The Jio Threat To Fintech Startups

One app to rule them all: that’s the fintech story in India over the past couple of years. And now Jio Financial Services (JFS) is ready to show off its own super app.

With the launch of the ‘JioFinance’ app, JFS is looking to integrate digital banking, UPI, bill payments, and insurance advisory in one app, and the company is also adding digital lending and an investments platform to the mix.

Even though it is in the beta phase at the moment, JioFinance is going to be a major headache for the competition due to Reliance’s vast network of retail stores and its various SME partners. If Jio 4G was a key growth factor for fintech apps (Paytm, PhonePe, Google Pay et al), JioFinance threatens to eat their lunch.

So, how does Jio’s entry change things for these startups and companies that have defined fintech in India till now? This is what we will look to answer this Sunday but after a look at the top stories from our newsroom over this past week, incidentally featuring two of JioFinance’s big rivals:

-

- Into The CREDverse: Super apps are a strong theme in the fintech world and CRED exemplifies this movement with its acquisition-led platform play. A deep dive into how the platform has expanded in the past year.

- Paytm’s Lost Merchant Magic: Paytm took the super app route for merchant services and it paid off massively till 2024, but now this vertical is reeling under operational challenges and compliance lapses. Can the fintech giant bounce back?

- The ‘30 Startups’ Spotlight: Going from scaled up giants to early-stage innovators — a look at the May edition of our coveted list of the most innovative startups in India that are cracking PMF and gaining traction.

Jio Goes The Paytm Way

Jio’s strategy of having products in key verticals is similar to Paytm’s playbook, right down to the payments bank licence. JioFinance app’s key features on debut include digital banking centred around the Jio Payments Bank as well as insurance broking and secured loans against mutual funds.

“Our end goal is to simplify everything related to finance in a single platform for any user across all demographics, with a comprehensive suite of offerings like lending, investment, insurance, payments and transactions and make financial services more transparent, affordable and intuitive,” a JFS statement said.

The payments bank account is likely to sit at the centre of the super app platform, just as Paytm Payments Bank did for Paytm till February 2024 before the RBI action against the bank, and the subsequent changes in Paytm’s backend banking partnerships for lending and payments.

Till the RBI action, most analysts saw the payments bank licence as a major competitive advantage for Paytm. It also enabled the payments app to offer faster transaction times and lower failure rates.

The same advantage will be critical for JioFinance to stand out among a sea of payments apps today. JFS also plans to include secured lending products such as loans against mutual fund investments and home loans in the future. Besides this, it plans to enter the mutual fund business through the JV signed with BlackRock.

During the Q4 FY24 post-earnings call with analysts, JFS managing director and CEO Hitesh Kumar Sethia said, “In the past quarter, the [payments] bank has revamped its digital savings account offerings and also launched virtual debit cards leading to a rapid increase in the number of customers acquired. In the coming quarters, we expect to ramp up our business correspondent touch points to facilitate further growth.”

But given the current market, the payments play will be the central large funnel through which Jio Financial Services acquires users for other services. JFS’ go-to-market strategy will be critical given the competition.

The Fintech Super App Field

While most large fintech companies have gone the super app way, their GTM strategy has differed.

Paytm relied heavily on acquiring digital payment consumers at a very early stage with its wallet business and built inroads into other services including UPI. Till very recently, in fact, UPI was not a big focus for Paytm given how much more profitable the wallet business is and the better terms for merchant discount rates on wallets compared to UPI.

Google Pay and PhonePe used Paytm’s example and doubled down on customer acquisition as well, before slowly adding more and more pieces to their platforms. PhonePe’s entry into the secured lending space, announced this week, is an example of how the Bengaluru-based decacorn is building a larger fintech empire leveraging its lead in UPI.

BharatPe took the B2B route and is now slowly adding B2C products to its mix. BharatPe’s JV for the Unity Small Finance Bank is another competitive advantage for the Peak XV Partners-backed company.

