Balancing The Books: Here’re The Indian Startups Which Turned Profitable In FY23

The years 2020 and 2021 were among the most historical ones for the Indian startup ecosystem. Amid the Covid-19 pandemic wreaking havoc across the globe, Indian startups made a name for themselves on the back of their innovations. This resulted in global investors making a beeline to pump in capital in the country’s startup ecosystem.

Such was the gold rush to India that the startups in the country raked up a record $42 Bn funding. Every investor of note seemed to be wanting a piece of India’s digital ecosystem. The fear of missing out took over and the bottom lines of the startups in which capital was being infused took a back seat.

To put things into perspective, as many as 55 out of 74 Indian unicorns incurred a cumulative operating loss of $5.9 Bn in FY22, as per an Inc42 analysis. This was almost double the cumulative loss of $3 Bn incurred by 53 of these startups in FY21. However, this didn’t deter investors from participating in the funding rounds of these startups.

At the time, it seemed as if nothing could go wrong for the Indian startup ecosystem. Then, came the funding winter. Amid the global economic slowdown and tight liquidity, investors suddenly started focussing back on profitability and the growth-at-all-costs approach was thrown out of the window.

This came as a rude shock to Indian startups, which had got accustomed to the free-flowing funding scenario of the previous years. As investors tightened their purse strings, realisation struck that they needed to focus on their bottom lines to extend their runways and get fresh funding. This resulted in the start of restructuring exercises across startups.

Layoffs, pay cuts, and cuts in advertising expenses became the norm as turning profitable and cutting down loss became the top priority. As per Inc42’s layoff tracker, Indian startups have laid off over 29,000 employees so far.

But did it help Indian startups turn profitable? While a majority of Indian startups are still in the red, a few of them managed to turn profitable in FY23. Besides, many of them also managed to cut down on their losses.

