Indian Founders Found Investors’ Corporate Governance Diktat Ineffective, Will 2024 See Better Guardrails?

Towards the fag end of the funding mania-led 2021, Aditya Birla Group chairman, Kumar Mangalam Birla, warned that the fear of missing out (FOMO) was driving up valuations of many fledgling companies to stratospheric levels.

To put things into perspective, Indian startups raised more than $42 Bn in 1,583 deals that year and minted 44 unicorns. However, tables turned in 2022 as geopolitical tensions, rising interest rates and a spurt in inflation triggered a re-evaluation of investment strategies at VC and PE firms.

Investors tightened their purse strings and capital suddenly became scarce. As the focus suddenly turned to profitability and sustainability, skeletons began to tumble out of the dark closets of Indian startups.

Be it the public spat between fintech startup BharatPe board and its former MD Ashneer Grover or financial irregularities at Trell and GoMechanic, Indian startups suddenly came under the scanner for lax corporate governance guardrails and lack of transparency.

Consequently, homegrown new-age tech startups felt the pinch across the board in 2023.

A survey of 400 founders by Inc42 found that nearly half, 44% to be precise, faced increased investor scrutiny last year.

However, as per Inc42’s Indian Startup Founder Sentiment Survey, 2023, the remaining 56% of Indian founders said that they witnessed low or moderate increase in investor checks and balances after the reports of corporate governance lapses at Indian startups made rounds in 2023.

Curiously, another interesting sentiment emerged from the survey. Founders believe that corporate governance measures instituted by investors were not entirely effective.

