The 2023 Face-Off: How Zomato Powered Past Swiggy In The Food Delivery Race

Studies reveal that one in four Singaporeans dine out daily, while 80% opt for at least one restaurant meal every week. This shift away from traditional home-cooked meals has stemmed from broader socio-economic changes such as busy lifestyles, increased affluence and, most importantly, the rise of on-demand food delivery services riding the wave of ubiquitous digital tech and the smartphone economy.

But the dynamics of change are not limited to the island nation alone. In the past decade, India has witnessed a similar transformation in eating habits, driven by the rapid growth of the online food delivery segment. As mentioned by Statista, a Rakuten survey in December 2022 found that most Indian respondents aged 16-54 dined out at least once a week.

Given the exponential growth across India, the online food delivery market volume is estimated to reach $81.9 Bn by 2028, growing at a CAGR of 19.7% during 2023-2028. However, this surge would not have been possible without the sturdy industry stalwarts – Zomato and Swiggy – who lay the groundwork for the food-delivery ecosystem.

Both leverage the techvantage of a digital-first ecosystem to cater to the diverse Indian food palate but compete fiercely for a bigger market share. Zomato has maintained a sizable lead over its closest competitor in terms of execution. But is Swiggy lagging far behind or breathing down its rival’s neck?

An assessment of the year gone by (2023) and the outlook for 2024 will reveal these interesting ground realities and the shape of things to come.

Is It Zomato All The Way In 2023?

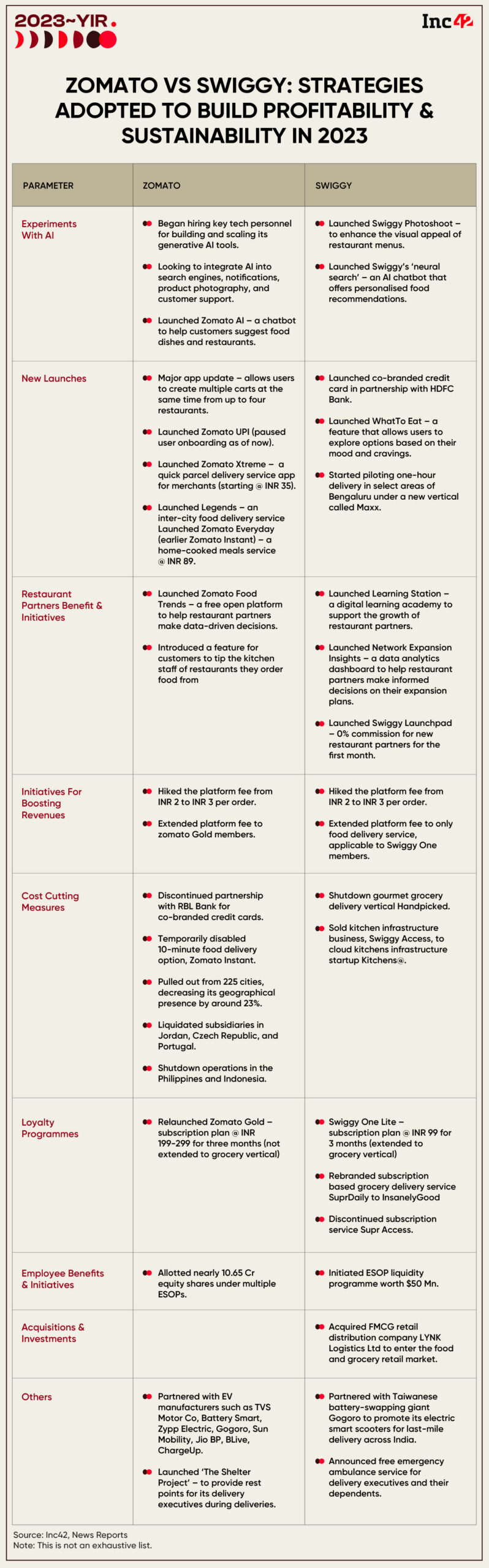

The narratives of Gurugram-based Zomato, now a listed company, and its unlisted peer Swiggy from Bengaluru are not analogous. However, much of their growth is the direct outcome of innovative marketing strategies (more on that later) and lucrative sales tactics such as discounts, cashback deals, exclusive offers and attractive loyalty programmes.

These sureshot bets (to say nothing about their expansive reach in the pan-India restaurant market) have lured gastronomes to online food-ordering over the years. Subsequently, engagement has increased and customer loyalty has split into two distinct camps. (Take a look at the app download comparison.)

