8 Startup IPO Predictions For 2024

The year 2023 turned out to be much better for initial public offerings (IPOs) in the Indian equities market on the back of the bullish sentiment in the broader market. Despite macroeconomic headwinds and global geopolitical tensions, the domestic IPO market saw a revival this year after the lull of 2022. The public issues of new-age tech startups also saw a sharp improvement in demand in 2023 compared to a listless 2022.

But before we delve deeper into the IPOs of new-age tech stocks, let’s take a quick look at the overall IPO landscape.

As per the BSE data, 92 companies took the IPO route in 2023 till mid-November as against 90 companies doing so in the entire 2022. The number of IPOs further crossed the 100 mark by the beginning of December this year. Interestingly, the number of SME IPOs in 2023 was more than the mainboard public listings.

While the sluggishness of the previous year continued in the first half of 2023, the situation turned on its head in the second half of 2023.

- Data collated by IIFL Securities suggest that out of the 48 mainboard listings in the first 11 months, 39 took place between July and November.

- Against the intended fundraising of INR 44,159 Cr across the 48 companies, the total subscription interest received across categories – qualified institutional buyers (QIBs), high net-worth individuals (HNIs) and retail investors – was to the tune of INR 14.29 Lakh Cr, as per the report by IIFL Securities.

- Tata Technologies’ public issue, the first IPO by the Tata Group in two decades, saw very high demand, receiving 70X subscriptions and bids worth INR 1.56 Lakh Cr. The other superstar IPOs of the season included Mankind Pharma, Gandhar Oil, and JSW Infrastructure.

