PhysicsWallah’s IPO Frenzy

In August, when we last looked at PhysicsWallah’s product strategy, we said the company is the only game in town for edtech investors. And now the Gurugram-based startup is looking to capitalise on this with an IPO.

In fact, sources close to PhysicsWallah, or PW, investors have revealed that the company has been preparing for an IPO for several months now and that the $210 Mn fundraise earlier this year was pretty much a pre-IPO round.

After the trials and tribulations for the edtech sector from 2022 all the way through 2024, PhysicsWallah is the lone bright spot, with the competition either struggling with slow growth and losses (Vedantu and Unacademy) even after several years of operations, or dealing with existential crises (like BYJU’S).

And now, it’s looking to press home this advantage with an IPO that could set it up with the capital to execute its product strategy too. Let’s take a look, but first, the top stories from our newsroom this week:

- A Controversial Year: Inc42’s annual list of controversies is back, highlighting the founders who remained in the headlines for all the wrong reasons — from the MapMyIndia shareholder fracas to Bhavish Aggarwal’s social media spat

- Recapping Ola Electric: Speaking of Ola Electric, our review of the EV company’s 2024 shows a wide chasm between the ambitions of the company and the ground reality for the EV giant with market share slipping

- Zomato’s Story Of 2024: Our Year In Review train stopped by at Zomato land this past week to take a stock of the company’s emergence as the north star for the Indian startup ecosystem, but the times to come will not be easy, even for Zomato

Where PhysicsWallah Won The Game

A few weeks ago, Unacademy Group cofounder and CEO Gaurav Munjal revealed the company’s operating numbers in 2024 on social media. He claimed that Unacademy had $170 Mn in the bank and was ready to leverage this for the long run.

Munjal was also dismissing speculation of an acquisition, just as he had done in the past. But one comment below the post stood out more than the post itself.

“This sounds so good. I miss the old times of fierce competition. I am waiting for the same. It is only when we compete, students get more options. Wish you luck,” said PhysicsWallah founder Alakh Pandey.

Many might see that as a snipe at Unacademy, given the phrasing used by Pandey. Especially when you look at the revenue growth for Unacademy and PW in the past two years. While PW has reported nearly 3X growth in revenue and is close to the INR 2,000 Cr mark, Unacademy’s revenue has fallen in FY24 to around INR 716 Cr.

One also cannot overlook the damage caused by two years of absolute mayhem at Unacademy, BYJU’S and Vedantu. All three unicorns had to scale back, and while both Unacademy and Vedantu have trimmed losses in the most recent FY24 fiscal, it came at the expense of slow revenue growth.

For PW, the online business is still the dominant category, but with a 55:45 split, that could soon change. That’s also vital if the company wants to improve its unit economics mix and get back to profitability in FY25. For instance, the margins on offline coaching are significantly higher for PW, according to sources in the investor base, and this will be the focus for the company going forward.

Even when it’s entering new verticals, the company has an offline-first approach today, as seen in its new School Of Startups vertical for aspiring entrepreneurs.

Despite having a huge operational headstart over PW, Unacademy has failed to capitalise on this advantage. What PW has today is the momentum that it needs to become the biggest target for edtech investors, customers, educators and partners.

Notably, the edtech major raised $210 Mn in its Series B funding round, led by Hornbill Capital, in September this year at a valuation of $2.8 Bn. Besides the new investor, Lightspeed Venture Partners, GSV Venture and WestBridge Capital also participated in the round.

In fact, one might even say that PhysicsWallah’s advantage is that it only formally entered the market in 2020, and therefore did not commit some of the cardinal mistakes that have become heavy weights around the shoulders of its rivals.

And it also helped that PhysicsWallah never over-capitalised itself even as it ventured out and branched into new products. The biggest criticism for PW’s product strategy is that it’s overleveraging the capital raised through acquisitions and not focussing on scaling up in a sustainable manner.

But with more capital in its bank now, perhaps the company has enough fuel to push forward on all fronts — especially outside its core of test prep.

Setting Up Shop For The IPO

If we analyse the weaknesses for PW or the potential challenges on its way, one can say that the startup’s relative youth is not something that will give confidence to public markets investors. Besides this, It’s also not a company that has a wealth of experience when it comes to its leadership or promoters.

Beyond the revenue growth challenges, edtech unicorns that started before PW have suffered reputational damage as well, thanks to layoffs and failures on the product front which led to sudden cutbacks. Now fixing this image is proving to be a harder challenge than many anticipated. And this has an impact on what kind of talent one attracts.

In fact, employee benefit costs more than doubled in FY24 for PW, and were its highest expense item.

While Unacademy and Vedantu have looked to continue operations well away from the public spotlight, PW has not shied from the limelight. Pandey has thrived in it, in fact, particularly with very public support for students impacted by the NEET controversy earlier this year.

PW’s penchant to put itself in the middle of the conversation has perhaps made it an even more attractive opportunity for investors, and seemingly even high-level talent.

Bolstering its top brass earlier this year, PhysicsWallah roped in former Blinkit finance head Amit Sachdeva as CFO, who will lead the company’s transition from a private to a public company in 2025. He was also the finance head at Wipro Digital prior to Blinkit, and comes with a wealth of experience in the finance function, which bodes well for PW’s IPO bid.

The startup has also reportedly finalised the bankers — Axis Capital, Kotak Mahindra Capital, Goldman Sachs, and JP Morgan — for its proposed $400 Mn to $500 Mn IPO next year.

