New-Age Tech Stocks Surge In The First Week Of FY25, Tracxn The Biggest Gainer

Indian new-age tech stocks started the first week of FY25 with a massive rally as the broader domestic market also gained momentum.

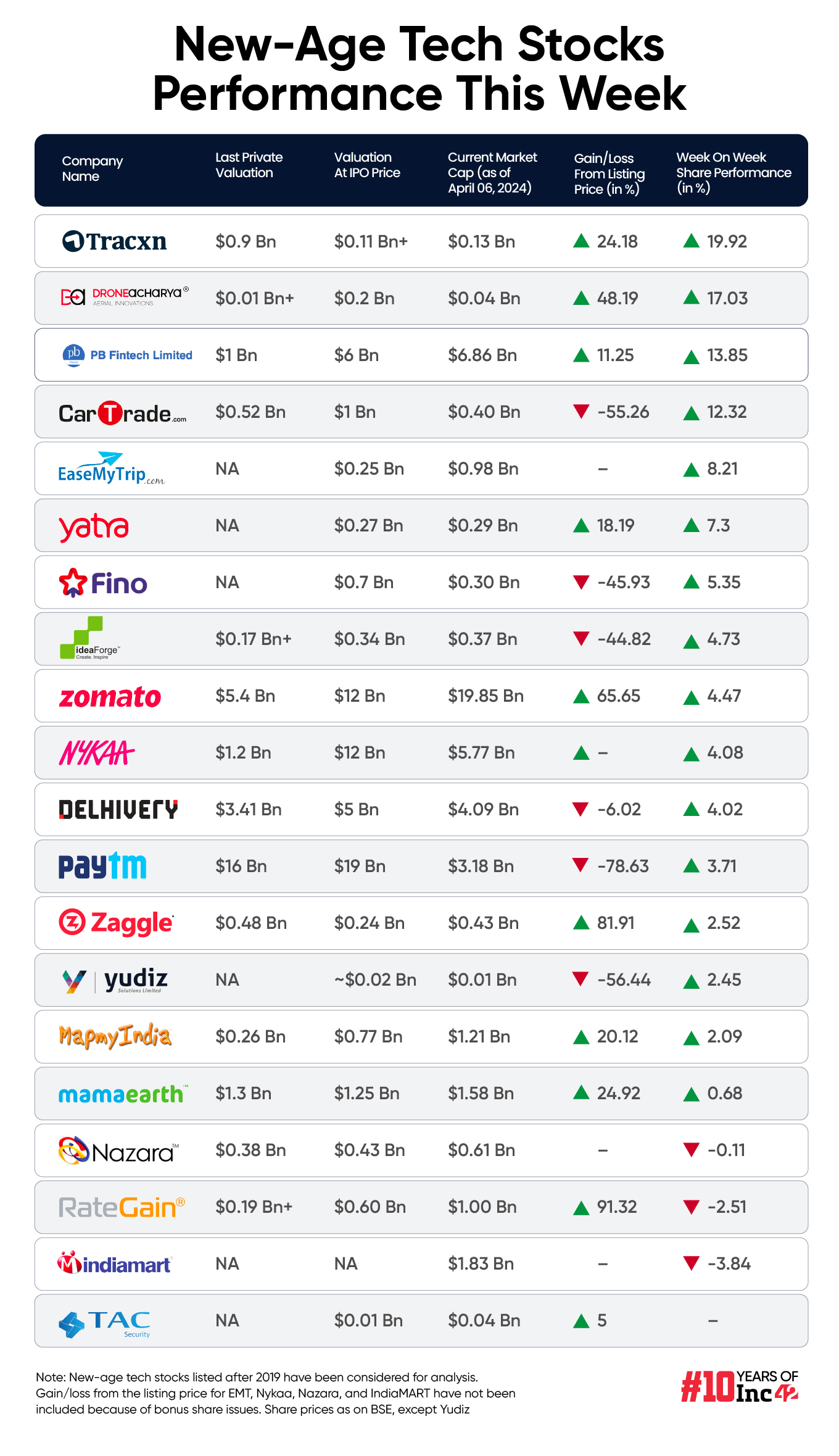

Sixteen out of the 19 new-age tech stocks under Inc42’s coverage gained this week in a range of 0.6% to 20% on the BSE, with Tracxn Technologies emerging as the biggest gainer.