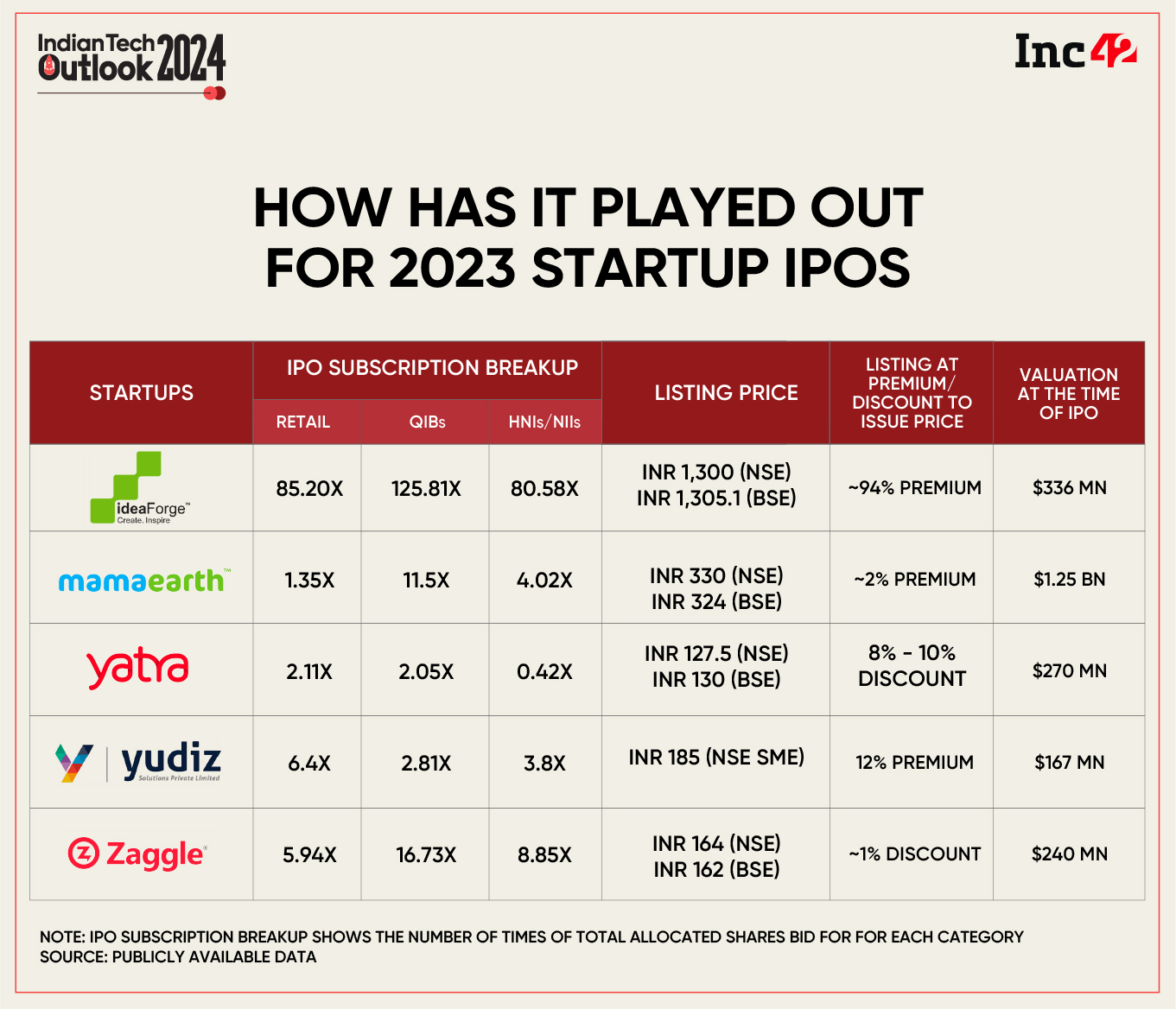

In the startup ecosystem, a total of five new-age tech companies – ideaForge, Mamaearth, Yatra, Zaggle, and Yudiz – went public in 2023, with one listing on the SME platform and the rest on the mainboard.

Overall, the cumulative size of these five startups’ IPOs stood at over INR 3,600 Cr as against a little over INR 5,500 Cr in 2022 and around INR 50,000 Cr in 2021.

It is pertinent to note that the year 2021 saw 11 new-age tech startups going for IPOs amid the funding boom and buoyancy in global stock markets post the pandemic, while only three such companies went public in 2022 – Delhivery and Tracxn Technologies on the mainboard and DroneAcharya on SME platform.

