Inside India’s New-Age Tech IPO Frenzy Of 2024

Last month remained action-packed for the new-age tech startups aiming to get listed on the Indian stock exchanges. While Go Digit, Awfis and TBO Tek made the headlines for their stock market debut, ixigo received the market regulator SEBI’s nod for its IPO.

From what the trends suggest, this is just the beginning of a significant momentum that’s impending in the tech startup IPO space in the months to come.

Late last year, Inc42 reported that at least 10 startups were expected to get listed in 2024, a majority of which would be embarking on their IPO journeys only after election results.

Notably, IPO activity remained muted in April and May due to market volatility, with only two mainboard IPOs in April and five in May, including the IPOs of the tech startups mentioned above.

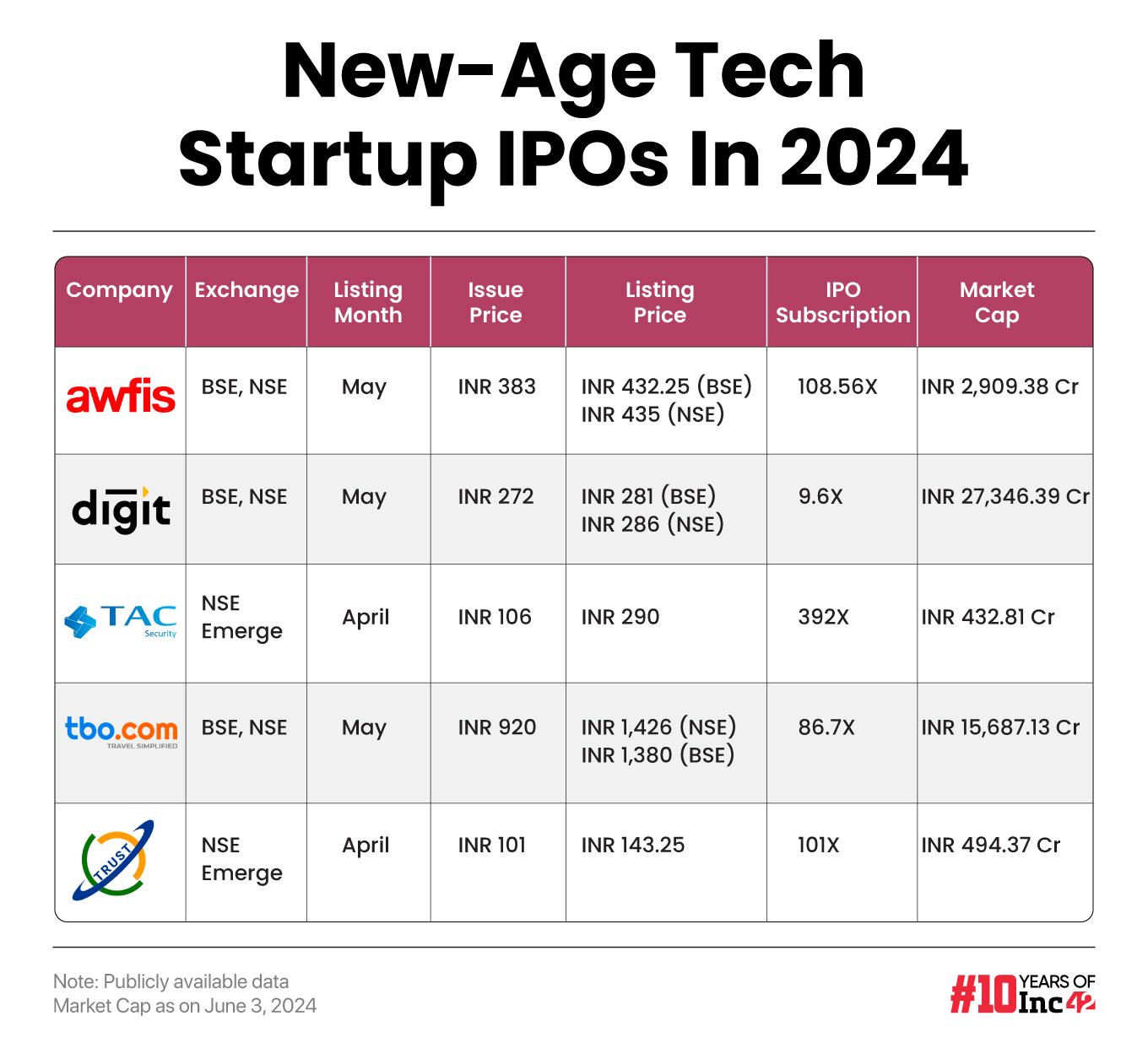

Interestingly, despite a wave of caution across the broader market, B2B travel portal Travel Boutique Online or TBO Tek made a noteworthy listing at a premium of 50-55% to its issue price. Its public issue was subscribed 86.7X.

