New-Age Tech Stocks Rally In Volatile Election Result Week, Nazara Emerges Top Gainer

The Indian new-age tech stocks witnessed significant volatility this week, in line with the broader market trends as projection of exit polls and then Lok Sabha election results dictated investor sentiment at the beginning of the week.

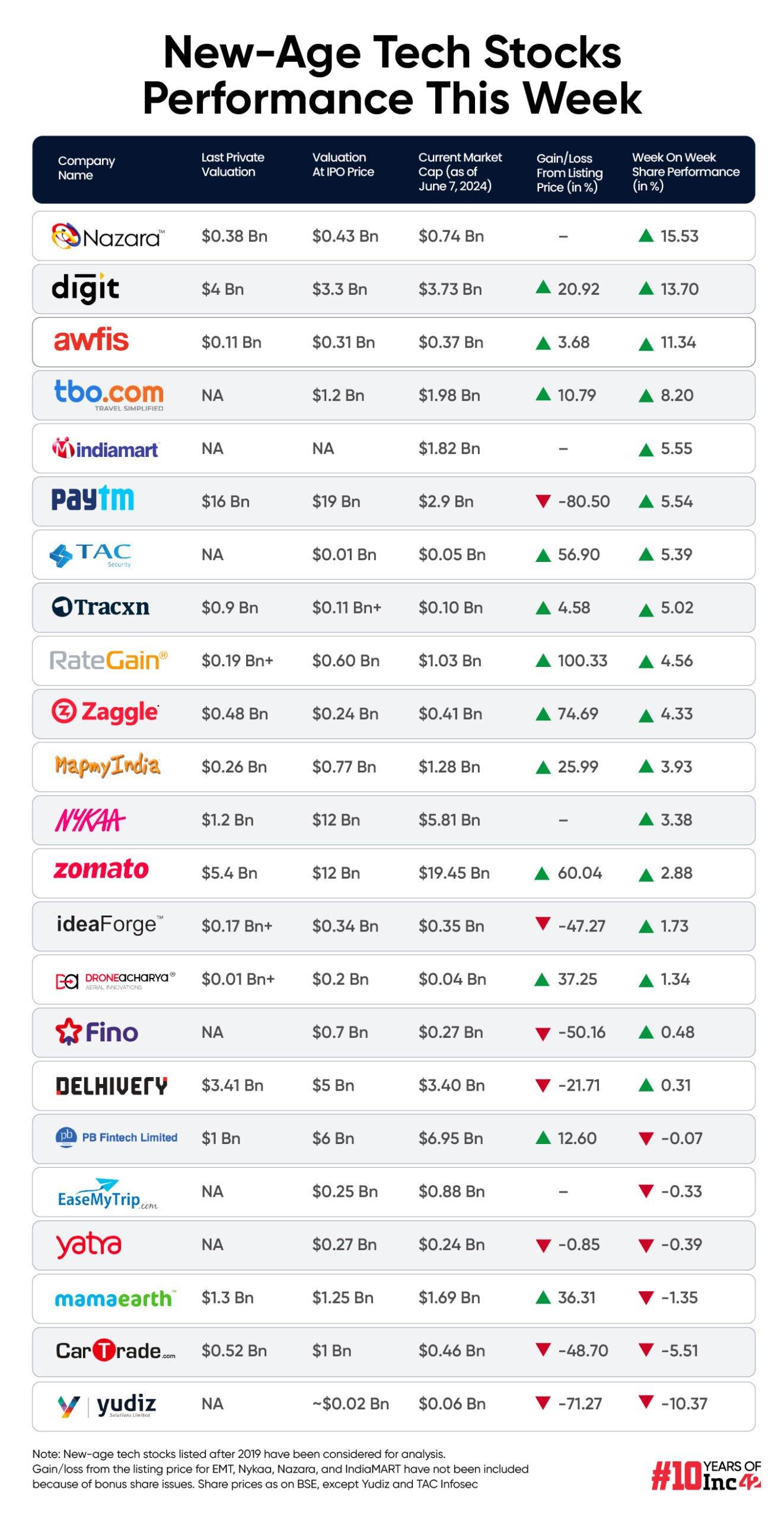

After a slump on the vote counting day on Tuesday (June 4), 17 out of the 23 new-age stocks under Inc42’s coverage gained this week in a range of 0.3% to over 15%.