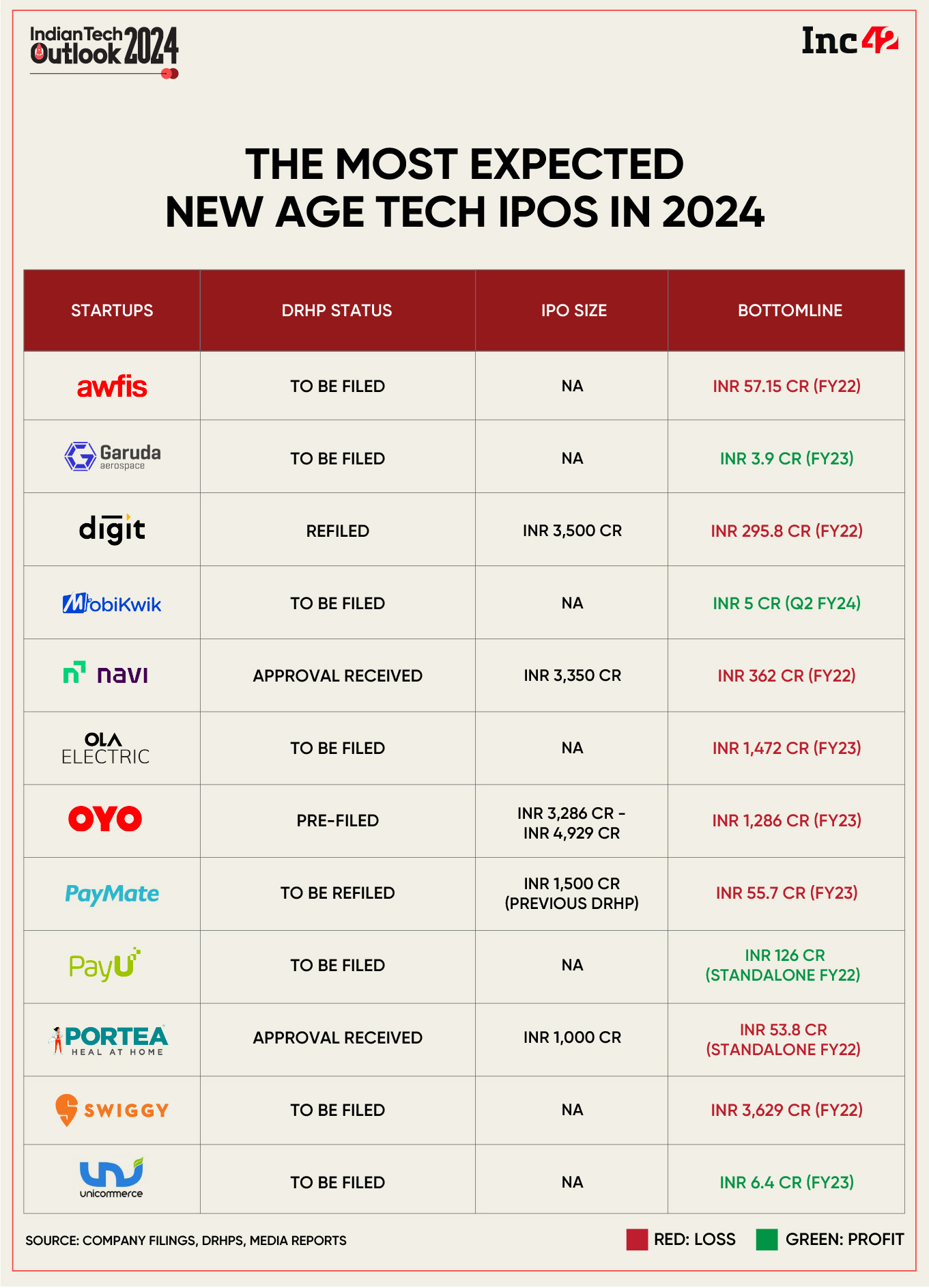

Despite at least 10 startups either filing DRHPs or announcing IPO plans, they didn’t make any progress last year as the market remained tumultuous. Even this year, many of them continued to defer their IPO plans. However, experts suggest that the number of new-age tech IPOs will rise in 2024 despite the startups continuing to be cautious about the timing of going public.

8 Startup IPO Predictions For 2024

According to a recently published EY report on Q3 2023 IPO data, the surge in activity in the Indian IPO landscape is driven by strong economic activity and positive domestic and foreign investor sentiments. This momentum is expected to continue well into the 2024 second half.

Now let’s take a deeper look at the key trends expected in the Indian new-age tech IPO market next year.