The Zomato-Swiggy face-off in the food-delivery space has been accelerated by sustained investor interest. Together, these industry leaders have raised $5.4 Bn for strategic acquisitions, cloud kitchens and implementation of value-added services. More importantly, their deep pockets and industry dominance slowly squeezed out other players from the arena.

For instance, ride-hailing giant Uber India’s food delivery business UberEats was acquired by Zomato in early 2020, while Ola completed the 100% acquisition of Foodpanda (India) in early 2022 from Germany-based Delivery Hero.

The outcome: The industry has a duopoly now where the arch-rivals claim nearly identical market shares in India. However, Zomato maintained its lead with a 54% market share compared to Swiggy’s 46% in the food delivery space as of H1 2023, according to reports.

Although it has not been a smooth ride for either of the companies in 2023, Zomato has taken the lead in several critical areas to hold strong as an icon of India’s post-pandemic gig economy boom. Here is a look at how the companies have fared this year.

Zomato Tops The Consumer Sentiment Survey

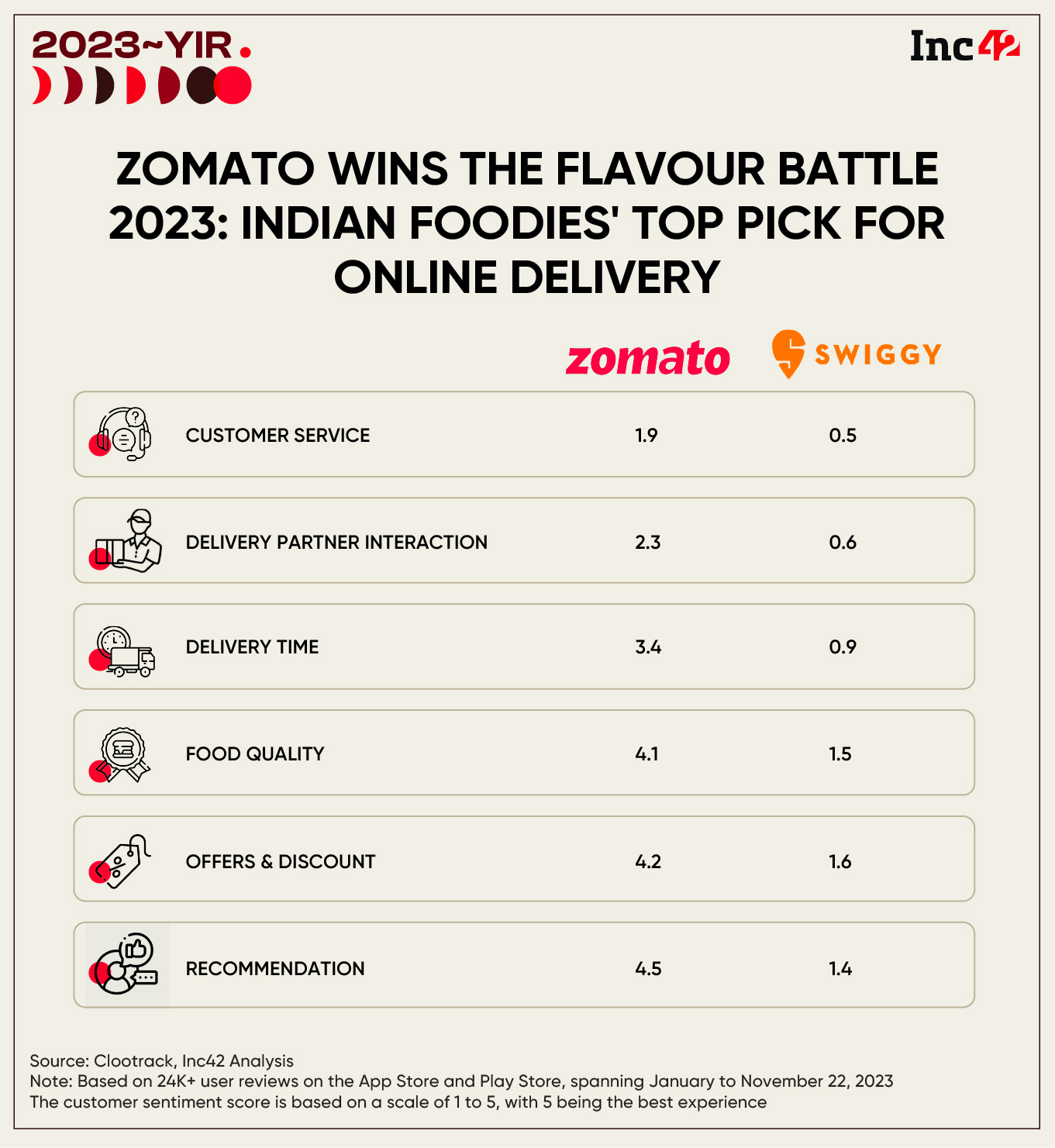

According to Inc42’s Consumer Sentiment Survey 2023, done in collaboration with Clootrack, Zomato emerged as the preferred online food delivery service among Indian consumers.

The conclusion was based on a Clootrack analysis of more than 24K user reviews on the Apple App Store and Google Play Store between January 1 and November 22. The findings underscore Zomato’s stronghold and positive reception in the highly competitive food aggregation, online ordering and delivery market.

The survey also revealed that key success metrics, including offers and discounts, food quality, customer service, delivery time and interactions with delivery partners, received high scores for Zomato on a scale of 1-5, where 1 signified the lowest and 5 represented the top score for consumer experience.

