New-Age Tech Stocks Rally In The First Week Of 2024, Paytm Second-Biggest Gainer After Fino

Beginning 2024 on a largely bullish note, most Indian new-age tech stocks witnessed a northbound movement in the first week of the year amidst high volatility in the broader domestic market.

Fifteen out of the 19 new-age tech stocks under Inc42’s coverage gained in a range of 0.3% to over 12%, with Fino Payments Bank emerging as the biggest winner.

While CarTrade Technologies, RateGain, and four others gained below 1% this week, Yudiz gained 1.8%, and EaseMyTrip and Tracxn Technologies rose above 2% each. While Yatra, Delhivery, and DroneAcharya gained over 3% in the week, Paytm and Zomato zoomed over 7% each.

Meanwhile, Zaggle was the biggest loser this week as it fell almost 1.4% on the BSE. Nykaa, Nazara, and ideaForge were the other losers.

In the broader market, Sensex ended the week 0.3% lower at 72,026.15 and Nifty fell 0.1% to close Friday’s session at 21,710.8.

Vinod Nair, head of research at Geojit Financial Services, said that the week began strongly with optimism about future rate cuts, easing global inflation and softer bond yields. However, concerns over weak China and Eurozone manufacturing data, along with the ongoing tensions in the Red Sea, led to a flat market close. Moreover, Fed minutes added uncertainty around the timing of Fed’s rate cut.

Siddhartha Khemka, head of retail research at Motilal Oswal, believes that the market will now take cues from the upcoming earning season, which will be kickstarted by TCS and Infosys.

“Healthy pre-quarterly business updates indicate that the earnings growth momentum is likely to continue in Q3 as well. Overall, we expect markets to remain in a positive range,” said Khemka, adding that now stock-specific actions will pick pace.

Meanwhile, more new IPOs are expected in the coming months in the new-age tech startup ecosystem. Two startups – Unicommerce and MobiKwik – filed their draft papers with SEBI for respective IPOs this week, following Ola Electric, FirstCry, and Awfis filing their respective DRHPs towards the end of 2023.

Now, let’s take a deep dive into understanding the performance of some of the major new-age tech stocks this week.