Nazara Technologies emerged as the biggest gainer, with its shares rallying 15.5%. It was followed by three newly-listed startups – Go Digit (up 13.7%), Awfis (up 11.3%), and TBO Tek (up 8.2%).

Paytm, Tracxn, IndiaMART, RateGain, Zomato, and DroneAcharya were among the other gainers this week.

However, shares of PB Fintech, EaseMyTrip, and Yatra declined marginally this week. Meanwhile, Mamaearth fell 1.3%, CarTrade declined 5.5%, and Yudiz slumped 10.4%.

In the broader market, benchmark indices Sensex and Nifty50 shot up over 3% on Monday on the exit polls results indicating a comfortable majority for the Prime Minister Narendra Modi-led National Democratic Alliance (NDA). However, on Tuesday, both the indices slumped almost 6% as the ruling Bharatiya Janata Party (BJP) fell short of the majority mark.

However, in the last three trading sessions of the week, the market revived again as the BJP and its alliance parties together are set to form the government. Overall, Sensex gained 3.69% this week, ending at 76,693.36 and Nifty50 gained 3.37% ending at 23,290.15.

Siddhartha Khemka, head of retail research at Motilal Oswal, said that strong domestic economic data, falling oil prices, and NDA unanimously passing a resolution to elect PM Modi as the leader of the coalition has uplifted investor confidence.

It must be noted that the Reserve Bank of India (RBI) this week raised the country’s GDP growth forecast for FY25 to 7.2% from 7% earlier.

“Global cues added to the positivity with the European Central Bank announcing interest rate cut by 25 bps for the first time in nearly five years, moving faster than its US and UK counterparts. Now hopes have revived that the US Fed might cut interest rate in the September meet, based on recent macro data points,” he said.

“Next week, the focus will be on the allocation of key cabinet portfolios such as finance, defence, roads, energy, commerce, and railways ministries. The market will continue to be volatile with upward bias,” added Khemka.

Meanwhile, the INR 740 Cr IPO of traveltech startup ixigo is opening for subscription next week.

Now, let’s take a deeper look at the performance of the new-age tech stocks this week.

