How Tiger Global-Backed Koo Lost Its X-Factor

Just last year, Bengaluru-based Koo claimed to be the world’s second-largest microblogging platform, after X (formerly Twitter). This claim was short-lived, however, as Meta launched Threads which garnered 100 Mn users within just five days.

Even if we overlook Threads, a look at Koo’s financials and user metrics paints a completely different picture, which is more in line with reports over the past two years about layoffs, multiple revenue experiments and growth bottlenecks.

Koo may claim to be the world’s third-largest microblogging app, but this is not an enviable third place by any means, especially because it has not resulted in any business growth.

What we can see from the numbers is that Koo has gradually receded from the social media landscape in India, and even around the world. Its product launches for Brazil and Nigeria, though initially promising, have also begun to falter.

Even through its various marketing campaigns — remember ‘Vocal for Local’? — media collaborations, monetisation experiments such as Koo Premium and Koo Coin, and engagement efforts like daily jackpots, Koo has not made a major dent.

Plus, the startup has not taken any significant strides towards reaching milestones such as 100 Mn users by 2022, which are very vital in the social media game.

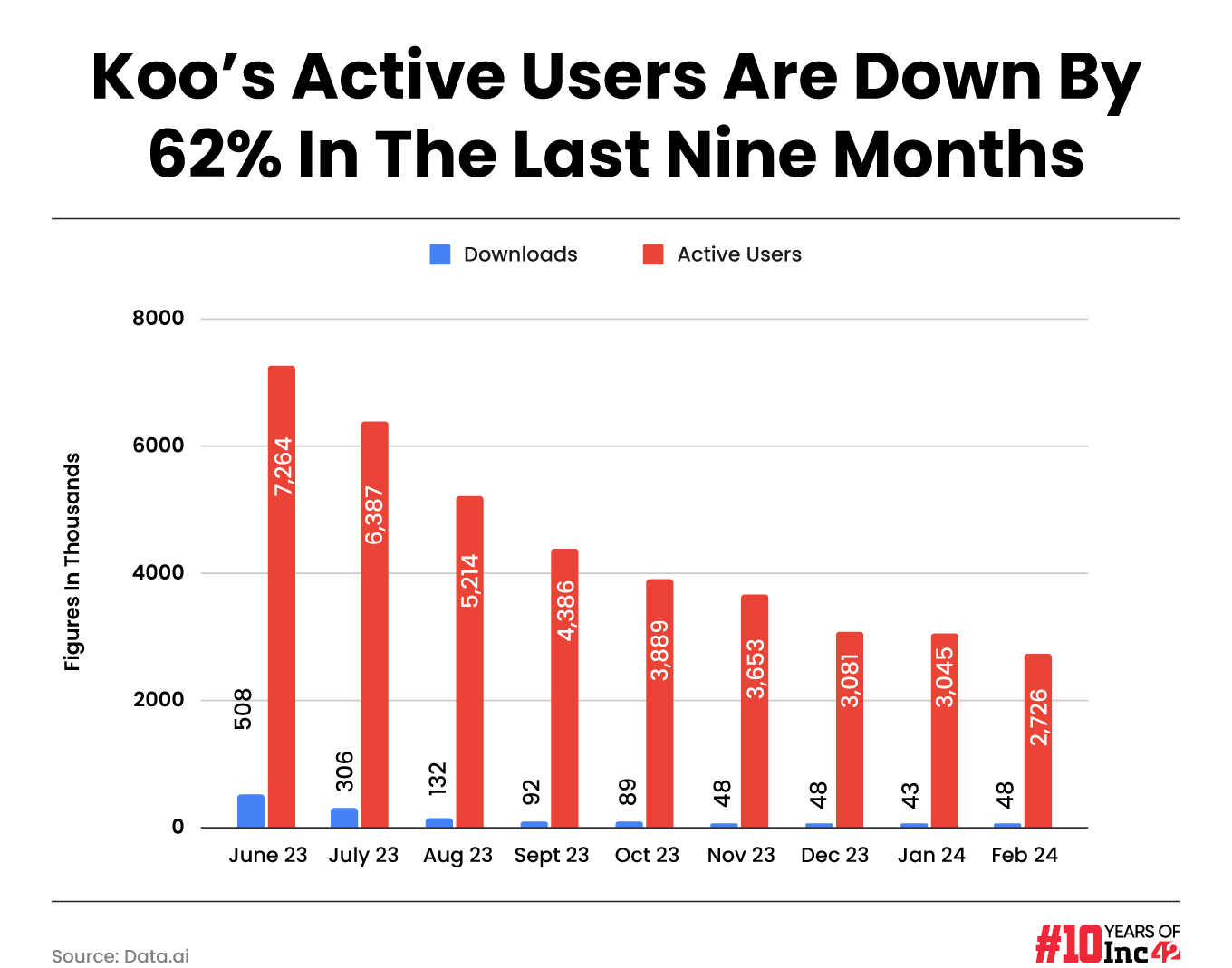

In fact, Koo has had to cut customer acquisition costs (CAC) and has witnessed a decline in active users since then. The number of active users has plummeted from 7.2 Mn in June 2023 to a merely 2.7 Mn, representing a 62% drop in the past nine months, according to data intelligence firm Data.ai.

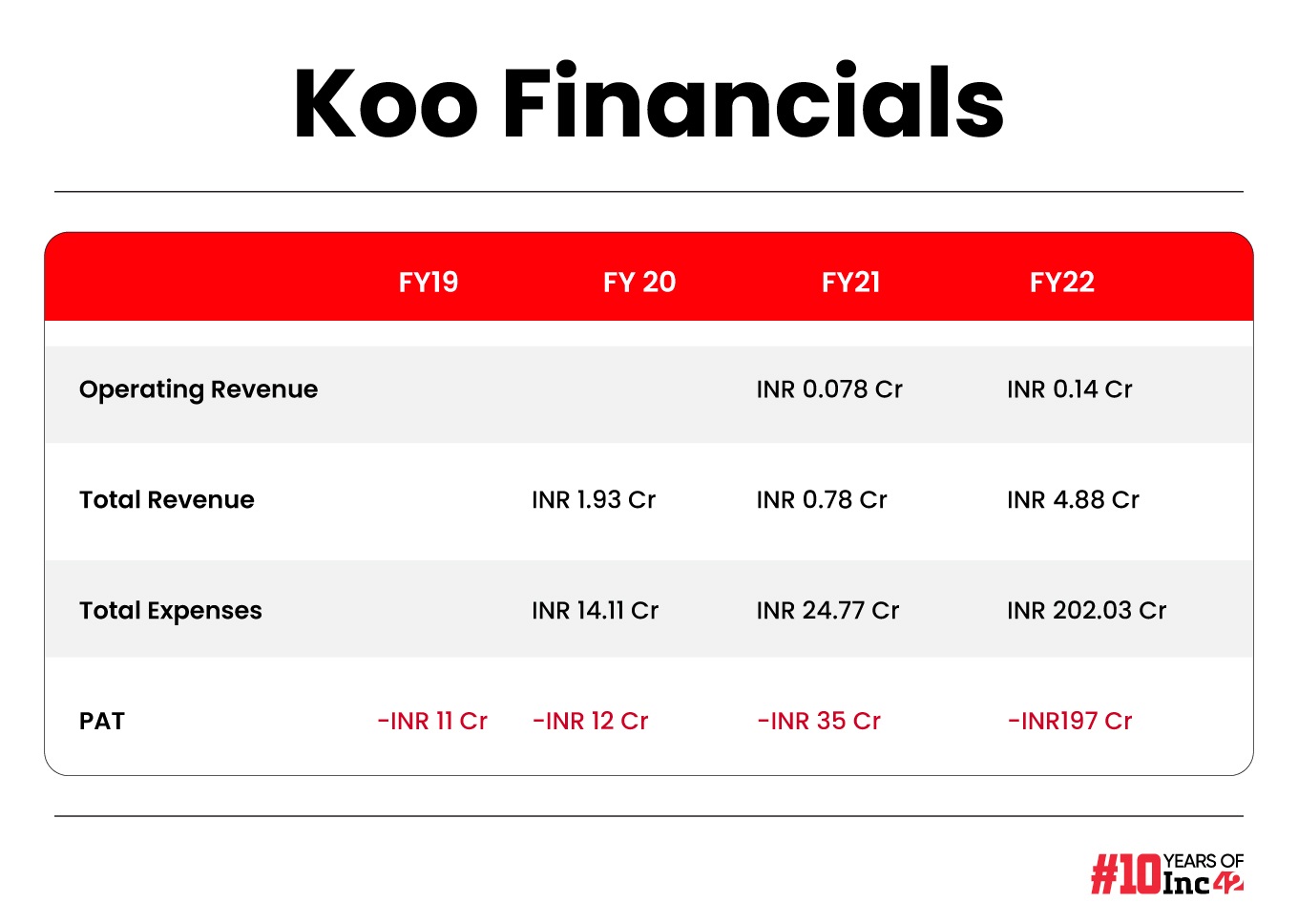

With a meagre operating income of INR 14 Lakh and a staggering INR 197 Cr loss in FY22, the company has struggled to identify a revenue model and heavily relies on cash burn to acquire new users. The startup’s FY23 numbers are not yet out, but we cannot imagine a major change given what has been reported in the past year.

