Is Food Delivery The Silver Lining For Zomato, Swiggy?

Food delivery-turned-quick commerce giants Swiggy and Zomato have seen significant erosion in value and stock price in the past month, with Swiggy dropping by around 45% and Zomato by 30%. Pertinently, Swiggy hit its all-time low this past week before bouncing back curiously just after reports of the food delivery business being undervalued.

A lot of the pressure from sellers in the past few months has been down to the view that any profitability for these companies is short-term because of expenditures to come.

Spending and investments in quick commerce (QC) is not only for increasing market share but also fighting off Zepto and others. This has crystallised attention on this segment, but perhaps taken the eye off food delivery, which is still a strength according to one report this week.

ICICI Securities claims that the current market valuations of Swiggy and Zomato do not reflect the full scope of their businesses. The brokerage’s analysis says Swiggy is trading approximately 30% below the value of its food delivery operations alone, even without accounting for the negative implied value to its quick commerce vertical.

Even Zomato, which is a more mature stock, is not pinned to the QC business, says ICICI Securities. The brokerage claims that investor sentiment is influenced more severely by short-term financial concerns than long-term growth potential.

Food delivery has remained EBITDA profitable for both companies since mid-2023. Although growth in the segment slowed in the third quarter of FY25, the brokerage claims a boost in spending from the tax cuts in the latest budget is not unexpected.

The Contrarian View

It relies on past instances of tax cuts to base its thesis, but to play devil’s advocate, this largely depends on how discretionary spending grows in key markets for Zomato and Swiggy and how much of the share of the higher consumer spending these platforms can grab.

Food delivery growth in the short term has come through experiments such as 15-minute food delivery, but longer-term value still remains unlocked. Swiggy began charging an additional 2% fee from restaurant partners in February. But investors would perhaps be more willing to stick to see persistent and repeatable growth rather than short spikes.

Beyond food delivery, quick commerce will continue to face scrutiny over cash burn and competition. At one point, quick commerce was seen as a growth hope, but now the reliance is turning towards food delivery to prop up Zomato and Swiggy. Quick commerce, for now, is a cash burn business.

Just a few days ago, Zomato’s Deepinder Goyal stirred things up by suggesting that Zepto was responsible for half of the industry’s INR 5,000 Cr quarterly burn.

“This statement is verifiably untrue and it will be clear when we publicly file our financial statements. However, I know Deepinder, and I know he has only good intentions; this quote could have been taken out of context or said as an honest mistake,” Zepto CEO Aadit Palicha responded on LinkedIn.