CRED started by tapping the creditworthy creamy layer of the urban population and built on that with more products, while Groww built a sizable lead in the investments space before jumping into lending and payments.

Zerodha which has the second largest active investor base after Groww is another formidable competitor for JFS in the investments space.

Each of these companies is also looking at payment aggregator licences to build further products that help them own a bigger piece of the digital financial services value chain. Jio too has a PA licence which will be leveraged for its B2B verticals.

While the super app field is growing wide, and rightly so given the untapped depth in the market, these specific GTM strategies indicate that owning a single niche is vital. This forms the spine against which the other parts can be added.

What strategy will Jio Financial Services and JioFinance rely on? And how will the fintech platform look to tackle the scale of existing players in each of these verticals? How will the larger Reliance universe link to JFS?

The Jio Financial Services Advantage

By all indications, JFS is more focussed on the wealth management opportunity. The JV with BlackRock has been expanded to cover wealth management and broking, in addition to the asset management.

The strategy questions will be more important for Jio to answer because it is already on course to raise funds and is expected to garner plenty of interest from institutional investors, sovereign funds and private equity giants.

The company is also looking to raise the limit of foreign investment in its equity capital up to 49%, for which it has sought a shareholder nod. JFS’ formation as part of a demerger from Reliance Industries in mid-2023 meant it was already a heavily capitalised business, but its new platform push will require further fresh infusion.

Remember the Jio Platforms funding spree in 2020, and then a similar run for Reliance Retail in 2023? It’s time for Jio Financial Services to be the next big Reliance bet.

Besides investments in the JV with BlackRock, Jio will also use the funds to scale up its merchant business and take on the likes of Paytm which are currently struggling. JFS launched Voice Boxes last year and plans to add to its PoS and devices network in 2024.

Its subsidiary Jio Payment Solutions Limited, which operates the payment aggregator business, will drive the merchants business, and here Jio will also have to fight off Paytm, PhonePe, Google Pay, BharatPe, CRED, Pine Labs and others that have scaled up their PoS businesses.

Not to mention the big investments needed on the consumer side for payments. If Jio hopes to drive scale for its platforms rapidly, it will need to invest heavily on customer and merchant acquisition. The Jio telecom subscriber base of 470 Mn (47+ Cr) users will very likely be JFS’ first target.

Adani Group is also eyeing a fintech super app and has partnered with ICICI Bank for its payments play. The Adani One super app logged INR 750 Cr in sales in FY24, according to reports, the group could leverage ONDC for its ecommerce and payments businesses. Along with Jio, Adani also poses a major threat to the fintech startup ecosystem.

Given the intense competition, Sethia told analysts in April this year that JFS’ advantage can be broken down into three aspects: “Number 1, the Jio brand; number 2, capital; and number 3, customer adjacency from our ecosystem,” he said.

Will these three be enough for the JFS super app? The competition has the deeper fintech experience, and startups such as Paytm, PhonePe, Google Pay, BharatPe, CRED have shown that they rapidly implement new technology and have built tech stacks that can support scale of millions. These are brands in their own rights too and are digitally-native companies that are also investable.

JFS will definitely have the pedigree of Reliance and the Jio brand and even the capital, but fintech is proving to be more than that. Can Jio Financial Services step up?