According to a current employee who prefers to remain anonymous, the company has laid off over 80% of its workforce since June 2022, resulting in a headcount reduction to just 60 employees. Additionally, salaries for existing employees have been cut by up to 40% since October 2023.

So much so that speculation is the company is about to be acquired by VerSe Innovation. Unable to secure substantial funding after its Series B round in 2021, Koo is said to be in advanced acquisition discussions with the media company that operates the news aggregation platform Dailyhunt and video social media app Josh.

While this may not constitute a complete acquisition, sources close to the development suggest that it would involve a majority of stocks, likely in a combination of cash and stock.

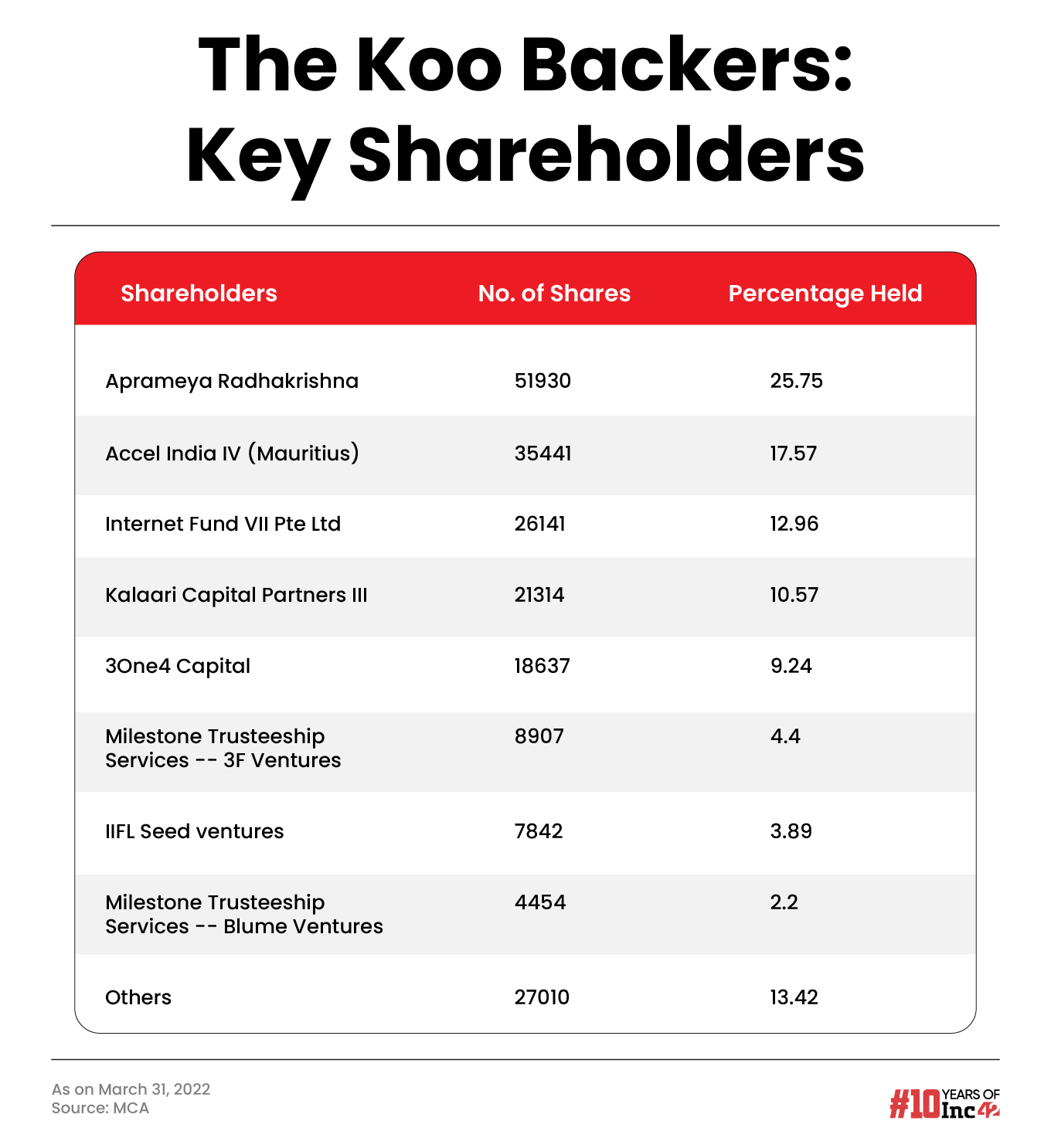

Despite support from notable investors like Tiger Global, Accel, 3one4 Capital, Kalaari Capital, and Blume Ventures, Koo has faced challenges in arriving at a steady revenue model.

So what exactly went wrong after the initial euphoria? And is Dailyhunt the right partner to steer Koo back on track — if indeed, it can be steered back?

From Vokal To Koo

Serial entrepreneur Aprameya Radhakrishna sold his startup TaxiForSure to Ola Cabs for $200 Mn in 2015 and then teamed up with Mayank Bidawatka to launch Vokal, a platform similar to Quora but in key Indian languages, in 2017.

Despite attracting key educators from across the country and claiming to have built a community of 15 Mn users by 2020, the startup did not gain revenue traction. The startup did not manage to generate any income from these millions of users and had zero operating revenue for three straight years, leading to mounting losses.

Clearly, investors were unwilling to tolerate losses without a clear path to revenue. But by 2020, there was a renewed wave of attention for the Indian social media apps. There was a constant tug of war between the Indian government/state governments and X on multiple fronts.

Global social media giants such as Facebook and Twitter (aka X) were under fire for not complying with local regulations. Tiktok was also banned in India.

