Flipkart Looks To Upstage Amazon Prime Again: Will Its Revamped VIP Programme Be The Charm?

During the recently concluded Big Billion Days Sale, Walmart-owned ecommerce major Flipkart launched an annual membership programme – yet again. The announcement of Flipkart VIP was not a rarity, though. Over the years, it came up with a handful of premium memberships and loyalty programmes, but they failed to compete with its arch-rival, Amazon India, and its flagship, Amazon Prime.

Flipkart First, Flipkart Plus and Flipkart Plus Premium came and went without much ado. This year, Flipkart VIP was clubbed with its biggest online event to create maximum impact. But can it trump Amazon Prime at long last?

Let us delve deep into their offerings to understand what value they bring to users and which is worth our money.

Just like Alibaba’s Singles Day or the western world’s Black Friday sales (the latter is no longer a novelty in India), the country’s shopping frenzy peaks during Navratri, a hallmark celebration of Indian consumerism across states and communities. No wonder ecommerce behemoths like Amazon and Flipkart gear up with big deals, discounts and promotions to make the best of this mega-sales event.

The critical importance of this festive season was best exemplified when, on 6/10/2014, Flipkart launched its first Big Billion Days sales, eyeing a target of INR 600 Cr. (Fun fact: 6.10 was the flat number in Koramangala, Bengaluru, where the company was set up in 2007.) The rest of the narrative is pretty well-known. The overwhelming online traffic led to technical failures, and eventually, Flipkart’s website and payment system crashed.

