Behind The Sleep Company’s INR 300 Cr Revenue Run

When Crocs debuted in 2002, the American footwear brand was an outlier in a market dominated by storied incumbents like Puma, Adidas, Skechers and others. As recently as 2021, it still struggled with its image as the most polarising of footwear brands that often pushed the boundaries of fashion and humour.

But in spite of the persistent scepticism, Crocs has emerged as a global powerhouse with a market capitalisation of $8.3 Bn. It has also joined the top 10 international footwear brands, alongside industry titans like Nike, valued at $124.9 Bn.

Aesthetics may not be a strong point for Crocs. But the comfort it provides resonates with consumers worldwide. The brand disrupted the footwear market by introducing a polymer-based material that was lightweight, dustproof and water-resistant – groundbreaking features at the time.

Harshil Salot, founder of the direct-to-consumer (D2C) mattress brand The Sleep Company (TSC), operates in a different space. But he draws parallels between Crocs and his brand’s innovations in the comfort tech industry.

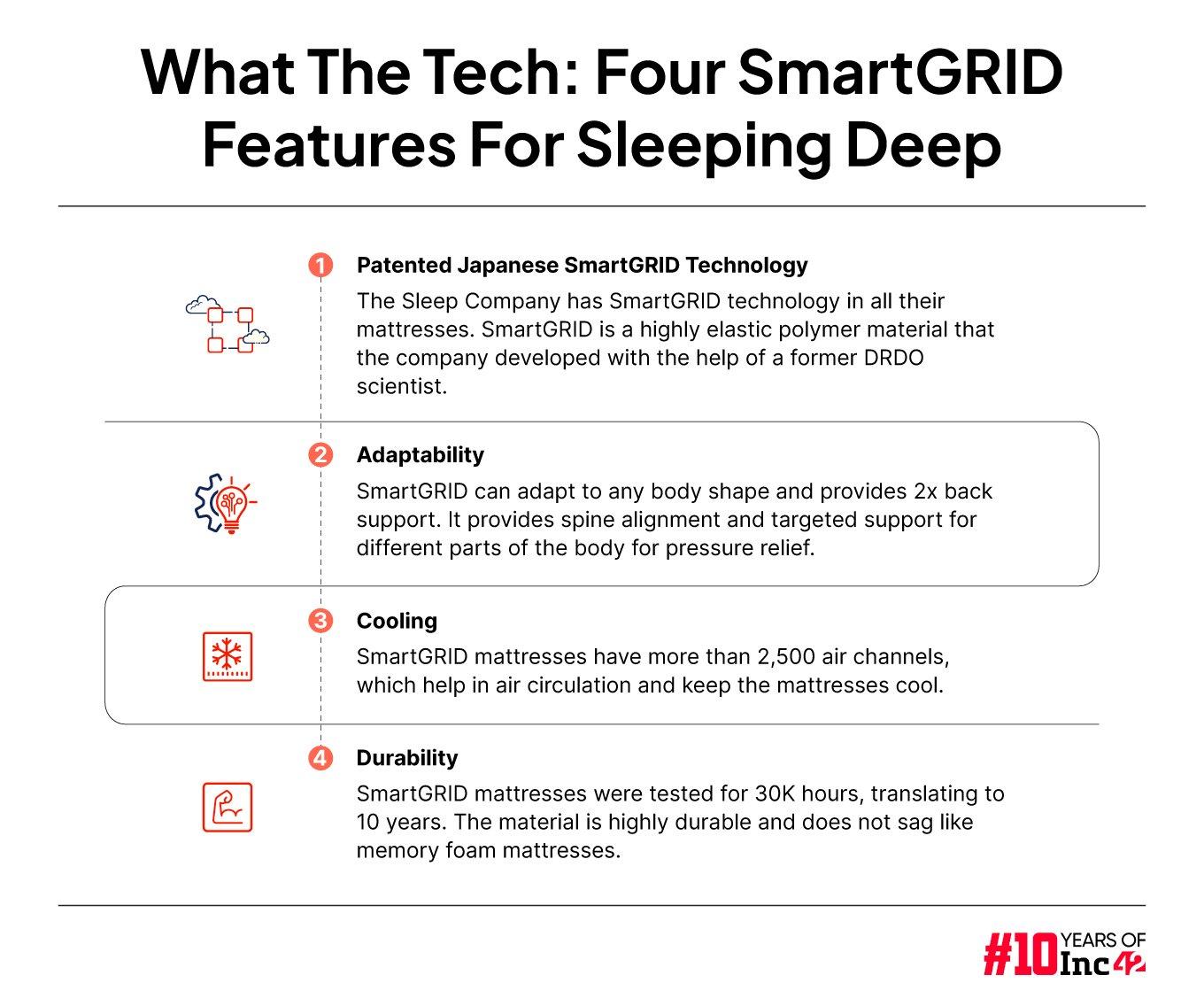

Launched in October 2019 by Harshil and his wife Priyanka (both IIM-Calcutta alumni), the brand differentiates its products by using SmartGRID, a patented technology developed in-house. The startup uses thermoplastic elastomer (TPE), a hyperelastic polymer or natural rubber-like material, made into a grid shape to distribute the body pressure evenly and improve sleep quality.

Talking about SmartGrid’s unique features, Harshil explained how TPE intelligently adapts to body contours and provides cushioning and firm support based on body requirements. For instance, it enhances comfort for body parts like the head and the hips but remains firm around the back/spine as it requires the support. “This adaptability ensures better comfort and long-term spinal support, a critical USP that determined the brand’s early success,” he said.

