New-Age Tech Stocks See A Mixed Week Despite Bull Run In Broader Market; Mamaearth Plunges

Indian new-age tech stocks witnessed another mixed week even as the broader market surged on the country’s strong GDP data and positive global cues.

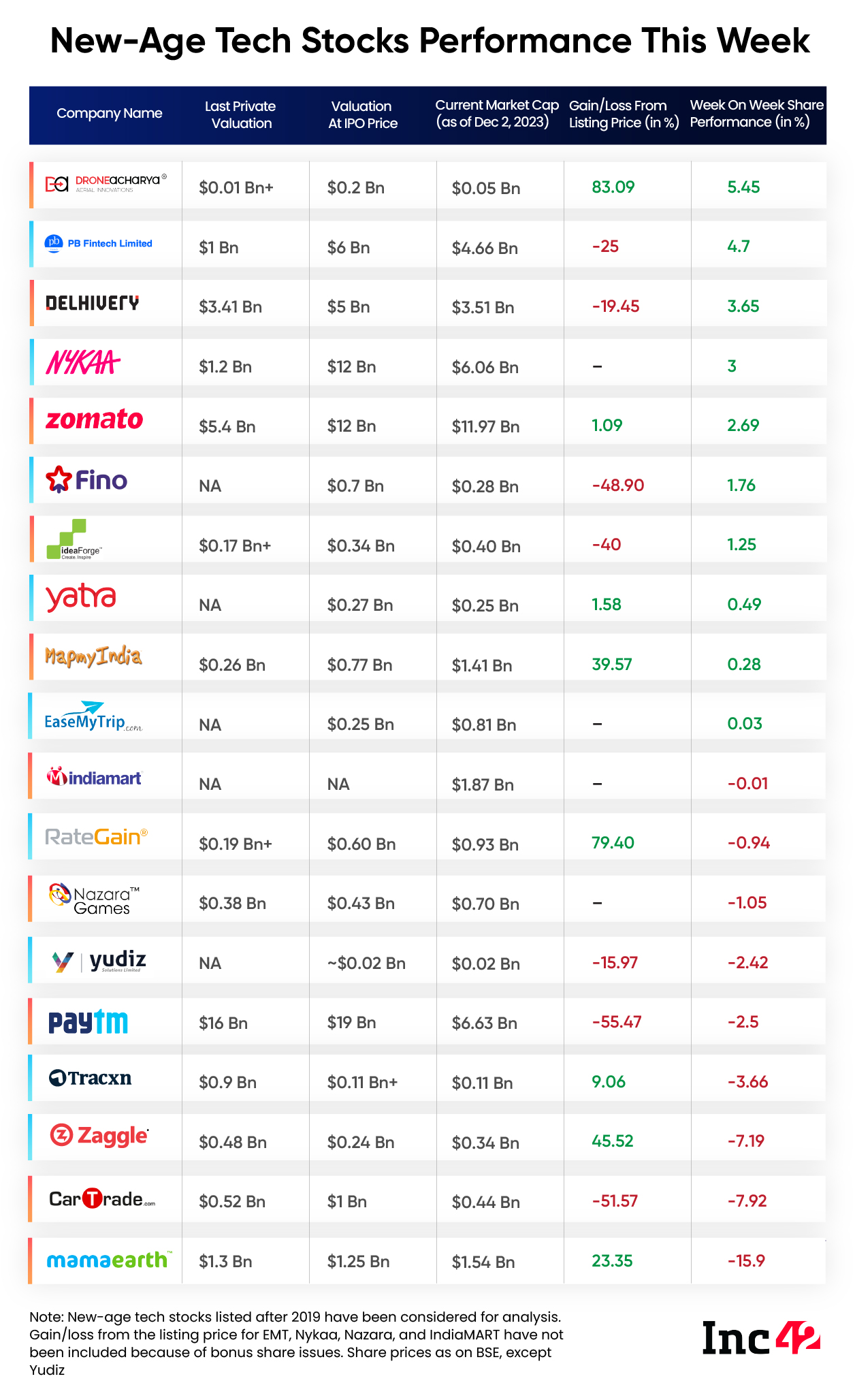

Of the 19 new-age tech stocks under Inc42’s coverage, shares of 10 companies witnessed northbound movement in a moderate range of 0.03% to above 5%, with drone startup DroneAcharya emerging as the top gainer.