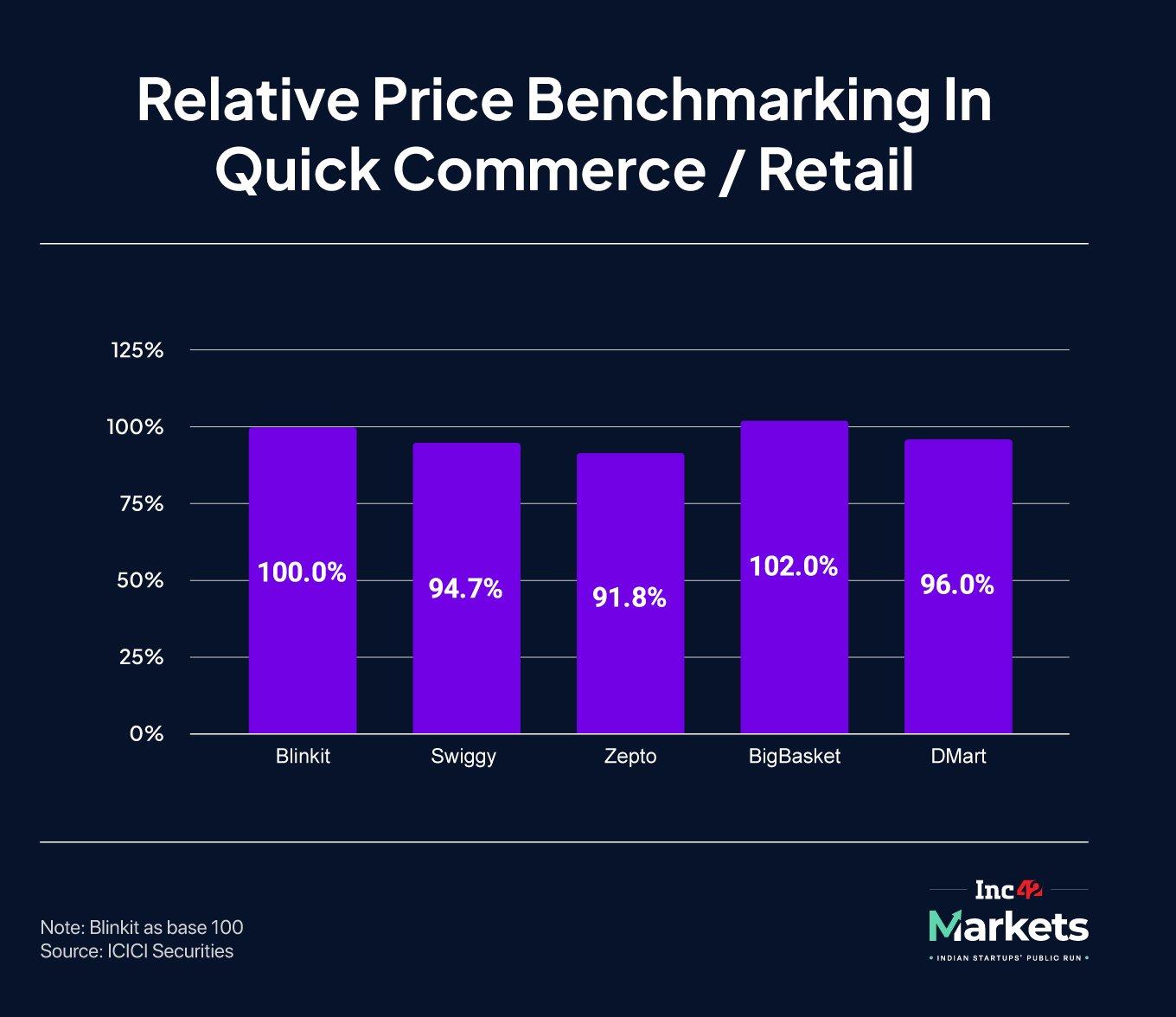

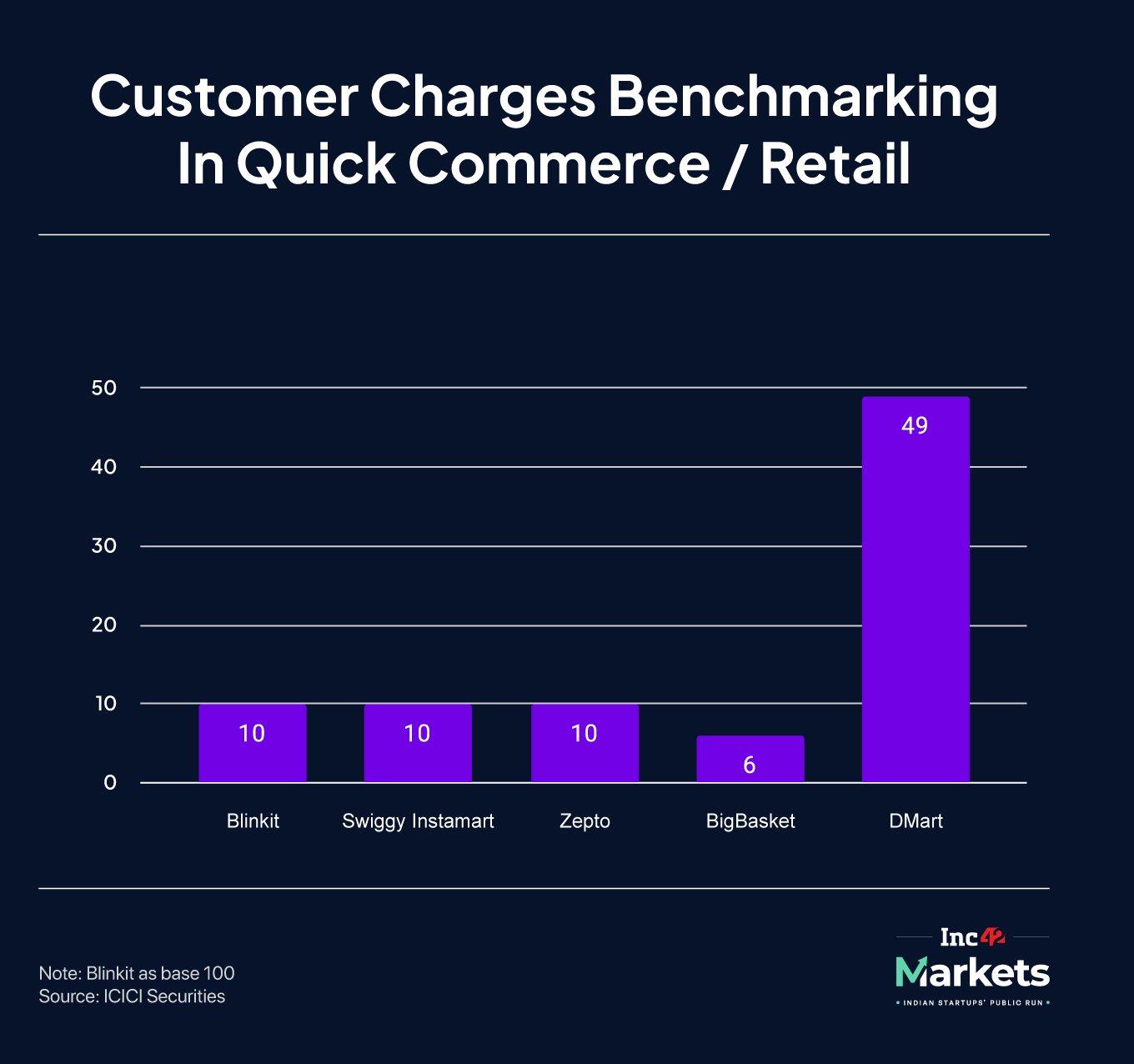

What’s undeniable is that discounting is a major factor in quick commerce — we are seeing something akin to the Swiggy-Zomato battle of the early days but with around five or six players vying for market share.

Turning focus to profitability means losing out on some market share in the short term and then burning more to catch up. It’s this cycle of spending for growth that has complicated the profitable growth potential of quick commerce.

As for food delivery, it could potentially be a silver lining, but revenue streams in food delivery are perhaps a bit saturated despite any potential boost for consumer spending in the near term.