In contrast, traditional mattresses made from memory foam, latex or springs are either too soft or too firm, but not both.

“SmartGrid is our core technology, and we are bringing this to every category of comfort tech. We have patents granted in India and Japan and have filed for the same in China and many EU countries,” added Harshil.

TSC has also ventured into bedding accessories, including fitted sheets, pillows and comforters. A smart recliner bed was launched in 2021, followed by ergonomic chairs in 2022 and recliner sofas and adjustable desks in 2024. Industry insiders lauded the move, saying it is not enough to remain a SmartGrid-slab company. As mattresses do not figure among frequent purchases, anything less than new products or novelty experiences cannot keep the shoppers glued to the brand’s ecosystem.

India’s mattress market, projected to reach $3.2 Bn by 2029, has undergone a quiet revolution. Once dominated by legacy brands like Kurl-on (now part of the Sleepwell portfolio), Duroflex, Springwel and more, mattress shopping was a routine, in-store experience until the middle of the last decade. But the state of the industry began to change since 2016, with the rise of new-age mattress brands like Wakefit, Sunday, Flo, Sleepycat and The Sleep Company.

Each promises an innovative tech twist to its feature-rich products and claims to redefine what people think of comfort and sleep. Nevertheless, it is a crowded market, and TSC is locking horns with traditional players and new entrants.

Incumbents are not too impressed by the category disruptors or their take on orthopaedic benefits and other tech advantages. In contrast, plenty of ‘woke’ consumers take sleep seriously, track sleep quality and believe these brands are selling innovation and luxury, which will impact comfort and lifestyle. (Remember Crocs?)

It’s not just customers who resonate with new-age mattress brands. So do investors. The Sleep Company raised around $44 Mn+ from well-known investors such as Fireside Ventures, Premji Invest, Alteria Capital, LogX Ventures and Mamaearth cofounder Varun Alagh.