Sensing the clear market opportunity for an Indian social media app, founders Radhakrishna and Bidawatka swiftly pivoted from Vokal to Koo and built a Twitter rival that allowed users to post up to 400 characters at once, compared to Twitter’s limitations of 280 characters at that time.

Radhakrishna highlighted the existing gap, stating, “Almost a billion people in India do not speak English. Instead, they speak one of India’s hundreds of languages. With access to smartphones increasing, they desire internet content in their own language. Koo aims to amplify the voices of these Indians.”

Amid the Covid-19 pandemic, the Indian government focussed on self-reliance or Atma Nirbharta as a mantra for all products and services, including digital ones.

While Twitter squared off with the Indian government over many crackdowns and policies, Koo quickly gained attention, with Prime Minister Narendra Modi also mentioning the app as an iconic ‘Made in India’ product. Shortly after its launch, Koo also won the government’s Aatmanirbhar Bharat App Innovation Challenge’.

And when Twitter suspended multiple influencer accounts for policy violations, Koo became the immediate go-to alternative. By February 2021, Koo crossed the 3 Mn mark, claimed cofounder Bidawatka.

Koo: Building The Brand

To start with, Koo went after the hot categories to start to stimulate advertisers and marketers. For example, cricketers and cricketing authorities were a major target.

Platforms such as Koo are horizontal social media apps. Users are spread across various interest areas and communities. In such a scenario, Koo marketers faced challenges to lure advertisers. The simplest way to ensure this is to add to users and to accomplish this, Koo went after Indian celebs aggressively. Even though this meant burning cash on user acquisition, amid a competitive market. Besides this, it went after accounts that have large regional language followers.

The app initially partnered with the Tamil Nadu Cricket Association for the Fifth edition of the Tamil Nadu Premier League (TNPL). Under the agreement, TNPL provided live updates on Koo through its official handle. It added engagement features and unique contests with TNPL merchandise as rewards.

In October 2021, at the start of the T20 World Cup, Koo collaborated with Ogilvy India to launch a mega TV campaign under the tagline #KooKiyaKya.

