OEM Business Model Does Not Align Well With VCs: Blume Ventures’ Arpit Agarwal

The Indian EV industry has achieved several major milestones recently. Some of the noteworthy ones include the IPO of two-wheeler EV startup Ola Electric and its competitor Ather Energy preparing to make its market debut.

This is happening at a time when the industry is learning to rely less on subsidies, indicating that the Indian EV ecosystem is moving towards maturity.

After the FAME-II fiasco in 2023, a cutback in EV subsidies negatively impacted the sector, but it’s now in the recovery mode. Recently, after much speculation, the Centre also introduced the INR 10,900 Cr PM Electric Drive Revolution in Innovative Vehicle Enhancement (PM E-DRIVE) scheme as an extension of FAME to further support the EV segment.

Meanwhile, the country is striving to enhance its domestic manufacturing capabilities. Electronics component manufacturing is strengthening, semiconductor fabs are in the process of being set up, and EV players are now working under stricter regulations of domestic value addition.

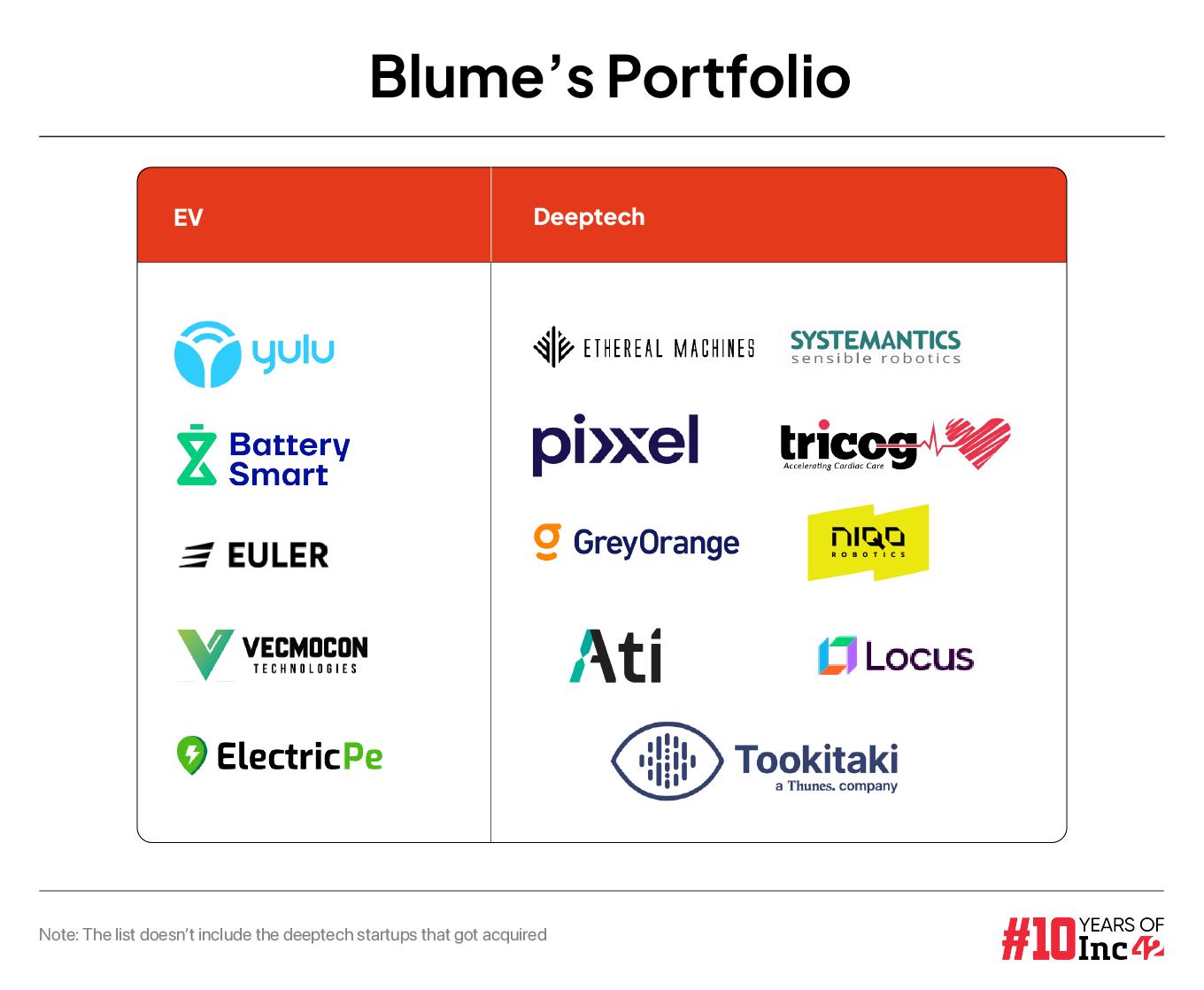

In light of these developments, Inc42 spoke to Blume Ventures’ partner Arpit Agarwal, one of the early investors in deeptech in India and a top EV investor. Blume’s EV portfolio includes electric mobility startup Yulu, battery swapping platform Battery Smart, EV charging infra provider ElectricPe, and three-wheeler EV OEM Euler Motors, among others.

Besides, Blume has invested in robotics startups GreyOrange and Niqo Robotics, spacetech startup Pixxel, deeptech manufacturing startup Ethereal Machines, just to count a few.

While our discussions with Agarwal were largely focussed on Blume’s EV thesis, investments, trends and analysis of the emobility sector, we also touched upon the much-talked-about semiconductor and electronics manufacturing.

However, during our conversation what stood out was Agarwal’s take on the OEM business model, which, according to him, does not align well with VCs. What made him say so, and where is the VC interest skewed towards the most?

Here are the edited excerpts…

Inc42: What has motivated Blume to start investments in the EV space? Also, what has been the firm’s thesis here?

Arpit Agarwal: We have made five investments in the sector so far. We started investing in the EV sector not because we found it special but because of our curiosity to understand the EV space deeply as deeptech investors.

Our first EV investment was in Yulu. Honestly, we didn’t have a clear thesis at the time. We knew Amit Gupta, the founder and CEO of Yulu, so we decided to get involved.

Through this investment, we learnt a few things about electric vehicles and understood how businesses could be built in this space. Alongside, we were also looking at global trends, with companies like Tesla gaining popularity.

