How Credgenics Is Using AI & ML To Help Banks & FIs Improve Debt Collection By 25%

Estimated to become a $2.1 Tn market opportunity by 2030, the Indian fintech space is one of the fastest-growing sectors in the world. Propelling its growth is digital lending, which is projected to surpass the $1.3 Tn mark by the end of the decade.

While things appear all rainbows and sunshine on the face of it, the rot of stressed loans and non-performing assets (NPAs) runs too deep ailing the industry. According to RBI’s “Report on Trend and Progress of Banking in India 2022 & 2023″, banks reported a gross non-performing assets (GNPA) ratio of 3.2% at the end of September 2023.

The report further states that the GNPA (Gross Non-Performing Assets) ratio of NBFCs continued its downward trajectory, with the personal loans segment maintaining the lowest GNPA ratio in September 2023 (3.6%).

Trying to keep these NPA numbers at bay have been the country’s new-age debt collection tech platforms, which are part of the larger Indian debt collection software market projected to grow at a CAGR of 9.18% from $190.78 Bn in 2023 to $296.08 Bn in 2028.

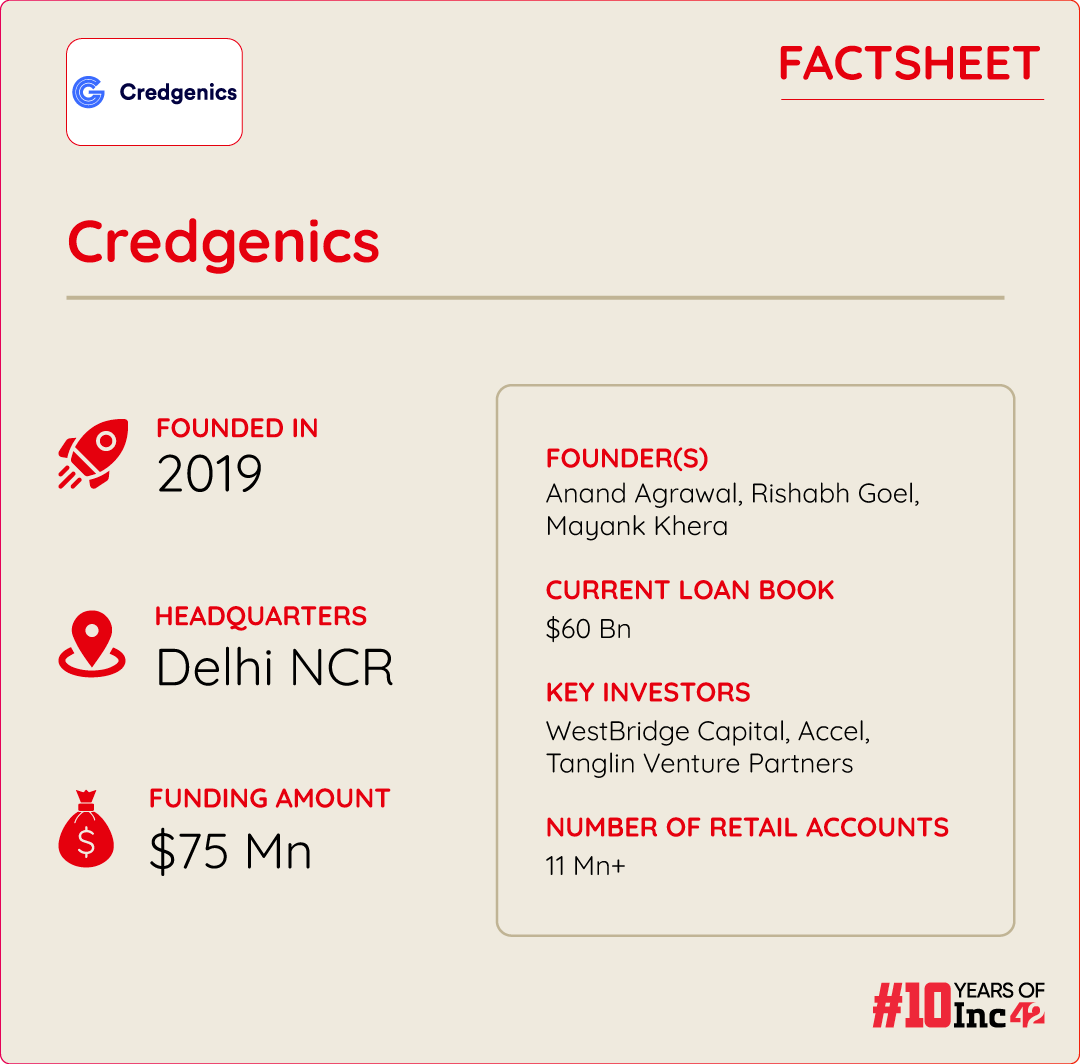

It is this lucrative opportunity that Credgenics, an AI-focussed digital-first collections platform, wants to leverage by helping banks, non-banking finance companies (NBFCs), fintechs, and asset reconstruction companies (ARCs) strategically manage risks across loan collections lifecycle.