Stocks In Focus: Nykaa & FirstCry Show Some Spark

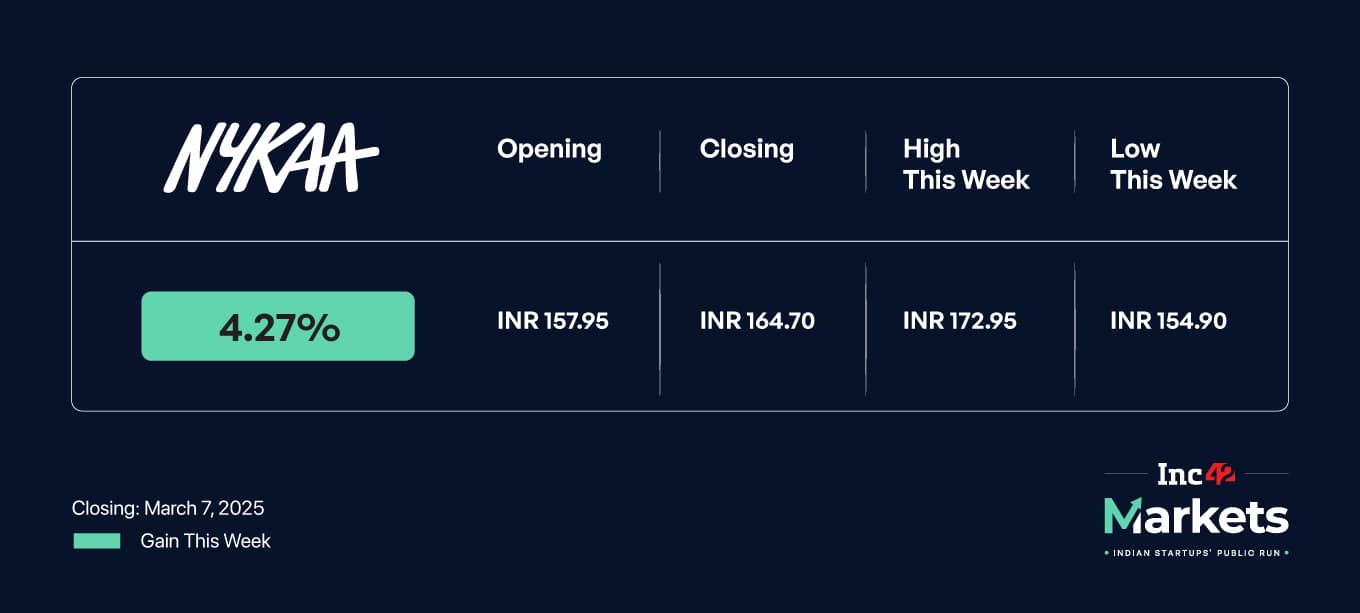

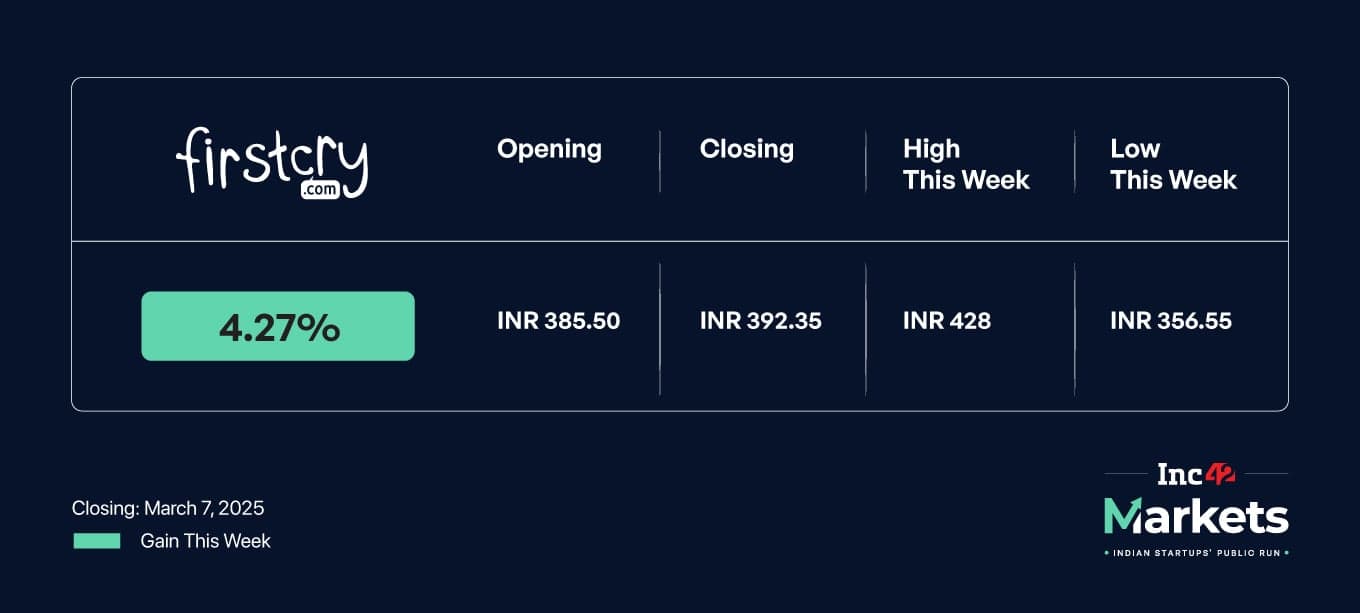

After seeing muted investor interest early in the past week, shares of ecommerce marketplaces Nykaa and FirstCry surged by Friday.

While shares of Nykaa gained 4.27% to end the week at INR 164.70, FirstCry gained 1.78% to close at INR 392.35. In comparison the average gain for the new-age tech stocks cohort tracked by Inc42 was 3.47%.

For BPC major Nykaa, the bull run of the week was capped by a thumbs up from brokerage UBS. On Friday, UBS upgraded its rating on the company to ‘Buy’ from ‘Neutral’. However, it cut the price target for Nykaa to INR 200 from erstwhile INR 205.

Nykaa’s growth and margins for the BPC vertical continue to improve despite competitive pressure, UBS claimed. A significant part of this would be through private label brands selling through new channels such as quick commerce.

On the other hand, shares of FirstCry plunged to an all time low of INR 356.55 on Wednesday (March 5). However, the stock revived by about 12% on the subsequent day before shedding the gains of Thursday on the final day.