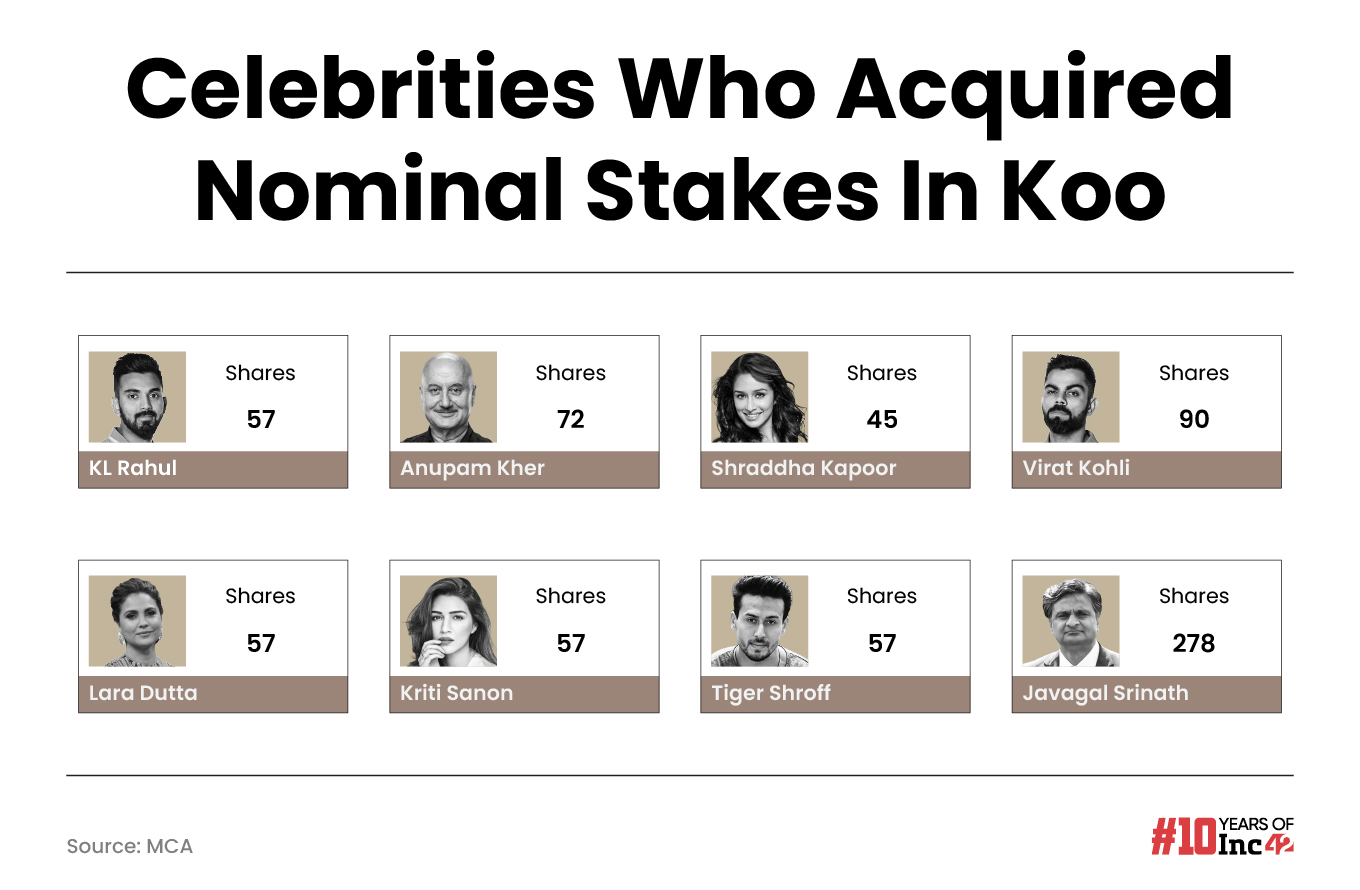

Similar to the Ask Me Anything (AMA) sessions on X or Reddit, Koo also began hosting AMA sessions in local languages, targeting specific segments to enhance engagement. A host of celebrities and influencers also acquired stakes in Koo.

Politicians and government institutions were also big targets for Koo. It brought on ministers from the union cabinet, state governments of Uttar Pradesh and Telangana, institutions such as Central Institute for Indian Languages and several others to trigger organic user acquisition.

Between July 2021 and July 2022, Koo organised over a dozen major campaigns to increase user numbers, engagement, and consequently attract more advertisers. It also recognised over 8,000 individuals as ‘people of eminence’ on Koo.

In October 2022, Koo also launched a loyalty programme called Koo Coin rewarding users for spending time using Koo consistently.

Several brands, including Groww, UCO Bank, Droom, Snapdeal, Amul, HDFC Securities, Bajaj Group, and Fortis Healthcare were on Koo running ads. But this was the golden period for apps like Koo and soon, big tech returned to dominate social media advertising.

Like platforms such as Sharechat and Trell, Koo struggled to retain advertisers like Twitter and Instagram could.

A former senior employee attributed this to two major factors: the slowing down of digital marketing and advertising budgets by large brands after the pandemic and a relatively small user base.