Sunday Roundup: Tech Stocks, Startup Funding & More

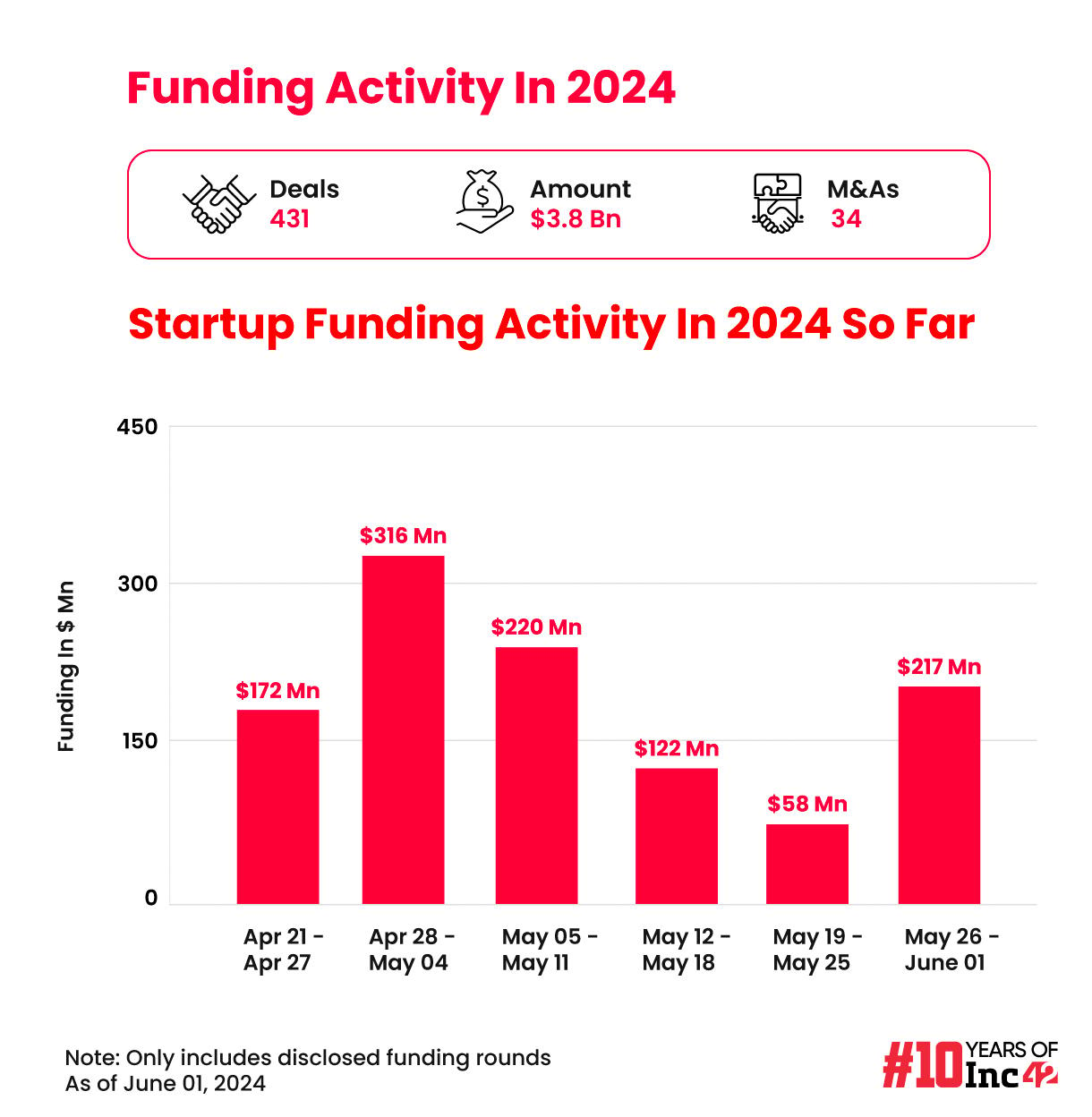

- Indian startups raised more than $217 Mn across 31 deals, this past week, a massive 273% week-on-week jump, taking the May 2024 tally to just over $650 Mn. Stay tuned for our full report