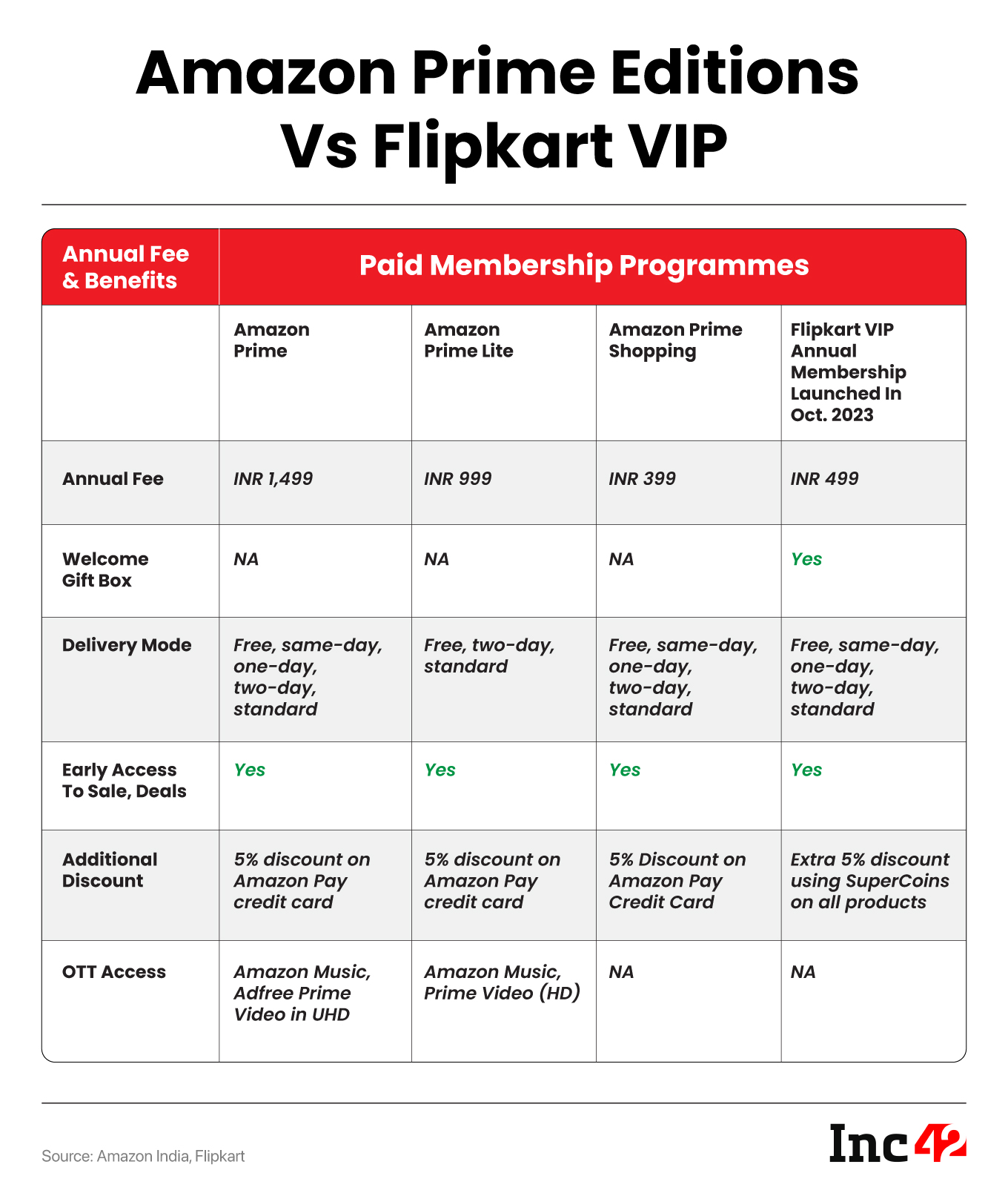

The narrative changed this year when Flipkart launched its annual membership, Flipkart VIP, on October 4, just before the Big Billion Days (TBBD) kicked off on October 8. The pricing is enticing, INR 499, compared to Amazon’s full-fledged Prime membership at INR 1,499 (it has other versions, but more on that later).

A look at the festive numbers puts Flipkart ahead in the competitive landscape. While the Amazon India site and app claimed 1.1 Bn visits, Flipkart claimed 1.4 Bn visits. Also, Flipkart Fashion played an important role in customer acquisition, bagging more than 44% of new users during TBBD.

According to consulting firm RedSeer, ecommerce platforms in India clocked a gross merchandise value (GMV) worth INR 47K Cr during the first week of the online festive sales. Last year, total GMV across ecommerce platforms was around INR 76K Cr, compared to a whopping INR 90K Cr+ estimated this year.

The Flipkart Group, including Flipkart, Myntra and Shopsy, led the race with a 63% market share in GMV, followed by Amazon. The group also led the field in volume play, followed by Meesho, with 25% of the total orders, up from 21% in the first week of the 2022 festive season sales. Amazon, however, disapproved the data collated by RedSeer.

However, competing with Amazon remains a formidable task for its peers. Going by the data revealed by Amazon India, the highest Prime sign-ups happened in a single day this festive season, along with the highest seller participation and 5K product launches from top brands. Interestingly, “This festive season, 80% of our customers who shopped came from tier 2-3 cities,” said Manish Tiwary, country manager, India Consumer Business, Amazon in a press statement.