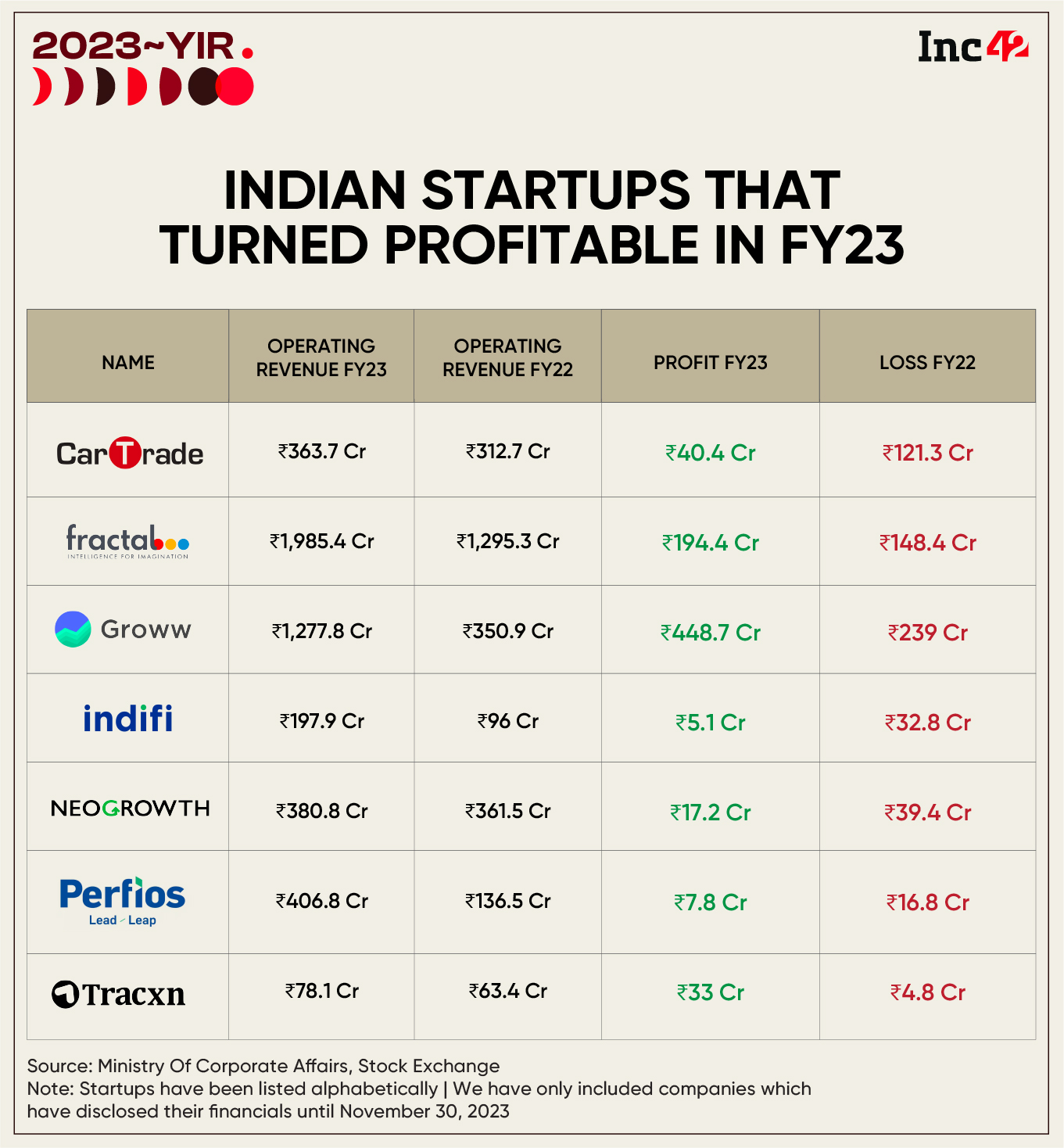

As 2023 nears its end, we have collated a list of startups that managed to turn around their business and became profitable in FY23.

Editor’s Note: This compilation is neither exhaustive nor a ranking of any kind. Startups are listed alphabetically.

Decline In ESOP Expenses Steers CarTrade To The Profitability Lane

Listed auto marketplace CarTrade turned profitable in FY23. It reported a net profit of INR 40.43 Cr in FY23 as against a net loss of INR 121.35 Cr in the previous fiscal year.

The sharp improvement could be attributed to the decline in its ESOP expenses, or non-cash share-based payment expenses. ESOP expenses plummeted to INR 27.94 Cr during the year under review from INR 185.18 Cr in FY22. This resulted in a drop in the startup’s overall expenses to 23.2% to INR 367.16 Cr in FY23 from INR 478.07 Cr.

On the other hand, the startup’s revenue from operations rose by 16% to INR 363.74 Cr during the year from INR 312.72 Cr.

Meanwhile, the startup has continued its profitable ride in FY24 as well. In Q2 FY24, it reported a 132% year-on-year (YoY) increase in consolidated profit to INR 12.96 Cr.

Exceptional Gain Catapults Fractal Into The Profitable Club

AI Intelligence startup Fractal, which took almost two decades to enter the unicorn club, reported a profit of INR 194.4 Cr in FY23 as against a loss of INR 148.4 Cr in the previous financial year.

However, the startup would still have posted a loss if not for an exceptional item gain of INR xxx Cr from the loss of control of a subsidiary company. An email sent to Fractal seeking information about this exceptional item gain didn’t elicit any response till the time of publishing this story.

Meanwhile, Fractal’s operating revenue zoomed 53% to INR 1,985.4 Cr in FY23 from INR 1,295.3 Cr in the previous year, with majority of the revenue coming from the US.

Founded in 2000 by Srikanth Velamakanni and Pranay Agrawal, along with core team members – Nirmal Palaparthi, Pradeep Suryanarayan, and Ramakrishna Reddy, Fractal offers AI and advanced analytics solutions to Fortune 500 companies.

The startup has raised a funding of around $680 Mn to date and counts TPG, Apax Partners, and Khazanah Nasional among its investors.

Groww’s Growing User Base Helps It Become Profitable

Billionbrains Garage Private Limited, the parent entity of Groww, turned profitable in FY23. It reported a net profit of INR 448.7 Cr in FY23 as against a loss of INR 239 Cr in the previous fiscal year.

The primary reason for the startup turning profitable was strong growth in its operating revenue, which rose over three-fold to INR 1,277.8 in FY23 from INR 351 Cr in the previous fiscal year. Meanwhile, total expenses rose a meagre 1.4X to INR 932.9 Cr.

The increase in operating revenue could be attributed to the startup’s growing user base. Groww surpassed bootstrapped unicorn Zerodha in terms of number of active investors at the end of September 2023.

As per National Stock Exchange (NSE) data, Groww had 6.63 Mn active investors at the end of September 2023 as against Zerodha’s 6.48 Mn.