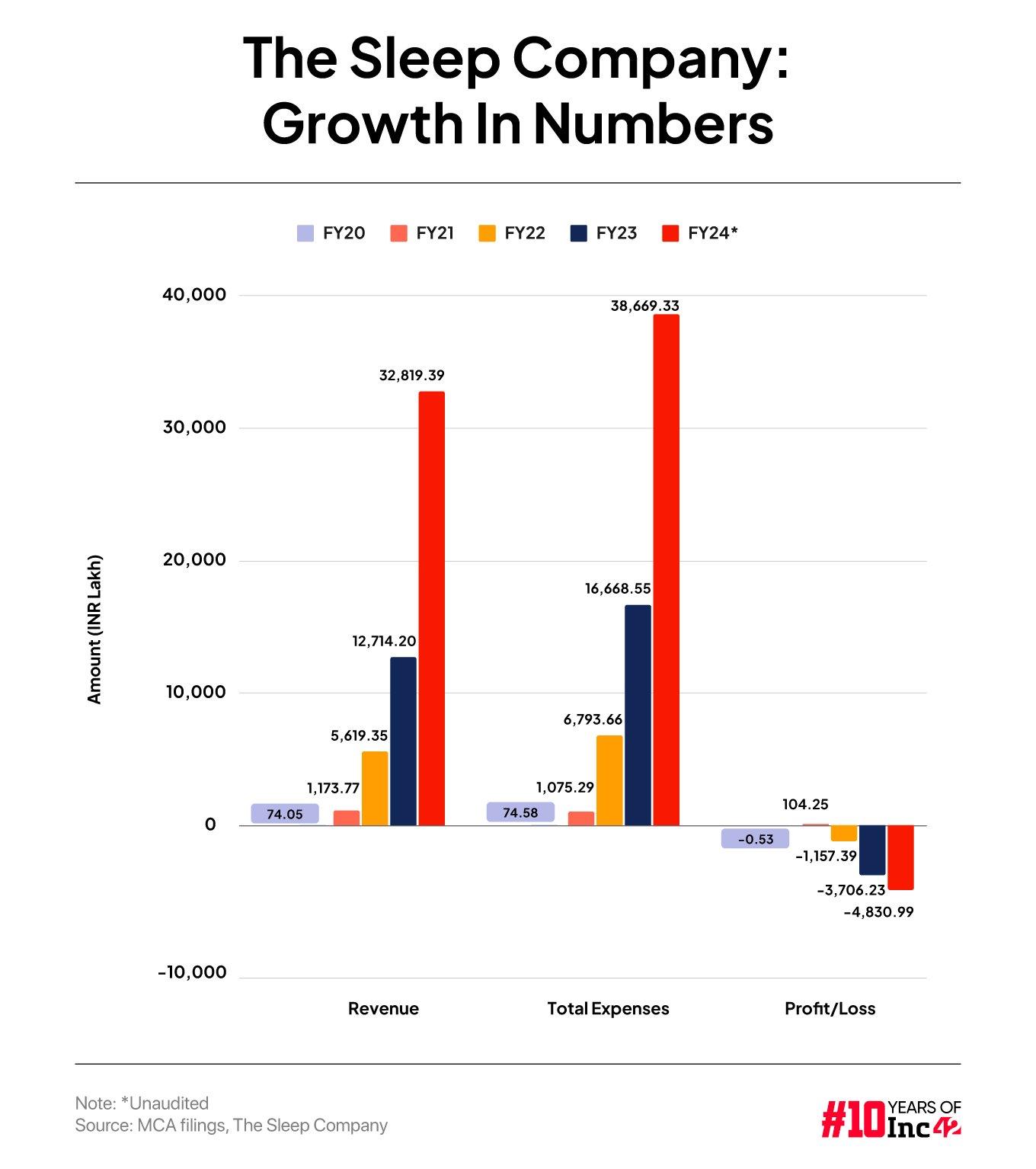

The startup turned a profit within two years of its launch, securing INR 1.04 Cr in FY21. But the pandemic had started just then, and comfort tech products saw a massive spike in demand, pushing TSC to open many COCO (company-owned, company-operated) stores by FY23.

As of October 2024, it runs more than 100 of these stores across 25 cities, with most of the outlets in Bengaluru (21 stores), Hyderabad (15 stores), Mumbai and Delhi NCR (12 stores each), and Chennai (10 stores). All its products are made in the company’s two manufacturing units, one located in Bhiwandi, Maharashtra, and the other in the Nelamangala taluk of Karnataka, employing 141 people.