Delhivery, PB Fintech, Nykaa, and Zomato were among the other gainers of this week.

Meanwhile, nine new-age tech stocks fell in a much broader range of 0.0.1% to 16% this week, hurt by stock-specific actions. After a sharp rally last week, shares of Mamaearth saw a major correction and nosedived 16% this week.

Shares of Tracxn Technologies also declined almost 8% this week following last week’s uptrend. Paytm, Zaggle, and CarTrade were among the other losers this week.

This week had only four trading sessions as November 27 was a market holiday on the occasion of Gurunanak Jayanti.

Meanwhile, the broader market soared this week on the back of both domestic and global positive cues. Benchmark indices Sensex and Nifty50 gained in all four sessions. Sensex rose 2.29% to cross the 67K mark, while Nifty50 surged 2.4% to cross the 20K mark after two months.

The broader market outperformed, with mid and small caps displaying resilience and no signs of fatigue, said Vinod Nair, head of research at Geojit Financial Services.

“Investors remain optimistic about government spending and heightened consumption, driven by easing inflation, propelling up growth in H2FY24…,” he added.

Meanwhile, India’s Q2 GDP data also boosted investor sentiment. The Indian economy blew past the estimates and grew 7.6% during the July-September quarter, as per the data released by the Ministry of Statistics on Thursday (November 30).

Multiple factors, including domestic and global macroeconomic data, election results for the five states which went to polls last month, RBI policy meeting, and crude oil inventories, will drive the market next week, believe analysts.

Now, let’s take a look at the performance of some of the major new-age tech stocks this week.

