Ola Electric’s Plan B

When a hero product begins to wobble, the founder’s first instinct is almost always the same: pull the diversification lever. That’s exactly the crossroads where Bhavish Aggarwal of Ola Electric is finding himself standing. And he has been swift in diversifying. In October, Aggarwal launched Ola Shakti, a residential battery energy storage system (BESS).

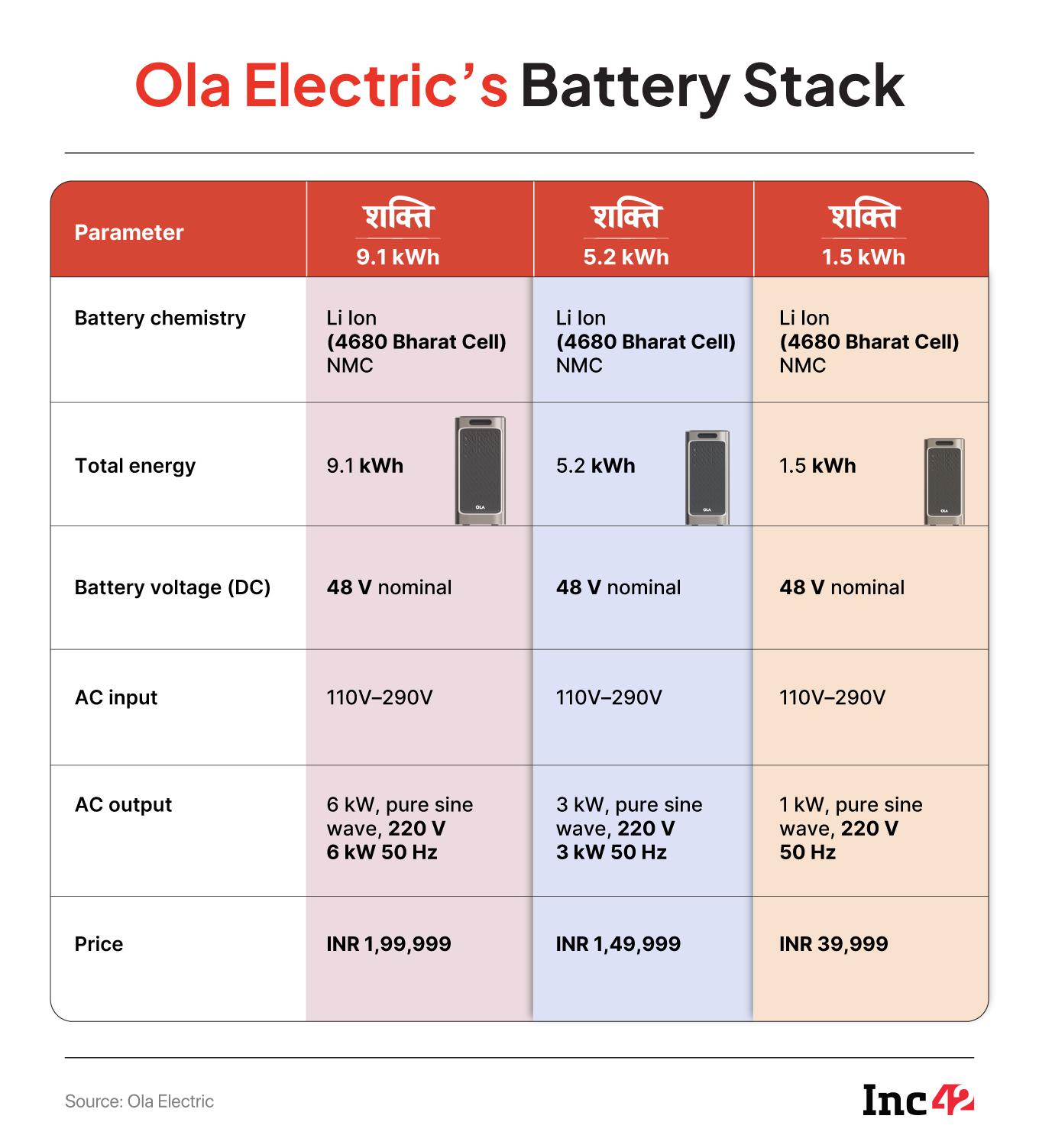

The device, which uses Ola’s in-house 4680 Bharat Cells, has been built to provide power backup to residential units, farms, and commercial purposes.

But why this diversification from an EV maker, one may ask?

Well, once celebrated as India’s largest electric vehicle maker, with a commanding 30% market share, Ola Electric’s state of affairs is in complete shambles. The company has lost its leadership position, thanks to its shrinking monthly unit sales, which it acknowledges could fall even further. Then, raising fresh capital has become challenging for the EV maker.

