From Ripplr To Neo — Indian Startups raised $195 Mn This Week

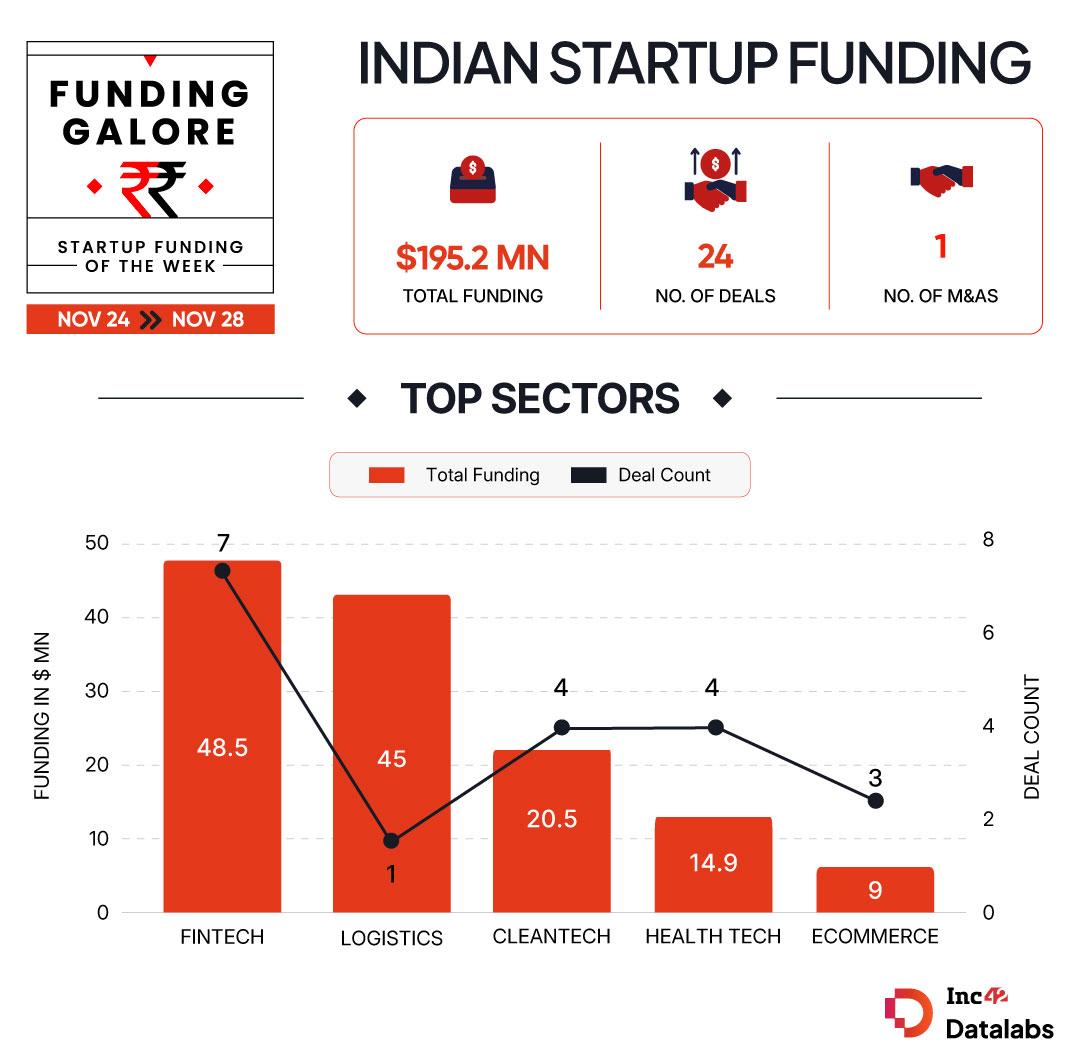

Week-on-week startup funding had a spike for the second consecutive week, as a total of 24 Indian startups cumulatively raised $195.2 Mn from November 24-28, up 14% from $171 Mn raised in the previous week.

Ripplr’s $45 Mn Series C round was the biggest deal of the lot, followed by the $35 Mn infusion into Square Yards by Smilegate VC. Not far behind was Neo Group, which raised $25 Mn from Crystal Investment Advisors and other investors.

