IPO-Bound Awfis’ Net Loss Narrows To INR 46.6 Cr In FY23

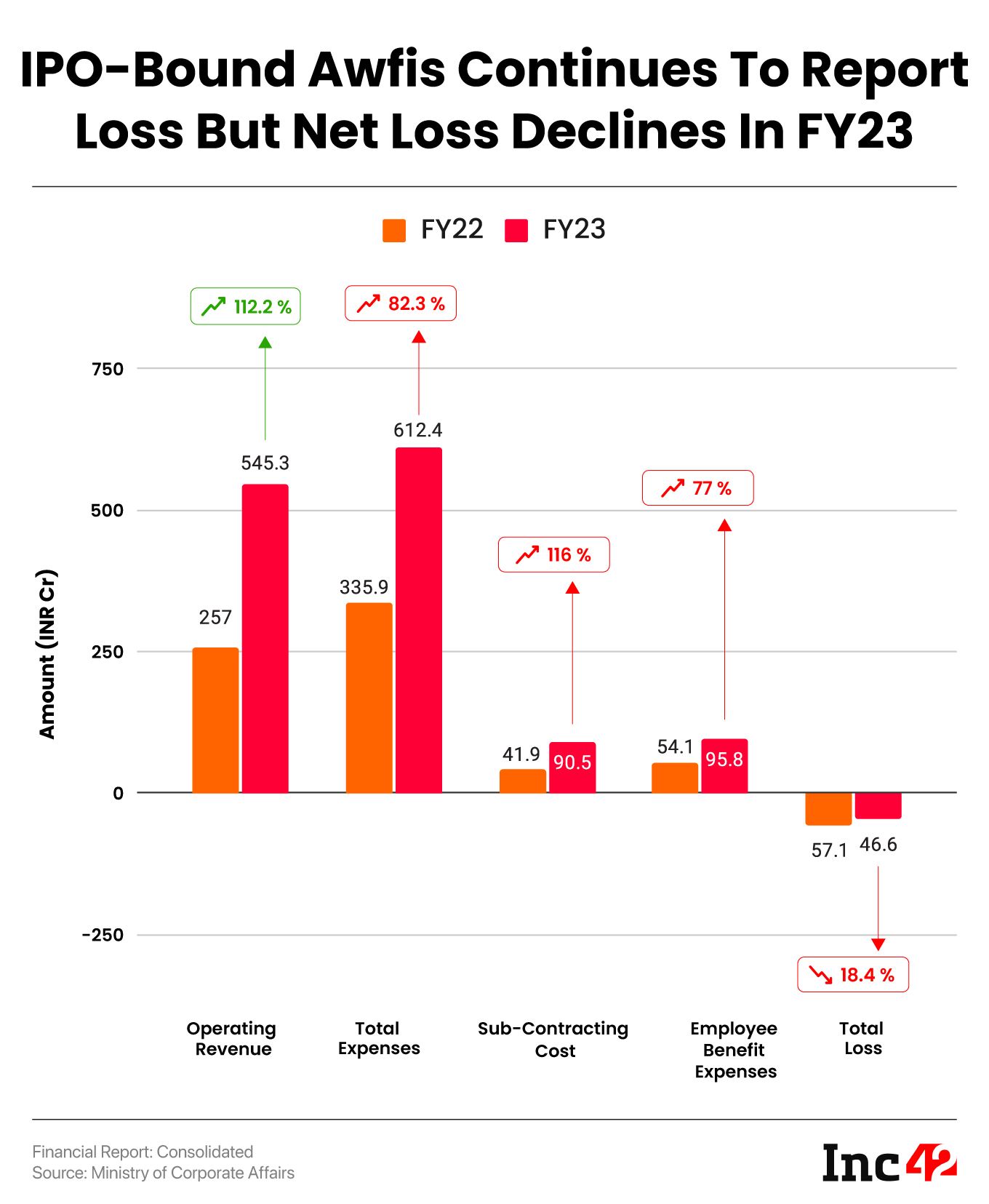

IPO-bound coworking space provider Awfis reported a little over 18% decline in its consolidated net loss to INR 46.6 Cr in the financial year 2022-23 (FY23), helped by significant growth in its business as the demand for flexible office spaces increased.