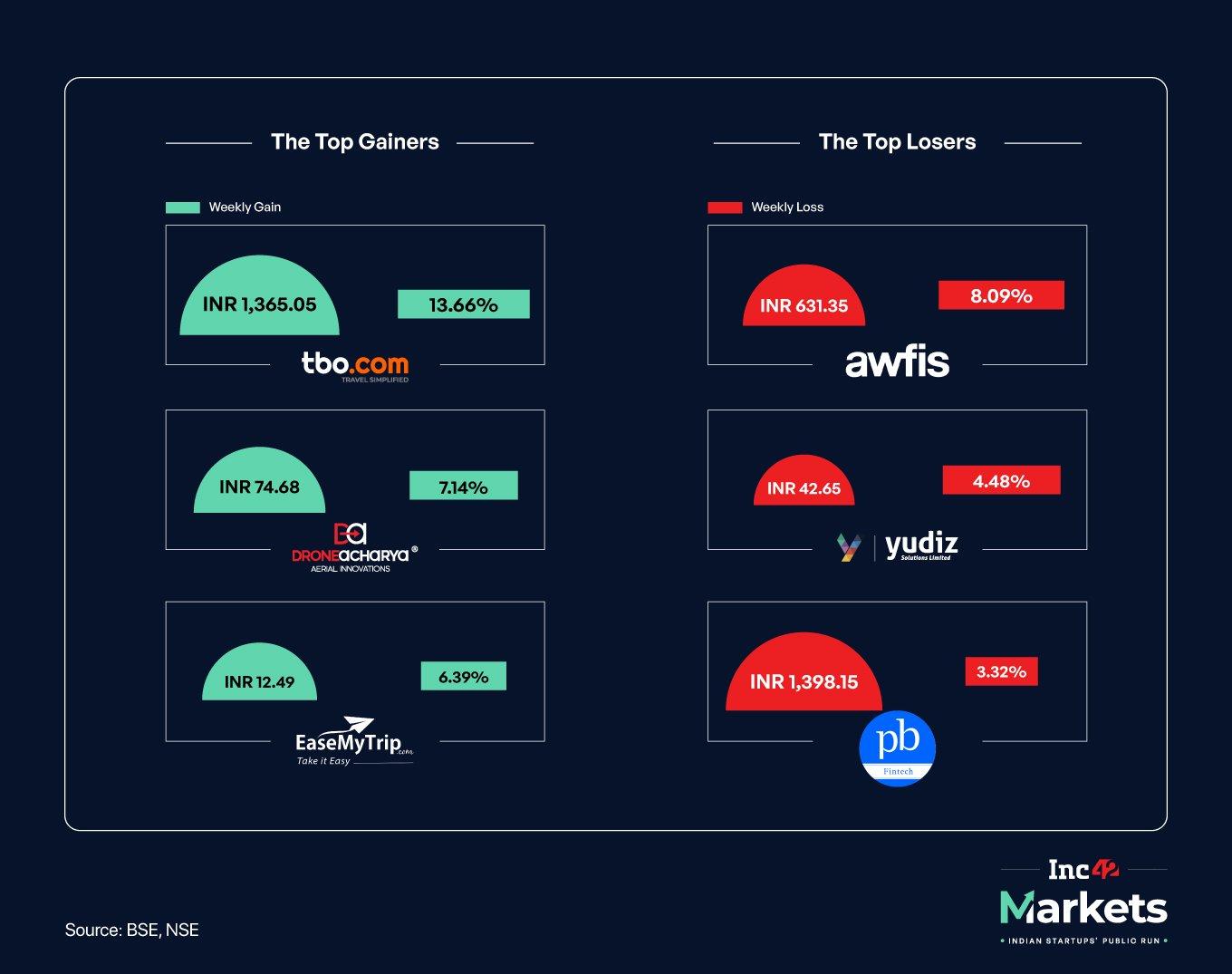

And here’s a snapshot of the top gainers and losers this week:

OYO Races Against The Clock

Hospitality giant OYO is being pushed to expedite its IPO plans as founder Ritesh Agarwal faces pressure from creditors to clear a looming debt repayment.

Lenders, including Mizuho Financial Group, are reportedly asking Agarwal to pay up $383 Mn. A Bloomberg report claimed that if the company doesn’t list by October this year, the lenders want Agarwal to repay $383 Mn as part of the $2.2 Bn he borrowed in 2019 to increase his stake in the company and gain more strategic control.

The OYO founder has paid off a portion of the debt through secondary deals, but the company’s slow revenue growth has set some alarm bells ringing. Lenders are likely wary as OYO has turned its focus towards profitability and revenue contribution of recent acquisitions is only likely to become pertinent by next year.

