GainBitcoin Back On The Radar, Delhi NCR Funding Report & More

Raj Kundra Tangled In GainBitcoin Mess

The alleged INR 90,000 Cr GainBitcoin scam is back in the news. Raj Kundra, businessman and husband of actor Shilpa Shetty, has been summoned by a special PMLA court on January 19 in connection with the case. But why is he under the radar of authorities?

Beyond A Mediator: The summon follows ED filing a chargesheet last year, alleging that Kundra’s role in the scam went beyond that of a mediator. The agency claims that he earlier received 285 Bitcoins from the scam’s deceased mastermind, Amit Bhardwaj, to set up a Bitcoin mining farm in Ukraine. While the deal did not materialise, ED alleges that Kundra is still in possession of Bitcoins valued at over INR 150 Cr.

The agency also claims that Kundra managed to carry out “clean” transactions with his wife to disguise the origin of the funds obtained from alleged criminal activities.

ED On Crypto Trail: Kundra appears to have been under the scanner of the agency for some time now. In April 2024, ED attached assets, including a flat in Mumbai and a bungalow in Pune, worth INR 97.8 Cr belonging to the celebrity couple. The directorate also seized assets worth more than INR 10.63 Cr, including properties owned by Bhardwaj in Dubai, as part of the probe.

The GainBitcoin Fraud: The alleged scam was a crypto-based Ponzi scheme that started circa 2015. The scheme lured investors with promises of 10% monthly returns in Bitcoin for 18 months through “cloud mining” contracts. When new investments dried up in 2017, the operators switched payouts from Bitcoin to their in-house token MCAP (mining capital), which had significantly less value.

The scam is estimated to have defrauded around 1 Lakh victims, making it one of India’s largest cryptocurrency frauds. So, will Kundra’s court appearance unlock access to the Bitcoin wallets, or will the digital trail remain cold? Let’s find out…

From The Editor’s Desk

Delhi NCR’s 2025 Funding Report

Delhi NCR’s 2025 Funding Report

- The Delhi NCR-based startups raised $2.2 Bn across 224 deals last year, overtaking Mumbai to become India’s second most-funded startup hub after Bengaluru. However, funding declined 4% YoY from $2.3 Bn in 2024.

- Delhi NCR remains a startup hub owing to its proximity to policymakers, affluent consumer market, IIT Delhi and IIM Lucknow talent pool, dense VC network, and strong infrastructure connectivity.

- Over 1,700 Delhi NCR-based startups have raised over $47 Bn in the past decade (28% of India’s total). The region also hosts 23 listed new-age tech companies and several unicorns and soonicorns.

Even Healthcare Nets $20 Mn

Even Healthcare Nets $20 Mn

- The healthtech startup has raised fresh funding from existing and new backers to expand its hospital footprint in Bengaluru and scale its managed care services business. With this, it has raised $70 Mn to date.

- Founded in 2020, Even Healthcare offers subscription-based services for doctor consultations, diagnostics, and medical guidance. The startup claims that its first hospital in Bengaluru achieved operational breakeven within six months.

- The fundraise comes amid renewed investor interest in the sector. Homegrown healthcare startups raised $746 Mn across 78 deals in 2025, up 4% and 37%, respectively.

Tax Outgo Hits Blue Tokai’s FY25

Tax Outgo Hits Blue Tokai’s FY25

- The speciality coffee chain clocked a record INR 325.4 Cr operating revenue in FY25, up 1.5X YoY. However, losses declined only 20.2% YoY to INR 50.2 Cr due to soaring rent expenses and tax liabilities during the fiscal year.

- The startup’s bottom line was hit by a tax outgo of INR 11.1 Cr in FY25 as against a tax gain of over INR 1 Cr in the preceding fiscal year. Notably, the coffee brand’s loss before tax fell almost 40% YoY to INR 39.1 Cr.

- Founded in 2013, Blue Tokai operates four roasteries and over 100 physical outlets across key Indian metros and two international locations in Tokyo and Dubai. It has raised over $97 Mn to date from Verlinvest, 12 Flags, A91 Partners and others.

CCI Okays Prosus’ Acquisition Of Rapido Stake

CCI Okays Prosus’ Acquisition Of Rapido Stake

- The competition commission has approved the Dutch investor’s proposal to pick up a stake in the ride-hailing giant. It is unclear if the nod covers only secondary purchases or the fresh equity round, too.

- This comes months after Prosus purchased Rapido shares worth INR 1,968 Cr from Swiggy and an additional stake worth INR 145 Cr from TVS Motor. Following this, Rapido’s board also approved a plan to raise $200 Mn at a $2.5 Bn to $2.7 Bn valuation.

- The VC firm has been doubling down on Rapido for some time now, viewing the mobility startup as a key portfolio bet ahead of its potential IPO. Other IPO-ready Indian startups in Prosus’ portfolio include PayU India, CaptainFresh, Mintifi, and Eruditus.