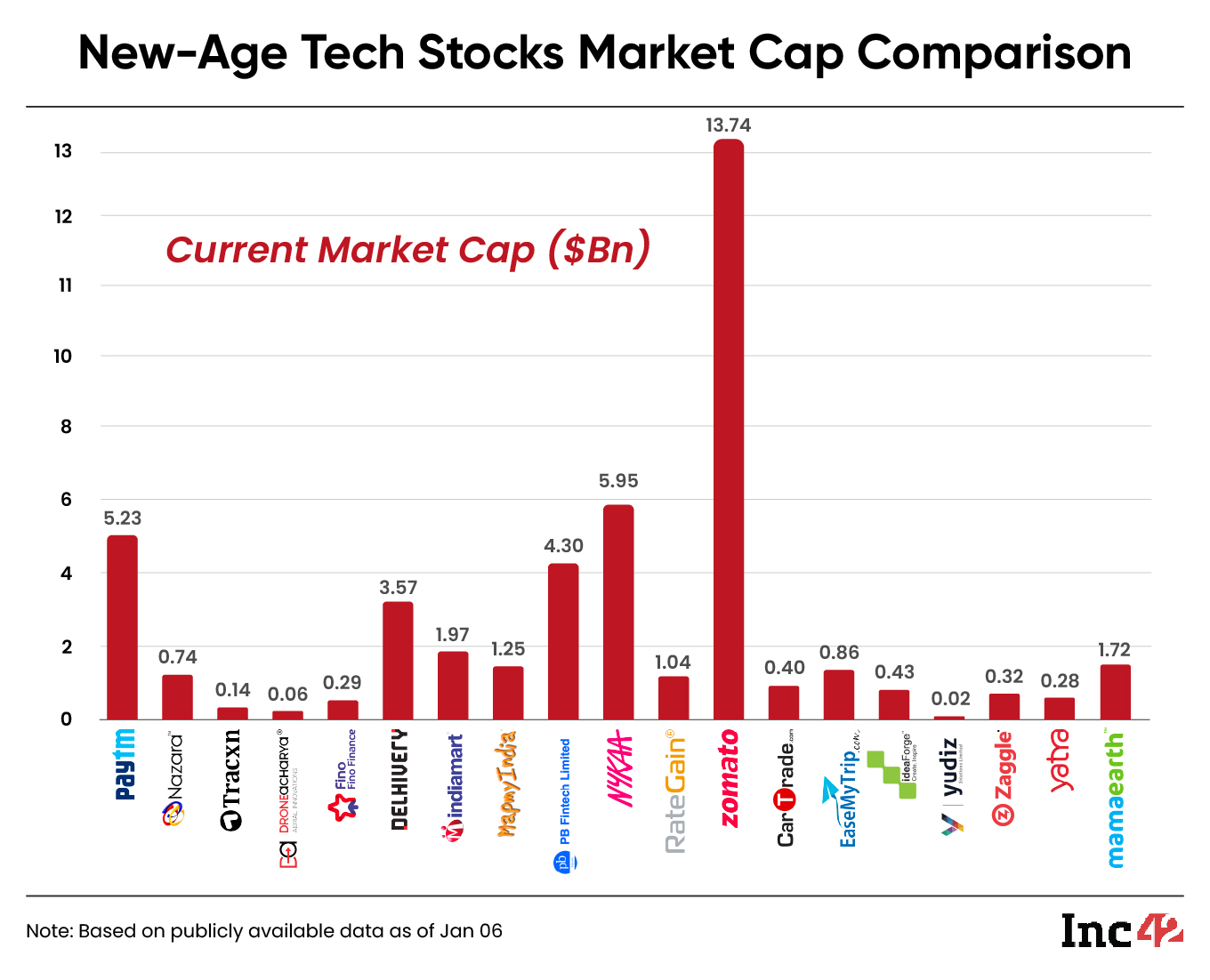

The total market capitalisation of the 19 new-age tech stocks under Inc42’s coverage fell slightly to $39.72 at the end of this week from $40.6 Bn last week.

Zomato’s Sustains Bull Run Even As Tax Trouble Looms

Share of food tech major Zomato, which gained over 100% last year, gained another 7.6% this week, ending Friday’s trading session at INR 133.15 on the BSE.

The stock managed to continue the rally despite the company receiving another tax notice this week. Let’s take a look at some of the key developments related to the company this week.

In The New For:

- Tax authorities slapped an INR 4.2 Cr notice on Zomato for alleged short payment of GST.

- Zomato, which started levying platform fee at INR 2-3, has now raised it to INR 4 per order.

- The company announced initiating the liquidation process for its Vietnamese and Polish subsidiaries as it continues to take measures to streamline the business.

- Reportedly, Zomato has decided to stop the integration of Blinkit with the food delivery app and is now planning to make the quick commerce arm a distinctly separate brand to focus on building super brands.

After the company recently received a GST notice at the end of last year, JM Financial said in a research note that the platform would pass the GST burden directly to the end customers if it receives any adverse tax order. Besides, the company’s cash balance of INR 11,800 Cr would be enough to cover the impact of any adverse GST orders towards its historical dues.

Most analysts Inc42 spoke to towards the end of 2023 projected that Zomato shares would continue to see the uptrend.

Last week, Amol Athawale, VP of technical research at Kotak Securities, said that if Zomato breaks the INR 130 level, it could move up to INR 137-INR 140 in the near term.

Paytm Regains Some Momentum

After the sharp decline in Paytm’s share price, following the company’s decision to scale down its postpaid loan business, the year 2024 began on a happy note for the fintech giant. Paytm shares surged 7.8% this week to end Friday session at INR 685 on the BSE.

It is pertinent to note that the company also got some boost after securing a spot in BofA Securities’ list of top 10 short-term recommendations in the Asia Pacific region for the first quarter of 2024.

BofA, in its research note, said that the recent change in strategy from low-ticket, low-margin loans to high-ticket, high-margin loans is directionally positive for the company.

The international brokerage also reiterated its ‘buy’ rating on the stock, with a price objective of INR 1,165, which implies over 70% upside to Paytm’s current price.

Meanwhile, Bernstein also said in a research note this week that the scaling down of Paytm’s postpaid loan vertical was not expected to have any major immediate impact. It also sees Paytm turning profitable this calendar year.

Bernstein reiterated its ‘outperform’ rating on Paytm, however, its price target of INR 950 implies around 40% upside to the stock’s current price.

Despite this, the stock is giving bearish signals on technical charts, as per analysts.

Fino Payments Bank Emerges As The Biggest Gainer

Shares of Fino Payments Bank made a sharp rally this week and gained a little over 12%. On Friday alone, the shares rallied 6.7% to end the week at INR 292 on the BSE.

While there were no immediate fundamental triggers, the stock witnessed high trading volume on the exchanges on Friday.

It is pertinent to note that Fino Payments Bank saw the lowest growth in market cap and share price last year amidst rallies in most of the new-age tech stocks. Its shares gained a mere 3.2% last year.

However, the average price target of the brokerages covering the stock is currently at INR 402.5, which implies almost a 38% upside to the stock’s current price.

Fino Payments Bank’s current market cap stands at $0.29 Bn.

The post New-Age Tech Stocks Rally In The First Week Of 2024, Paytm Second-Biggest Gainer After Fino appeared first on Inc42 Media.

No comments