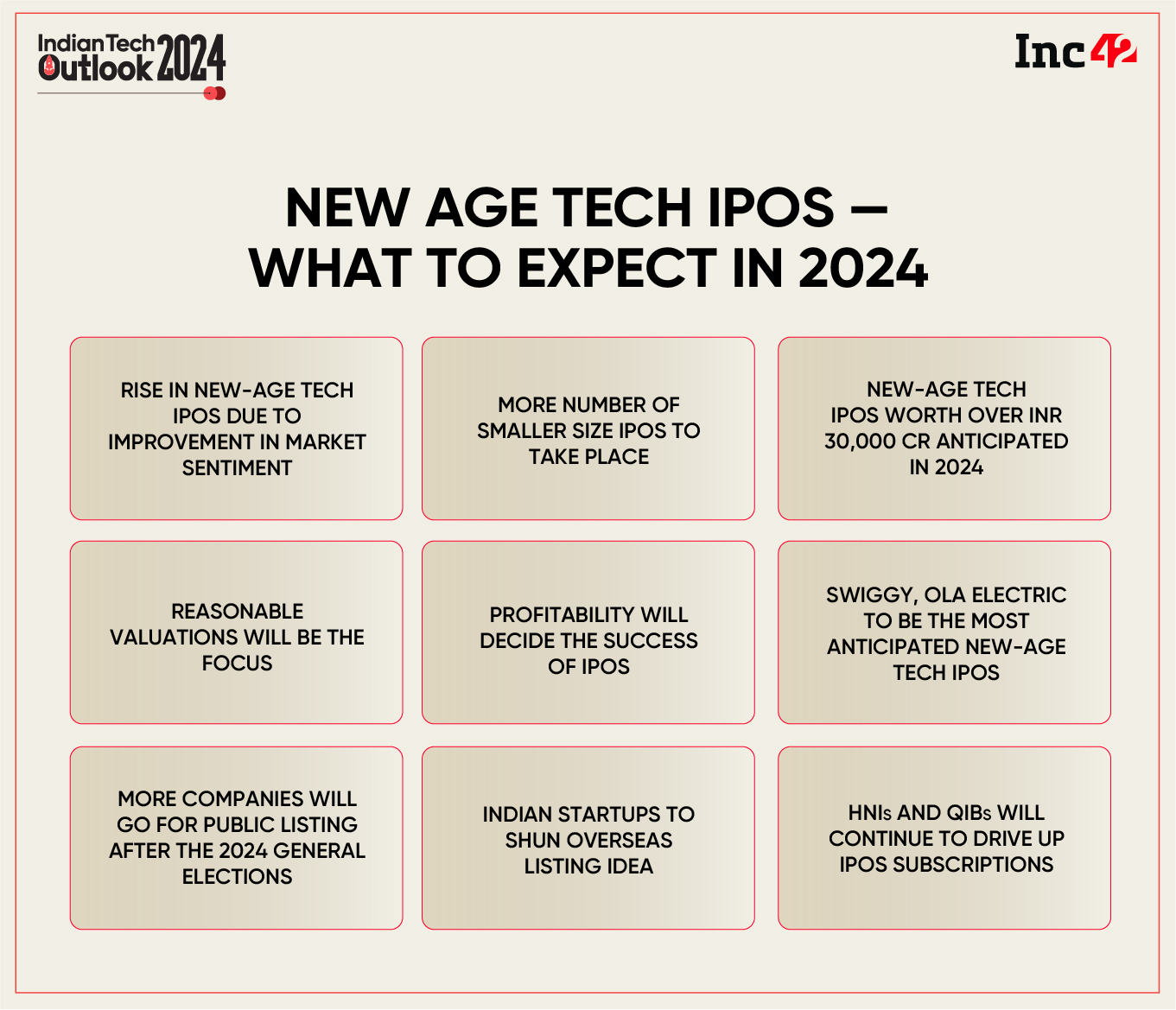

Bull Market Effect: Rising Number Of Tech Startups To Head For IPOs In 2024

Indian markets have been touching new all-time highs post the victory of the BJP in the recently-held Assembly elections in Rajasthan, Madhya Pradesh and Chhattisgarh. The dovish commentary of the US Fed this month further aided the rally. All these factors are expected to result in an increase in the number of new-age tech startups opting for IPOs in the coming year.

Deepak Shenoy, founder and CEO of Capitalmind, said that the current market is a bull market. This will result in the success of IPOs and lead to more such public issues in the next year. According to him, the chances of a big fall in the markets in the near term seem very low, despite the ongoing geopolitical tensions, high-interest rates in the US, and other macroeconomic uncertainties. This will encourage companies to take the IPO route.

Coming to new-age tech IPOs in 2024, they can be divided into three distinct categories:

- IPOs of companies which have already filed their draft red herring prospectus (DRHP) with SEBI;

- Companies which earlier filed their DRHPs but either withdrew or did not get listed due to uncertain market situation;

- Companies which began working aggressively on their IPO plans this year.

Navi Technologies, GoDigit, PayMate, Portea, EbixCash, and OYO, which has pre-filed its IPO papers with SEBI confidentially, are in the first category. These startups’ IPO size is cumulatively around INR 20,250 Cr.

It is pertinent to note that following the bankruptcy filing by Nasdaq-listed Ebix, the IPO of EbixCash now seems unlikely.

There are also not-so-prominent names like Travel Boutique Online, or TBO Tek, and agri-drone company AITMC Ventures which filed their DRHPs in 2023.

Mobikwik, Capillary Technologies, ixigo, and Snapdeal fall in the second bucket. Among these tech startups, fintech unicorn Mobikwik has reportedly restarted its IPO plans. Though there is no update on the IPO timelines for the rest, these companies were looking for the market condition to improve before their listings, hence 2024 could be a potential target for them to go public.

In the third category would be Zomato’s rival Swiggy, which has started its IPO preparations and recently hired investment bankers. Prosus-owned PayU and Peak XV Partners-backed Awfis are also said to be looking to soon file their draft IPO papers, while drone startup Garuda Aerospace is eyeing a mid-2024 listing.

Besides, emobility startup Ola Electric is also working on a 2024 IPO.