Nexus Partner Quits To Float Startup

Nexus Partner Quits To Float Startup

- SuprDaily cofounder Puneet Kumar has exited the VC firm less than two years after joining as a venture partner in May 2024. He is now building a startup in stealth mode.

- His exit comes shortly after Nexus closed its eighth fund with a corpus of $700 Mn to back early stage startups in AI, enterprise tech, consumer services, and fintech across India and US.

- In total, Nexus manages $3.2 Bn in assets across eight funds. It has so far backed 130+ startups, including names such as listed Delhivery, IPO-bound Infra.Market, Zepto, Rapido, and Postman.

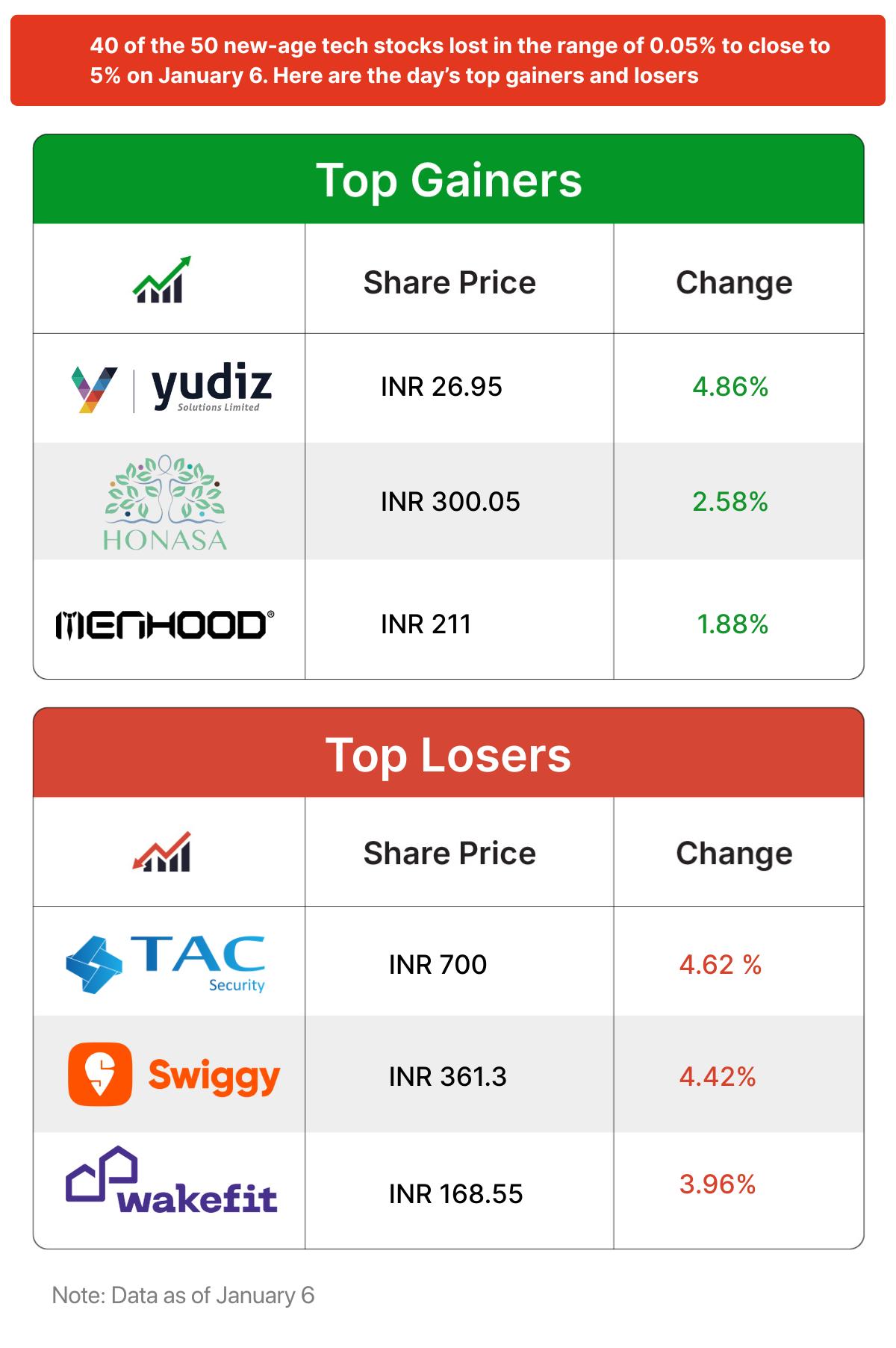

Inc42 Markets

Inc42 Startup Spotlight

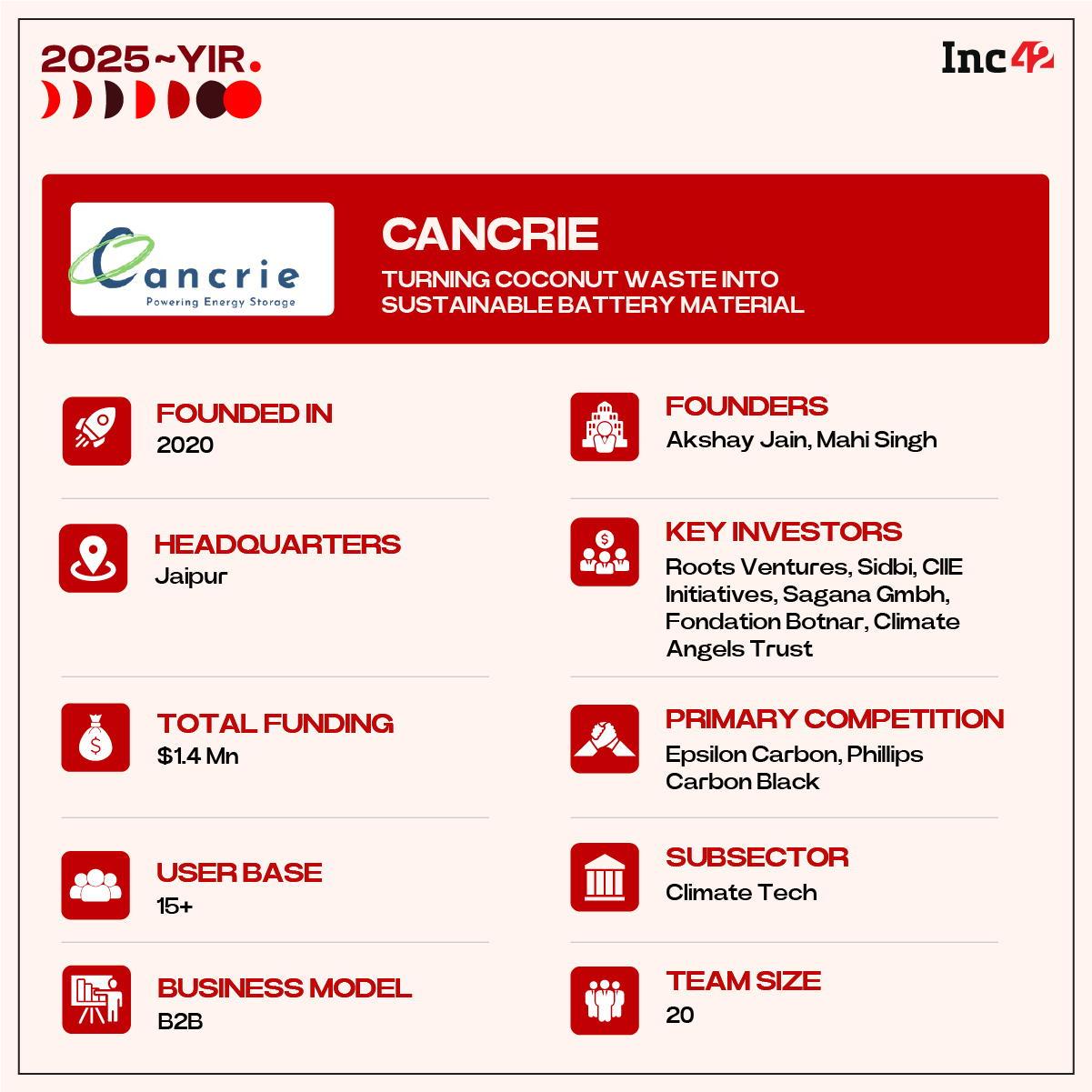

How Cancrie Is Using Coconut Shells To Stir A Battery Revolution

India is the third-largest coconut producer globally, but discarded shells often end up as agricultural waste. However, Jaipur-based Cancrie is upcycling this rich biomass into high-performance battery components.

Patented Nanocarbon Tech: Founded in 2020, Cancrie converts coconut shell waste into components for next-generation batteries using patented technology to produce customised nanocarbons tailored for different battery chemistries. The company claims that it can improve battery life by 25-30% by reducing heat loss and improving charge efficiency.

Commercialisation & Traction: Cancrie claims to have so far sold 50,000 batteries that embed its nanocarbons. The startup is also running trials with lithium-ion, lithium-iron phosphate, and sodium-ion batteries. It is also launching paid pilots with Mercedes and completing drone pilots with lithium-ion batteries.

Eye On Exports: Backed by IIMA Ventures and SIDBI, the startup claims to have scaled its production 15X and begun exports, positioning itself as a sustainability-led player in the battery manufacturing ecosystem. But can Cancrie coconut-to-carbon playbook disrupt India’s battery materials market?

Infographic Of The Day

After a bumper 2025, at least 48 Indian new-age tech companies are eyeing public listings over the next 18 months. So, which startups are jumping on the IPO bandwagon?

The post GainBitcoin Back On The Radar, Delhi NCR Funding Report & More appeared first on Inc42 Media.

No comments