Here’s a look at all the deals of the week:

Funding Galore: Indian Startup Funding Of The Week [ Nov 24 – 28 ]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 28 Nov 2025 | Ripplr | Logistics | Inventory & Warehousing | B2B | $45 Mn* | Series C | 3one4 Capital, SBI, other existing investors | – |

| 28 Nov 2025 | Square Yards | Proptech | Property Listing & Discovery | B2B, B2C | $35 Mn | undisclosed | Smilegate VC, undisclosed exisiting investors | Smilegate VC, |

| 25 Nov 2025 | Neo Group | Fintech | Investment Tech | B2B,B2C | $25 Mn | undisclosed | Crystal Investment Advisors (Atha Group), Morde Foods Pvt. Ltd. | Crystal Investment Advisors (Atha Group) |

| 22 Nov 2025 | Agnikul | Advanced Hardware & Technology | Spacetech | B2B | $17 Mn** | – | Advenza Global, Artha Select Fund, Atharva Green Ecotech, HDFC Bank, Prathithi Ventures, 100X.VC | – |

| 24 Nov 2025 | Wealthy | Fintech | Investment Tech | B2B | $14.4 Mn | Series B | Bertelsmann India Investments, Shepherd’s Hill, Alpha Wave Global | Bertelsmann India Investments |

| 26 Nov 2025 | 3ev | Cleantech | Electric Vehicles | B2B | $14.4 Mn | Series A | Mahanagar Gas Limited (MGL), while it saw participation from Equentis Angel Fund and Thackersey Group. | Mahanagar Gas Limited (MGL) |

| 26 Nov 2025 | Mirana Toys | Ecommerce | D2C | B2C | $6.4 Mn | Series A | Arkam Ventures, with participation from Accel, Info Edge and Riverwalk Holdings. | Arkam Ventures |

| 25 Nov 2025 | immunitoAI | Health Tech | Lifescience | B2B | $6.1 Mn | Series A | Ashish Kacholia, 3one4 Capital and AC Ventures, pi Ventures, Anicut Capital, JITO Incubation & Innovation Foundation and LVX, JJ Family and Angels. | Ashish Kacholia |

| 27 Nov 2025 | Tijori | Fintech | Investment Tech | B2B, B2C | $5 Mn | undisclosed | Zerodha | Zerodha |

| 25 Nov 2025 | Morphle Labs | Health Tech | Healthcare Devices | B2B | $5 Mn | Series A | Inflexor Ventures | Inflexor Ventures |

| 27 Nov 2025 | Neuron Energy | Cleantech | Electric Vehicles | B2B | $3.4 Mn | pre-Series B | Equanimity Ventures, Rajiv Dadlani Group, Thackersay Family Office, Chona Family Office | Equanimity Ventures |

| 25 Nov 2025 | CrisprBits | Health Tech | Lifescience | B2B | $3 Mn | pre- Series A | Spectrum Impact, promoter family of HBL Engineering and C-CAMP (Centre for Cellular and Molecular Platforms), Vijay Alreja Family Office, and founders Vijay Chandru, Sunil Arora, Rajeev Kohli, Bharat Jobanputra and Aditya Sarda. | Spectrum Impact |

| 27 Nov 2025 | Sports For Life | Consumer Services | Hyperlocal Services | B2C | $2.7 Mn | Series A | Fireside Ventures, Genesia Ventures, Roots Ventures, and TDV Partners | Fireside Ventures and Genesia Ventures |

| 26 Nov 2025 | Arctus Aerospace | Advanced Hardware & Technology | Aerial Vehicles | B2B | $2.6 Mn | pre-seed | Version One Ventures, South Park Commons, gradCapital, former Coinbase CTO Balaji Srinivasan and OpenAI CTO Srinivas Narayan | |

| 26 Nov 2025 | axiTrust | Fintech | Fintech SaaS | B2B | $2.6 Mn | Seed | General Catalyst, Atrium Angels, YAN Network, Supermorpheous | General Catalyst |

| 24 Nov 2025 | FAE Beauty | Ecommerce | D2C | D2C | $2 Mn | – | Spring Marketing Capital, Titan Capital, Winners Fund, Arihant Patni | Spring Marketing Capital |

| 26 Nov 2025 | Enerzi | Cleantech | Climate Tech | B2B | $1.8Mn | Seed | Capital A and 8x Ventures | Capital A |

| 27 Nov 2025 | BatteryPool | Cleantech | Electric Vehicles | B2B | $894K | Pre-Series A | Inflection Point Ventures, Indian Angel Network (IAN), Chennai Angels, Keiretsu Forum | Inflection Point Ventures |

| 25 Nov | Riverline AI | Fintech | Fintech SaaS | B2B | $825K | Pre-seed | South Park Commons, DeVC, gradCapital, and undisclosed angel investors from Google, Meta, Tesla, M2P, HyperVerge. | South Park Commons |

| 27 Nov 2025 | Yuvrit Ayurveda | Health Tech | In-Clinic Healthcare | B2C | $800 K | Seed | Incubate Fund Asia | Incubate Fund Asia |