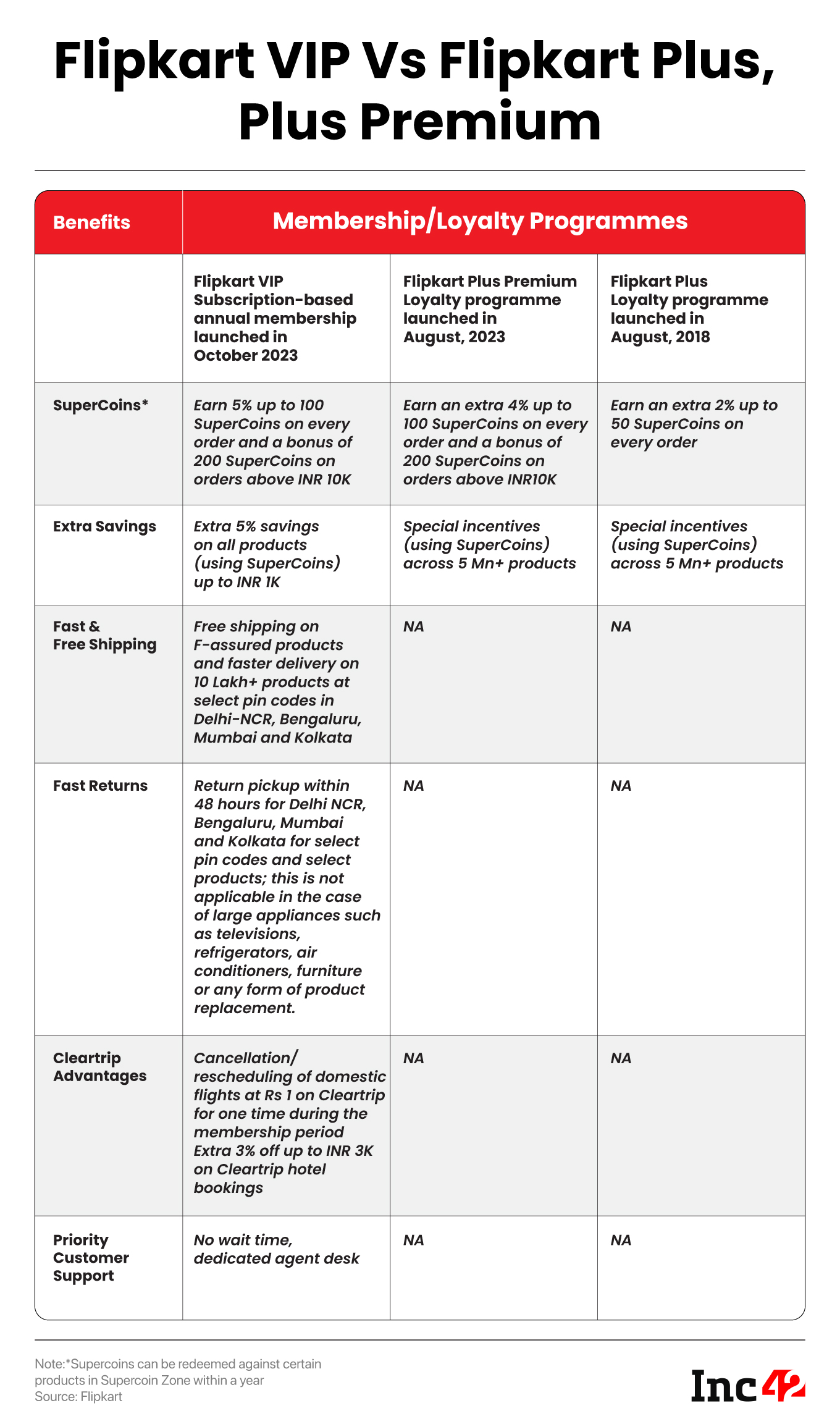

All You Need To Know About Flipkart VIP & Other Loyalty Programmes

Although Flipkart VIP is the group’s third attempt to launch a paid annual membership (with two loyalty programmes in between), experts think it still lacks the Prime punch. Nevertheless, it may generate quick revenue without significant investments due to price advantage. But before comparing the pros and cons of Flipkart VIP and Amazon Prime, a quick look at VIP and its previous programmes will help us understand how Flipkart has evolved over the years.

How Flipkart VIP Stacks Up Against Amazon Prime

Before we assess whether Flipkart’s new VIP membership can compete with Amazon Prime and dent its fast-growing member base, here is a quick look at the key features offered by the ecommerce giants.

Unlike Prime, Flipkart VIP, as the name suggests, offers priority customer support.

Prime Membership provides free one-day delivery on 4 Mn+ products, ad-free access to Prime Video and Prime Music, unlimited 5% cashback (for Amazon Pay Credit card holders), Prime Reading, Prime Gaming, including monthly free games and exclusive in-game content for popular titles, early access to lightning deals and additional 10% discount on certain products.