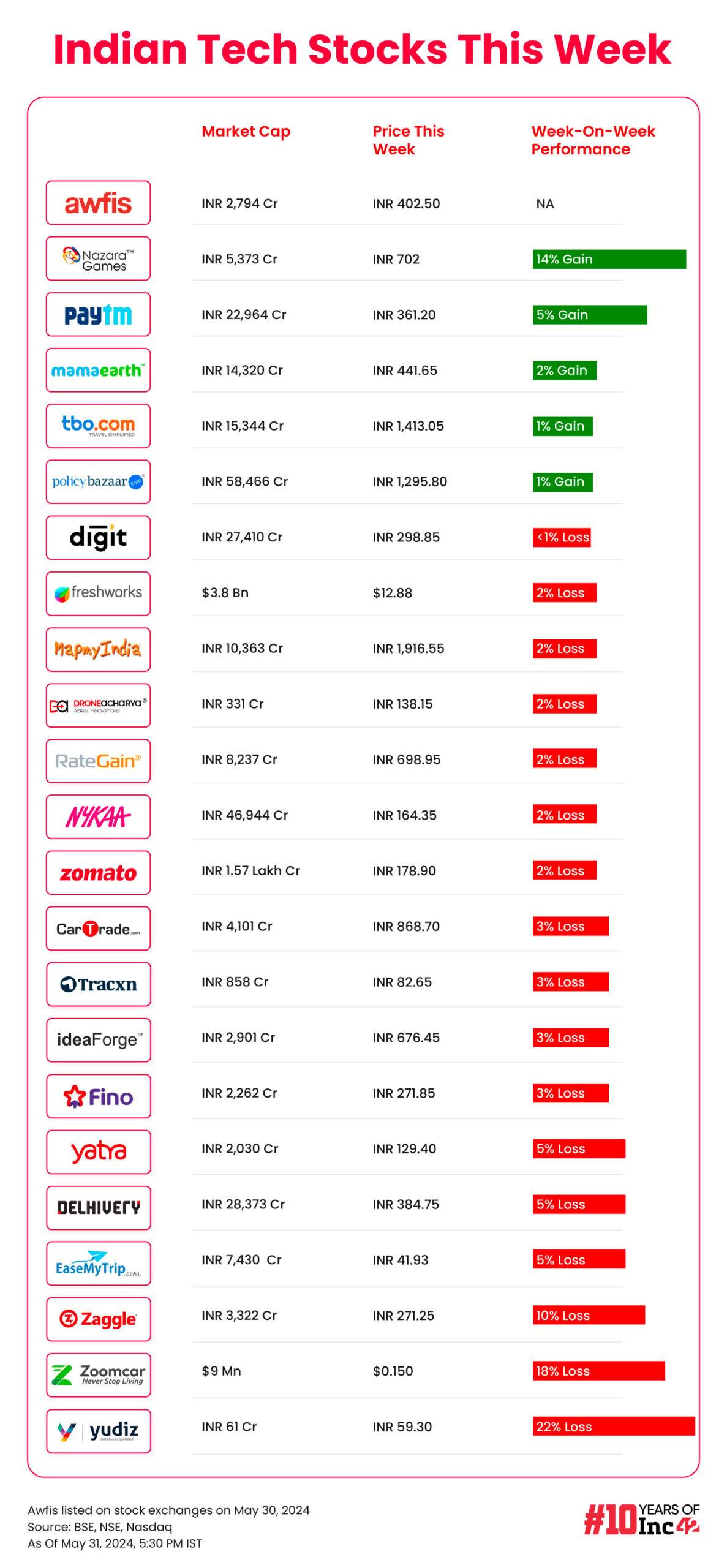

- Coworking space provider Awfis made a strong market debut this week, with its shares listing at a substantial premium of 12.8% on the BSE

- Online travel aggregator Yatra slipped into losses in FY24, just like software development company Yudiz, which reported a loss of INR 2.9 Cr

- On the other hand, recently listed B2B travel portal TBO Tek posted a 64% jump in profit at INR 46.4 Cr for Q4 FY24

- Paytm CHRO Swati Rustagi has quit the company, adding to the recent leadership exodus as the fintech company goes through a reorganisation

The post The Jio Threat To Fintech Startups appeared first on Inc42 Media.

No comments