DroneAcharya (up 17%), PB Fintech (up 13.8%), CarTrade Technologies (up 12.3%), EaseMyTrip (gained 8.2%), Zomato (up 4.5%), and Paytm (up 3.7%) were among some of the biggest gainers this week.

However, Nazara Technologies fell 0.1% this week, while RateGain and IndiaMART declined 2.5% and 3.8%, respectively.

Meanwhile, TAC Infosec made its debut on NSE Emerge this week, listing at a premium of 173.6% to the issue price. The SaaS cybersecurity startup listed at INR 290 on the exchange.

In the broader market, both Nifty50 and Sensex gained 0.8% to end the week at 22,513.7 and 74,248.22, respectively. While the week began on a strong note, the market saw volatility in the later part of the week.

Vinod Nair, head of research at Geojit Financial Services, attributed the rise in volatility to a surge in US bond yields and crude oil prices, along with escalating geopolitical tensions.

“Despite the RBI’s policy meeting aligning with expectations, concerns surrounding food inflation and alerts of a heat wave tempered market sentiment,” Nair said.

It is pertinent to note that the Reserve Bank of India (RBI) this week kept the repo rate unchanged at 6.50%.

Analysts expect the market focus to shift to Q4 earnings season from next week, with TCS scheduled to announce its results on April 12.

“Also, markets will take cues from global events like India and US inflation data, US Fed meeting minutes, and ECB policy meetings,” said Siddhartha Khemka, head of retail research at Motilal Oswal. “Markets on Monday would react to US non-farm payroll data and unemployment rate. Overall we expect the market to consolidate in a broader range with stock-specific action.”

Now, let’s take a look at the performance of some of the new-age tech stocks this week.