“Brands wanted to reach out their targeted segments. Koo’s user base was diverse and not concentrated as required by most of the brands. There wasn’t a specific user demographic that could dominate and appeal to advertisers across the board,” a former employee added.

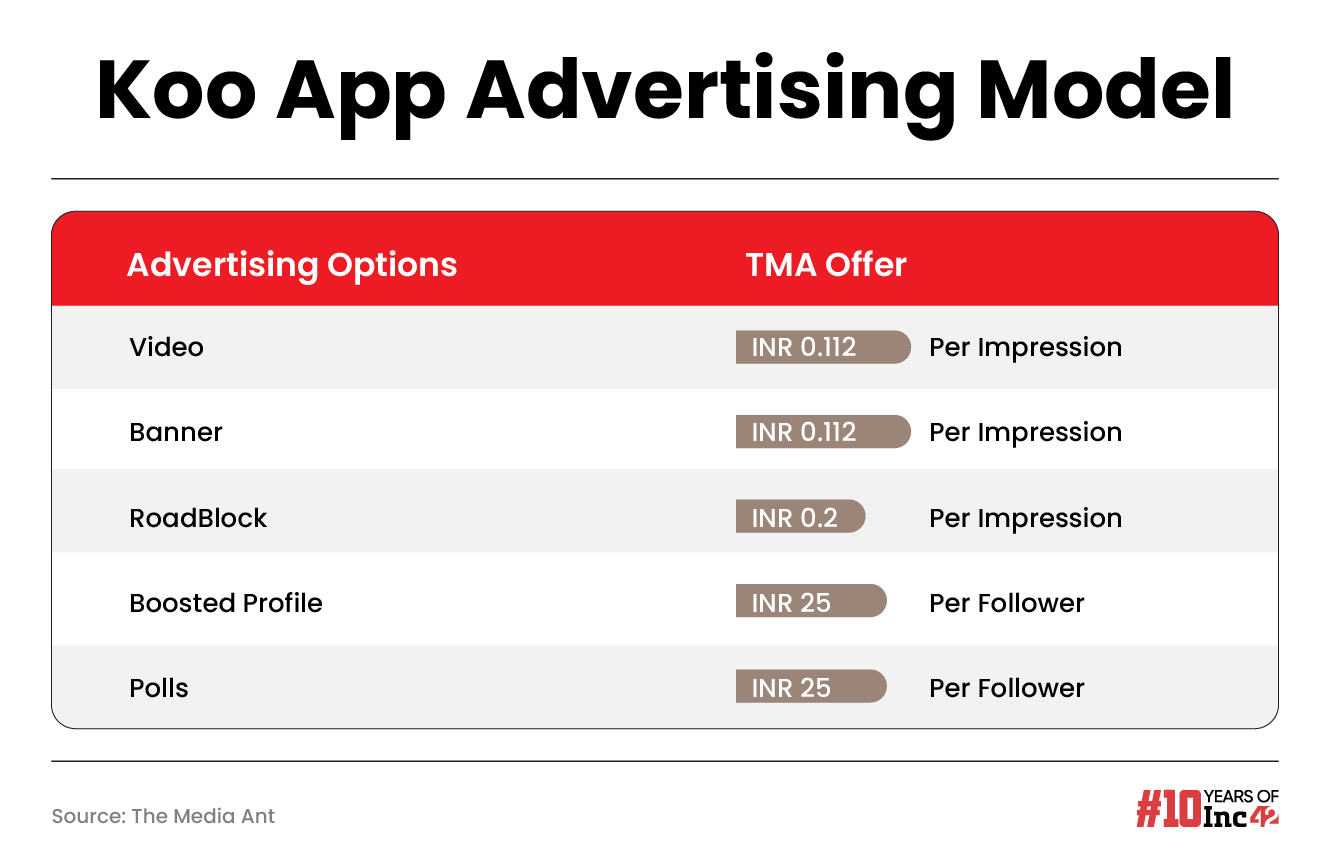

Inc42 spoke to one advertiser who echoed similar sentiments about the platform. Despite the relatively low rates of advertisements on Koo, the ads themselves did not garner the expected level of attention or impressions. Koo did not establish the ecosystem necessary to attract advertisers effectively, we were told.

From the user perspective, Koo failed to offer any competitive advantage over X. Besides advertisements, the introduction of subscription models like Koo Premium (priced between INR 6 and INR 30 per month) also proved insufficient to offset its accumulated losses.