Swiggy, Ola Electric To Be The Most Awaited IPOs

Overall, at least 10 tech startups are expected to get listed next year. However, the IPOs of Swiggy and Ola Electric have already started creating buzz and would be the most watched out IPOs among the startups.

After picking a substantial share in the domestic two-wheeler EV market, Bhavish Aggarwal has decided to take Ola Electric public.

It is pertinent to note that the IPO plans for Aggarwal’s ride-hailing business Ola Cabs have been put on hold since 2022.

Coming back to Ola Electric, while the startup has made a name for itself in the two-wheeler EV market, it continues to burn cash and is loss making. Despite this, the startup is said to be looking at a market capitalisation of $10 Bn for the IPO.

On the other hand, Swiggy’s listing will make Zomato’s biggest competitor trade on the public bourses and give another option to investors looking to bet on the food delivery and quick commerce space.

Swiggy’s IPO is being deemed the biggest IPO by an internet company next year, with an issue size of $1 Bn (INR 8,300 Cr).

Mid-sized IPOs To Be The Theme Of The Year

Amid the slowdown in the global markets, the last two years saw an increase in the number of SME IPOs in India. While the mainboard IPOs did see a rise, the companies opted to go for smaller size for their public issues.

Highlighting this trend, Capitalmind’s Shenoy said that while the IPO market looks brilliant right now, the demand is not high when compared to what the market witnessed in 2021.

“Technically, while we are eloquent about the current IPO situation, this is a dip in the ocean in comparison to what was earlier,” he said, adding that the size of Paytm’s IPO was much higher than many other recent IPOs combined together.

It must be noted that Paytm’s IPO in 2021 was for over 18,000 Cr, while last year insurance company Life Insurance Company (LIC) went public with an IPO of over INR 21,000 Cr. However, both these companies saw muted listings and their share prices have remained under pressure after listing. This is also one of the reasons why companies don’t want to go for big IPOs.

Market experts believe that there is not enough investor appetite for big public issues. Hence, 2024 will mostly see companies going for more mid- and small-sized IPOs.

Elections To Decide The Timelines Of IPOs

With India going for general elections in 2024, experts believe that a lot of companies would wait for the election results before firming up timelines of their IPOs.

According to Lightspeed MD Anuj Bhargava, while Mamaearth’s public listing and its performance after that on the bourses will encourage a lot of other companies to take the IPO route, the general elections will play a major role in deciding the timeline of these IPOs.

The likes of OYO, Swiggy, and also FirstCry are said to be looking to list on the bourses after the results of the general elections are out.

It is also pertinent to note that Lightspeed is a major backer of IPO-bound OYO.

“Generally, people are a little bit cautious and wait for big political events to take shape. When you have something this substantial coming up, I think people normally like to wait and see the outcome before they make big decisions and IPOs are normally very big decisions… Investors also wait on the sidelines,” Bhargava said while explaining the rationale of the companies.

If the current government continues, as is the expectation and has been priced in right now, the current policies and regulations will continue. However, if a new government is to come, investors would want to see the new policies before they start investing in India, he added.

Fundamentals To Decide The Success Of IPOs

The slump in the share prices of the 11 new-age tech startups, which went public in 2021 despite most of them being loss-making, in 2022 shifted the focus on the fundamentals of companies.

For instance, Paytm, which made a muted debut on the bourses and listed at 1,955 on the BSE, saw its valuation nosedive nearly 68% in 2022. Similarly, Zomato, which had a market cap of over INR 1 Lakh Cr after its listing in July 2021, lost over 60% of its market value by the end of 2022.

This rout made other new-age tech companies looking to go public put their IPOs plans on hold and focus on improving their bottom lines first.

The rally in Zomato shares in 2023 on the back of it reporting back-to-back profitable quarters further highlighted how investors are looking for profitability. Like Zomato, Paytm and PB Fintech also saw a change in investor sentiment with the improvements in their bottom lines.

“Businesses today need to have strong growth, profitability or at least a clear path to profitability… it doesn’t matter which sectors they belong to… Profitability today is the biggest ask from the public market investors,” Lightspeed’s Bhargava said.

Startups, even those not mulling to go public anytime soon, have realised what the markets want, and the last few quarters have seen them chasing profitability. Consequently, many startups also reported their first profitable months and quarters recently, although it came at the expense of mass layoffs and other restructuring efforts in many cases.

