India’s GenAI Destiny

Today marks the end of the financial year 2023-24 (FY24), and in some ways, it’s also the beginning of a new phase in the hype cycle for generative AI (GenAI), especially for tech startups in India.

The GenAI trigger began sometime in July 2020 and since then several subsegments such as prompt engineering, foundation models and large language models have not only close to the so-called peak of inflated expectations, but are on course to hit a plateau of productivity within the next two years.

That’s not necessarily a bad thing — it points to the growing maturity of the GenAI space, and even Indian startups are now looking at GenAI not as a novelty, but a reality. And as Inc42 builds up to The GenAI Summit in Bengaluru on April 3, it’s this realisation that we are looking to spotlight. In other words, GenAI is now serious business.

So ahead of The GenAI Summit, this Sunday, we are looking to look behind the generative AI curtain, and asking ourselves what this new revolution means for Indian startups. Before we get to that, here are top stories from our newsroom this week — unsurprisingly, dominated by GenAI:

- Let’s Talk About Healthcare: While the Indian healthcare industry is strongly positioned to harness the true potential of GenAI, there remains a dire need to get fundamentals like data accuracy, privacy and security in place

- GenAI Comes Into Fashion: India’s $110 Bn fashion industry has thrived on innovation, but NeuroPixel is looking to take it into the AI age with its GenAI-powered fashion tech platform