Besides its stock broking platform, Groww has also started offering loans. Earlier this year, it rolled out UPI payments feature on its broking app and acquired the mutual fund business of Indiabulls Housing Finance for a consideration of INR 175.6 Cr.

Increase In MSME Lending Helps Indifi Post Profit

ICICI Venture-backed Indifi reported a profit of INR 5.1 Cr in FY23 as compared to a loss of INR 39 Cr in the previous fiscal year.

The improvement in the startup’s financials could be attributed to the 2X jump in its operating revenue. The MSME lender reported an operating revenue of INR 197.9 Cr in FY23 as against INR 96.29 Cr in the previous fiscal year.

As per Aloke Mittal, the founder of Indifi, the startup saw a sharp improvement in business during the pandemic due to higher demand from MSMEs for working capital. Amid the stay-at-home restriction, MSMEs relied more on digital lenders for their hassle-free and digital offerings than banks, which often require tedious paperwork and visits to the branch.

Lower Expenses Help NeoGrowth Report Profit

Mumbai-based non-banking financial company (NBFC) NeoGrowth turned profitable in FY23 on the back of decline in its expenses. The startup reported a profit of INR 17.2 Cr in FY23 against a loss of INR 39.4 Cr incurred in FY22.

Neogrowth’s operating revenue rose 5.3% to INR 381 Cr during the year under review from INR 361.5 Cr in FY22. At INR 363.1 Cr, the NBFC earned the biggest chunk of revenue from interest income in FY23. This number stood at INR 357.5 Cr in the previous year.

Besides interest income, NeoGrowth also earned revenue from commissions and fees. Total revenue rose to INR 382.9 Cr in FY23 from INR 362.7 Cr in FY22.

Meanwhile, total expenses declined 14% to INR 357.4 Cr in FY23 from INR 414.5 Cr in FY22.

The NBFC raised $66 Mn in a mix of debt and equity funding across multiple rounds in FY23. Overall, it has raised around $188 Mn to date and counts Dutch development bank FMO, Development Finance Corporation (DFC), Omidyar Network, and Lightrock among its backers.

Perfios Turns It Around In FY23

Fintech-focussed SaaS startup Perfios achieved profitability in the fiscal year ending on March 31, 2023, marking a significant milestone after four consecutive years of losses.

The Bengaluru-based company reported a profit of INR 7.8 Cr after incurring a net loss of INR 16.8 Cr in FY22.

In FY23, Perfios’ operating revenue surged nearly 200% YoY to INR 406.8 Cr compared to the INR 136.5 Cr reported in the preceding fiscal.

The company generates revenue by providing software solutions to financial institutions, covering areas such as analytics, onboarding automation, and due diligence.

Earlier this year, Perfios secured $229 Mn in its Series D funding round from Kedaara Capital.

Looking ahead, Perfios is gearing up for a public market listing within the next 18-24 months. For this, the company has appointed Sumit Nigam as the Chief Technology Officer (CTO) and Anu Mathew as the Chief People Officer (CPO).

Tracxn Takes The Profitability Route

Listed data intelligence platform Tracxn turned profitable in FY23 with a PAT of INR 33.09 Cr against a loss of INR 4.85 Cr a fiscal ago.

During the year under review, Tracxn recorded a deferred tax expense of INR 23.26 Cr. Additionally, in the December 2022 quarter, the company recovered INR 4.78 Cr, previously recognised as an IPO expense, from shareholders who sold their shares during the public offering.

Excluding the aforementioned recovery of IPO expenses and the deferred tax expense, the startup’s profit stood at INR 5.34 Cr in FY23 versus a loss of INR 36 Lakh in FY22.

The startup’s operating revenue rose 23% to INR 78.11 Cr in FY23 from INR 63.45 Cr in FY22 on the back of continued growth in large accounts and increased uptake of products globally, especially in India, the Americas, and Asia Pacific. It must be noted that around 70% of the startup’s revenue comes from outside India.

In the first quarter of FY24, the startup’s profit declined 18% to INR 69 Lakh from INR 1.36 Cr reported in the same quarter last fiscal year. Revenue from operations increased to INR 19.82 Cr, up 8% YoY.

The post Balancing The Books: Here’re The Indian Startups Which Turned Profitable In FY23 appeared first on Inc42 Media.

No comments