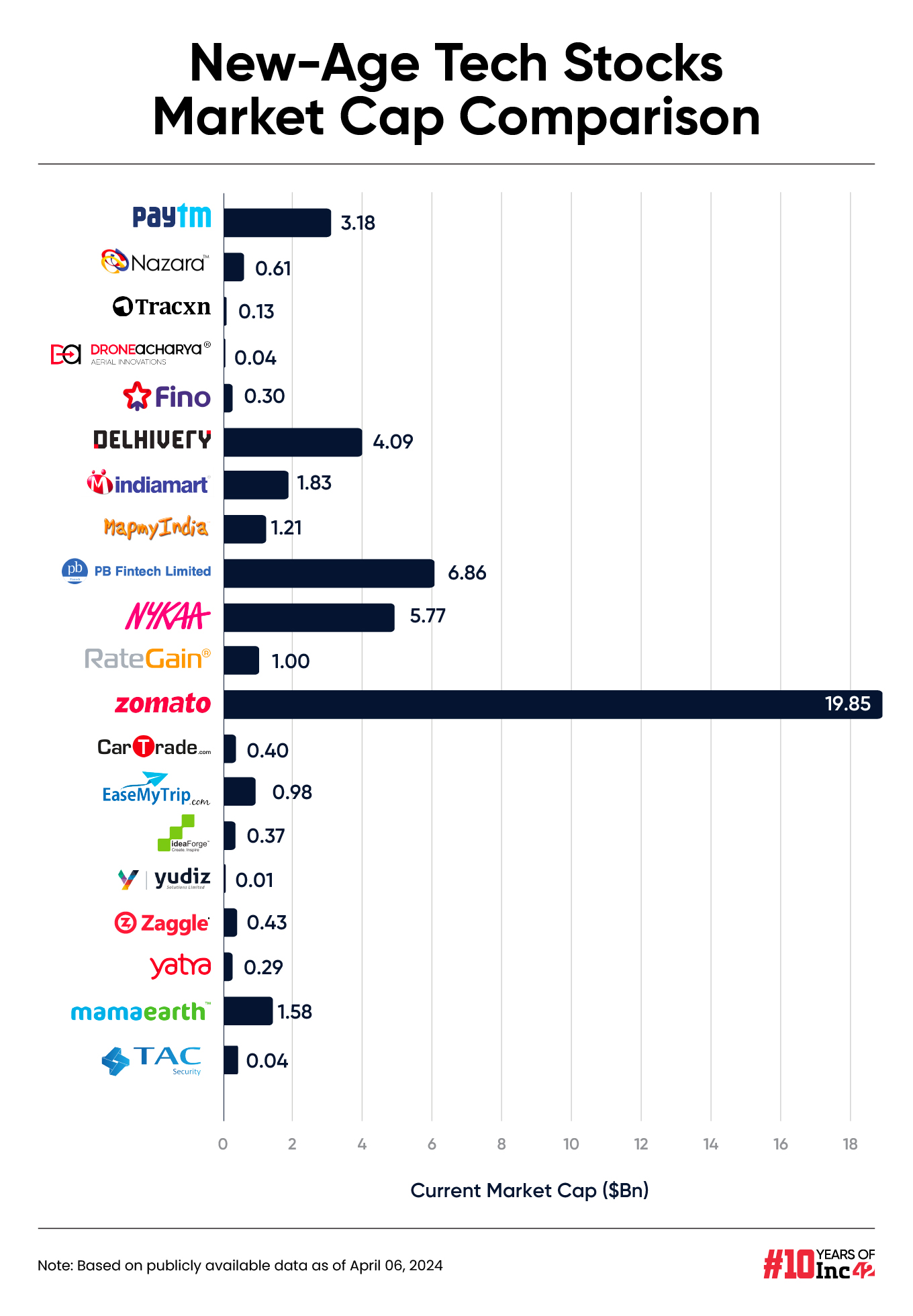

The total market capitalisation of the 20 new-age tech stocks now under Inc42’s coverage stood at $48.97 Bn at the end of this week as against 19 tech stocks ending last week at $46.56 Bn.

