Reversal Of Fortunes: After 50% Fall In 2022, PB Fintech Soars Nearly 75% In 2023

Shares of PB Fintech, the parent entity of insurtech major Policybazaar, became one of the biggest gainers of 2023 on the back of the bull run in the domestic equity market, which resulted in the reversal of fortunes for new-age tech startups after the hammering they got in 2022.

Like its peers Zomato and RateGain, the fintech player made big gains in the first half of 2023 and also sustained the uptrend for the rest of the year. As per analysts, the stock is on track to continue this rally in the mid to long term.

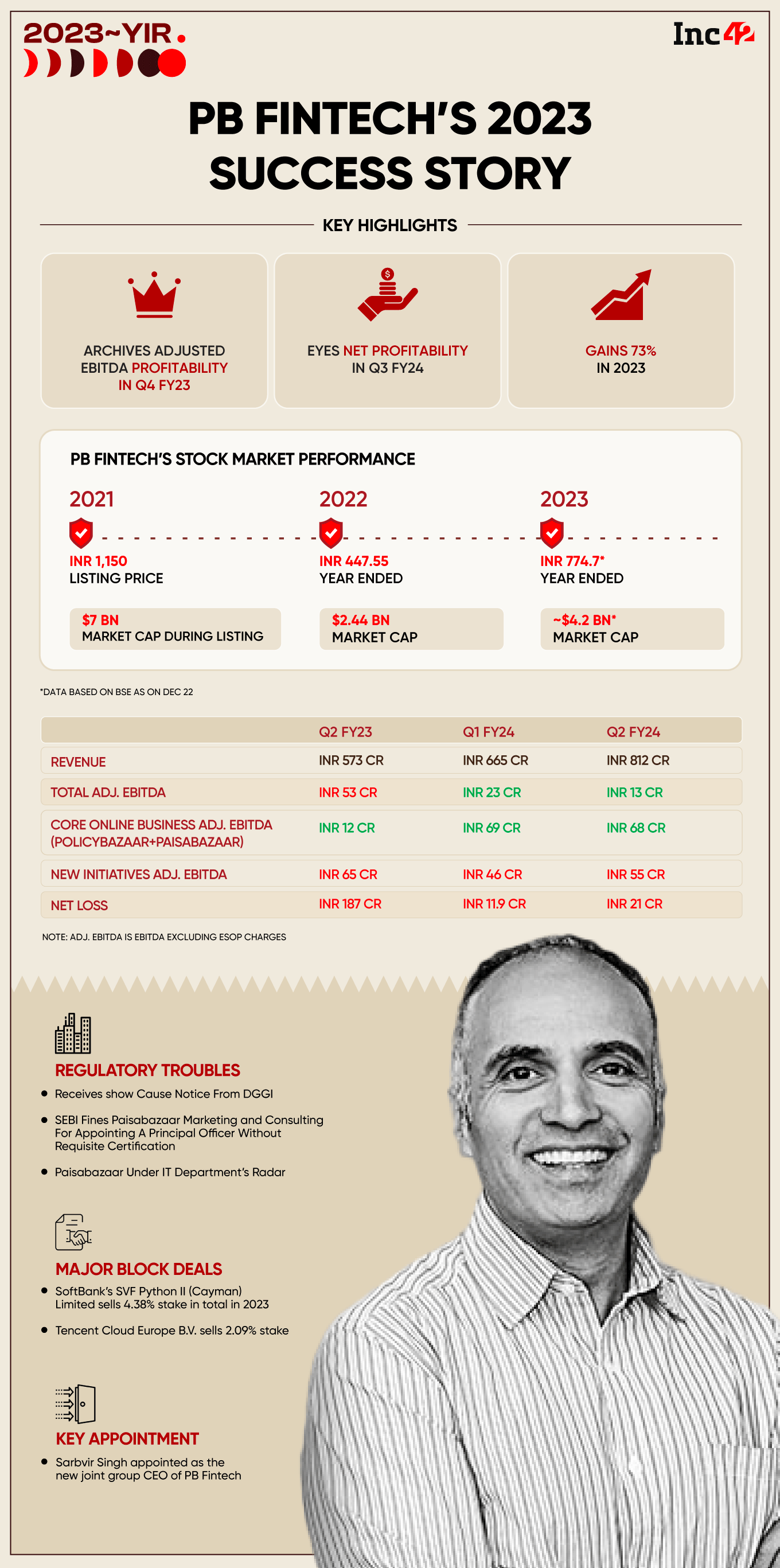

On the back of the uptrend of 2023, PB Fintech’s market capitalisation more than doubled to $4.2 Bn by the end of the year from $2 Bn at the end of 2022. Its shares gained 73% in 2023 versus an almost 50% decline last year.

So, what led to the rally in 2023? The answer is the same as we have discussed in our analysis of other new-age tech stocks as part of Inc42’s 2023 In Review series — improvement in fundamentals and an aggressive march towards profitability.

