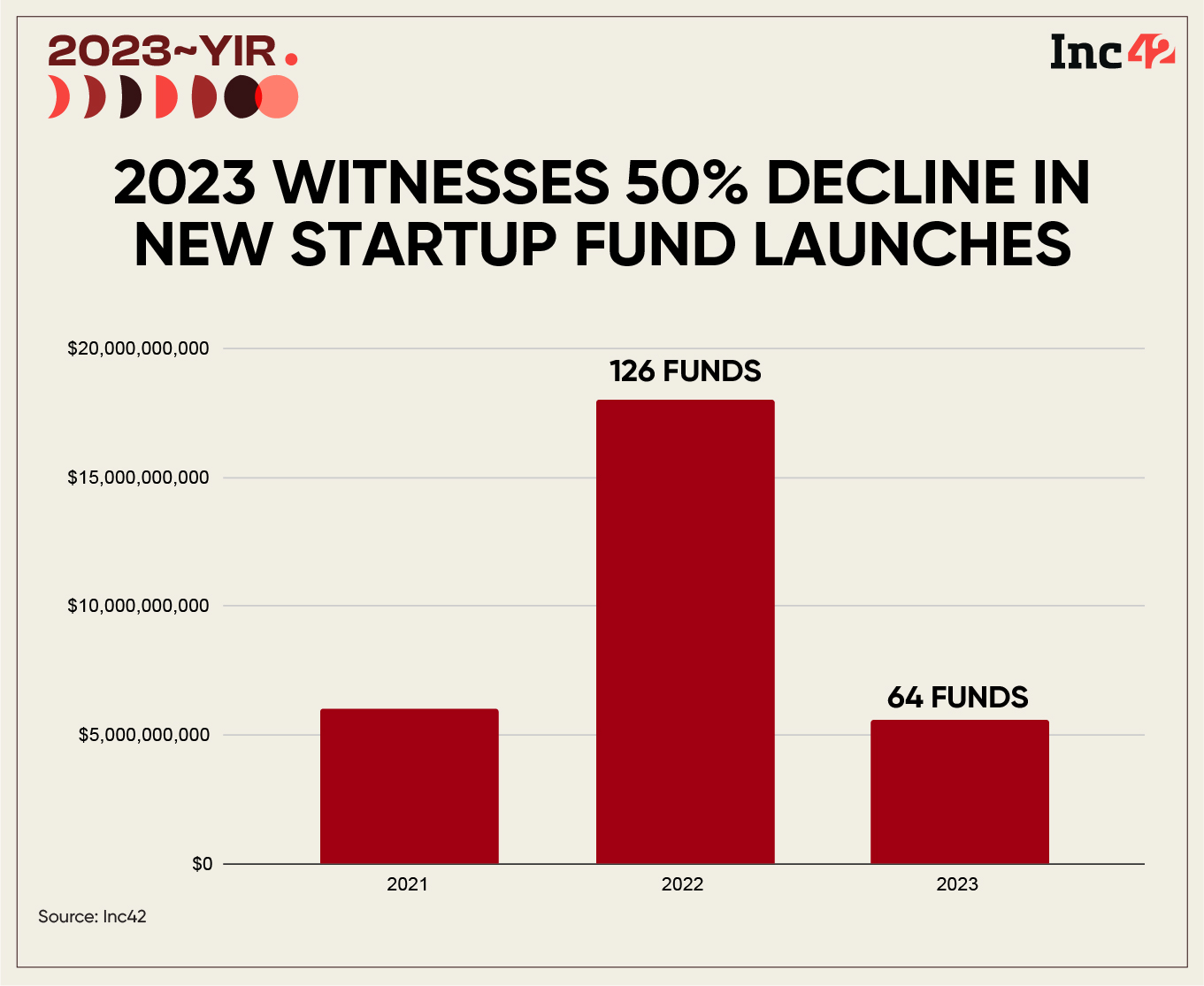

Dry Spell Reigns Havoc: Only 64 Funds Worth $5.6 Bn+ Launched In The Year Of Extended Funding Winter

Marked by a confluence of economic downturn and funding constraints, the year 2023 has proven to be a challenging one for the Indian startup ecosystem on many fronts. Even late and growth stage ventures bore the brunt of the funding crunch, with new fund launches by venture capital firms decreasing both in total value and the number of fresh funds.