Zomato Continues To Soar

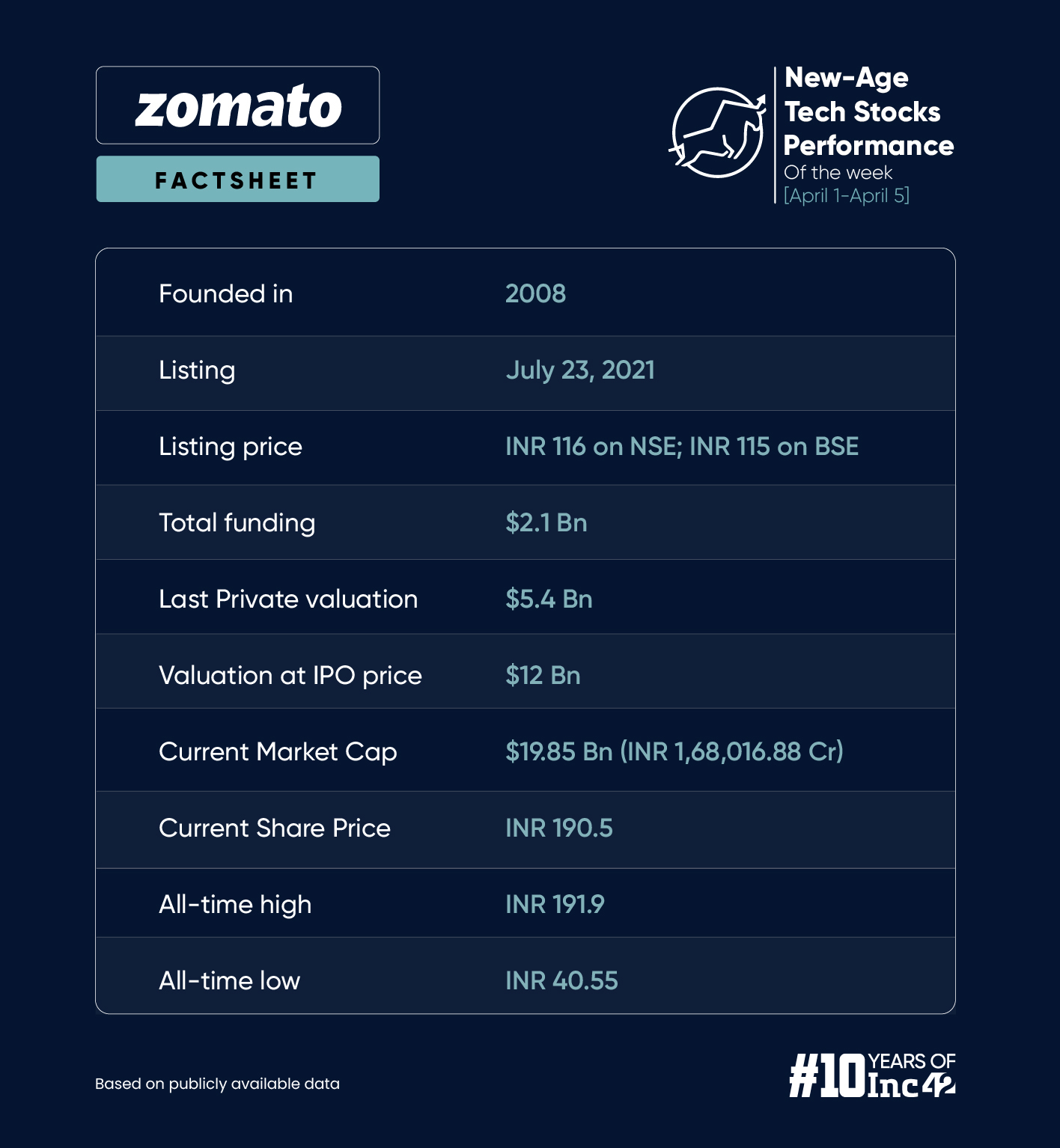

Despite some volatility at the beginning of the week, shares of food tech major Zomato touched a new all-time high of INR 191.9 on the BSE, gaining almost 4.5% during the week.

The stock also seems to be largely resilient to any negative developments.

In The News For:

- Earlier this week, the company received an INR 92 Cr tax order and a GST notice of INR 23.26 Cr for FY19 from Karnataka tax authorities.

- Continuing with its experiments, Zomato has now reportedly started piloting a new initiative that offers last-mile delivery to office goers inside corporate parks.

Meanwhile, in a research note published this week, brokerage Bernstein reiterated its confidence in Zomato.

It sees Zomato gaining share with a higher MTU base compared to Swiggy. Besides, Zomato has a bigger reach and deeper penetration in Tier 2 cities, driving a 67% share in monthly active userbase as of March 2024, Bernstein noted.

Amol Athawale, VP of technical research at Kotak Securities, said the stock looks bullish on the charts and is holding breakout continuation formation.

“In the near future, as long as Zomato trades above INR 175, this sentiment will continue. On the higher side, INR 200-INR 205 is the immediate resistance for the stock,” said Athawale.