Founded in 2019, the startup today handles 11 Mn retail loan accounts and claims increased lenders’ resolution rates by 20% and improved collections by 25%. Further, the startup takes pride in reducing collections costs and time by 40% and 30%, respectively.

Notably, the startups entered the Indian debt collection space at a time when most lenders were too vulnerable to data leakages. It was this white space that was staring right into the eyes of Credgenics’ cofounders Anand Agrawal, Rishabh Goel and Mayank Khera, and waiting to get disrupted.

“Lending in India has been growing at a CAGR of more than 22-23% since FY19. The growth of the Indian debt collection space has been on par with the growth in lending. But, when we entered the market, only a few technology players were catering to the collection use case. Most fintechs and legacy lenders have been doing collections on their own with manual processes while facing high data leakages,” Agrawal said.

Sensing the opportunity to disrupt the Indian lending space, the founders of Credgenics decided to build a platform that could be integrated into lenders’ loan management systems to optimise pre and post-litigation collections and settlements.

With its integration, Credgenics gave lenders the superpower to take full control of their loan lifecycles, including borrower communication, defaulter management and legal.

In August 2023, the startup raised $50 Mn in a Series B round at a valuation of $340 Mn. The round was led by Westbridge Capital, Accel, Tanglin Ventures, Beams Fintech Fund and other strategic investors.

In 2021, it raised $25 Mn in a Series A round at a valuation of over $100 Mn. Since then, Credgenics claims to have grown 7X in 2023.