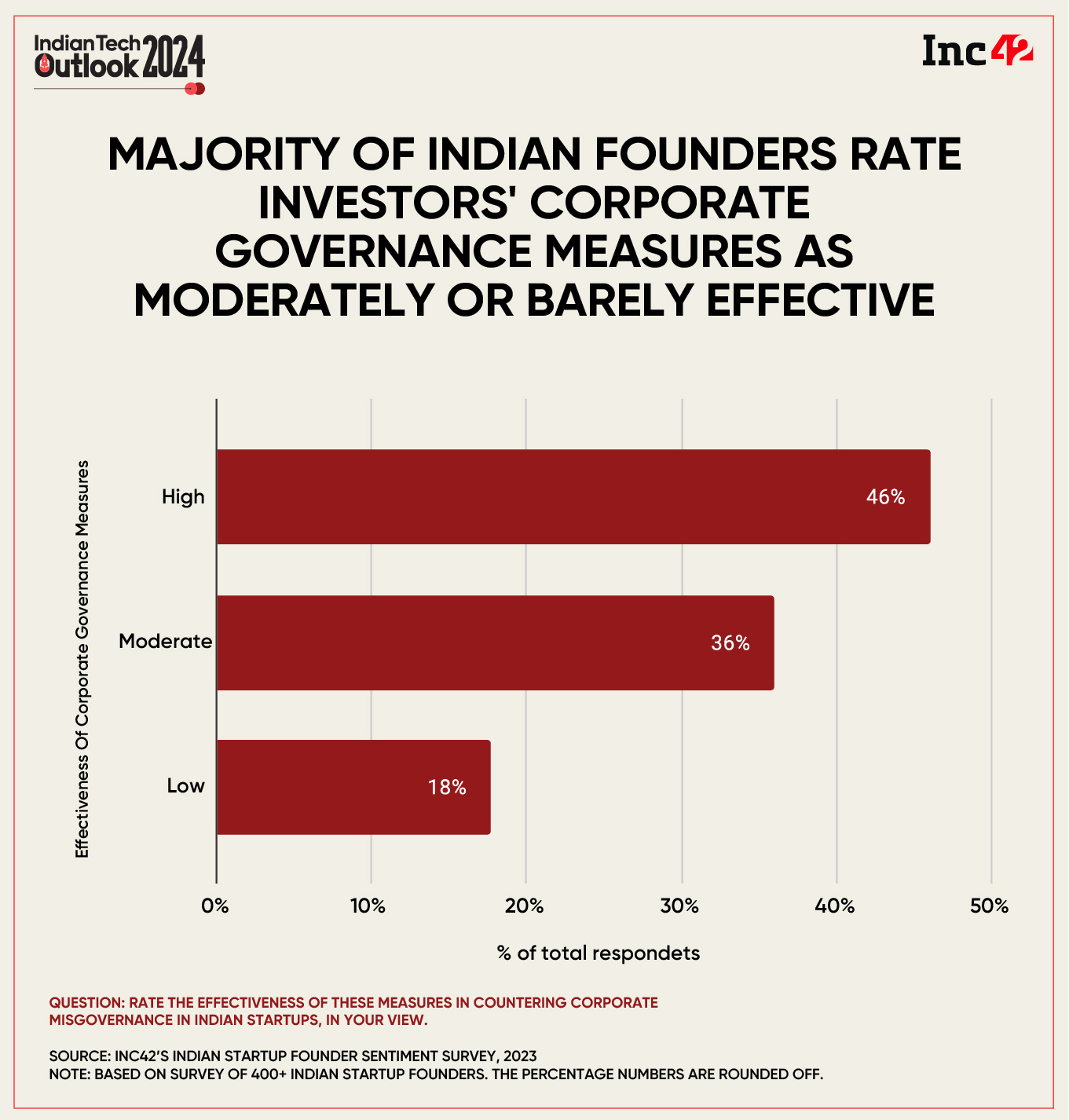

Download The ReportThe Inc42 survey revealed that 54% of Indian founders believe that the wary stance adopted by investors to counter flawed corporate governance practices among Indian startups was moderately or barely effective.

The remaining 46% opined that the investor measures were indeed effective and had a ‘high’ impact on the homegrown startup ecosystem.

Meanwhile, most venture capital (VC) firms Inc42 earlier spoke with opined that fundraising will continue to be a struggle in 2024, at least at the outset, as limited partners (LPs) may raise apprehensions about the ongoing corporate governance debacles at Indian startups.

It is pertinent to note that corporate governance issues at Indian startups made major headlines throughout 2022 and 2023. While the likes of Grover and Broker Network’s Rahul Yadav faced court cases, edtech juggernaut BYJU’S faced raids by the law enforcement authorities.

GoMechanic’s four cofounders faced allegations of financial mismanagement, forging documents, cheating, and falsification of accounts, further eroding trust in the Indian startup ecosystem. On the same lines, Trell faced the ire for alleged irregularities while edtech Skill-Lync found itself on the wrong end of the stick for allegedly pushing students into a debt trap.

This eroded the trust of investors who changed tacks and began focussing more on building better governance guardrails at their respective portfolio companies.

In terms of 2023, the concerns of investors stand more or less in contrast with founders’ perspective on the matter. That said, all eyes are now on what could transpire later this year.

What Will Be In Store For 2024?

While investor sentiment is expected to remain cautiously optimistic throughout this year, funding winter is expected to abate somewhat in the latter half of 2024. However, learning from the lessons of the past year, investors are expected to favor founders who handle their capital more judiciously and have strong corporate governance safeguards in place.

The rise of new VC firms with managers with a successful track record of governance is only expected to push their portfolio companies to focus more on strengthening governance norms.

On top of that, the massive rejig that took place at VC firms will see the new leadership actively unearthing more issues related to lax governance at their portfolio startups. This is especially pertinent for VCs that saw their founders hit by allegations of fraud, and as such, more such cases may come to light.

An early-stage investor told Inc42 last year, “VCs didn’t realise the amount of risk and liability that they are subject to because they trusted a lot of founders.” The person further added that more cracks could appear going forward as this trust erodes.

However, things appear to be on the mend. Most Indian founders expect a positive shift in investor sentiment towards Indian startups late this year. Meanwhile, Inc42 projects an overall YoY increase of approximately 36% in Indian startup funding for 2024.

As startups get their act together and investor sentiment improves, the homegrown ecosystem could see a major inflow of capital as the year progresses.

Download The ReportThe post Indian Founders Found Investors’ Corporate Governance Diktat Ineffective, Will 2024 See Better Guardrails? appeared first on Inc42 Media.

No comments