Flipkart VIP also ensures fast and free delivery, early access to lightning deals and discounts. Although it does not provide streaming services like Prime, it has a few unique benefits such as a Welcome Box with assorted products, the ability to cancel/reschedule domestic flights booked on Cleartrip for INR 1 (can be used only once during the membership period) and an additional 3% discount of up to INR 3K on Cleartrip hotel bookings.

While Prime offers cashbacks on flight bookings done via Amazon Pay card holders it lacks the cancellation feature that VIP offers.

A Close Look At Flipkart’s ‘VIP’ Targets

Flipkart has consistently focussed on the fast-growing non-metro market where aspiring customers seek new products but have limited access to the ecommerce ecosystem. According to the company, it witnessed close to 50% user growth after the pandemic lockdowns, with Tier III+ regions accounting for nearly 65% of the newfound growth. Even in 2023, the first day of its festive sales saw more than 60% of the orders coming from Tier I, II and III cities.

Nevertheless, Flipkart’s VIP programme aims to deepen its position across the key cities. Although the company has declined to comment on its shift in focus, some ecommerce analysts think it will be essential if Flipkart wants to emulate Prime-like delivery schedules.

“Extending free and fast deliveries in Tier III+ locations is difficult, as it will increase logistics costs in the first place,” said an analyst from Gartner who did not want to be named. “Add to that is the average return rate that would further increase the cost. No wonder, Flipkart had initially offered return pickup within 48 hours in 4 cities – Delhi NCR, Bengaluru, Mumbai and Kolkata as part of VIP programme.

That’s why Prime is hugely popular in metros, but in smaller cities, Amazon’s OTT service [and not fast deliveries] lures people to subscribe.”

Though this festive season, Amazon claimed that more than 65% of Prime members who shopped during the festive season were from tier 2 & 3 cities/towns.

However, the average volume as value of transaction per customer is still significantly higher in metro cities.

Of course, some users from non-metros may opt for the VIP programme as they want faster delivery. But here is the catch. Be it Prime or VIP, fast deliveries or quick pickup for returns, say in 48 hours, are rarely available in Tier III and IV cities.

Moreover, Flipkart VIP (or any premium membership) is meant for frequent shoppers with deep pockets. Paying membership fees and delivery charges (when required) is costly, and not all buyers can afford it, said Satish Meena, advisor to Datum Intelligence.

As the success of these programmes is underpinned by frequent buying and buying of more categories (volume) as well as big-ticket purchases (value) from metros, it makes sense for Flipkart to target customers from Tier I and II cities only to grow its VIP member base.

According to Meena, non-Prime shoppers on Amazon have an average order value (AOV) of INR 1,000-1,200, while Prime members have an AOV of INR 1,800-2,000, nearly double the spend of a regular shopper. Understandably, Prime generates maximum profit for Amazon in India and globally.

Flipkart VIP must target this customer segment to win the battle royal. Although Amazon Prime enjoys a strong presence in metro cities, many Prime members continue to use other platforms to buy stuff not sold on Amazon. Flipkart VIP can make a dent if it can create a go-to shopping hub at one-third the charge.

How The Titans Battled It Out Over The Years

Flipkart pioneered paid annual membership with Flipkart First in 2014, offering free and fast delivery for INR 499. The all-new programme included a host of benefits such as free shipping for all orders, free ‘in-a-day’ guaranteed delivery, guaranteed same-day delivery at discounted pricing, a 60-day replacement policy, priority customer support and more. The company also gave away 75K free memberships to attract online shoppers for whom it was a novelty.

The narrative changed in 2016 with the launch of Amazon Prime at the introductory price of INR 499. The ecommerce giant introduced cheaper same-day deliveries, a better cancellation policy and, most importantly, access to Prime Videos. It was an added attraction as we had yet to witness the OTT tsunami of the pandemic days.

Flipkart quietly discontinued its membership programme, but not for long. It relaunched Flipkart First in 2017, primed with an entertainment pack that offered a three-month Hotstar subscription at a discounted price of INR 99 and free premium membership for the music streaming platform Gaana.com. Its core offerings included free and fast delivery and free cancellations for a limited number of flights booked on MakeMyTrip.