The aggressive expansion fuelled its top-line growth nearly 28x, from INR 11.74 Cr in FY21 to INR 328.19 Cr in FY24. But the rapid scale-up came at a cost and resulted in year-over-year losses. TSC posted a loss of INR 48.31 Cr in FY24, up from INR 37.06 Cr in the previous fiscal year, a 30.35% rise.

Expenses surged as well, reaching INR 386.69 Cr in FY24 compared to INR 166.68 Cr in FY23 and INR 67.94 Cr in FY22, reflecting the financial strain of its ambitious growth strategy. For context, FY24 numbers are unaudited at the time of publishing this story.

“In FY22, 70-75% of our revenue came from online sales, but FY23 was all about building a solid business foundation,” said Harshil. “We invested in the right technology, expanded offline and strengthened the team, which enabled us to achieve almost 160% YoY revenue growth in FY24.”

How The Sleep Company Got On Track To Begin The Mattress March

For the Salots, the idea behind The Sleep Company rose from a personal requirement. The couple hadn’t been getting a lot of rest when they became new parents, and they soon realised the importance of a good mattress for comfortable sleep. It was 2016, but in spite of an extensive search, they could not find a product that met their expectations.

The mattress quality in India lagged behind Western standards, and the buying experience disappointed them. Most mattresses were sold through exclusive brand outlets (EBOs) or multi-brand outlets (MBOs), but the sales staff often lacked the technical knowledge to address customer concerns.

“Conversations felt superficial,” recalled Harshil. “The salespeople focussed more on the price than explaining product benefits and their unique features.”

Around that time, the duo also learnt about the bed-in-a-box, compressed mattresses in cardboard boxes or plastic wrappings delivered straight to buyers’ homes. After hassle-free unpacking, these will expand to their full size within a few hours. The innovative technique transformed the logistics process, which was previously a messy and labour-intensive method of shipping heavy slabs that could be damaged if folded.

“It’s when we realised that the category was ripe for disruption, and we must do something to improve product quality and ensure smart packaging,” said Harshil.

The duo was ready to take the challenge, but The Sleep Company did not happen overnight. At the time, Harshil managed his family business, which exported high-end engineering products to the EU and North America, while Priyanka was a marketing head at Procter & Gamble. In April 2018, she left her job to focus on research and led a team of scientists headed by Vijay Nimbalkar, a former head of polymers at DRDO. Harshil eventually joined her, and the project became a shared passion.

Their initial plan was to complete research and launch the product in three months. But it took nearly 18 months to perfect the material and the manufacturing process. “Seven or eight months into R&D, we were not even sure if we would be able to launch any product at all,” admitted Harshil.

“Consumer preferences in India were changing, but how fast the market would grow was still uncertain. We kept pushing, though, and launched in October [2019] on Amazon India and our D2C website.”

Market Strategies, Techvantages Keeping The Sleep Company Ahead

Just like many emerging brands, The Sleep Company experienced a slow start. The founders left no stone unturned to gain traction, daily interacting with customers to gather feedback. “Our products mostly got a five-star rating, as users could cope better with sleep issues like insomnia. Nevertheless, it posted a modest revenue of INR 11-12 Lakh in the first five months post-launch but managed to secure a small profit in FY21.

“Then the pandemic hit hard, and it turned out to be the biggest turning point for us,” said Harshil.

The series of lockdowns forced most manufacturers and service companies to stop operations. But mattresses came under essential commodities, and the Salots kept their factories running. It helped the newcomer gain online traction, win consumer trust in troubled times and solidify its product-market fit. By April 2021, the startup hit a monthly revenue stream. Going ahead, it broke into offline retail (more on that later) and recast itself as ‘the Apple of mattresses’ that helped develop a lucrative affection for the brand that thrived on ‘experience’.