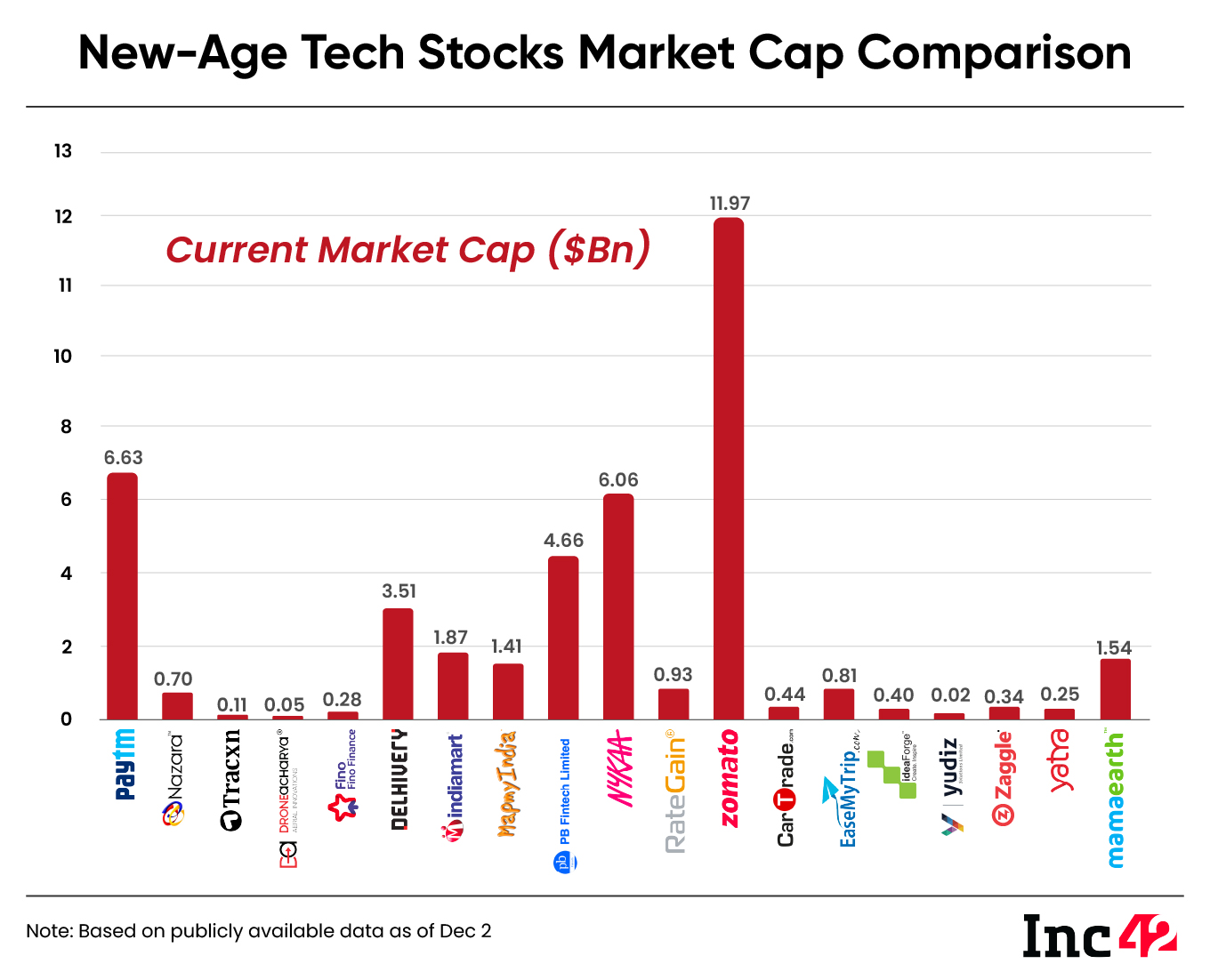

The total market capitalisation of the 19 new-age tech stocks under Inc42’s coverage stood at $40.32 Bn at the end of this week, improving slightly from $39.37 Bn last week.

Antfin Ditches Zomato

In what turned out to be one of the most anticipated events for new-age tech stocks this week, Antfin, an affiliate of Chinese conglomerate Alibaba, sold its entire stake in Zomato.

Antfin had offloaded some stake in the Indian foodtech major in November last year as well and held a 3.44% stake in the company after that. This week, the Chinese company sold its entire stake, involving 29.6 Cr shares in Zomato.

Antfin exited the food tech platform with a profit of about $40 Mn compared to its initial investment of $360 Mn in 2018.

Despite the share sale in multiple block deals, Zomato gained 2.6% this week as many institutional investors lapped up the company’s shares.

Morgan Stanley, Government Of Singapore, Birla Mutual Fund, Fidelity Investment, and Vanguard were among those who bought the shares sold by Anfin.

Meanwhile, Zomato’s share price surpassed its listing price of INR 115 on the BSE once again this week after a slight correction in mid-November. On Friday, the stock ended the session at INR 116.25 on the BSE.

It is pertinent to note that the shares of Zomato have gained over 71% in the last six months on the back of the company reporting two consecutive profitable quarters.

Commenting on the stock, Amol Athawale, VP of technical research at Kotak Securities, said that it looks bullish on the charts in the medium term but will likely consolidate in the short term.

“For the short term, INR 125 and INR 123 would be the immediate resistance area and on the downside, INR 110 and INR 108 would be the immediate support area,” said Athawale.

A range-bound activity will continue in the counter in the near-term, he added.

Mamaearth Loses Steam

After rallying a whopping 43% last week, the most-recently listed new-age startup Mamaearth witnessed a sharp correction and plunged 15.9% this week.

It was reported earlier this week that Mamaearth’s employees were likely to sell shares worth INR 150 Cr in a block deal. However, as per the publicly available data, no such deal took place this week.

The shares of the leading D2C beauty brand ended Friday’s trading at INR 399.65 on the BSE. Experts expect volatility to continue in the stock in the coming days.

On the other hand, as per a media report this week, the company distributed excess stock of its products through its offline supply chain ahead of its IPO in November. This has reportedly resulted in distributors in Maharashtra and Goa being saddled with goods of about 90 days in inventory.

Shares of Mamaearth are currently trading over 23% above their listing price.

DroneAcharya Emerges As The Biggest Gainer

Shares of the drone startup made a significant rally in the first two sessions of the week and also jumped 1.4% in the last trading session to end at INR 186.75 on the BSE.

The company announced the expansion of its drone training program this week as it collaborated with IIT Ropar to launch its third Remote Pilot Training Organization (RPTO). With this, DroneAcharya plans to improve training in the northern part of the country.

Overall, the company’s shares rallied 5.4% this week.

Kotak Securities’ Athawale said that the current texture of the stock is largely non-directional. He believes that INR 195 is the immediate resistance for the stock while INR 175 would be a crucial support.

The startup listed on the BSE SME platform in December last year and is currently trading over 83% higher than its listing price.

The post New-Age Tech Stocks See A Mixed Week Despite Bull Run In Broader Market; Mamaearth Plunges appeared first on Inc42 Media.

No comments