The tension is clearly visible. While its losses continued to take a toll on its balance sheet, compounded with falling revenues, its cash balance dropped to INR 2,903 Cr in Q2 FY26 from INR 3,959 Cr in March 2025.

This erosion has bit Ola Electric, and Aggarwal has been forced to shift his narrative and capital towards an ancillary business that he hopes will eventually reduce costs and offset slowing scooter demand.

While the future holds the answer to whether the bet will eventually pay off, let’s trace how the EV juggernaut skidded out of the fast lane.

The EV Rocket That Lost Its Grip

For years, Ola Electric symbolised India’s EV two wheeler revolution. Despite arriving later than its Bengaluru rival Ather Energy, Ola Electric sprinted ahead with a strong brand recall, aggressive marketing, and rapid scale-up of its scooter manufacturing.

For a brief period, the company held a 30% market share. Ola Electric has struggled to be consistent.

Poor after-sales service, unresolved quality concerns, and intensifying competition steadily eroded its lead.

Compounding this, Ola Electric quietly shelved its ambitions in electric three-wheelers and cars, signalling that the company was stretched way too thin.

The situation further worsened when, in a bid to conserve cash, Ola Electric abruptly discontinued discounting, an aggressive pricing tactic that had fuelled its early rise. Without subsidies, customers simply walked away. The sales collapse was immediate, allowing Ather Energy to overtake Ola Electric.