Here is a close look at how the founders developed The Sleep Company to climb from zero to one.

Building For The Mass-Premium Segment

Harshil and Priyanka discovered that a single manufacturer made mattresses for multiple brands, which were sold under different labels but at slim gross margins to drive volume. Understandably, this approach was not ideal for a new entrant eyeing recognition and robust returns.

They went for premiumisation and put the brand price slightly higher. Earning better margins helped them invest more in marketing and brand-building. Their proprietary technology and disruptive advertising created a unique brand identity in a competitive market.

Early Buzz Through Endorsement, Word-Of-Mouth

The founders took another bold step early in their journey by bringing in Bollywood actor-producer Anil Kapoor for celebrity endorsement. They did it as soon as The Sleep Company started generating INR 1 Cr in monthly revenue, creating a lot of early buzz and boosting consumer confidence.

Word-of-mouth referrals followed as happy customers recommended the brand.

Consistent Marketing For Brand Recall

The brand’s USP lies in material-based patented innovation, which sets it apart from the competition. The founders frequently compare TSC’s features and benefits with other market alternatives like memory foam and latex, highlighting the former’s adaptive support and 2.5K air channels on the top layer to cool body heat.

Such consistent marketing drives home the same core message every time – its product superiority remains unmatched in the market. This communication focus from Day 1 has gradually attracted customers and has built trust over time, positioning it as a business with strong brand recall.

The Tech Behind Successful Storefronts

The Sleep Company has developed data-driven solutions to target customers and validate store expansion. With the help of an experienced team and advanced technology, the brand collects and analyses 300+ variables per customer when delivering products from experience centres. These variables could range from average rental prices in the vicinity to dining costs, gym and salon density and much more to create internal profiles and identify common traits among its customers.

Armed with this information, the brand maps customer density across a specific locality’s micro-markets and pinpoints target areas. Next, it uses a specialised tool to analyse foot traffic patterns on specific streets (of a target area), understand who is visiting and when, and help the team select ideal locations for new stores.

TSC’s business development team then negotiates rental deals with landlords and property owners. This systematic, tech-first approach, honed over two years, enables the startup to predict potential store performance accurately.

Vertical Integration For Business Success

As Harshil emphasises, the startup’s integrated approach – from material innovation to in-house manufacturing and COCO outlets – has eliminated intermediaries from the entire system. The result is a streamlined, efficient and cost-effective supply chain.

In a highly fragmented mattress industry where dealer commissions typically range between 25% and 35%, this vertical integration allows the brand to maintain competitive pricing while safeguarding healthy profit margins.

How The Sleep Company Cracked Offline Retail

If hitting the profit button in FY21 was the first landmark, The Sleep Company continued to grow in the following fiscal year, given the pandemic push and its ascendancy in online sales. By April 2022, the brand reached an annual revenue run rate (ARR) of INR 100 Cr. But the next strategic move must be a leap from digital-only to omnichannel (online+offline) distribution to keep up the momentum.

“To be a top brand, you need an omnichannel presence. As mattresses are touch-and-feel products, many customers wanted to try and buy, and we used to get loads of those requests,” recalled Harshil. The founders realised that offline expansion would be crucial to emerge as a pan-India mattress destination.

Moving offline was challenging. The traditional mattress market was largely unorganised, and even big players were not earning big as dozens of competitors crowded the market. For example, the country’s largest mattress brand (which Harshil did not name) operates about 12K stores but generates just INR 60-70K per store per month. In fact, the high commissions these brands pay to retain dealers deter them from investing more in product innovation, skilled staff and visual merchandising.

“Within a few months, we met around 8.2K dealers and distributors across geographies but soon realised that our products would only get pushed based on the commission we offer. Dealers also demanded long credit periods, which could affect our cash flow. Sadly, no one talked about technology, product differentiation, or customer experience,” rued Harshil.

This approach did not align with The Sleep Company’s vision. So, the founders set up COCO stores, launching seven outlets in key destinations like Delhi NCR, Mumbai, Bengaluru, Hyderabad and Pune.