Similarly, Peak XV-backed coworking startup Awfis was listed at a 12.8% premium to its issue price. Its public issue was subscribed 108X.

However, the IPO of Fairfax-backed insurtech startup Go Digit lacked lustre, with the company making a muted market debut at a 3-5% premium to its issue price. Also, Go Digit’s issue was subscribed only 9.6X, a far cry from the interest garnered by its other two peers.

Analysts believe that in the prevailing market condition, the differentiating factors of the companies and their unique value propositions (USPs) are deciding their fate in the IPO market.

Speaking with Inc42, senior VP (research) at Mehta Equities, Prashanth Tapse, said that the companies that lapped up decent valuations during public listings either have a first-mover advantage or differentiating business models to attract investors.

To comprehend the current situation better, we decided to analyse the recent tech startup listings on the Indian bourses and decode what the upcoming months are going to look like for the IPO-bound startups and the broader IPO market.

However, before delving deeper into analysing some of the recent tech IPOs, let’s first understand what the broader market trends suggest.

A Closer Look At The 2024 IPO Run

After a slump in the IPO market in 2022, last year witnessed some IPO green shoots on the back of improving global as well as domestic market sentiments.

As per market experts, the year 2024 is expected to see these green shoots further bloom, with as many as 100 companies anticipated to embark on their stock market expeditions.

However, what’s worth noting is that the IPO size has declined despite a rise in the number of public listings.

In 2023, for instance, India saw 57 mainboard IPOs raising INR 49,434 Cr, enduring a decline from INR 59,302 Cr raised by 40 companies a year ago.

As many as 29 mainboard listings have already taken place so far this year, collectively raising INR 27,652 Cr.

However, SME exchanges have seen more activity in 2024 so far. On the startup front, too, SME exchanges have witnessed much bustle, with Trust Fintech and TAC Infosec listing at significant premiums on the NSE SME platform.

While fintech SaaS company Trust Fintech listed at a premium of 42% on NSE Emerge, SaaS cybersecurity company TAC Infosec listed at a 173.6% premium to its issue price on the same platform.

Despite this uptick in the IPO momentum, Mahavir Lunawat, MD at Pantomath Capital Advisors believes that there is an appetite for more IPOs. As per Lunawat, India is very short of capital formation, and as an economy, the country needs more than INR 2.5 Lakh Cr of capital formation if it has to double its economy by 2030.

“Also, if we look at it from a liquidity perspective, we have more than INR 2 Lakh Cr coming in the capital market from mutual funds, insurance, pension, and other modes annually. So, if there are fewer fresh equity issuances and IPOs (which currently stand at INR 60K-INR 70K annually), where will this money flow?” Lunawat pointed out.

Hence, to meet the demand and supply equilibrium, the Indian market needs to beef up its IPO activities by 4X from the current level, he observed.

Shrinking IPO Sizes On The Rise

According to Lunawat, the country is witnessing a surge in IPOs on the back of several small-size offerings.

Interestingly, in many recent IPOs of new-age tech startups, we have noticed companies reducing their IPO sizes after receiving SEBI approval.

In Go Digit’s case, the insurtech unicorn cut the size of the fresh issue to shares worth INR 1,125 Cr and an offer for sale (OFS) component of 54 Mn shares. Earlier, it was looking at raising INR 1,250 Cr from the fresh issue, along with an OFS component of 109.45 Mn shares.

Similarly, Awfis brought down the amount raised via fresh issue of shares to INR 128 Cr from INR 160 Cr earlier (as per DRHP). However, the coworking space provider increased its OFS component slightly to 1.23 Cr shares from 1 Cr earlier.

On the other hand, travel tech major ixigo, whose IPO is scheduled to open next week on June 10, is looking to raise INR 120 Cr in primary capital, which is a sharp drop from INR 750 Cr it was aiming for in 2021.