| 25 Nov 2025 | Navanc | Fintech | Fintech SaaS | B2B | $670K | pre-Series A | GrowthCap Ventures, Navin Kukreja (Founder, Paisabazaar), Gaurav Aggarwal (former CXO, Paisabazaar),Prasanna Rao (cofounder, Arya.ag) | GrowthCap Ventures |

| 26 Nov 2025 | ONYA | Ecommerce | D2C | B2C | $614K | pre-seed | Zeropearl VC, MyGate founders Vijay Arishetty, Abhishek Kumar, Shreyans Daga, and Rohit Jindal, Amal Mishra, and Alkendra Pratap Singh. | Zeropearl VC |

| 27 Nov 2025 | Lemnisca | Media & Entertainment | Gaming | B2B | – | Pre-seed | Theia Ventures, PointOne Capital, and Satakarni Makkapati | Theia Ventures |

| 25 Nov 2025 | Blostem | Fintech | Fintech SaaS | B2B | – | pre-Series A |

Key Startup Funding Highlights Of The Week

- Another week and the fintech sector continued to be investors’ favorite segment. The segment witnessed a total of 7 deals, across which startups cumulatively raised $48.5 Mn.

- Cleantech also managed to be one of the most prominent sectors with 4 startups raising a total of $20.5 Mn this week.

- 3one4 Capital, South Park Commons, and gradCapital were the most active investors this week, backing two startups each.

Startup IPO Updates This Week

- B2B contract-manufacturing company Zetwerk hired six major investment bankers — including Kotak Mahindra Capital, JM Financial, Avendus Capital, and the Indian arms of HSBC, Morgan Stanley, and Goldman Sachs — to helm its $750 Mn IPO.

- Aequs IPO will open for subscription on December 3. The company set the price band at INR 118–124 per share, implying a valuation of around INR 8,316 Cr ($930 Mn) at the upper end. It has reduced its IPO size to the fresh issue of INR 670 Cr, and the offer-for-sale (OFS) will comprise around 2.03 Cr shares.

- The ecommerce giant Meesho has set the price band for its IPO at INR 105–111 per share. The issue will open on December 3. At the upper end of the price band, the IPO will value the company at INR 50,096 Cr (about $5.6 Bn).

- SaaS unicorns Fractal Analytics and Amagi Media Labs received SEBI’s approval to proceed with their public issues. While Fractal’s IPO will comprise a fresh issue of up to INR 1,279.3 Cr and an OFS component of up to INR 3,620.7 Cr, Amagi’s public listing will offer a fresh raise of up to INR 1,020 Cr and an OFS of up to 3.41 Cr.

Mergers And Acquisitions Updates

- Business accounting startup Vyapar acquired AI-powered accounting automation startup Suvit in an undisclosed financial deal. With this acquisition, Vyapar aims to enhance its digital compliance capabilities for MSMEs.

- Listed auto classifieds platform CarTrade dropped the idea of acquiring CarDekho’s parent entity Girnar Software Private Limited. However, the listed entity did not disclose the rationale behind the fall through of this potential deal.

Fund Updates This Week

- Mobility-focused VC firm AdvantEdge founders claimed that it generated 11X returns from its first fund, AdvantEdge Fund I, driven primarily by the firm’s partial exit from Rapido.

- VentureSoul Partners plans to close its maiden INR 600 Cr venture debt fund by February 2026. It has secured commitments for the INR 300 Cr base fund, of which 72% has already been received, and is now raising an additional INR 300 Cr via a greenshoe option.

Other Developments

- BYJU’s founder plans to seek $2.5 Bn in damages via a defamation legal suite against the consortium of lenders, Glas Trust. Byju Raveendran claimed that earlier court proceedings denied him sufficient time to get a US attorney

- The Enforcement Directorate (ED) took WinZO cofounders Saumya Singh Rathore and Paavan Nanda into custody under provisions of the Prevention of Money Laundering Act (PMLA). The arrest was followed by an interrogation at the company’s Bengaluru zonal office

- Dream11 parent entity Dream Sports open-sourced the tech stack (HorizonOS) behind its platform. The company aims to make its tech infrastructure available to startups and MSMEs across ecommerce, fintech, health tech and other sectors.

- The parent company Eternal has infused INR 600 Cr into Blinkit, marking the third such infusion this year and signalling a fresh push for expansion in quick-commerce via aggressive dark-store growth.

- Rapido and magicpin announced collaboration, through which Rapido is exploring to expand Ownly’s footprint beyond Bengaluru. In return, magicpin will have access to Rapido’s delivery fleet in certain locations.

The post From Ripplr To Neo — Indian Startups raised $195 Mn This Week appeared first on Inc42 Media.

No comments