To gauge their brand’s performance, the Salots benchmarked their revenue against Duroflex, a competitor also running a chain of company-owned and company-operated stores. At the time, those stores used to earn about INR 15-20 Lakh per month.

“Our goal was to exceed Duroflex numbers by 15-20%. We opened our first store in Koramangala [Bengaluru] in June 2022 and generated more than INR 50 Lakh in the debut month. That was a huge boost for us,” said Harshil.

In pandemic times, sleep became a major health concern for discerning consumers, who were more careful when buying mattresses. In the first month of their offline expansion, TSC’s sales team handled numerous technical questions from customers about mattress density, solutions for back problems and product benefits.

“We knew the limitations of an entirely sales-driven model and realised the need to create an experience to help our customers make informed decisions,” said Harshil.

In sync with this vision, TSC designed its stores as the ‘Apple’ of mattresses with a strong brand identity and an experience-driven customer journey. Each store features a sleep lab to respond to queries on mattress tech, and customers can test the products for 20-30 minutes. Highly trained sales staff provides personalised assistance, focussing on solving customer problems.

The Sleep Company also provides a free trial for 100 nights for people buying SmartGRID mattresses. “Research shows it takes at least three to four weeks for the body to adapt to a new mattress. If our customers are not completely satisfied within 100 nights, we provide a full refund,” said Harshil.

The startup has introduced a referral programme and offers discounts to existing customers who help grow the network. It also provides free shipping, a 10-year warranty and no-cost EMI options to enhance the buying experience.

Key Learnings For The Sleep Company & Plans For FY25

Going by the capital raised, even amid a harsh funding winter, investors have seen enormous potential in TSC and its innovations. But the founders admitted their missteps, saying the insights gained would shape their future strategy. Take, for instance, the decision to launch wooden beds, once a popular category on Amazon. The Salots said they jumped in without full knowledge of that market and pulled out the product after a few months.

“We should not step into areas outside our core competence just because there is market demand,” said Harshil. It underscored the importance of building internal capabilities first and focussing on strengths rather than chasing trends.

“Again, the brand’s offline expansion taught us some valuable lessons. Some places did not perform as expected and we had to close a few outlets. Our initial grasp of consumer behaviour was lacking at the time. But these setbacks led to process improvements and the outcomes will be better when we launch other stores,” he observed.

Harshil, however, believes that experimentation is the key [to innovation and success]. “Startups need to fail fast and learn quickly. The Sleep Company embraces failure as an essential part of the learning curve and uses those lessons to sharpen its vision and strategy.”

Another early challenge was talent acquisition. The business struggled to attract the right people as it was too small and had limited vision. It often hired fewer people even when more hands were needed. However, with guidance from leading investors The Sleep Company began hiring early and building a strong team, which were crucial for success.

TSC also had to shift its business focus and let go of its digital-only approach, which is the classic trait of a pure-play D2C brand. According to Harshil, that is another practical business lesson, as an omnichannel strategy is essential for any D2C brand to scale successfully.

“Consumers are transitional; they research online and purchase offline, or vice versa. To cater to all buying behaviours, you need an online and an offline presence,” he explained. The startup’s focus on consumer obsession and insights from its store chain have helped it scale effectively.

For FY25, The Sleep Company’s goal is clear. It is looking at sustainable, long-term profitability. “We are not targeting profits just for this year. We are thinking about what actions today will drive outsized returns over the next five years,” said Harshil.

With strong unit economics in place, the founders are confident of breaking even in the current financial year and outpacing industry growth. While the startup arrived heralding the SmartGRID technology, it now aspires to emerge as a legacy brand in the comfort tech space, setting up new wellness standards and helping people sleep deep and sit ergo-smart.

[Edited By Sanghamitra Mandal]

The post Behind The Sleep Company’s INR 300 Cr Revenue Run appeared first on Inc42 Media.

No comments