While the companies largely attribute this revision to their decreased appetite for capital, it could also be attributed to the lukewarm response received by Paytm, Life Insurance Corporation of India (LIC), and a few others’ IPOs in 2021 and 2022.

Indian Startups To Take Cues From Go Digit

Among the new-age tech startups going public in 2024, across mainboard and SME, the IPO of the Virat Kohli and Anushka Sharma-backed startup received a lukewarm response.

Discussions with market experts suggest that its valuation and lack of a differentiating factor in a crowded market like insurance failed to garner much interest in the public market. This is despite the startup turning profitable.

The company was eyeing a valuation of $3 Bn on the higher band, which was lower than its last private valuation in 2022 of $4 Bn. However, Digit’s valuation expectations were still relatively higher compared to other more established insurance players in the market. At the higher end of its IPO price band, the startup’s valuation multiple was 680X of its revenue. This number for leaders in the insurance industry stood at about 43X.

Just a few days after its listing, brokerage Emkay Research has a ‘sell’ rating on the stock with a downside potential of 30% from its listing price (INR 281).

The brokerage’s cautious sentiment stems from the rationale that Go Digit is “just another general insurance player” at its core and does not have a clear moat.

Besides, the brokerage believes that there is no justifiable reason for the stock to trade at a premium valuation over the industry leaders like ICICI Lombard and Star Health, which have established their profitable business model, have a far stronger retail business, and are powerful brands. Emkay has also raised profitability-related concerns in the company in the near-to-medium term.

Riding On The First-Mover Advantage

While market experts believe that strong fundamentals will play a crucial role in making the public offers of startups attractive to investors, elements like first-mover advantage in a particular industry and other USPs should not be underestimated. Interestingly, there are several examples to substantiate this statement.

For instance, coworking space provider Awfis is the first-of-its-kind in its sector to get listed on the Indian stock exchanges. Its shares were listed at INR 432.25 on the BSE, lapping up a 12.8% premium over the issue price of INR 383. On the NSE, the startup’s shares opened at INR 435, 13.5% higher than the issue price.

This has been despite Awfis being a loss-making entity.

Tapse said, “We believe the healthy listing is justified on the back of the company’s number one rank among the top five benchmarked players in India in the flexible workspace segment.”

Tapse also drew a parallel with the IPO of foodtech major Zomato. He said that during its IPO, Zomato was also a loss-making company, but it has been a leader in its segment and first-of-its-kind to go public.

“Right now, though its balance sheet and P&L are negative, going forward Awfis will leverage the growing demand for flexible office spaces in India to expand its business. Also, like Zomato, Awfis will experience a growing awareness of its brand post listing, which will eventually lead to profitability,” Tapse added.

Sonam Srivastava, founder and CEO at Wright Research also emphasised that Awfis has gone public piggybacking on the untapped potential of shared office space in India. Besides, it’s also not extremely overvalued, which also makes it a good addition to one’s folio.

What’s Next?

