper end.

- SEBI Cracks Down On DroneAcharya: SEBI has penalised DroneAcharya, its founders Prateek and Nikita Srivastava, and associated advisors INR 75 lakh for alleged fraud, inflated revenues, poor disclosures, and misuse of IPO funds.

- Ola Electric Board Clears Plan To Raise Up To INR 1,500 Cr: Ola Electric has received board approval to raise up to INR 1,500 Cr as the loss-making EV maker works to bolster its cash reserves.

[Edited by Nikhil Subramaniam]

The post Fractal IPO: Turning Point For Indian Deeptech Or More AI Hype? appeared first on Inc42 Media.

No comments