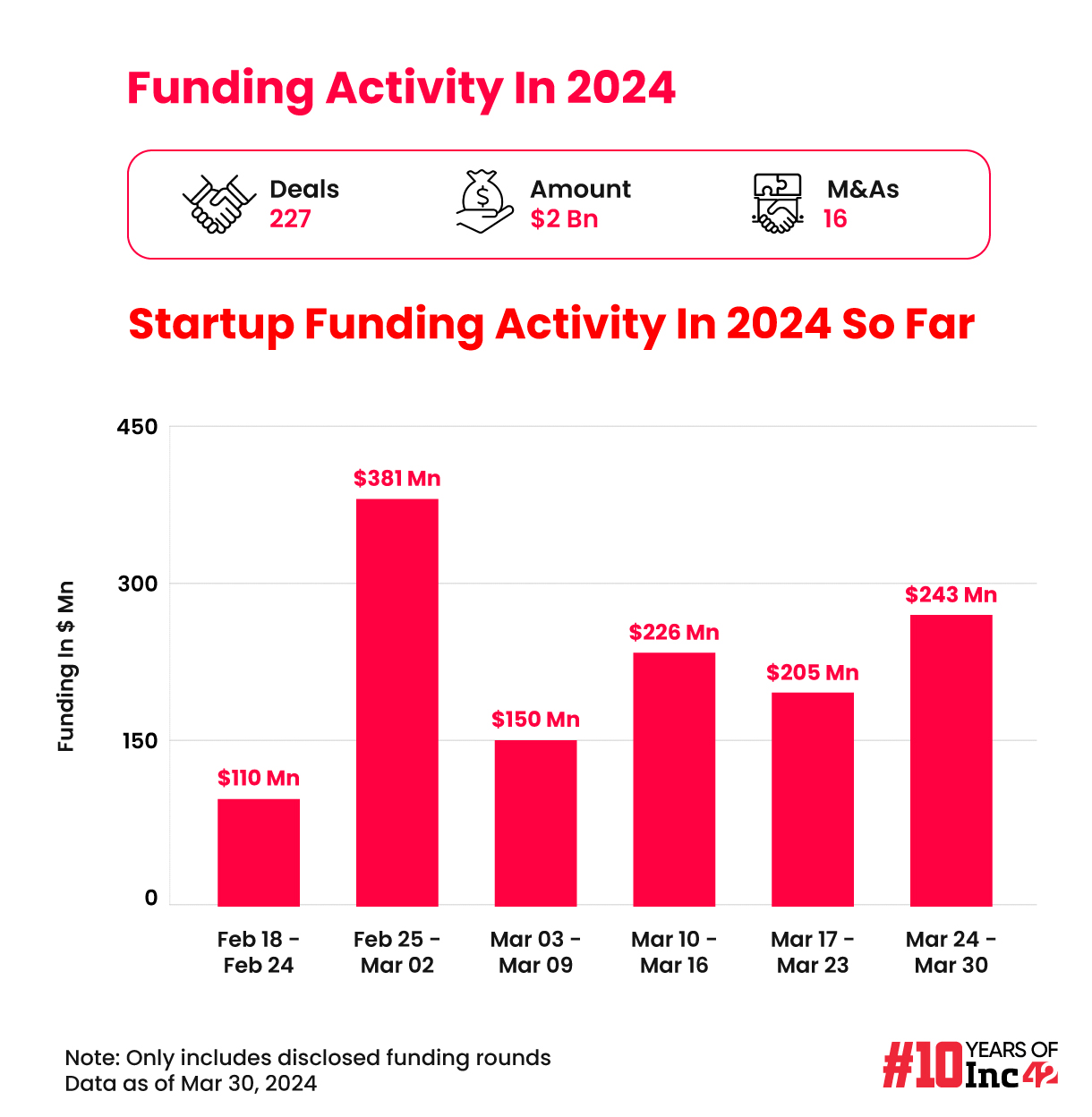

- Q1 2024 Funding: Despite talk of the funding winter receding, Indian startup funding declined 33% year-on-year in the first quarter of 2024 to $2 Bn, registering a seven-year low

Where Is GenAI Heading?

The month of March began with SaaSBoomi in Chennai, where the country’s enterprise tech and SaaS startups descended en masse to showcase the latest products and solutions. Unsurprisingly, GenAI dominated the conversations on and off the stage.

While founders expounded on how GenAI will change marketing, operations and product development during several of the sessions, investors confessed to not knowing which GenAI models will continue to remain relevant. Our interactions with several VCs on the ground revealed that the investor ecosystem is excited about emerging AI models, but there is a cautious streak as well.

“It’s very difficult to keep up. Everyone is claiming to be GenAI, but how much of it is just automation vs actual implementation of LLMs and generative models? A conservative approach is needed because of just how capital-intensive these GenAI models are becoming,” asked one Bengaluru-based early stage investor.

Echoing this notion, Dev Khare, partner at Lightspeed India, believes that India is still catching up to global GenAI investment trends. “If you look at the investments in GenAI, I would say India has seen a one or two-year lag to what’s been going on elsewhere in the world. The amount of capital going into and companies being formed in the US and Europe is just a whole different level in comparison to India,” Khare said in an earlier interaction.

One of the factors is that the last two big waves of investment such as crypto or Web3 resulted in weak outcomes for investors. It’s not surprising then that investors are biding their time. While the likes of Lightspeed, Peak XV, Accel and others have backed early stage GenAI startups, there is intense competition in terms of business models, which brings us to how native GenAI startups companies are looking at GenAI.

Finding The Right Niche

For one, startups in the middle enablement layers for GenAI are fast gaining investor attention, particularly those enabling LLM ops and on-premise deployment. These also include companies that are building applications on top of existing LLMs, such as the likes of InVideo, Rephrase.AI, Murf.AI and others.

But this also means there is a growing crowd of startups with overlapping business models, something which was seen in the early days of SaaS in India. But in the GenAI space, startups are competing globally from the very get go. For every Rephrase.AI, there are alternatives such as Synthesia or Kapwing, and other segments are also getting increasingly crowded.

For instance, with more and more large companies resorting to using LLMs for operations, startups such as Lightspeed-backed Portkey or Lysr.ai are building control panels to help with cost optimisation and improving observability of API usage by employees.

Just like the early SaaS wave resulted in products with overlapping features, the GenAI wave is sprouting applications that do the same thing slightly differently.

Portkey cofounder Rohit Agrawal told Inc42 that when businesses face challenges when deploying generative AI products. Besides cost control, they also need to eliminate LLM hallucinations and have oversight on the prompts and queries. So it’s only natural that there will be other companies that approach the problem in a different way.

Just like there’s room for multiple SaaS tools to manage sales, marketing and enterprise resources, there will be multiple GenAI products competing in the same domain. So how are companies looking to differentiate themselves?

Speciale Invest-backed GenAI startup Trainn.co’s cofounder Vivekanandhan Natarajan believes that GenAI will change several businesses, but it’s imperative to not lose sight of the larger problem.

“You can do several things with GenAI, but that doesn’t mean that everything is right for you. Sometimes, it’s enough to use LLMs to streamline your ops, because that can give you a cost advantage. And sometimes you need to add it to your product because that’s what your customers want. This is the decision that many companies will have to take,” the Chennai-based founder told Inc42.

Indian Startups On The GenAI Trail

Of course, it’s not just native GenAI startups that are driving the hype forward. There’s a real wave of scaled up startups that are adopting GenAI to stay on the cutting edge. The likes of Swiggy, Zomato, Blinkit, Meesho, PhysicsWallah and others are leveraging GenAI to personalise search, discovery and for content generation.

From SaaS to ecommerce to healthcare to fintech, GenAI is fast spreading into niches of the startup ecosystem. But here too, startups need to go back to first principles thinking instead of just tacking on GenAI into their products.