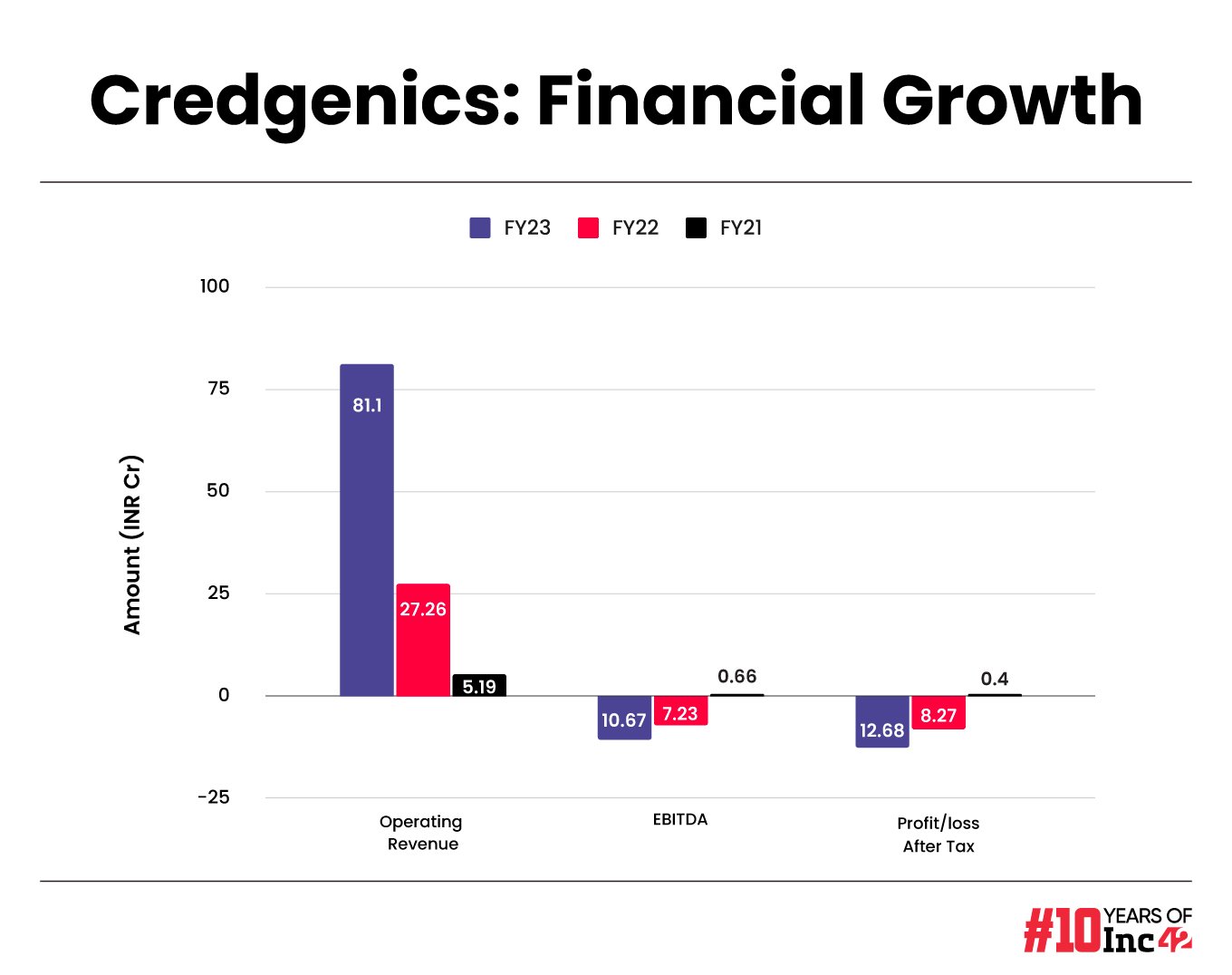

It claims to have turned operationally profitable, garnering total revenues of INR 90.25 Cr in FY23, up from INR 32.55 Cr in FY22. Credgenics has yet to file its FY24 financials.