Around 2019, we found out that Delhi alone had 5 Lakh e-rickshaws on the road, which was a big number, and I realised something interesting was happening in the sector that we were not aware of. While doing our research, we realised that the concept of total cost of ownership (TCO) was driving the market.

Globally, the widespread adoption of new technology happens for economic reasons. Now, it could be economical because a government is subsidising it, because someone is absorbing all the cost, or because the technology itself is superior.

Once the cost of production comes down, everyone starts moving towards it. We have seen this in CNG earlier, and we knew a similar thing was set to happen in EV.

Inc42: None of the five EV investments you have made is in the electric two-wheeler OEM space. Why did you avoid this segment?

Arpit Agarwal: We did invest in Euler Motors, and what we learnt is that building a successful business in the EV space is not just about creating a good product. You also need to make sure that the vehicle is manufactured at the right cost.

Now, this requires significant capital expenditure and the venture capital model is generally anti-capex. In EV manufacturing, a company will only be able to get to the right price point once they receive initial investments in the range of $10-$20 Mn. However, most companies do not have access to this kind of capital.

Ola Electric did the right thing when it started with $250 Mn in investment as the company knew it required the capex to produce at scale and cost that the market wanted. Therefore, I think that the OEM business model is not a great fit for VCs, at least not for early-stage VCs.

Inc42: What trends are you currently noticing in the EV sector, and how have they shifted over the past two years?

Arpit Agarwal: Let me give you a six-year paradigm. When we invested in Euler in 2018, OEMs were new in the market, and it felt like investing in a technology company. Today, OEMs have become larger and more mature, hence less suitable for early stage investors.

Similarly, no new trend is emerging in the battery-swapping segment. Two companies, Sun Mobility and Battery Smart, have become established players. However, the investors who are now entering these companies are the ones typically with $30-$50 Mn cheque sizes.

The component manufacturing space is also capex-heavy. Therefore, early-stage investors have not touched it, except for data and intelligence components like Battery Management Systems (BMS), which companies like Vecmocon make. While some of these companies have already raised venture capital, they aren’t mature enough to raise more money.

Even the financing space has reasonably large companies like RevFin, Turno, and Vidyut. We looked at some of them but could not see differentiation, so we stayed away. Charging infra is experiencing a similar trend.

