From Pocket FM to Ultrahuman- Indian Startups Raised $205 Mn This Week

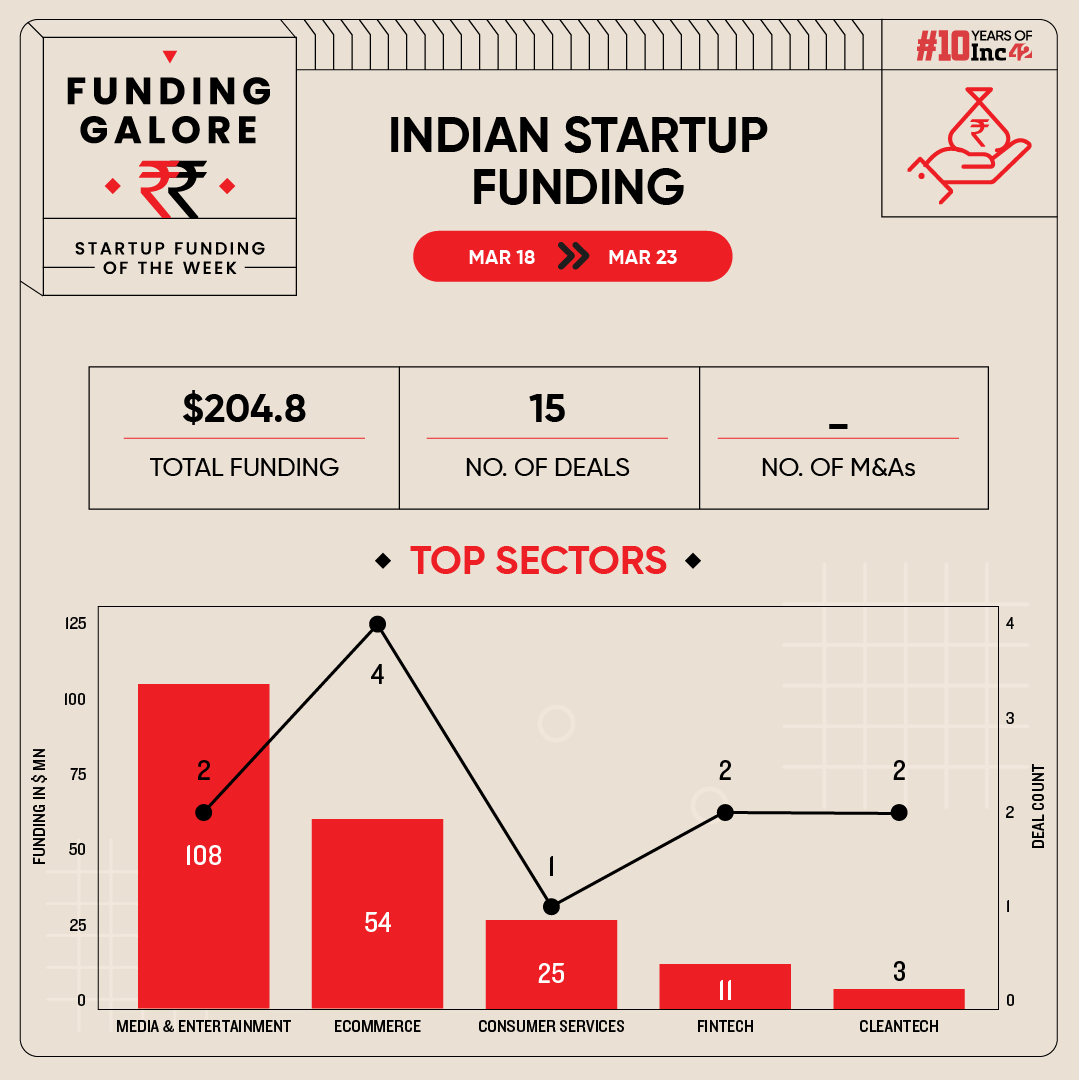

Investment activity across the Indian startup ecosystem saw a marginal dip in the third week of March after an uptick. Between March 18 and 23, startups cumulatively raised funding of $204.84 Mn across 14 deals, a 10% drop from $226.2 Mn across 18 deals in the preceding week.

The week also saw audio entertainment platform Pocket FM raising $103 Mn in its Series D funding round from Lightspeed and Stepstone Group. Besides, the company is also in talks with Abu Dhabi Investment Authority (ADIA) for a fresh fundraise which will likely value it at around $1.2 Bn.