PB Fintech Closes At A 28-Month High

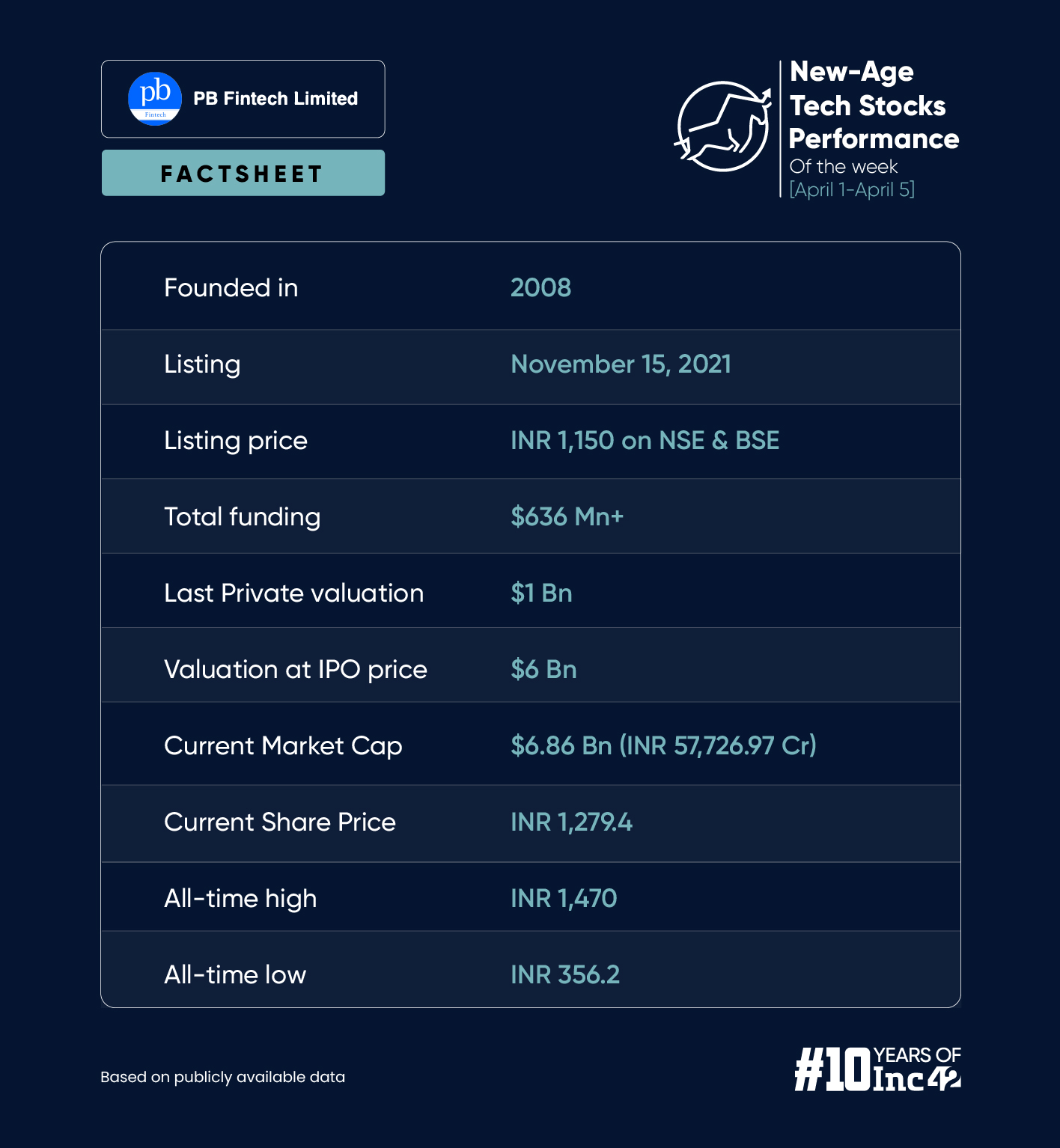

Shares of fintech major PB Fintech ended the week at INR 1,279.4 on the BSE, surpassing their listing price of INR 1,150 for the first time since December 2021.

The shares are currently trading at a level last seen in November 2021, just after the startup’s market debut.

This week, the shares rallied almost 14% amid its investors’ meeting.

Meanwhile, PB Fintech recently received a tax penalty order of INR 16.7 Cr. As per the company’s regulatory filing, the tax penalty was on the share premium received from investment houses during its Series D investment towards the share capital in the company in FY16.

Commenting on the stock, Athawale said that the long bullish candle on the weekly chart suggests that the uptrend is likely to continue. He said INR 1,150 and INR 1,120 would be the immediate support area for PB Fintech shares, above which it might test INR 1,300-INR 1,325 in the near future.

Overall, shares of PB Fintech have gained over 60% year to date.