Credgenics Gets The Covid-19 Booster Shot

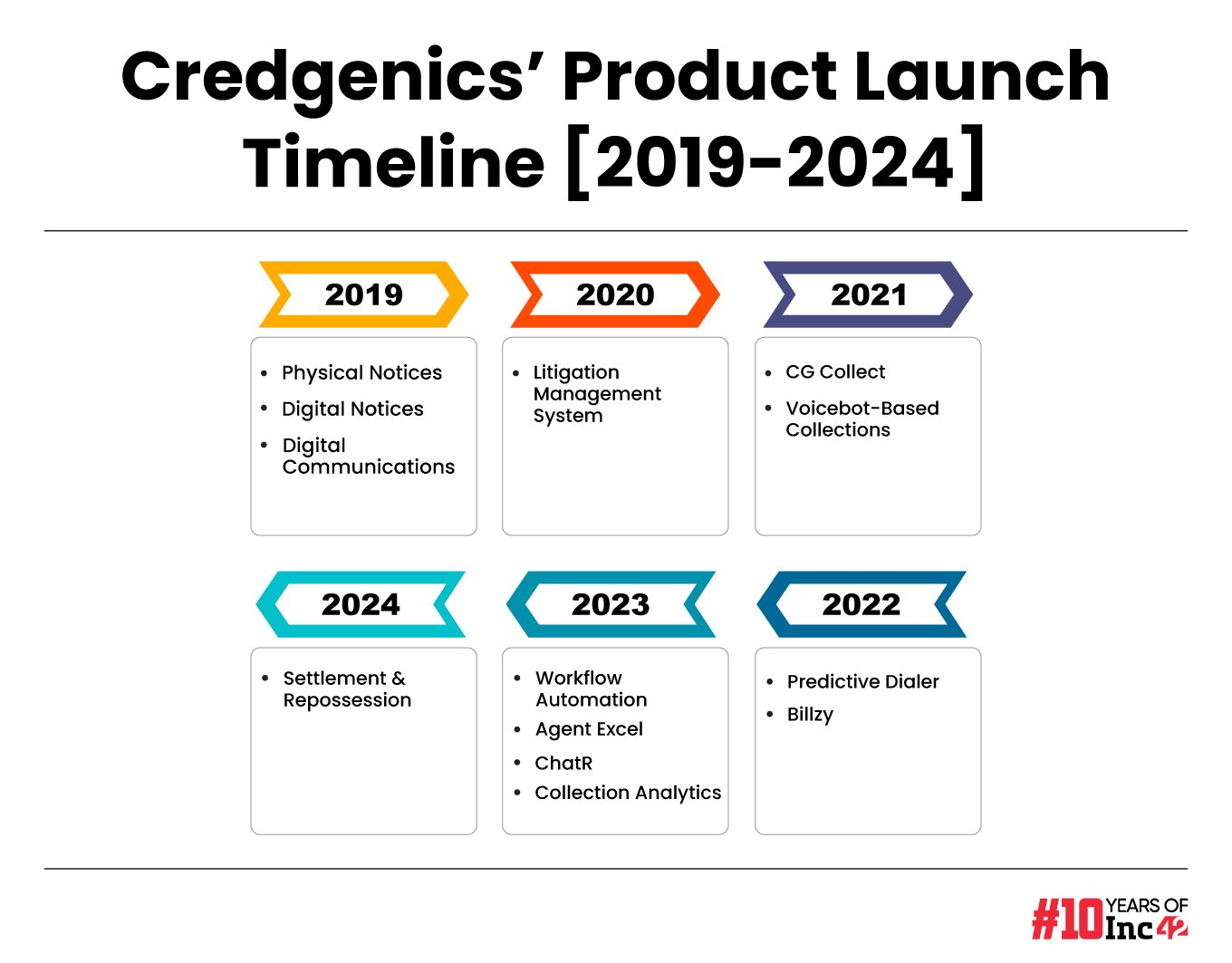

The cofounders started building a debt collection system in early 2019. It took them about a few months before they rolled out their first minimum viable product (MVP) towards the end of 2019.

“As we kept building, we joined hands with fintechs like RupeeRedee and Cashkumar, which were open to experimenting with our offerings then,” he said.

However, soon the Covid-19 pandemic struck havoc on the world. Realising that a lot of people were either facing pay cuts or job losses due to the Indian economy coming to a standstill, the RBI offered moratorium relief to Indian borrowers. Consequently, debt collections came to an unsettling low.

Following the end of the three-month-long moratorium period, Indian lenders witnessed a huge wave of loan defaults. Even big banks like HDFC and ICICI had put out public comments about how loan defaults were increasing.

Agrawal told Inc42 that upon recognising the opportunity, he began reaching out to lenders, positioning the platform as one that can handle collections at scale with technology at the centre.

“So, that’s what we targeted and we started onboarding a lot of these clients, especially starting with fintechs and went on for NBFCs and then got banks on board too,” he said.