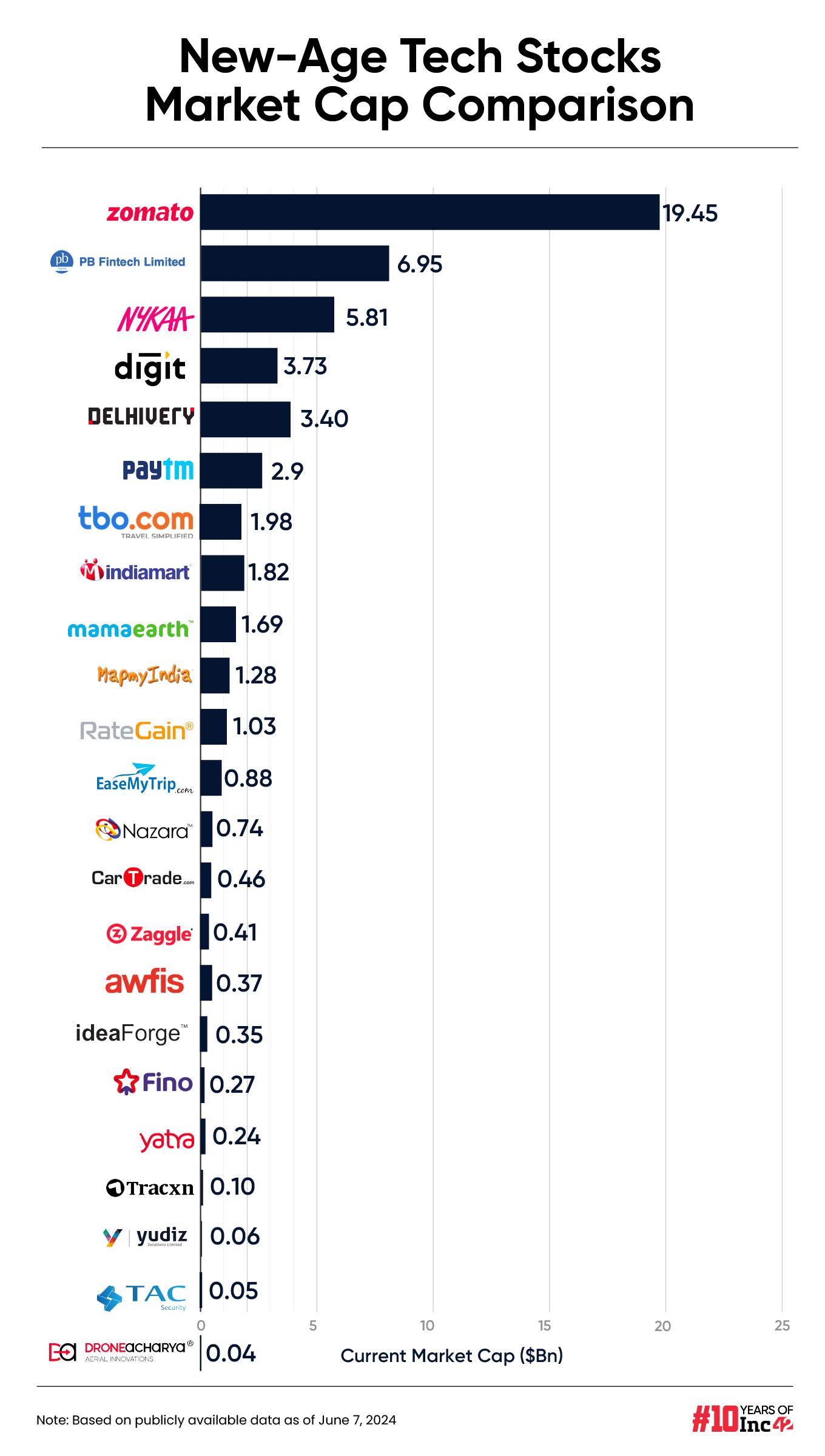

The 23 new-age tech stocks under Inc42’s coverage ended the week with a total market capitalisation of $54.01 Bn as against $52.3 Bn last week.