With these spaces taken, the emerging opportunity now lies in software around EVs. We have met companies making middleware. There is a company that is creating a software platform through which customers and financiers can get access to certain data. OEMs don’t have this capability, making it an interesting area to watch.

There is enough scope for companies to create new features around EVs, such as mobile apps for finding charging stations or services. There is also an opportunity coming around the secondary use case of the batteries.

A lot of later-stage investors are now coming in across the EV sub-segments. Globally, with an increase in green financing, more global players are likely to check into these companies.

Inc42: What is your take on the new EV subsidy scheme PM E-Drive? Are you satisfied with the current government support for the sector?

Arpit Agarwal: PM E-Drive is the continuation of FAME-III, which is a step in the right direction. However, what we need to understand is that the prerogative of the government of India or any state government goes beyond just reducing pollution.

While pollution is a serious issue, the push for EVs is more driven by geopolitical concerns. We rely heavily on oil imports (about 80-85%), which makes us vulnerable to supply chain disruptions and geopolitical risks. Reducing this dependency is critical, and that’s where EV adoption comes in.

India could have chosen a more aggressive subsidiary regime, but the reason why we have not is that the automotive industry employs crores of people. Choosing anything more aggressive could have hurt a lot of stakeholders. Therefore, the government chose to tread carefully.

I do not have anything against the subsidy scheme, except that it could have been sharper and more intentional. For instance, why isn’t there a green tax on diesel cars? Imposing a green tax on the sales of diesel vehicles could generate enough money, which could then be deployed in the EV space.

Similarly, why is the registration price of an EV and an ICE vehicle still the same? Also, the road tax for both vehicle categories is the same in most states across India.

Inc42: Are you looking to invest in more EV startups in the coming days?

Arpit Agarwal: We are happy with our five investments and do not have any more investments planned. We can invest in a software company in the next three years but nothing in the main sub-segments.

The way our business works is we have a very narrow window of opportunity where both the sector and timing must be right. Once that has passed, it is no longer worth investing in the space.

Inc42: Is Blume looking to exit any of its current investments?

Arpit Agarwal: Not right now. However, this will happen after five to six years when the likes of Yulu, Battery Smart, and Euler start going for IPO.

Inc42: How do you look at deeptech from an investment and growth point of view?

Arpit Agarwal: Deeptech is gaining prominence in the country due to two primary reasons. The first one is the availability of capital. There are about 15-20 early stage funds, which didn’t exist three years ago, but are now actively investing in the space.

The second reason is that the domestic market has become very receptive to technology. Startups in industrial automation that have been around for over a decade struggled to gain traction in India until 2018 or 2019. Now, they are being well received as the Indian manufacturing sector has expanded in both scale and standards.

When we invested in Ati Motors, which is a factory automation company, we didn’t think that it would find strong adoption in India. Today, India is a huge market for it.

The evolution of Indian buyers is also playing a role in making these Indian companies more successful, be it in the defence tech space, biotechnology, or industrial automation.

Tomorrow, I can imagine there will be Series B funds exclusively set up for deeptech companies because there is so much supply of deeptech companies, and these funds would have the special capability to just invest in those companies at that scale.

Inc42: What is your view on the semiconductor industry? How do you see it helping the EV ecosystem and broader electronics sector?

Arpit Agarwal: The current challenge is that even though we are able to reduce our reliance on global supply chains for oil, doing this for semiconductors will not be as easy.

Also, it is unlikely that consumer electronics will see sourcing of computing electronics from India because the necessary fabs are not expected to be established in the country anytime soon.

However, automotive electronics is likely to move where you will have Indian fabs providing to Indian OEMs, which is a good trend. However, are we going to be completely independent despite our significant demand? I don’t foresee that happening for at least the next 20 years.

Setting up a fab itself requires lakhs of crores of investment, and even then, it won’t be the most cutting-edge facility that is on par with global fabs producing 2-4 nanometer chips. Building an entire fab-friendly ecosystem — covering design, packaging, verification, and global supply — will take at least a decade or two.

[Edited By Shishir Parasher]

The post OEM Business Model Does Not Align Well With VCs: Blume Ventures’ Arpit Agarwal appeared first on Inc42 Media.

No comments