Today, we were told, the fintech SaaS startup works with more than 100 clients and claims to have touched an overall loan book worth $60 Bn in FY23. Some of Credgenics most notable clients are IIFL Finance, Mahindra Finance, ICICI Bank, HDFC Bank, DMI Finance, Hero Fincorp, TVS Credit, IREP Credit Capital and Indifi.

Its product stack encompasses multiple mini-modules, allowing enterprises to choose according to their specific requirements. Additionally, they have been expanding internally by introducing more loan products onto the platform. For instance, they began with credit cards but have since expanded to include commercial vehicle loans, two-wheeler loans, and personal loans as well.

“All our products stay in a growing stage all the time, and we keep on building mini modules for each use case,” he said.

How Credgenics Disrupts Debt Collections Market With Its AI, ML Models

As stated above, Credgenics disrupted the digital lending market by assisting its clients in reducing collection costs, minimising collection time, and significantly boosting collection rates.

For example, on a case-by-case basis, Credgenics helped increase collection rates by 90-92% while reducing costs by 20-35%, achieving results faster than traditional manual processes.

According to Agrawal, these efficiencies are enhanced by incorporating extensive data analytics and data science. For instance, if a client has a portfolio of 1 Lakh customers but a team of only 300, how can they reach out to them in just three days?

“At Credgenics, we approach this by identifying customers who require manual intervention and ensuring that the right person is sent via the right channel with the appropriate trigger of communication. This ensures efficiency and targeted outreach, where we leverage machine learning models to identify the most effective approach and customer segment to target,” Agrawal said.

In addition to this, Credgenics utilises AI and machine learning (ML) in three key areas:

Capturing The Customer Journey: Credgenics’ ML models assist organisations in tracking the consumer journey from the initial communication. This behavioural data serves as training data to develop more effective collection models and customised collection strategies, optimising ROI for clients.

Empowering Collection Agents: Credgenics’ AI, ML models enhance the efficiency of on-ground collection agents for clients. For example, standard communications can be automated, and agents can intervene only when human interaction is necessary.

Engagement With Customers Via GenAI Bots: Credgenics offers GenAI-focussed voice bots to automate clients’ mundane daily customer engagement processes.

The Future Of Debt Collections

Credgenics competes with industry players such as Receeve, CreditMate (acquired by Paytm), Credility, CreditNirvana, CLXNS, GoCollect, and Creditas. These entities are actively developing digital-first solutions in the debt collection space by leveraging technologies like AI, ML, and data analytics.

In addition, there exists another layer of debt collection players who manage their loan books and offer debt collection as part of a service-led approach rather than a product.

Asserting how Credgenics has emerged as one of the largest players in this segment, Agrawal said, “In India, there are approximately 220 Mn accounts with some form of loan, including credit cards, secured, and unsecured loans. Eleven million of these accounts are managed on our platform for collections.”

As of now, Credgenics, which, according to Agrawal, has been EBITDA positive for a few months now, is looking to rope in more clients from the public sector. However, Agrawal believes that onboarding PSUs may take anywhere between 8 months to a year.

As of now, being a completely cloud-operated digital SaaS platform is another challenge for Credgenics, as it sometimes takes time for an organisation to change its collection approach, which makes it longer to build a point of contact.

Meanwhile, the growing opportunity in the debt collection space offers a lot of opportunities for existing and new incumbents. However, entry barriers are formidable for players offering tech-enabled solutions, as tight integrations with loan management systems are essential. These integrations facilitate seamless information flow between systems, making it challenging to replace established solutions.

However, the slow pace of control, training, and adaptation of new models favours startups like Credgenics in retaining clients. Moreover, unless a new player introduces a critical differentiator, disrupting the market will be challenging. However, this also indicates that Credgenics would have to continue to innovate while tapping into different areas of the collection life cycle and turn profitable.

The post How Credgenics Is Using AI & ML To Help Banks & FIs Improve Debt Collection By 25% appeared first on Inc42 Media.

No comments