“What problem are you trying to solve and why will AI help you achieve that outcome? It’s not just enough to infuse LLMs into your products, but getting the product-market fit is extremely critical when you are building in AI. Otherwise, you are very likely to become irrelevant in a few months and have to look to pivot,” said Ankit Oberoi, cofounder of adtech startup AdPushup, which was acquired by Japanese tech giant Geniee for $70 Mn in March 2023.

For instance, enterprise tech unicorn Gupshup added AI chatbots for RCS conversations and launched a Conversational AI product suite, which enables companies to build their own chatbots, which is an extension of the chatbot service it offered in the first place. Gupshup introduced the ACE LLM, which leverages Google Cloud’s AI platform and the tech giant’s suite of large language models (LLMs), and this builds on the capabilities of its existing CPaaS platform, founder Beerud Sheth told us.

Sheth told Inc42 that GenAI is an extension of Gupshup’s strategy to leverage the most cutting-edge platforms which has allowed the company to target enterprises across verticals and industries.

But Adpushup cofounder Oberoi had a word of caution for founders. He believes that it’s imperative that GenAI adopters don’t just jump on to the bandwagon without thinking about the ramifications it might have in the long run.

Of course, that hasn’t stopped companies from experimenting and dipping their toes in the GenAI pool, particularly the big companies, which has a ripple effect across the market.

Amazon, for instance, introduced a set of GenAI capabilities last year to allow sellers to create better product descriptions, titles and details. Similarly, an increasing number of ecommerce platforms are harnessing GenAI to create rich marketing content, improve product discovery, enhance seller onboarding and more.

“With GenAI, it is easier and faster to generate rich and engaging content. This content can be dynamically personalised as well leading to a targeted and high retention consumer acquisition,” Vaibhav Khandelwal, cofounder and CTO at Shadowfax, told Inc42 earlier.

Further, fintech seems to be the domain where GenAI adoption is taking off the most because financial services have a lot of redundant manual business processes, which can be automated. In particular, fintech startups are looking to revamp customer support and onboarding through GenAI tools.

Will Regulations Stop The GenAI Train?

Of course, it’s hard to gauge whether this adoption wave will last for long, particularly in the face of potential regulations for AI in the near future, and the push by governments to create policies to promote responsible and ethical AI platforms.

In March this year, the Ministry of Electronics and IT (MeitY) released an advisory calling for intermediaries or platforms using AI models, LLMs and other generative AI platforms to only host, display and share lawful content. There

However, minister of state (MoS) for electronics and IT Rajeev Chandrasekhar later clarified that the advisory was exclusively meant for “larger companies” like Google and not startups.

But that doesnt mean startups won’t be impacted. Dubpro.AI founder Ishan Sharma, for instance, told us that even if policies target big tech companies like OpenAI or Google, startups still rely on these models as building a comparable foundational model is simply not possible. “We currently leverage these models to fine-tune our own data and they act as a foundation for our business. If access to these models is hampered, overall business can plummet,” he said.

Further, Tanuj Bhojwani, head of People+AI, said that following the government’s advisory, investor confidence has taken a hit, with some partnerships and deals facing delays, particularly due to foreign investors waiting for clarity in directives.

But investors we spoke to remain confident that these early pains will be solved eventually. “Even governments are coming to terms with it. There’s no right answer at the moment, but given how critical GenAI is going to become, we can only hope that policy makers meet startups midway rather than becoming a hurdle to innovation,” added a partner of a Mumbai-based early and growth fund.

We won’t know the answer to that one for a few more months. But we are certain to get clarity on plenty of other aspects about generative AI at The GenAI Summit by Inc42 on April 3. Here’s a sneak peek at what’s in store, including how unicorns such as PhonePe, Open, NoBroker, Perfios, PhysicsWallah, Droom and others are leveraging GenAI today. Join us in Bengaluru and get a glimpse at the future of AI in India.

Sunday Roundup: Tech Stocks, Startup Funding & More

- Funding Spring? Funding for Indian startups picked up pace this past week with $243 Mn raised across 17 deals, almost 20% higher than the previous week

- Jio Wants An Auction: Reliance Jio has taken a stance against allocation of satellite spectrum for 5G-like services without an auction even as the government is looking to skip the process

- Mamaearth’s New Bet: The beauty and personal care giant has forayed into the colour cosmetics space with the launch of a new brand called Staze, which will compete with L’Oréal, Lakme, and SUGAR

- BYJU’S Peace Offering? The edtech giant is looking to allow some shareholders to participate in the company’s rights issue. Will this end the battle between the company and its investors?

The post India’s GenAI Destiny appeared first on Inc42 Media.

No comments