Now, before we go into how 2024 looks for the stock, let’s take a look at the PB Fintech stock performance so far in 2023.

March Towards Profitability Set The Stock On Fire

Amid the increasing focus of startups, both listed and unlisted, on turning profitable, PB Fintech reported its first adjusted EBITDA profitable quarter in Q4 FY23. The startup also stated that it expected to turn profitable in FY24.

The development came just a quarter after PB Fintech’s lending vertical, Paisabazaar, achieved breakeven on an adjusted EBITDA level in Q3.

Led by two back-to-back positive developments, PB Fintech shares gained over 38% year to date (YTD) by the end of May 2023.

Amid all these, the startup saw a slew of new developments in 2023, including the rise in competition after Jio Financial Services entered into the insurtech space. However, the stock not only brushed aside the concerns and continued to climb up but was also less volatile in comparison to its fintech rival Paytm.

A look at some of the key developments at the startup during the year.

- The Directorate General of GST Intelligence (DGGI) reportedly sent a show cause notice to Policybazaar earlier in the year for alleged wrongful claim of input tax credit.

- The DGGI notice was just the beginning of many other regulatory actions. Later in the year, the Securities and Exchange Board of India (SEBI) imposed a penalty of INR 1 Lakh on Paisabazaar Marketing and Consulting, a subsidiary of PB Fintech, for appointing a principal officer without requisite certification.

- In the most recent incident, Paisabazaar also came under the radar of the Income Tax Department.

- PB Fintech appointed Sarbvir Singh as the new joint group CEO of the company.

- Policybazaar secured a fresh fund infusion of INR 350 Cr ($42 Mn) from its parent entity PB Fintech.

- The startup’s ESOP expenses continue to be a drag on its bottom line. However, it has managed to bring down these expenses over the last few quarters.

- Most analysts strengthened their bullish outlook on the stock this year.

In its last reported quarter – Q2 FY24 – PB Fintech reported a net loss of INR 21 Cr, which was a decline on a year-on-year basis but a rise on a quarter-on-quarter (QoQ) basis. However, the bull run in the stock remained unaffected by the QoQ rise as its two verticals, Policybazaar and PaisaBazaar, are showing strong growth.

The startup’s share price surged to INR 784 as of December 28 (Thursday) from INR 447.55 at the end of December 2022. The offloading of stakes by some of the major investors like SoftBank and Tiger Global during the year also failed to have any significant impact on the stock.