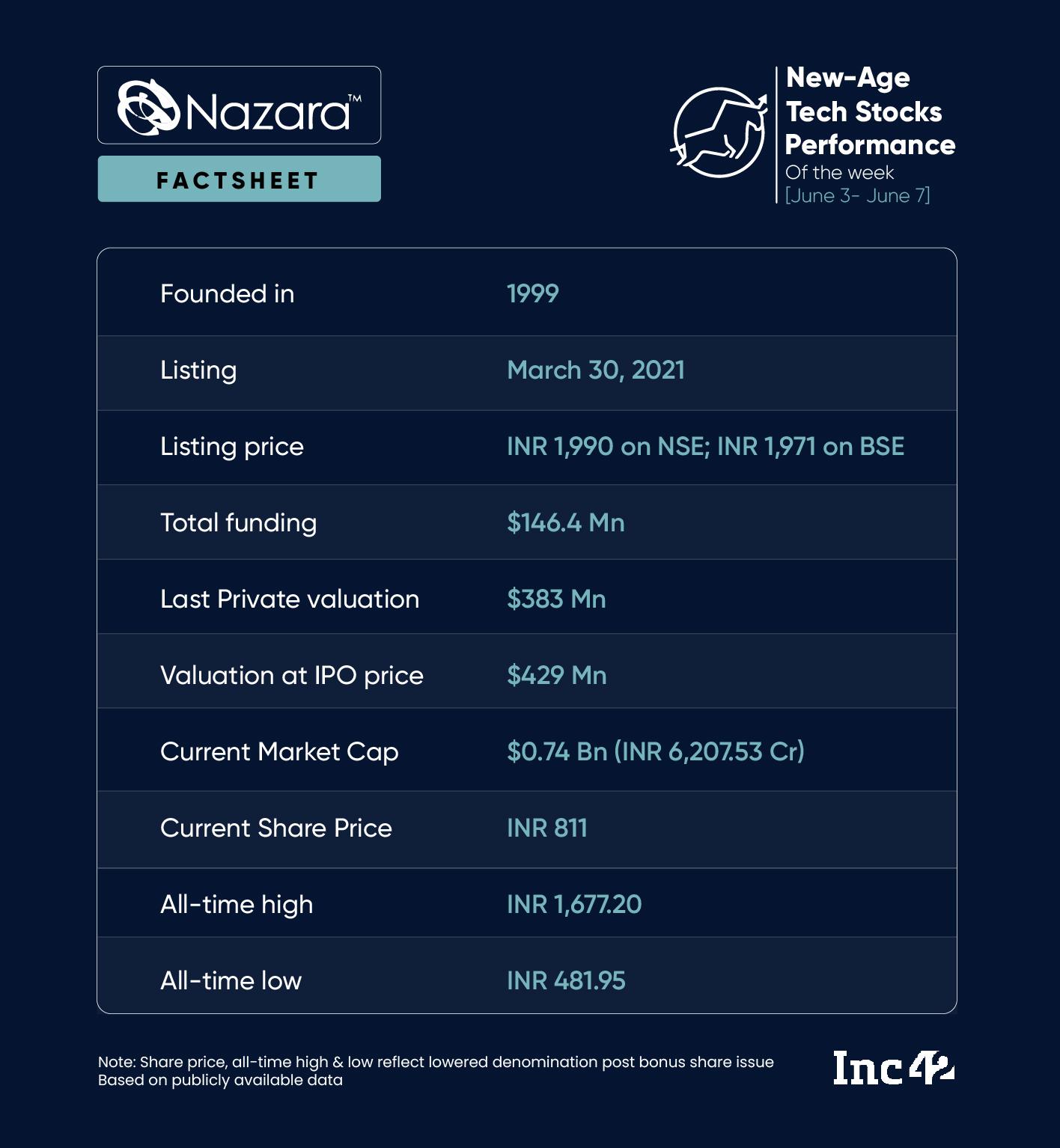

Nazara Emerges As The Biggest Gainer

Shares of Nazara rallied 15.5% this week, despite a 14% decline on Tuesday, to close at INR 811 on the BSE – a level last seen towards the end of February this year.

The stock has been on an upward trend since Nazara posted its Q4 FY24 earnings two weeks ago. Though its profit declined in Q4, certain metrics in its results were better than expected by analysts.

Besides, Nazara also increased its stake in Nextwave Multimedia Private Limited, the developer of mobile cricket game franchise World Cricket Championship, to 100% by acquiring an additional 28.12% stake.

Meanwhile, this week, its subsidiary Absolute Sports announced the US market foray by acquiring Pennsylvania-based entertainment news site Soap Central for $1.4 Mn (around INR 11.6 Cr) in an all-cash deal.

Shares of Nazara started gaining strength after a slump at the beginning of this year. The stock is still trading 5.3% lower year to date (YTD).