Imperative to mention that compared to 2021 and 2022, total funding in 2023 declined by $32 Bn and $15 Bn, respectively, to stand at $10 Bn as of December 25.

Also, the Indian startup ecosystem saw many controversies take shape, casting shadows over investor confidence. Instances of mismanagement and alleged fraud involving startups like GoMechanic, B Capital-backed Mojocare, and Rahul Yadav-led Broker Network raised governance concerns among VCs.

The wave of deception not only invited scrutiny of several Indian startups but also sparked dissatisfaction among Limited Partners (LPs). This dissatisfaction triggered a significant shift in LPs’ relationship with venture capital firms, prompting a re-evaluation of fund recommendation and management processes.

Despite these challenges, 2023 saw the announcement and launch of 64 funds, including venture capital funds, micro-funds, and corporate VC funds. These funds amounted to over $5.6 Bn. In comparison, 2022 witnessed the launch of 126 funds, raising over $18 Bn for startup investments.

Now, let’s take a deeper dive into the fund launch scenario in the world’s third-largest startup ecosystem tracked by Inc42 during the year of extended funding winter.

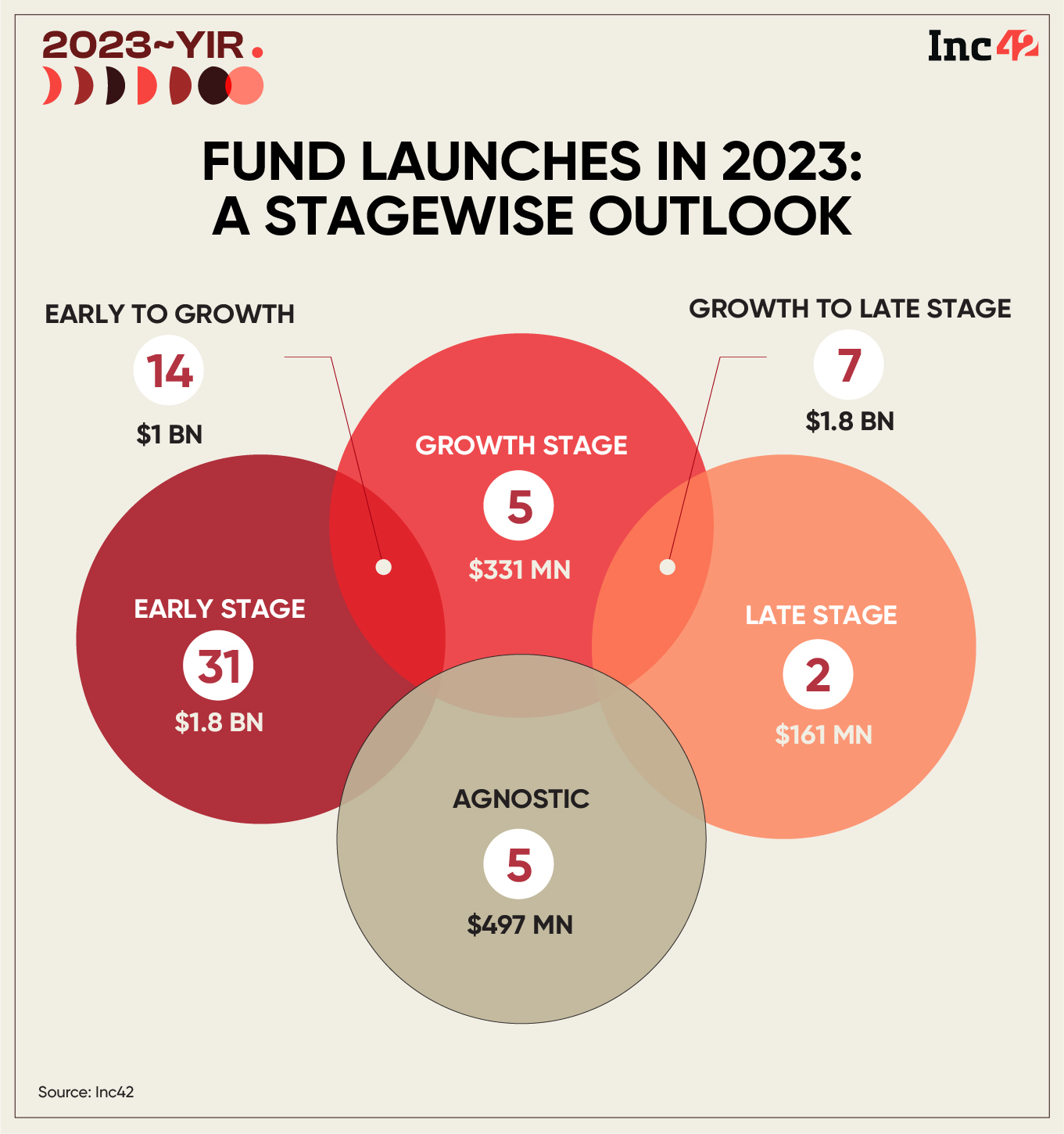

Early & Early-Growth Stage Fund Launches Took Centre Stage In 2023

In 2023, early-stage startups emerged as the investor favourites. This made way for 31 funds launched with a corpus of $1.8 Bn.

It is essential to mention that some early-stage VCs started seeing good returns from their funds this year. A case in point is Blume Ventures, an early stage VC firm that has backed unicorns such as Unacademy, Slice, Purplle, and Spinny.

The firm reported that its inaugural fund (Fund I) and its extension Fund IA have realised 5x of the invested capital so far and are on track to realise 6x gross returns by their full lifecycle in 2024.

Blume Ventures’ Fund I was launched in 2011 with an initial capital of INR 98 Cr, followed by INR 24.5 Cr for its extension Fund IA in 2013.

While the number of early stage funds increased in 2023, a notable trend is the rise of micro VCs, whose small-ticket funding into pre-seed and seed-level startups has grown markedly in the past couple of years. This trend gained momentum after 2016 and has continued to grow in the last two years.