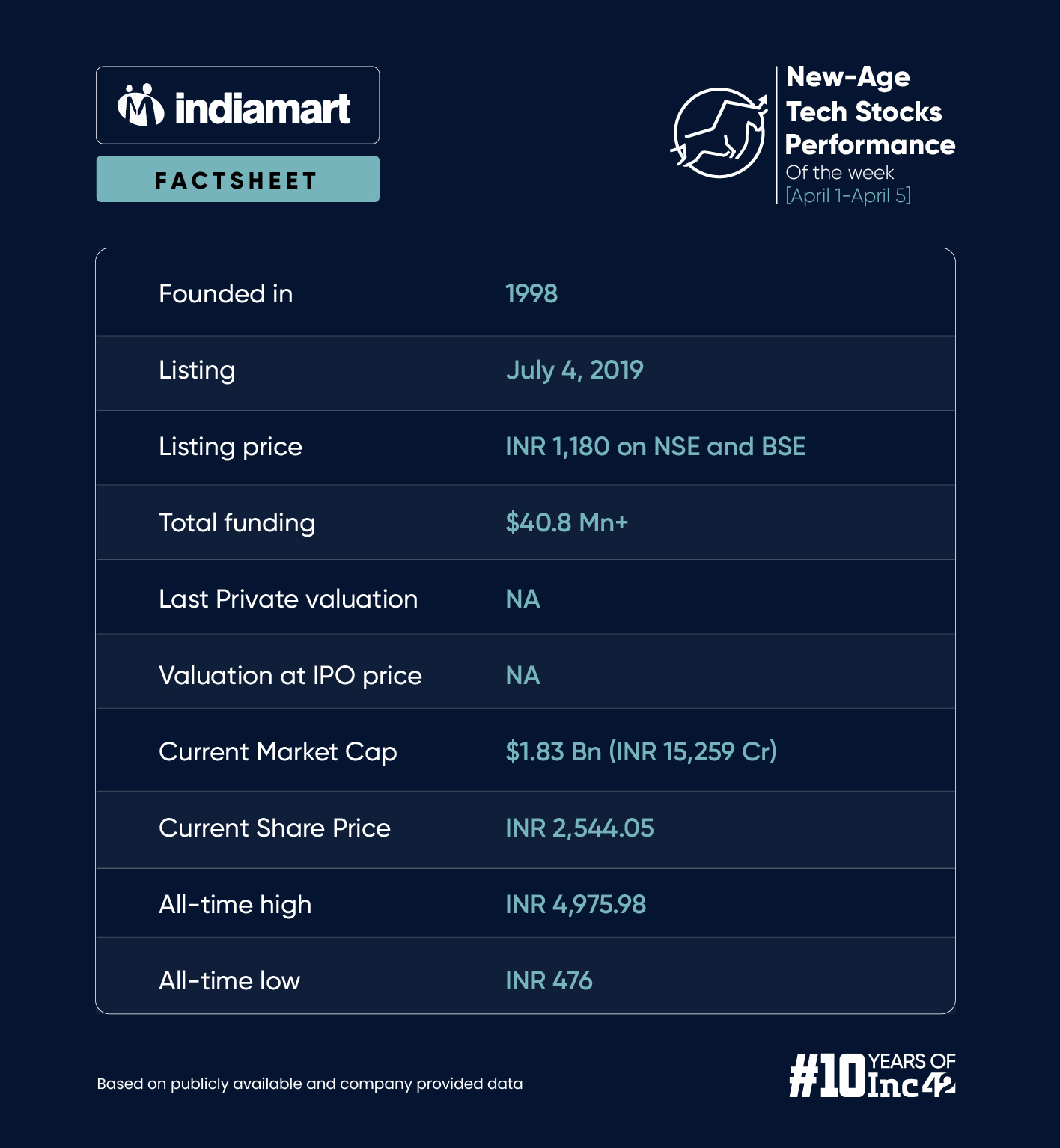

IndiaMART Emerges As The Biggest Loser

Shares of IndiaMART fell 3.8% to end the week at INR 2,544.05 on the BSE and emerged as the biggest loser.

The company announced a few rejigs recently:

- IndiaMART’s board approved the scheme of amalgamation amongst its three wholly-owned subsidiaries – Busy Infotech Private Limited (transferor company 1), Hello Trade Online Private Limited (transferor company 2), and Tolexo Online Private Limited (transferee company). The restructuring is aimed at streamlining group structure, and optimising operations and costs across the wholly owned subsidiary companies, IndiaMART said.

- Prateek Chandra, the company CFO has been transferred to a new role as chief strategy officer at IndiaMART.

- Jitin Diwan will be appointed as the new CFO, effective from May 14, 2024.

Kotak Securities’ Athawale said that IndiaMART is looking range bound on the charts and is expected to remain in the same state in the near future.

Below INR 2,500, the selling pressure is likely to accelerate and the stock may fall to INR 2,450-INR 2,425 level, he added.

The post New-Age Tech Stocks Surge In The First Week Of FY25, Tracxn The Biggest Gainer appeared first on Inc42 Media.

No comments