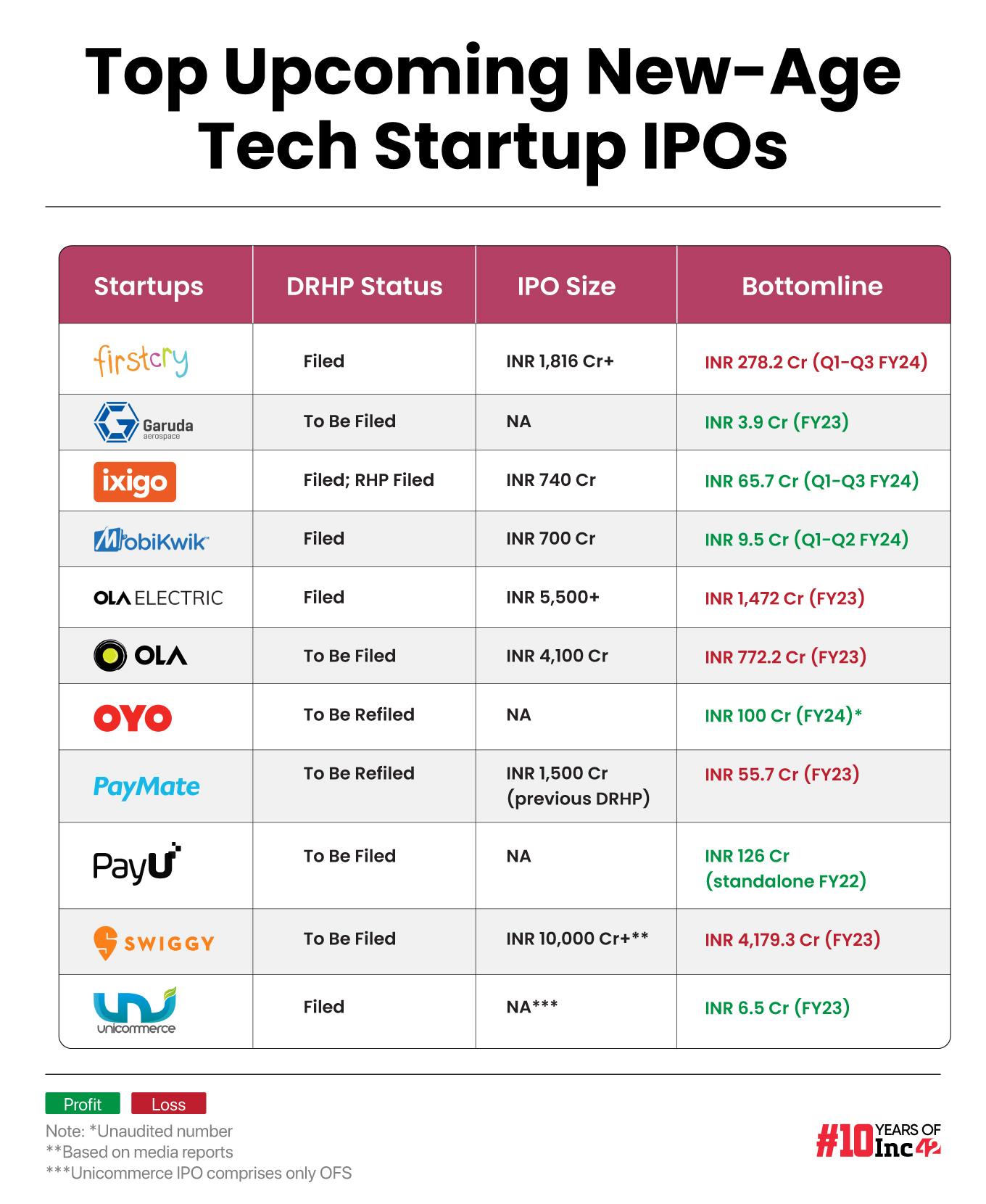

The Indian stock market is expected to see some of the most noteworthy new-age tech IPOs this year. The likes of Swiggy, Ola Electric, FirstCry, ixigo, Unicommerce, Ola Cabs, PayU, and MobiKwik are likely to go public this year.

Inc42’s recent discussion with market experts revealed that there is a positive public market response for ixigo on the anvil. Besides its profitability quotient, the company has differentiated itself from its other listed competitors such as EaseMyTrip, Yatra, and MakeMyTrip with a focus on railway ticketing, and a deeper penetration into the Tier II and smaller markets, which analysts expect to act as major contributors to the success of its IPO.

Speaking on the startups preparing for their respective IPOs, ixigo cofounder and CEO Aloke Bajpai told Inc42 that IPOs ensure that these ventures have strong corporate governance guardrails in place and more professional management teams running the show.

“After the 2021 era, some of the learnings from public markets are now acting as a feeder into the private market, which necessitates companies to have strong fundamentals and a sustainable business model, as well as the realisation that they need to turn profitable at some point and start delivering positive cash flows,” said Bajpai.

“I think for any company wishing to approach the public markets, these are some of the basic hygienes to check.”

Currently, the high valuations and big issue sizes of loss-making Swiggy and Ola Electric present a notable challenge, making them key IPOs to watch this year.

Meanwhile, after much back and forth, hospitality chain OYO withdrew its IPO papers again in May, with plans to refile its draft red herring prospectus (DRHP). However, the timeline for this is still unclear.

Despite this, public market investors are expected to get plenty of opportunities to invest in new-age tech companies in 2024 and beyond.

A recent research report by Pantomath suggests that the equity raised through IPOs could exceed the INR 1 Lakh Cr mark in FY25. Among the 56 prospective IPO candidates in the fiscal year, nine new-age tech firms are said to be looking to raise around INR 21,000 Cr collectively.

[Edited by Shishir Parasher]

The post Inside India’s New-Age Tech IPO Frenzy Of 2024 appeared first on Inc42 Media.

No comments