Furthermore, LPs are increasingly expressing interest in micro VC funds, drawn by the potential for more growth opportunities.

A prominent example is Mumbai-based Artha Group, which launched an INR 450 Cr winners-only micro VC fund, focussing on top-performing startups from the group’s portfolio of over 100 startups, with an average investment size of INR 20 Cr per investment.

Earlier this year, micro VC fund CapFort Ventures launched an INR 200 Cr India-focussed tech fund, while Singapore-based Grayscale Ventures made the first closure of its $20 Mn micro fund at $10 Mn.

In addition to making low-risk investments, VC funds are focussing on follow-on investments in well-performing portfolio companies, which has also increased the emphasis on growth stage funding.

Following early stage funds, the early-to-growth stage witnessed the highest number of fund launches, with 14 funds, amounting to $1 Bn. Investors believe that more Series A funding is expected to happen next year in the growth stage.

Late Stage Funds Remained Under Pressure

Throughout the year, there was significant pressure on growth and late-stage funds. Recognising the importance of more responsible and value-driven investments, VCs are scaling back on the number of funds launched.

Understandably, the launch of growth, growth-to-late stage, and late-stage funds has been low, with only 16 fund launches amounting to $2.3 Bn.

While late-stage fund launches may not see a significant increase in 2024, activity in the growth and growth-to-late funding stages is expected to rise.

A significant trend likely to accompany this shift is the departure of high-profile startup executives from their current ventures to establish new startups, with expectations of securing substantial funding from VCs.

For instance, Swiggy’s senior vice-president (SVP) Karthik Gurumurthy is departing the food tech giant to launch his startup and is said to be in talks with multiple venture capital firms, including Matrix and Accel, for funding.

Similarly, Vivek Sinha, former chief operating officer (COO) of edtech unicorn Unacademy, reportedly secured $11 Mn (around INR 91 Cr) in funding for his new edtech startup.