Nishant Mittal, a serial entrepreneur who had earlier founded a social media platform Cread, points out, “The biggest issue with Koo is that it does not offer any differentiation nor it wants to be, but simply a copy of X. This could be a good college project, not a serious business to count on.”

Other analysts wondered why would brands spend more money on another platform when Twitter offered better analytics, performance monitoring and has a bigger network? This led to challenges in growth and scaling up.

Layoffs & Growth Pains

Before the ecosystem-wide layoffs in 2022, Koo had a total workforce of almost 400 people. Since then, the company has let go of employees in multiple waves and its team strength now is just 60 employees.

So why did the company suddenly hit the brakes? Simply put, the returns on marketing and advertising spending were not good enough, leading to high cash burn and barely any growth on the revenue side.

By May 2021, the company had raised $30 Mn and then another $3.5 Mn round followed in December 2021 and another $6 Mn in December 2022. Despite nearly $40 Mn in funding, the company was reporting merely a few lakhs of rupees in revenue.

For instance, the T20 World Cup campaign, which was very expensive, showed below-par results. Most advertisers didn’t stick to Koo over several months, which meant that revenue would dry up in certain months, one former employee added.

The company failed to secure Series C funding commitments from investors as the financials were ‘not impressive enough,’ an existing angel investor told Inc42.

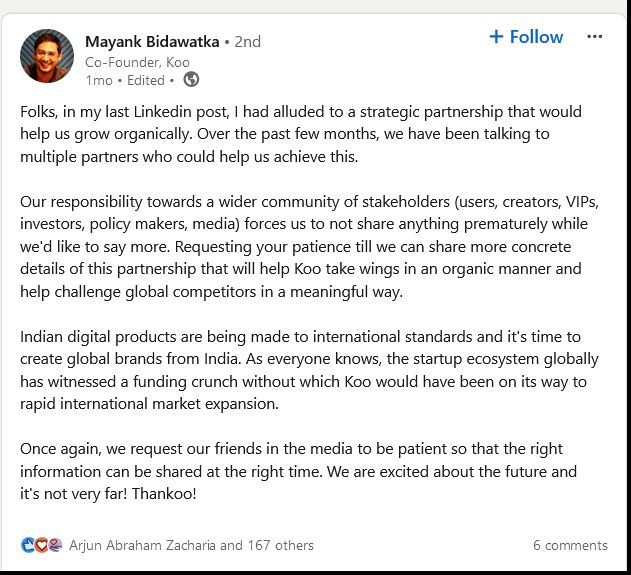

In October 2023, Bidawatka said in a LinkedIn post that Koo was caught in a sour market and had to switch its focus from growth to generating revenue. Easier said than done.

“With just six months more on our trajectory, we would have beaten Twitter in India. But we had to become more efficient by curbing expenses and start generating revenue. It takes years to build a globally competitive microblog. Even Threads, from the Godfather of social platforms, is taking time to build basic features. Over the last few years, we have invested heavily in building a microblog to global standards with very sophisticated algorithms, processes, policies and engines,” the cofounder claimed.

But this shift in focus did not necessarily move the needle.

No Revenue To Speak Of

Whether it’s Vokal’s story or Koo, Bombinate Technologies and Radhakrishna have not been able to figure out the revenue challenges.

For the first four years, revenue was at flat zero. In FY21 and FY22, the company registered INR 8 Lakh and INR 14 Lakh, respectively, as operating income. Even the growth rate is not impressive. No investor wants to see less than 50% growth after the first revenue year.

Total expenses and losses simply surged exponentially by 715% and 462% respectively in the first two revenue years.

“Look at Koo. It’s a clone of (erstwhile) Twitter. Twitter’s logo is a bird (blue & flying), while Koo’s logo is also a bird (yellow & not flying). There’s absolutely no product differentiation. None,” Mittal commented.

Given this, how was Koo going to make a dent on Twitter’s unfathomably strong, global network effects? And forget about network effects.

Despite being around since 2006, Twitter is itself a small business in India with INR 157 Cr in revenue (and losses of 32 Cr). Where is the TAM that justified Koo’s $50 Mn in funding and $275 Mn in valuation, Mittal wondered.

Plus things have worsened for Koo. The entire platform is currently on auto pilot, with very few employees, as per another former employee.

In the last nine months, the number of active users has been on a decline of 62% from 7.25 Mn in June 2023 to 2.7 Mn in February 2024. There are no active campaigns on the customer acquisition side, which means this decline is very likely to go on for a few more months.