Despite these measures, the relaunched Flipkart First folded up. In contrast, Prime became such a hit that Amazon could increase the membership fee from INR 499 to INR 999. A full-fledged Prime Membership currently costs INR 1,499, while a Prime Lite version is available for INR 999, with slight tweaks in OTT services.

When Flipkart launched its VIP programme in October this year, it played the price card and kept the introductory fee at INR 499. It was not a bad strategy. If 55% of Prime members subscribe for free and fast delivery, Flipkart should be able to lure them by offering the same convenience at 66% less. Also, member acquisition would be easy due to brand awareness and proximity. Most of these buyers already have Flipkart accounts, although they use the platform less frequently.

Amazon took note of the price play. At the time, it was offering Prime and Prime Lite, but soon after the VIP launch, the ecommerce major came up with Prime Shopping at INR 399, a strategic price point aimed to blow Flipkart’s advantage.

Although pricing can be a game-changer in the Indian context, the impact of ecommerce companies goes far beyond that. Inc42 has spoken to many analysts and industry experts who think Flipkart still has a long way to go to compete with Prime. The reason? Amazon offers an overarching ecosystem across the realm of shopping and entertainment, never matched by Flipkart. Despite high membership fees that could have backfired in a price-conscious market like India, bundle pricing attracts customers as they have to pay less than the total cost of buying individual services included in the package.

Consider this. Apart from giving access to its own content, Prime Video integrates popular OTT platforms such as Lionsgate Play, Discovery, BBC and Eros Now to offer bundled service that costs less than the total of those platforms’ standalone charges. Besides, one can access different genres in one place minus the hassles of multiple downloads and different payment schedules. This makes a huge difference for content lovers seeking convenience and variety.

According to a Datum Intelligence report, more than 50% of people opt for Prime Membership due to seamless access to Prime Videos, while 37% do it for the advantage of music streaming. These account for significant numbers, but Flipkart has not tried to service these segments yet.

The introduction of Amazon Fire TV Sticks (third-generation devices are available now) is another crowd-puller. The HD streaming device with Alexa Voice Remote includes TV and app controls, converts a regular television into a smart TV and can easily replace cable subscriptions. Amazon has sold 200 Mn+ Fire TV Sticks globally and claims to have sold the device across 90% of Indian pin codes. Although it has not revealed the India numbers, the pin code coverage underscores the depth and reach of its services, enhancing the scope for pushing Prime Membership in every nook and cranny.

Vaitheeswaran K, an ecommerce veteran and cofounder of Again Drinks, summed up the situation well. “Although Amazon has increased Prime membership fees several times, we are not overly concerned about the cost, primarily due to the experience it offers as an ecosystem,” he pointed out.

Why Flipkart VIP Lacks The Punch

Online shoppers could be in a fix trying to decide which membership programme would be worth their while in the long run. Meanwhile, here is a quick look at how some of the Flipkart VIP services fall short of Prime advantages.