As for the timeline of the IPO, our sources were not fully confident of the listing window but indicated that it could come around just around the Diwali festive season next year. And by then, we might even see PhysicsWallah back in the black and ready for its IPO.

Sunday Roundup: Startup Funding, Tech Stocks & More

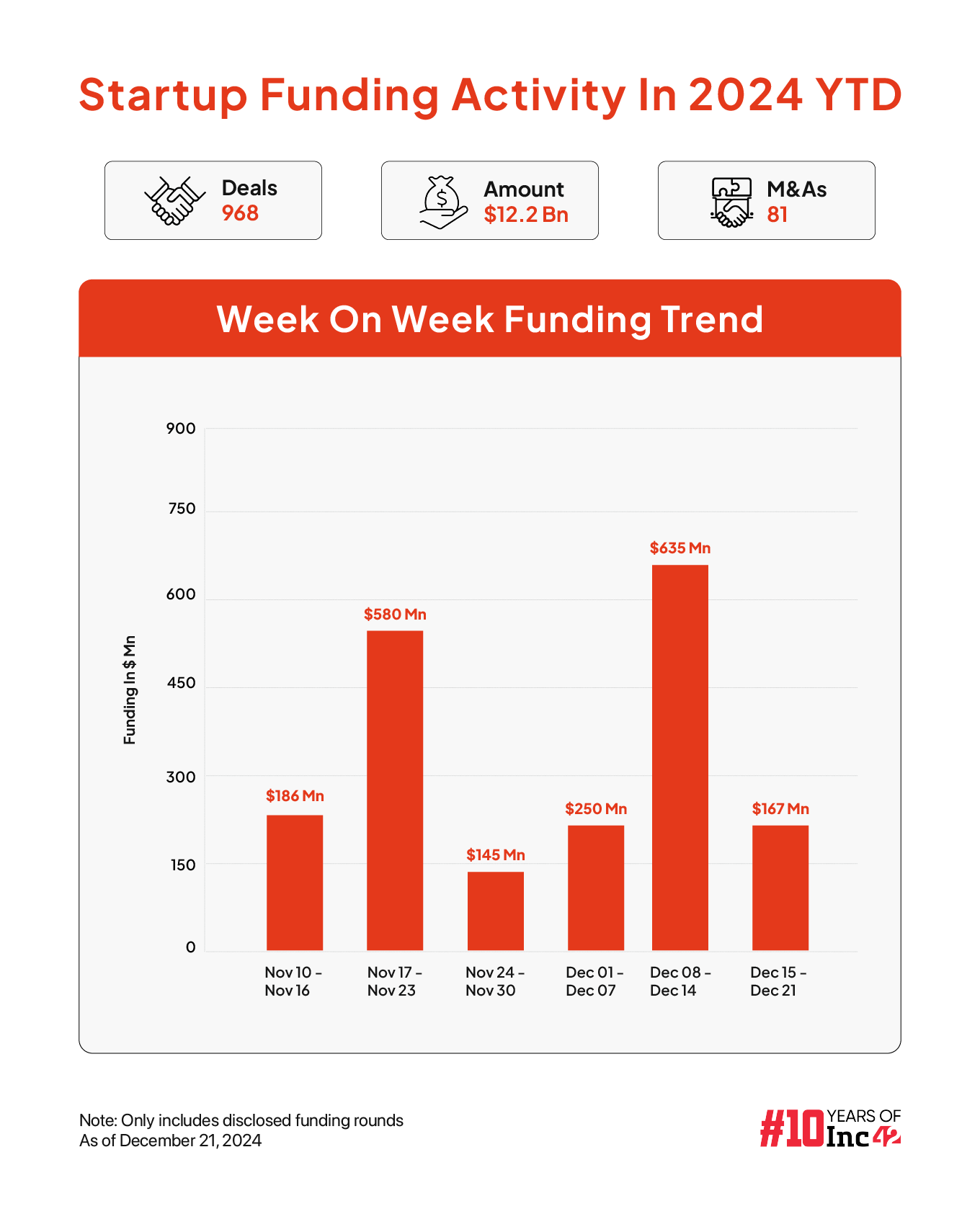

- Weekly Funding Falls: Between December 16 and 21, startups cumulatively raised $167 Mn via 19 deals, marking a roughly 73% decline from the $635 Mn raised in the previous week

- New Funds Worth $8.7 Bn+ In 2024: With 81 new funds worth over $8.7 Bn launched, VC activity in 2024 was comfortably higher than 2023, with early-to-growth stage funds dominating the investor pool

- Aye Finance’s INR 1450 Cr IPO: Aye Finance has filed its DRHP with SEBI for an INR 1,450 Cr IPO, which includes a fresh issue worth INR 885 Cr

- Unacademy’s FY24: The edtech unicorn trimmed its standalone net loss by 82.09% to INR 285 Cr in FY24, but revenue dipped marginally to INR 716 Cr in the year

- MobiKwik’s Listing Pops: Shares of fintech major MobiKwik tumbled nearly 10% on close on Friday, after the company’s bumper listing at a nearly 60% premium on the bourses earlier this week

- Swiggy’s Shares Jump: Shares of Swiggy jumped more than 10% week-on-week and finished at INR 597.50, following domestic brokerage Axis Capital initiating coverage with a ‘Buy’ rating

The post PhysicsWallah’s IPO Frenzy appeared first on Inc42 Media.

No comments