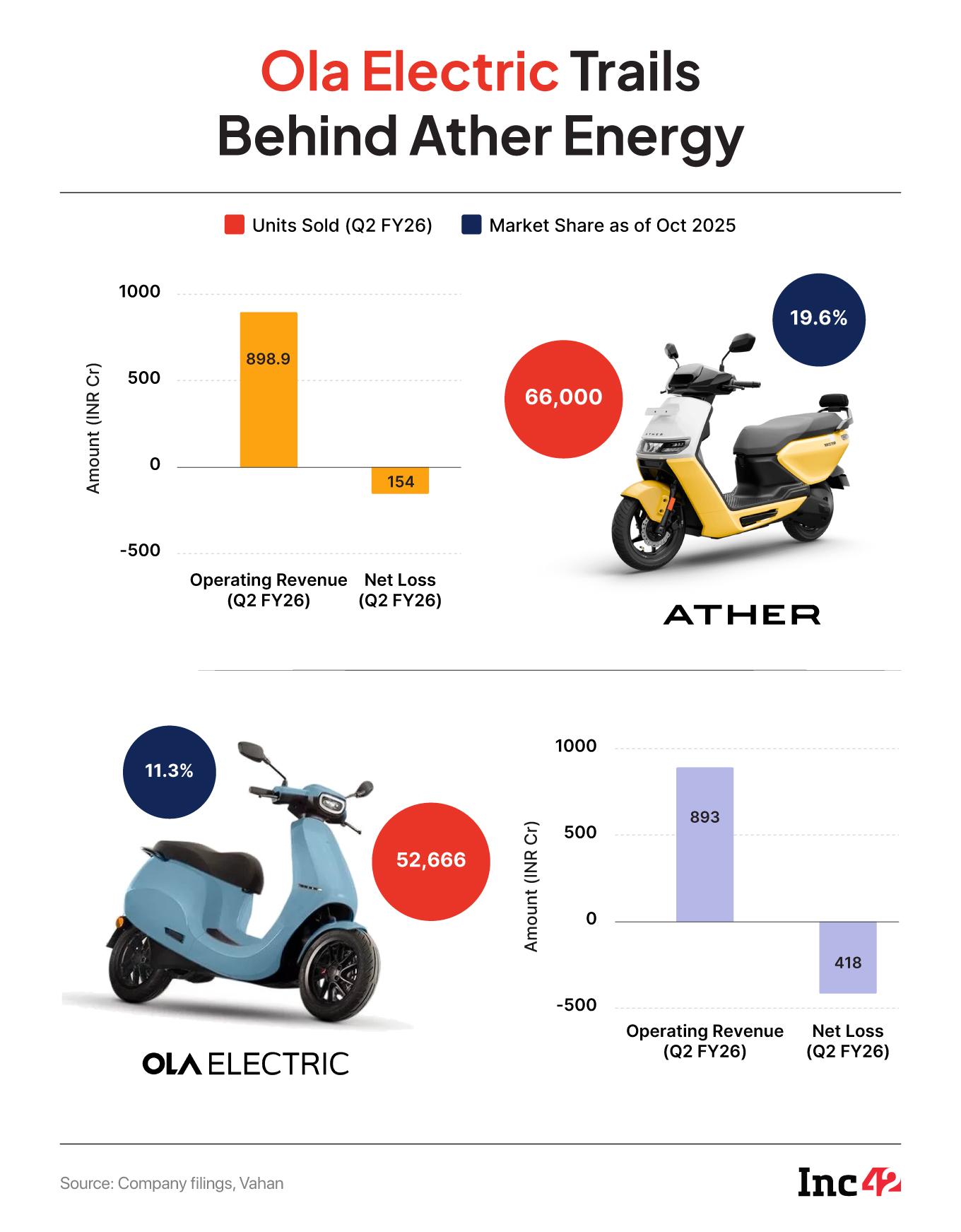

While Ola Electric sold around 52,666 units in Q2 FY26, Ather sold around 66,000 units in the quarter.

This reversal of fortunes has made fundraising exceedingly difficult for the EV major. Lenders have steered clear of the company’s proposal to raise INR 1,700 Cr via debt, a plan that was approved by the company board in May 2025. But more than six months later, the company is yet to conclude this raise.

Now, the company wants to raise INR 1,500 Cr in a mix of debt and equity, for which it received a shareholder nod this week.

While the company has avoided stating the reasons for this change in plans, backers are wary of declining sales and the absence of a stable operating model.

Ola Electric’s Backup Plan

On a sticky wicket, the listed EV maker has switched to plan B — B for battery.

In a move that many believe was inspired from Tesla’s journey, Aggarwal announced in 2022 that Ola Electric would manufacture its own cells to gain control over costs and supply chains.

By 2024, Bhavish Aggarwal was ambitiously projecting a 100 GWh battery cell capacity, even as Ola Electric was laying the groundwork for a mere 1.4 GWh.

Delays were inevitable. The much-touted “indigenous” battery cell, expected to be mass-produced in 2023, finally entered production in Q1 FY26, almost two years behind schedule.

Then, just one quarter after stating that Ola Electric would complete 5 GWh of installation by FY26, Aggarwal revised the target to 5.9 GWh by FY26-end and 20 GWh by the second half of 2027.

This ongoing course correction, with every milestone pushed back again and again, shows that it has been rather tough for Aggarwal to scale its battery manufacturing. Besides, the cell business is a major cash guzzler.

In Q2 FY26, its battery vertical, Ola Cell Technologies, clocked a mere INR 4 Cr in top line (up from INR 1 Cr in Q2 FY25), while losses surged a massive 61% YoY to INR 79 Cr.

To aid the slowing sales of its EV scooters, Ola needs a new narrative, and ideally, a new revenue generator. And its diversification to battery tech fits perfectly.

Aggarwal sees FY26 as a ‘transition year’ where Ola activates its next growth vector in energy. He claims this energy segment will generate INR 100 Cr by Q4 FY26, and INR 1,200 Cr by FY27.

Given Ola’s history of overpromising and underdelivering, these numbers could be just fancy mumbo jumbo.

An Uncertain Road Ahead

Aggarwal is now reportedly pitching his newly launched residential battery system to investors, an implicit sign that the scooter business no longer inspires confidence on its own. But the path ahead is fraught with structural challenges.

The battery storage market is already dominated by giants such as Exide and Amara Raja that have deep pockets, strong goodwill, and powerful distribution networks.

While the market is dominated by lead acid battery systems sold at relatively low price points, Ola Electric is attempting to sell pricey lithium-ion packs, priced in the range of INR 29,999 to a steep INR 1,59,999, depending on capacity.

Then there’s the challenge of building a nationwide distribution network from scratch, which will put even more pressure on the company’s already strained balance sheet. Putting pressure further on this will be Ola’s credibility in the market.

Its new 4680 cells, though positioned as a technological breakthrough, are untested at scale. The company’s history of quality issues with its scooters still hangs over it, and any reliability problems with these battery packs could cripple the segment even before it takes off.

Aggarwal may be betting big on energy storage, but he is entering a category where reputation, reliability and service matter more than hype – the areas where Ola still has significant ground to gain.

As for now, Ola Electric’s diversification to energy storage appears to be a defensive manoeuvre against sliding scooter sales, missed fundraising attempts, and eroding investor trust.

Aggarwal may frame this as the company’s next growth frontier, but the reality is that Ola is stepping into a capital-heavy, competition-dense industry with untested technology, a fragile brand trust, and weak balance sheets.

The question is simple: Is Ola only delaying the inevitable, or charting a real comeback?

Edited By Shishir Parasher

The post Ola Electric’s Plan B appeared first on Inc42 Media.

No comments