The startup had reported a loss of INR 57.1 Cr in FY22 on an operating revenue of INR 257 Cr. Awfis’ operating revenue, that is revenue from contracts with customers, jumped 112% year-on-year (YoY) to INR 545.3 Cr in FY23.

In fact, Awfis stated in its draft red herring prospectus (DRHP) with capital markets regulator Securities and Exchange Board of India (SEBI) that its revenue from contract with customers grew at a CAGR of 74.85% from FY21 to FY23.

“… due to the COVID-19 pandemic, there has been a reverse migration of workers to some extent, due to which employees are seeking increased flexibility, and as a result, several organisations have decentralised operations and the demand for hub and spoke model and flexible workspaces have increased… As a result, the demand for flexible workspaces increased,” the startup said in its regulatory filing.

Founded in 2015 by Amit Ramani, Peak XV Partners-backed Awfis has evolved from just being a coworking network to a tech-enabled workspace solutions platform, catering to freelancers, startups, SMEs, large corporates, and MNCs. The startup earns revenue from rental income, sale of food items, as well as sale of furniture and work-from-home solutions.

Awfis noted that 67.24% of its rental income from coworking spaces was derived from centres located in four major cities – Bengaluru, Mumbai, Pune, and Hyderabad, as of June 30, 2023.

However, the boom in coworking rentals also entails the possibility of a rise in expenses.

“This rapid growth places a significant strain on our existing financial resources. We expect our capital expenditures and operating expenses to increase on an absolute basis as we continue to invest in additional centres, launch additional solutions, products and services, hire additional employees and increase our marketing efforts,” said Awfis in its DRHP.

Awfis’ Rising Expenses

In line with the overall business growth, Awfis reported an over 82% jump in its total expenses to INR 612.4 Cr in FY23 from INR 335.9 Cr in the previous year. However, a large portion of the expenses were non-operating expenses such as finance costs and depreciation and amortisation expenses.

In fact, Awfis remained profitable at the EBITDA level, which is calculated as earnings before tax, finance costs, depreciation and amortisation expenses. In FY23, its EBITDA increased to INR 176 Cr from INR 90 Cr a year ago.

Sub-Contracting Expense: Awfis saw its sub-contracting cost jump 116% YoY to INR 90.5 Cr in FY23.

As per its disclosure, the startup’s sub-contracting cost includes design fees and material cost associated with providing construction and fit-out services under the brand Awfis Transform.

Employee Costs: The startup reported a 77% surge in its total employee benefit expenses to INR 95.8 Cr in the year under review from INR 54.1 Cr in FY22.

In that, INR 84 Cr was spent towards salaries, wages, and bonuses. Meanwhile, the startup also spent around INR 4 Cr on ESOPs in FY23.

Depreciation and Amortisation Expenses: Awfis spent almost INR 150 Cr in this bucket in FY23, which jumped from INR 98.4 Cr in the prior year.

Finance Cost: Awfis’ finance cost jumped over 49% YoY to INR 72.7 Cr in FY23, with interest paid on lease liabilities accounting for the biggest portion.

Rent & Electricity: The startup spent INR 39.1 Cr and INR 50.7 Cr towards electricity and rent, respectively, in FY23

Outlook

Awfis said in its DRHP that while the Covid-19 pandemic has led to a major surge in demand for flexible workspaces in recent days, its historical growth rates might not be indicative of the future growth.

“We cannot assure you that such instances will occur in the future. The market for our solutions, products and services may not continue to grow at the rate we expect or at all, and our client base may decline because of increased competition in the space-as-a-service sector or the maturation of our business, or the abatement of the effects of the Covid-19 pandemic in respect of reverse migration,” the DRHP noted.

Besides, Awfis also warned of significantly rising competition in its space.

“The flexible workspace industry in India is intensely competitive and we compete in both the organised and unorganised sectors with large multinational and Indian companies, as well as regional and local companies in each of the regions that we operate,” said Awfis.

As per the DRHP, Awfis is looking to raise INR 160 Cr through a fresh issue of shares during its IPO. The public issue will also comprise an offer-for-sale component of up to 1 Cr shares.

The post IPO-Bound Awfis’ Net Loss Narrows To INR 46.6 Cr In FY23 appeared first on Inc42 Media.

No comments