Zomato Sweeps The Field In App Downloads

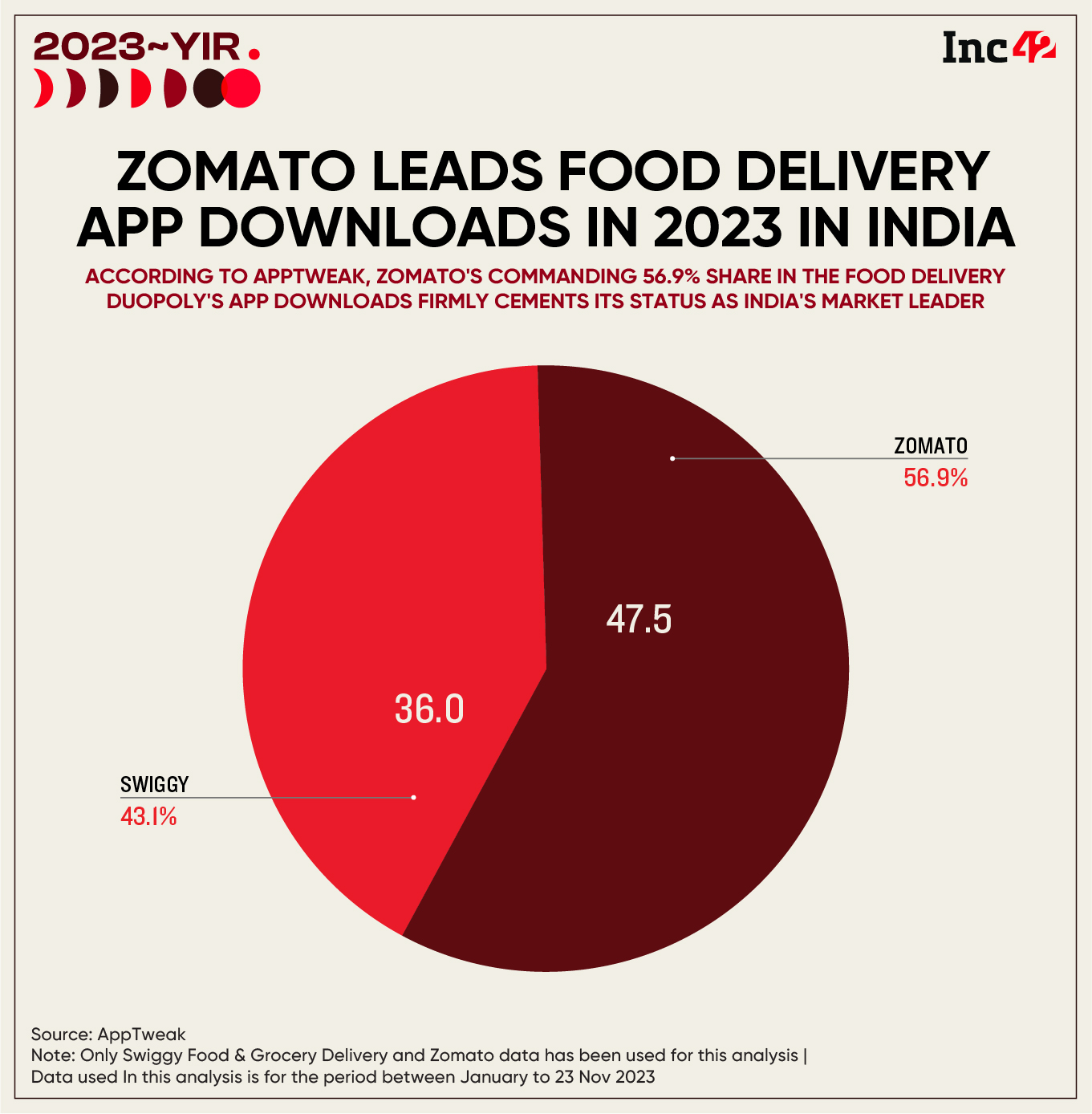

According to an Inc42-AppTweak analysis, the combined monthly app downloads of Zomato and Swiggy averaged 7.6 Mn and reached a total of 83.5 Mn between January and November 2023. Zomato led with 47.5 Mn downloads (56.9%), while Swiggy recorded 36 Mn (43.1%).

It is worth noting that the Swiggy app covers its grocery services (Instamart) and restaurant deals and discovery (Dineout) vertical besides food delivery.

Although Zomato has integrated UberEats’ operations with its own to strengthen the food delivery business, its quick commerce platform Blinkit (formerly Grofers, which was acquired in 2022) operates via a separate app. It has seen 14 Mn downloads in 2023 (excluding December data), and combined with Zomato’s download numbers, puts the parent company in a superior position.

But Financial Dips, Critical Exits – Who Has Weathered It Better

Zomato faced a challenging start to 2023, marked by the departure of its CTO, Gunjan Patidar. A subsequent 2% dip in its share prices was followed by an 8% decline, hitting its lowest since July 2022. Despite the setback, Zomato’s consolidated revenue for Q3FY23 (October-December 2022) surged by 1.75x to INR 1,948 Cr, but the foodtech giant saw a 5x spike in losses, reaching INR 346.6 Cr.

Not only this, it liquidated its subsidiaries in Jordon, Czech, Portugal while in process of shutting operations in the Philippines and Indonesia with active operations only in India and the UAE.

Zomato had also placed early bets on non-metro markets to widen and deepen its reach, a cash-burning exercise as it would not provide immediate results. However, given the global slowdown in 2023 due to macro headwinds, the foodtech unicorn focussed on improving its financial performance.