Given the lack of revenue and unjustifiable valuation, experts believe the Dailyhunt M&A, could be a distressed sale. Incidentally, this is not the first acquisition report around Koo.

A Checkmate Situation For Koo

The problem with Koo is deep but also simple to understand. Even the market is not ready to accept the alternatives. Even Threads, a formidable competition of X from Meta is biting the dust, said a former director of KPMG India. Engagement on Threads reduced by 50% after the highs of the first week, which shows that perhaps there just isn’t enough room for a Twitter rival that does the same thing.

“Even Twitter’s revenue has just gone down by 50%. However, this was precisely due to Elon Musk’s factor,” the former KPMG director said, adding that had Koo arrived a few years earlier, such as in 2017 or 2018, things could have been different.

Moreover, many of the opportunities that Koo looked to tap in the early days soon disappeared. The startup did not capitalise on the momentum it saw in late 2020 and early 2021.

When Twitter was facing government action, pro-government accounts quit Twitter to join Koo and many of those blocked from Twitter also jumped ship, but soon after taking over Twitter, Musk unblocked most of these accounts, and these users were back on X.

A similar situation was seen in Nigeria, where the government banned access to Twitter and many Nigerians opened accounts on Koo. However, as soon as the ban was lifted, these users were back on X and their Koo handles became dormant.

Losing these organically acquired users was a big loss for Koo. The app also failed to position itself as a neutral platform, which is crucial for social media. “Despite posing an alternative to X, Koo also failed to attract global advertisers who left Twitter due to Musk’s takeover and was only chiefly targeting the Indian market,” said another angel investor in Koo.

When Koo became a sensation among users, its UI and UX were not good enough to retain those users as more active users. “Most of the users see the interface as a copy of Twitter. Despite catering to the same audience, Koo was supposed to offer a better experience whether it’s the user experience, products within. Sadly, Koo failed on both of these accounts,” the angel investor told Inc42.

The investor quoted above added that there are a few clear areas where Koo could have done better. It needed a calculated and strategic approach to growth. Just because the word ‘Koo’ is a joke in Brazil, and helped the app gain some traction, was not enough, for instance. Secondly, Koo failed to identify areas where Twitter is weak in India, and could have focussed there for organic growth.

Can Dailyhunt Turn Koo Around?

So is an acquisition the right path for Koo at this time in its journey? Can the Dailyhunt and Josh parent company offer whatever it takes to rebuild Koo?

Back in October 2023, Bidawatka stated that Koo was looking for strategic partners. He said that the next phase for Koo is to build scale and that will happen with either funding or through a strategic partnership with someone who already has scale.

With the current reality of the funding winter, the best way forward is to partner with someone who has the distribution strength to give Koo a massive user impetus and help it grow.

“With a platform that’s scale-ready, Koo can outshine competitors with the right push on growth. While we talk to the right partners to build this out, we urge and request our well-wishers and friends in the media to stop speculating and be patient till we have something concrete to announce. All we can tell you is that, with all these changes, Koo will be much stronger as an organization and will make all of us proud!” wrote Bidawatka in his LinkedIn post.

Multiple analysts and experts Inc42 spoke to pointed out that like Twitter, Koo and other horizontal social media apps will take at least a decade to succeed, irrespective of the strategic partnerships.

While Koo declined to respond to specific questions around the acquisition, the company cited Bidawatka’s LinkedIn post as its statement.

VerSe has some experience on the social media side, despite Dailyhunt primarily being a news app. With short video app Josh, VerSe has been in the social media space for some time now and there is a probability that Josh could add a Koo-like experience to give its existing users new ways to interact.

However, the reality is that VerSe is also a loss-making company. Its FY23 losses amounted to a whopping INR 1,900 Cr. The company won’t even be able to break even within the next 2-3 years, by most estimates, unless there is a complete change in strategy or a big revenue-generating product. Koo is not that product, at least going by the track record.

So one might also wonder what exactly is VerSe buying? Koo is not among the headlines any more (except for the wrong reasons), the product itself is inadequate as its own investors have told us, and there is no growth to speak of. Dailyhunt and Josh have a bigger user base than Koo, they have the brands and advertisers too that Koo failed to retain. So what is the big upside for VerSe in this deal?

That’s the $275 Mn question in the case of Koo, a valuation that seems almost surreal at this stage.

[Edited Nikhil Subramaniam]

The post How Tiger Global-Backed Koo Lost Its X-Factor appeared first on Inc42 Media.

No comments