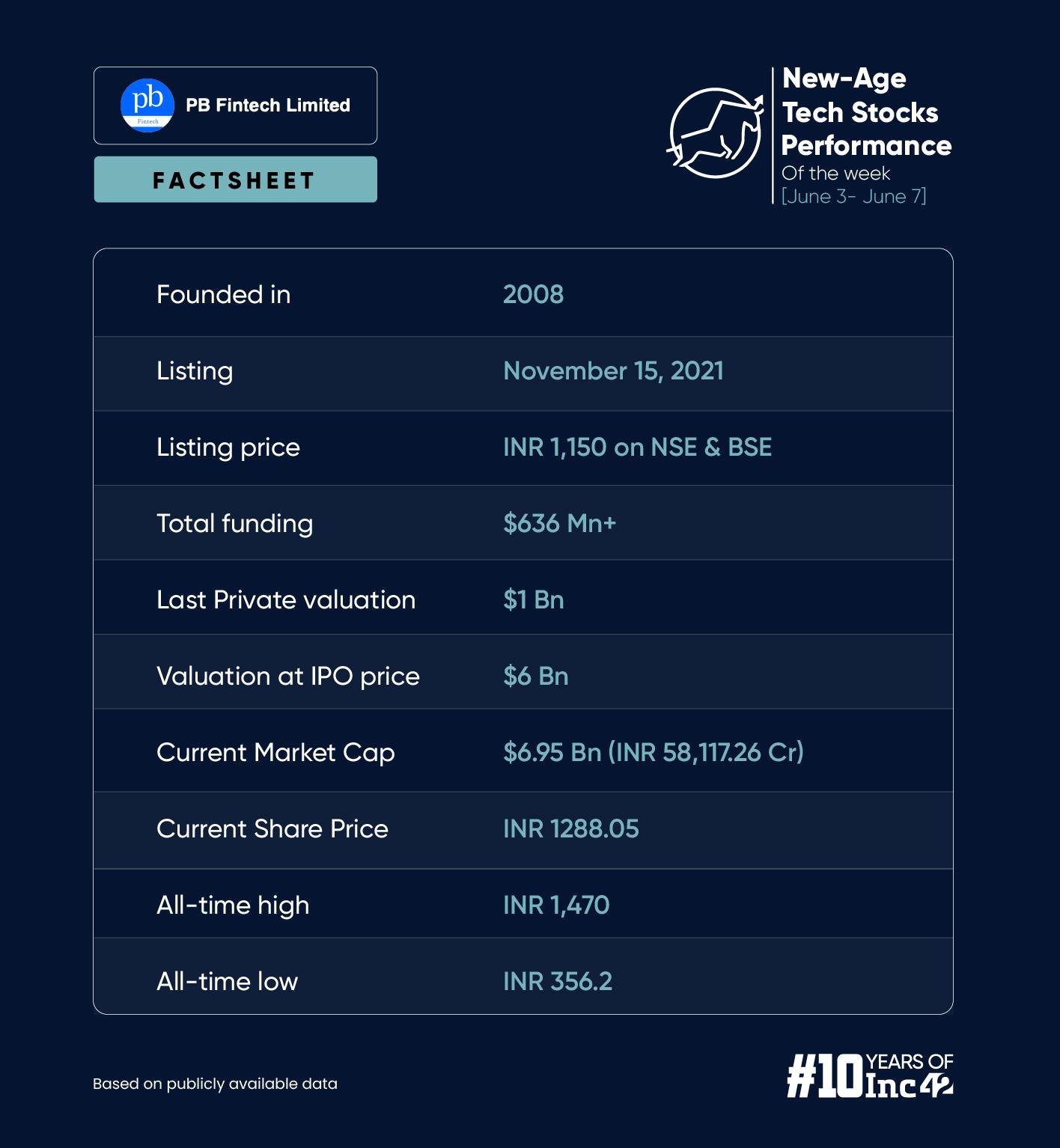

PB Fintech CEO Gets SEBI Show Cause Notice

CEO and chairperson of PB Fintech Yashish Dahiya received a show cause notice from the markets regulator Securities and Exchange Board of India (SEBI) on Thursday (June 6).

The show cause notice is regarding a $2 Mn investment made by PB Fintech FZ-LLC, Dubai in outsourced marketing services provider YKNP Marketing Management in November 2022 to acquire a 26.72% stake.

Meanwhile, Tencent Cloud Europe B.V. also offloaded 33 Lakh shares in the company on Thursday in a bulk deal worth INR 415.7 Cr.

Shares of PB Fintech, which had started gaining upward momentum after Tuesday’s market slump, fell again in two consecutive trading sessions on Thursday and Friday. The stock ended the week 0.07% lower at INR 1,288.05 on the BSE.

The stock rallied significantly since the beginning of the year and is currently trading 62.2% higher YTD.