Zomato hit overall profitability in Q1 (April-June 2023) and Q2 (July-September 2023) of the current financial year and reintroduced its Gold loyalty programme in January, which has now surged to 38 Lakh members.

Although it is not strictly contextual (Swiggy is not a listed company), Zomato stock has given excellent returns in 2023 on a YTD (year-to-date) basis. After some dismal performances post its IPO, the stock has emerged as a multibagger and gained around 103% as of November 2023.

We have not considered the market loss it suffered on December 11, 2023, as the company was under pressure after SoftBank offloaded its remaining stake in Zomato.

Swiggy, too, grappled with persistent losses, high-profile exits and diminished investor confidence ahead of its impending IPO.

The Bengaluru-based foodtech unicorn is yet to announce its FY23 earnings, but it reported a loss of INR 3,628.9 Cr in FY22 with an operating revenue of INR 6,119.8 Cr. It also restructured the business and adopted cost-cutting measures, resulting in the termination of 380 employees.

Key people, including Karthik Gurumurthy (Senior Vice President and Head of Swiggy Instamart), Dale Vaz (CTO), Anuj Rathi (SVP, Central Revenue and Growth ), Ashish Lingamneni (VP, Marketing) and Dineout cofounder Vivek Kapoor, were among its high-profile exits.

To add to its woes, the US-based investment firm Invesco marked down Swiggy’s valuation twice earlier this year, eventually slashing it to $5.5 Bn from an earlier $10.7 Bn. Swiggy reached the decacorn valuation when it raised $700 Mn from the US investor in 2022.

Things took a turn for the better when Swiggy CEO Sriharsha Majety claimed that the foodtech unicorn’s food delivery business achieved profitability as of March 2023, excluding ESOP costs. Investors also displayed renewed confidence, with Invesco marking up Swiggy’s valuation by nearly 43% to $7.85 Bn and Baron Capital internally raising the valuation by 33.9% quarter-on-quarter to $8.54 Bn.