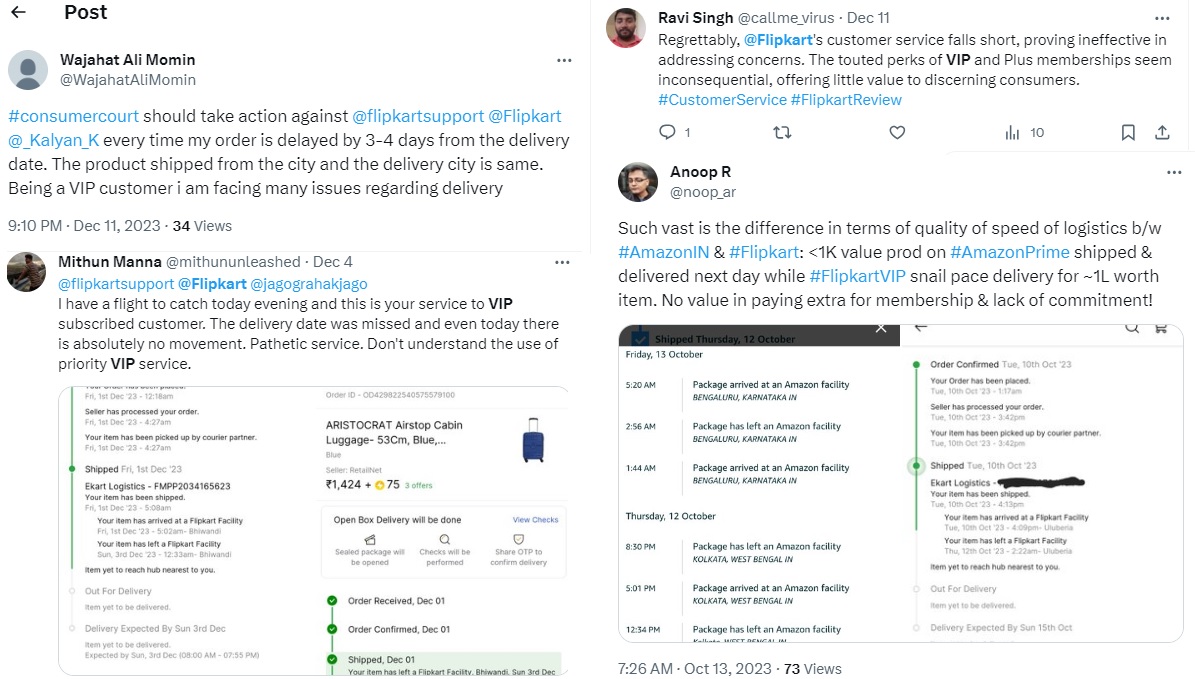

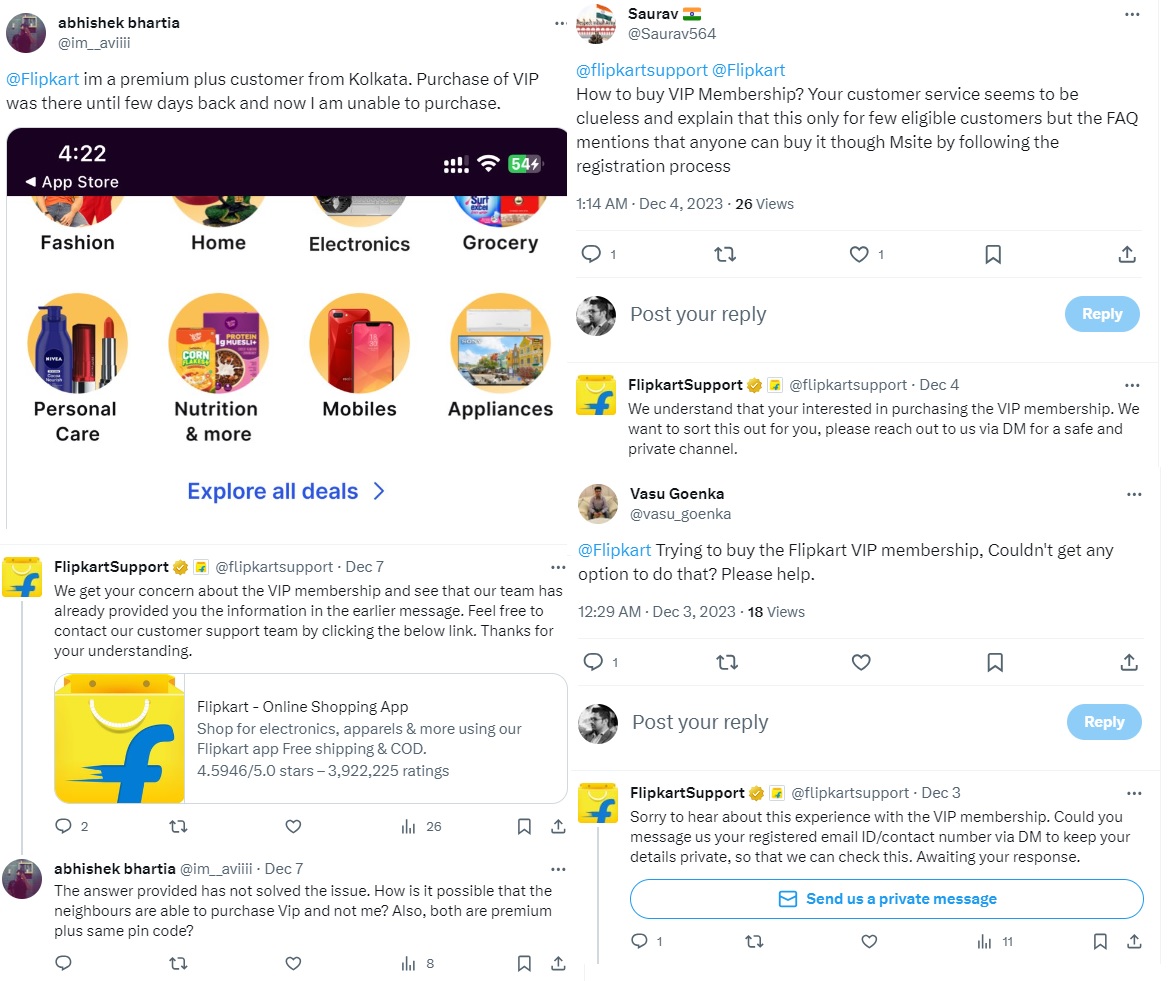

Customer Support and VIP Service Hit a Bump. Shortly after the launch, amidst the festive season, social media became inundated with complaints related to VIP membership services. Users expressed dissatisfaction with Flipkart, citing issues such as delayed delivery, return pickups exceeding 48 hours, and perceived lapses in prioritizing customer support.

Full refunds for flight tickets may not captivate users. Providing full refunds for domestic flight tickets that too only once will only appeal to a small segment – people who are frequent fliers.

Welcome Box is a puzzle. The Welcome Box is as vague as possible, points out the analyst associated with Gartner. To start with, Flipkart says it will send the box anytime during the membership year, thus killing the excitement. Moreover, users do not know what to expect, which may lead to disappointment.

VIP lacks unique and differentiated services. Unlike Amazon’s broad ecosystem and extensive services, Flipkart VIP solely focuses on free and fast delivery, which is a given for most ecommerce companies. More importantly, Prime offers complementary products and services to push growth. For instance, any user of Fire TV will opt for Prime Membership instead of other programmes. On the other hand, Flipkart VIP struggles to provide unique and differentiated services not featured in its loyalty programmes.

Limited availability may hinder growth. While more than 65% of Prime members who shopped during the 2023 festive season were from Tier II and III locations (versus 50% last year), Flipkart VIP is touted to be available across Delhi-NCR, Bengaluru, Mumbai and Kolkata. However, many users from Delhi, Mumbai and Bengaluru have reported that the registration link is not working.

So far, the entire exercise has been relatively low-key. The VIP subscription is not available online, and users who have contacted the support team have received little help. The team says the VIP programme is either selectively offered to users or might have been withdrawn.

In today’s fiercely competitive business landscape, companies emulating each other find it difficult to come up with service innovation that will gain a competitive advantage. While Flipkart is grappling with similar challenges, its limited availability may further hinder it from reaching a wider audience.

As the battle for supremacy in the Indian ecommerce space continues, Flipkart needs to recognise Indian customers’ unique nuances and turn those into cutting-edge opportunities. Otherwise, it will be a tortuous and uphill road as it tries to curb Amazon Prime’s overwhelming dominance.

[Edited by Sanghamitra Mandal]

The post Flipkart Looks To Upstage Amazon Prime Again: Will Its Revamped VIP Programme Be The Charm? appeared first on Inc42 Media.

No comments