Funding Galore Indian Startup Funding Of The Week [Mar 18- Mar 23]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 20 Mar 2024 | Pocket FM | Media & Entertainment | OTT | B2C | $103 Mn | Series D | Lightspeed, Stepstone Group | Lightspeed |

| 20 Mar 2024 | Ultrahuman | Ecommerce | D2C | B2C | $35Mn | Series B | Blume Ventures, Steadview Capital, Nexus Venture Partners, Alpha Wave Incubation and Deepinder Goyal | – |

| 18 Mar 2024 | Curefoods | Consumer Services | Hyperlocal Delivery | B2C | $25 Mn | – | Three State Ventures | Three State Ventures |

| 18 Mar 2024 | Jumbotail | Ecommerce | B2B Ecommerce | B2B | $18.3 Mn | Series C3 | Artal Asia, Heron Rock, Sabre Investment, Arkam Ventures, Jarvis Reserve Fund, Reaction Global and VII Ventures | Artal Asia |

| 20 Mar 2024 | Optimo Loan | Fintech | Lending Tech | B2B | $10 Mn | Seed | Blume, Omnivore, Prashant Pitti. | Blume, Omnivore |

| 20 Mar 2024 | Liquidnitro Games | Media & Entertainment | Gaming | B2C | $5.25 Mn | Seed | Nexus Venture Partners and others | Nexus Venture Partners |

| 19 Mar 2024 | Sprih | Cleantech | Climate Tech | B2B | $3 Mn | Seed | Leo Capital, others | Leo Capital |

| 18 Mar 2024 | HCIN Networks | Enterprisetech | Enterprise Services | B2B | $1.5 Mn | Equity | Swastika Investmart, Ankit Mittal, Vijay Khetan, Ageless Capital, MSB E-Trade Securities, others | Swastika Investmart |

| 18 Mar 2024 | Beatoven ai | Enterprisetech | Horizontal SaaS | B2B | $1.3 Mn | pre-Series A | Capital 2B, IvyCap Ventures, Upsparks Capital, Rukam Capital, others | Capital 2B |

| 19 Mar 2024 | Vobble | Edtech | Skill Development | B2C | $1 Mn | Seed | Lumikai, Blume Founders Fund, others | Lumikai |

| 19 Mar 2024 | Relso | Ecommerce | D2C | B2C | $840k | Pre-Seed | Ventures Catalysts, Inflection Point Ventures, Ramakant Sharma, Shantanu Deshpande, Saurabh Jain | Ventures Catalysts and Inflection Point Ventures |

| 22 Mar 2024 | Yenmo | Fintech | Investment Tech | B2C | $500k | – | Y Combinator | Y Combinator |

| 18 Mar 2024 | BNZ Green | Cleantech | Climate Tech | B2B | $100k | Pre-Seed | Climate Detox, others | Climate Detox |

| 20 Mar 2024 | Rock Paper Rum | Alcoholic beverage | Alcoholic beverage | B2C | $59k | – | Vineeta Singh | Vineeta Singh |

| 21 Mar 2024 | Droom | Ecommerce | Automobile Marketplace | B2C | – | – | Badshah | Badshah |

| Source: Inc42 *Part of a larger round Note: Only disclosed funding rounds have been included |

||||||||

Key Startup Funding Highlights Of The Week

– Pocket FM logged the largest-ticket transaction this week.

– Media and entertainment became the most funded sector this week, catapulted by Pocket FM’s $103 Mn funding. To be sure, the space saw a cumulative investment of $108.25 Mn across two deals.

– Ecommerce saw a maximum number of funding deals this week, with startups operating in the space bagging $54.14 Mn via four deals.

– Early stage startups raised $19.25 Mn this week largely driven by seed funding rounds. This is a 326% increase from last week’s $5.9 Mn.

– Nexus Venture Partners emerged as the most active investor this week, writing cheques for Liquidnitro Games and Ultrahuman.

IPO Updates

– The initial public offering (IPO) of SaaS cybersecurity startup TAC Infosec, also known as TAC Security, will kick off on March 27. The startup is looking to raise $3.5 Mn from its public debut.

– Fintech SaaS company Trust Fintech Limited’s IPO is set to open on March 26. The company plans to net INR 63.45 Cr from the public offering.

Other Major Developments

– US-based venture capital (VC) firm Alphatron Capital (formerly SMK Ventures) closed its maiden fund at $30 Mn. The fund will majorly invest on startups across SaaS, fintech, healthtech, AI/ML, digital content and D2C sectors.

– Fintech-focused VC Cedar Capital has marked the first close of its $30 Mn FinTech Venture Capital fund. It aims to back around 15 early stage startups in the fintech space.

– VC firm B Capital has announced the close of its ‘Opportunities Fund II’ at $750 Mn. The fund received commitments from both existing and new investors, including private and public pension funds and family offices, among others.

– Edtech startup Toprankers has acquired the judiciary arm of Lucknow-based Coach Up IAS. However, the startup did not disclose the financial terms of the deal.

– Investment fund Malabar Investments is seeking a stake in SUGAR Cosmetics via secondary deal worth $9 Mn- $12 Mn.

– The Good Glamm Group is in final stages of discussion to close a $70 Mn funding round as it gears up to go public next year, sources told Inc42.

– After a 13-year stint, Nexus Venture Partners’ Managing Director Sameer Brij Verma has stepped down to float his own investment fund majorly focussed on early stage startups.

– Delhi NCR-based used car marketplace, Spinny, is expanding its ESOP pool by granting an additional 24 Mn options.

The post From Pocket FM to Ultrahuman- Indian Startups Raised $205 Mn This Week appeared first on Inc42 Media.

No comments