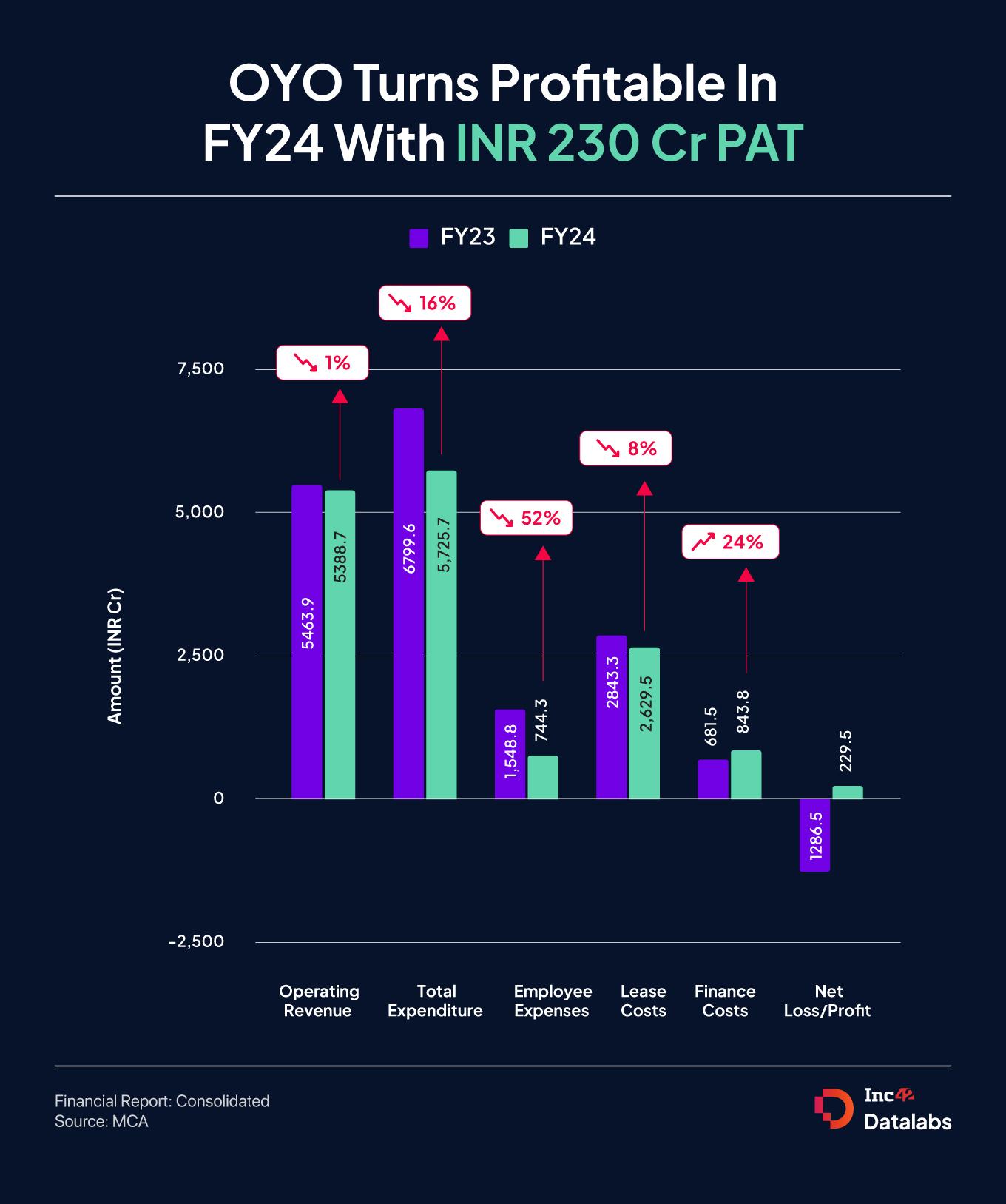

On the financial front, the company profit after tax (PAT) is said to have jumped nearly 6X to INR 166 Cr in Q3 FY25 with a 31% bump in revenue to INR 1,695 Cr on a YoY basis. But it must be noted that even though it was a profitable fiscal, FY24 was a degrowth year for OYO, and the profitability was a factor of cost-cutting.

A clearer look at the fundamentals for FY25 and more up-to-date unit economics nitty-gritties is warranted, which is likely to only come before OYO’s listing. The company has come to the IPO table twice before in 2021 and 2023, but Agarwal’s debt situation and poor market condition forced it to step back.

Now with the market having a bullish mid-term outlook, OYO is back on the IPO trail. And this time, there’s extra incentive to cross the finish line.

The Destination For Upcoming Startup IPOs

OYO is part of Inc42’s IPO Tracker, our up-to-date guide on the startups that are eyeing public listings which was launched last year. Besides OYO, boAt is also said to be revisiting IPO after pulling out earlier.

The consumer electronics startup has received the go-ahead from its board to proceed with its initial public offering (IPO) where it’s likely to raise INR 2,000 Cr.

See The IPO TrackerOne final thought: Food delivery remains as relevant to the narrative of Zomato and Swiggy today as it was a decade ago. But will the narrative that quick commerce value has not yet been accounted for change quickly as soon as profitability arrives?

The post Is Food Delivery The Silver Lining For Zomato, Swiggy? appeared first on Inc42 Media.

No comments