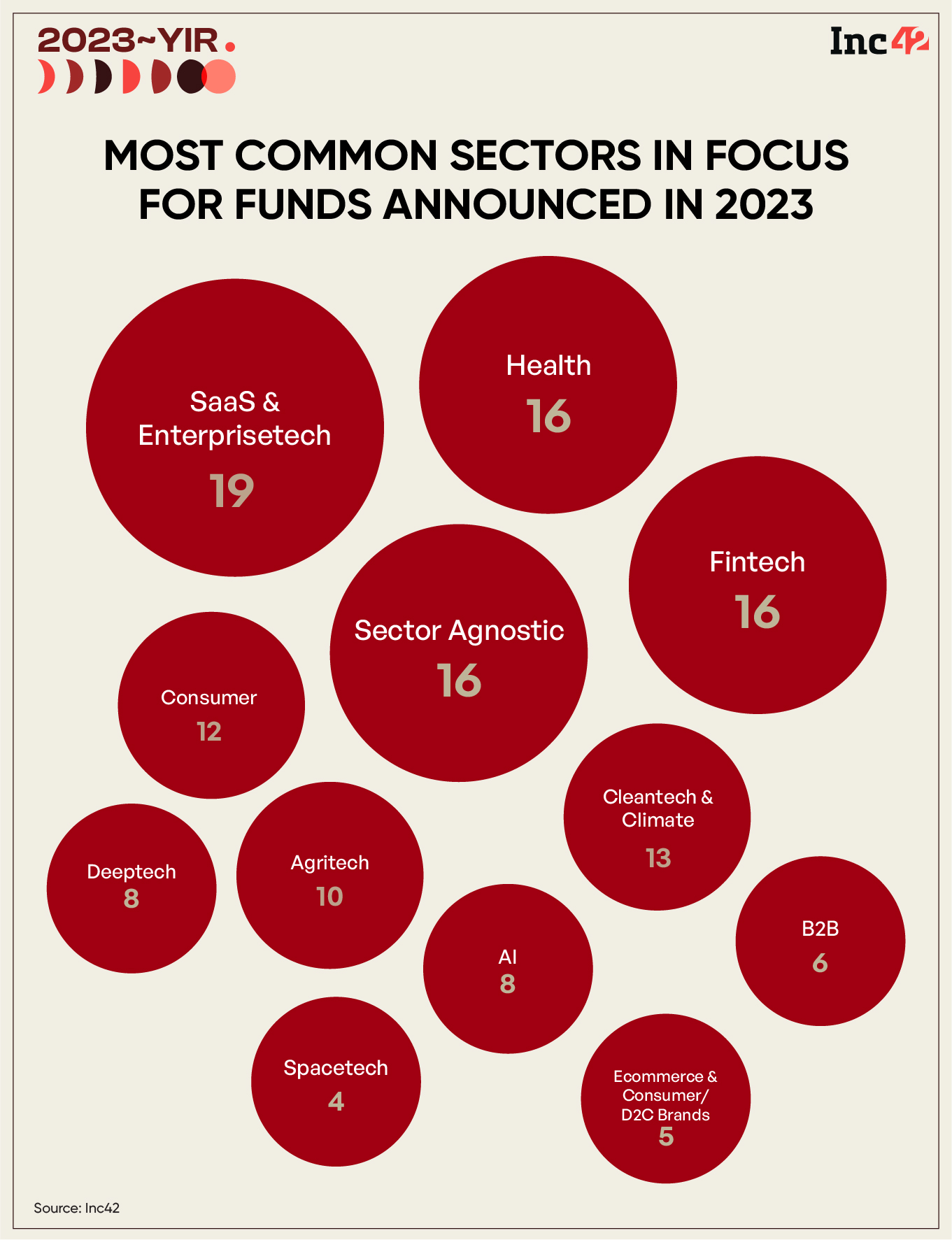

SaaS, Enterprise Tech Took The Spotlight

The year has seen a discernible trend toward sector-focussed fund launches in India. Out of the 64 funds launched so far this year, 19 have placed a strategic emphasis on SaaS-enterprise tech, with fintech closely following at 16 funds.

Pentathlon Ventures and Together Fund are among the VC firms that have launched SaaS-focussed funds.

Notably, the climate tech sector, which is still evolving in both investor perception and business models, continues to witness fund launches. Avaana Capital and Capria Ventures are notable VC funds that have introduced climate-focussed funds.

Meanwhile, AI has emerged as a newfound sweet spot in the VC arena, garnering significant attention and becoming a favoured investment choice for the year.

As of now, VCs are facing challenges in delivering returns to their LPs. Also, with the IPO market stagnant and M&A activities slow to pick up, many VCs have been unable to return capital to their LPs in the past 12 months.

Consequently, LPs are hesitant to inject additional capital into the ecosystem during this period of uncertainty. For now, the outlook for VC fund launches in 2024 remains uncertain, and it remains to be seen how the landscape will evolve in the coming year.

The post Dry Spell Reigns Havoc: Only 64 Funds Worth $5.6 Bn+ Launched In The Year Of Extended Funding Winter appeared first on Inc42 Media.

No comments