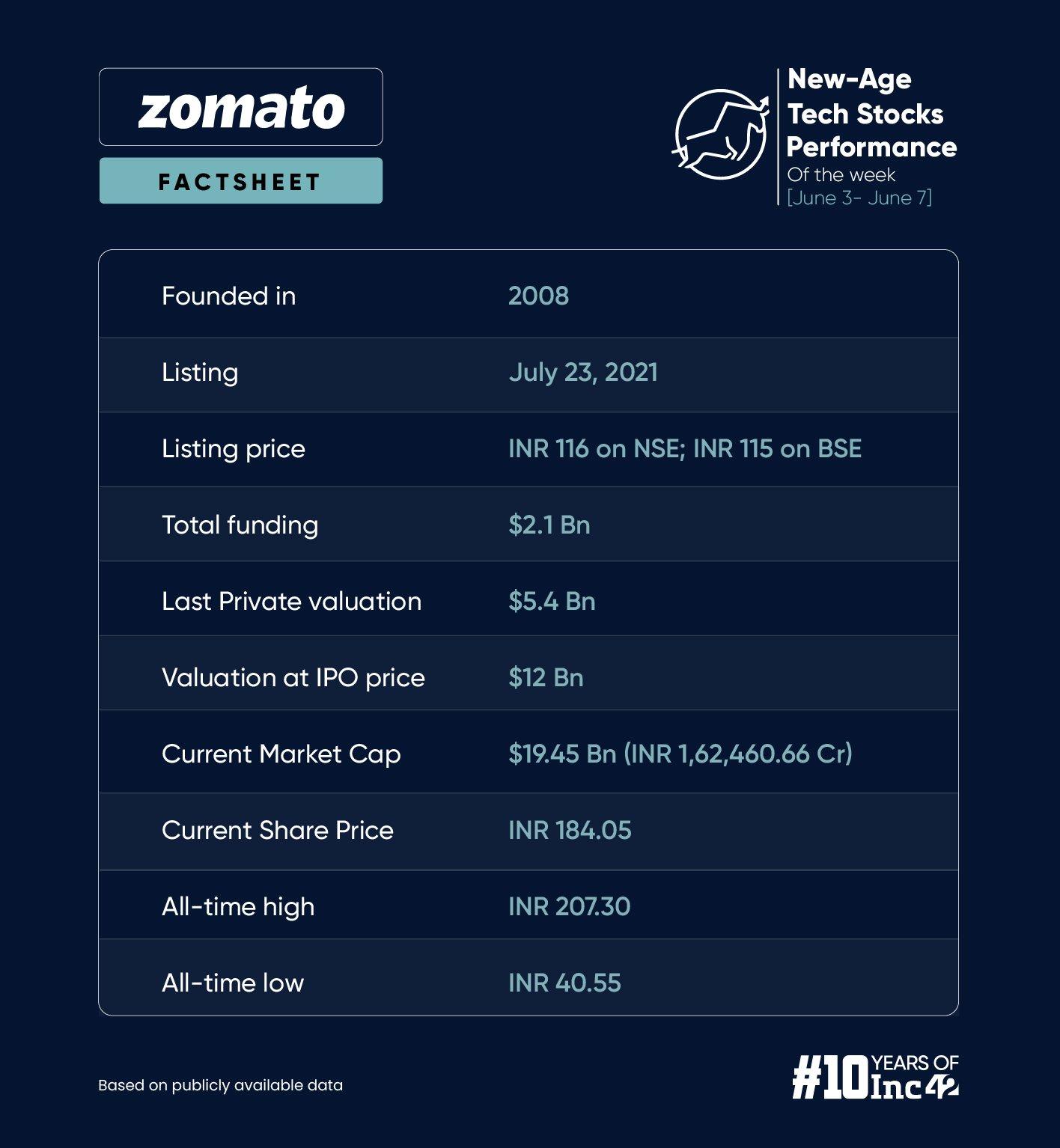

Zomato-Owned Blinkit’s Warehouse Raided

A warehouse of Zomato’s quick commerce platform Blinkit was raised by the Telangana food safety department this week in the state’s Medchal Malkajgiri district. The task force found the premises to be “disorganised, unhygienic and dusty”.

Several packets of expired food products were also found in the raid.

On the other hand, amid the severe heat wave in several parts of the country, Zomato urged its users to avoid placing delivery orders during the peak afternoon, which also sparked a major debate across social media platforms.

Shares of Zomato have recently lost their upward momentum after touching INR 200 level in May. The recent decline was partially also triggered by brokerage Macquarie reiterating its ‘underperform’ rating on the stock and a price target of INR 96.

Despite volatility, Zomato ended the week 2.9% higher at INR 184.05 on the BSE.

The post New-Age Tech Stocks Rally In Volatile Election Result Week, Nazara Emerges Top Gainer appeared first on Inc42 Media.

No comments