Creative, Relatable & Witty: How Zomato Campaigns Capture Foodies

Innovation-driven marketing is a major growth driver in today’s business scenario, and Zomato has vroomed into that space. Take, for instance, the age-old SEO tools consistently driving traffic 24×7. According to traffic analyser Ubersuggest, Zomato ranks in India for 2,494,988 keywords as of August 2023, with monthly organic traffic amounting to 30,484,205, as mentioned in an IIDE (Indian Institute Of Digital Education) report. Although these figures are a tad lower than its SEO performance in February 2023, Zomato has outperformed Swiggy by 2.5 times.

However, the company has taken the cake in the social media domain.

Zomato and Swiggy are active on major social media platforms like Instagram, Facebook and X (formerly Twitter). As of November 2023, Zomato has 891K followers on Instagram, 1.9 Mn on Facebook and 1.5 Mn on X. Swiggy is a notch down, with 457K followers on Instagram, 999K on Facebook and 209K on X.

Zomato’s ability to attract and engage people on every medium can be attributed to its use of trendy and witty posts. For instance, a recent collaborative campaign with Blinkit tweaked a famous Bollywood dialogue, leaving people in splits. While the Blinkit billboard turned the original dialogue on its head and said: Doodh mangoge, doodh denge (Ask for milk, and we will deliver it), Zomato took a page from it and made a humorous addition: Kheer mangoge, kheer denge (Ask for kheer, and we will deliver it).

Then there are other campaigns – the story of Raksha and Bandhan, Zomato vs Zomato and Humans of Zomato – which are equally intriguing and never fail to captivate consumers. A recent case study by IIDE also highlighted the food delivery giant’s effective strategy of creating witty and relatable content to enhance engagement and appeal to its audience.

Moreover, when Zomato’s founder and CEO, Deepinder Goyal, joins the upcoming season of the popular TV show Shark Tank India, the event can set social media on fire. The company will not let go of this opportunity to impress netizens.

As global customer reach is its primary objective, Zomato utilises every available digital marketing tool to understand the preferences of its target audience and cater relevant content. According to the digital marketing agency Ideatick, the company sticks to a creative marketing strategy to stay at the forefront of the industry.

That does not mean Swiggy is lagging. The company has earned industry acclaim for its skilful storytelling, exemplified by its famous campaign What’s In A Name, where it ingeniously weaves relatable stories around restaurant names. Swiggy typically looks at people’s hunger quotient to craft a comprehensive marketing strategy, epitomised by its timeless tagline: Craving Something?

It also captivates its audience with visually compelling content and relevant Indian topics, ranging from cricket to political unrest. Again, pictures of delicious food are promoted on Instagram to position the company as the go-to choice for those desiring delectable meals.

Recognising the fast-growing significance of memes in the new millennium vernacular, Swiggy infuses its distinct flavours into them to enhance customer interaction on social platforms. A notable example is its viral Vadapav meme on Instagram (posted in September 2022), which got more than 1.2 Mn views and 5K comments, showcasing the effectiveness of this approach.

2024 Outlook: Competitive Sparring On The Menu

According to a Statista report, the number of users across the meal delivery market in India is estimated to reach 346.6 Mn by 2028. This anticipated surge in user numbers has transformed online food aggregation and delivery into a highly lucrative segment, attracting new players and investors.

So, it is not surprising that startups like Waayu and Thrive, as well as the Indian government’s ambitious digital commerce network ONDC, are challenging the longstanding duopoly of Zomato and Swiggy.

Interestingly, WAAYU distinguishes itself as a no-commission food delivery platform, backed by Bollywood actor and investor Suniel Shetty and supported by the Mumbai-based Indian Hotel and Restaurant Association (AHAR). The startup charges an introductory fee of INR 1K per month per outlet, which will be doubled a month after the onboarding. Restaurants also have to pay a one-time onboarding/setup fee of INR 3,650.

Another noteworthy contender is Thrive, a foodtech platform supported by Coca-Cola. It collaborates with restaurants for online and WhatsApp ordering, order management and setting up digital menus. Thrive claims to have a large restaurant base (exact number not disclosed) as it charges a 3% commission compared to 18-25% levied by Zomato and Swiggy.

The presence of ONDC makes the market more competitive as it has already onboarded more than 50K restaurants, signalling a tough time ahead for Zomato and Swiggy.

As we approach 2024, the fate of these industry leaders remains uncertain. Only time will tell if they can operate in a stable market and grow sustainably, or it will continue to be a roller-coaster ride.

The post The 2023 Face-Off: How Zomato Powered Past Swiggy In The Food Delivery Race appeared first on Inc42 Media.

No comments