Decoding PB Fintech’s Shareholding Pattern

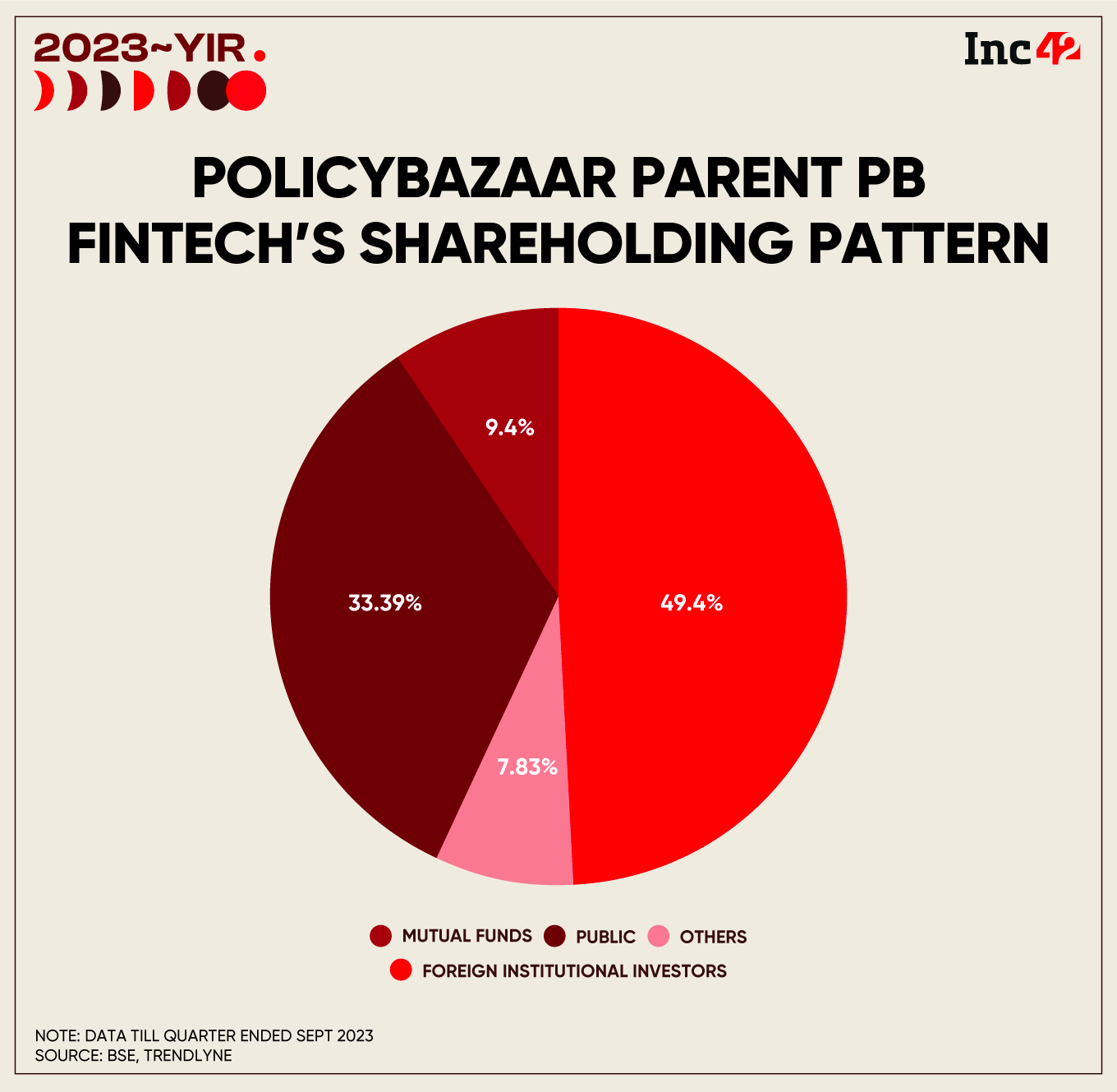

In line with the trend seen at Zomato and Paytm, PB Fintech also saw some of its pre-IPO investors selling their stakes in the startup.

- SoftBank, which has been selling its stakes in the listed Indian companies in its portfolio, offloaded a 2.53% stake in PB Fintech in December, held via its SVF Python II Cayman.

- Prior to that, the fund offloaded a 1.85% stake in the fintech major in October while SVF India Holdings (Cayman) also sold a 0.69% stake in the startup at the same time.

- Tencent Cloud Europe B.V. offloaded its 2.09% stake in PB Fintech in May this year, bringing down its holding to 6.28%.

Meanwhile, the rise in the stock price attracted interest from mutual funds and other institutional investors. A large number of PB Fintech shares offloaded by pre-IPO investors were lapped up by the likes of HDFC Mutual Fund, Mirae Asset Mutual Fund, ICICI Prudential Life Insurance Company Limited, Societe Generale Odi, BNP Paribas Arbitrage, and Citigroup Global Markets Mauritius, among others.

As of the September 2023 quarter, as many as 21 mutual funds held a 7.83% stake in PB Fintech as against 16 of them holding a 4.68% stake a year ago. Insurance companies also increased their stakes to 3.7% from 0.84% at the end of the quarter ended September 2022.

The stakeholding of foreign portfolio investors in the company increased to 29.92% in the quarter ended September this year. Overall, foreign institutional investors held a 49.4% stake in PB Fintech at the end of Q2 FY24.

Will The Stock Continue To Soar In 2024?

The Street is largely bullish on the stock and expects it to continue the ongoing rally next year. Some brokerages believe that PB Fintech has the first-mover advantage in the insurtech space, which, along with its strong tech backbone, will help continue the strong growth despite the rising competition.

In a research note earlier this year, Kotak Institutional Equities said, “We believe that intense competition in the life business, with a change in tax rules and increase in maximum bancassurance partnership and increased negotiating power of PB, provide tailwinds to its growth.”

Meanwhile, Citigroup opined that PB Fintech’s end-to-end customer journey model, market dominance in digital-backed origination, robust tech backbone, and transitioning monetisation model towards annuity revenue place it in a sweet spot.

Following PB Fintech’s Q2 FY24 earnings, Keynote Capitals noted that the company was standing at a “pivotal juncture”, driven by catalysts such as renewal commission growth, strategic expansion into Tier II and III cities through offline channels, and stringent cost management. All these measures, the brokerage said, were poised to generate favourable operating leverage.

Helped by its aggressive goals, the startup’s management now sees PB Fintech turning profitable by as early as Q3 FY24.

However, it is pertinent to note that brokerage JM Financial flagged competition from insurance regulator Insurance Regulatory and Development Authority of India’s (IRDAI’s) Bima Sugam and the rising losses of PB Fintech’s new initiatives business as key risks to its growth thesis.

Kush Ghodasara, CMT and an independent market expert, expects the stock to perform well in the long run but sees a decline in the next 2-3 months.

All said and done, the year 2024 promises to be another good year for PB Fintech’s investors. However, the stage for it would be set by the startup achieving its net profitability goal. As such, all eyes would be on PB Fintech’s financial performance in Q3 FY24 and the subsequent quarters.

The post Reversal Of Fortunes: After 50% Fall In 2022, PB Fintech Soars Nearly 75% In 2023 appeared first on Inc42 Media.

No comments