- OYO claimed to have achieved its first-ever profitable quarter in Q2 FY24, with a projected profit of INR 16 Cr. But in pursuit of turning profitable, OYO carried out multiple restructuring exercises in the last one year, and laid off around 600 employees, as per Inc42’s layoff tracker.

- ixigo also turned profitable in FY23 after a loss-making FY22.

- Fintech unicorns MobiKwik and PayMate narrowed their net losses in FY23. Meanwhile, MobiKwik claimed to have been profitable in the first two quarters of FY24.

Speaking to Inc42 right after Mamaearth’s listing, Prashanth Tapse, research analyst, senior VP (research) at Mehta Equities, said there was no chance of more new-age, loss-making businesses entering the Indian market anytime soon.

Companies To Seek Reasonable Valuations

The listing of Nykaa, Paytm, Zomato, and a few others at staggering valuations and the subsequent wealth erosion last year has resulted in investors closely scrutinising the valuations of companies going for public listing. As a result, new-age tech companies are expected to go for reasonable valuations while pricing their shares during the IPO.

Speaking on the issue after Mamaearth’s listing, Tapse said that this is a market where companies should create value for shareholders and not for themselves.

Interestingly, there were speculations in 2022 that Mamaearth would seek a valuation of around $3 Bn for its IPO. However, the D2C unicorn put its IPO on hold amid subdued market conditions. Subsequently, it listed at a much lower valuation of $1.2 Bn in 2023. However, many experts termed even this valuation higher considering the market condition.

As such, experts believe that companies aiming to get lofty valuations will struggle in the IPO market.

Startups To Shun Overseas Listing Plans

One trend which has emerged clearly over the last few years is Indian startups looking to list on the exchanges in the country rather than going for overseas listing.

In 2021, Freshworks listed on Nasdaq, while Yatra listed on the exchange in 2016. MakeMyTrip too made its debut on Nasdaq in 2010.

However, this trend has seen a clear reversal. Recently, Yatra got its second listing in the Indian stock exchanges after Nasdaq. During its listing process on the Indian exchanges this year, Yatra hinted that it might take the decision to delist from the US stock market depending on several factors.

Meanwhile, PhonePe, which has also been mulling an IPO (likely in 2025), shifted its domicile to India from Singapore. As per reports, Groww and Razorpay are also likely to shift their base to India. While the decision of the fintech companies to move to India could be guided by regulatory concerns, several other factors like lower corporate tax rate, zero taxes on capital gains, and the Indian government’s efforts to ease compliances are also said to be promoting reverse flipping and encouraging startups to list in the home country.

Besides, the Centre is also looking at making it easier for startups to list in India. Efforts are on to create a framework to offer exemptions to startups to list on the exchanges at GIFT IFSC so that they can tap global investors from India.

Commenting on this, Bhargava said, “We would want all leading Indian companies to list in India and give domestic investors the ability to be part of their growth and value creation journey… the valuations and the investor following the tech companies will get in India are far superior to their prospects in other listing locations.”

As a result, no major Indian startups, except Zoomcar, which is eyeing a US listing through SPAC deal, are expected to go for overseas listing next year.

HNIs, Retail Investors To Drive Up IPO Subscriptions

Data suggests that there is increasing demand for Indian IPOs from HNIs and QIBs.

As per experts, SEBI’s decision to divide the non-institutional investor (NII) category into two – INR 2-10 Lakh and INR 10 Lakh and above – has given a big boost to IPO subscriptions.

In 2021, SEBI proposed that one-third of the HNI portion in all IPOs be reserved for investors belonging to the sub-category of INR 2-INR 10 Lakh, while the remaining part within the HNI category will be for applications of above INR 10 Lakh. The new rules came into effect from April 1, 2022.

As a result, to increase their gains, HNIs have started increasing the number of applications in both categories and are even applying in the name of their family members for IPOs, as per market watchers.

Speaking on the matter, Mukesh Kochar, national head of wealth at AUM Capital, said that the listing of a number of recent IPOs at a steep premium to their issue price has made public issues attractive for investors looking for short-term capital gains. This trend is expected to continue next year and push up IPO subscriptions.

Here’s a chart depicting the subscriptions for the new-age tech companies that went for IPOs in 2023:

Speaking on HNIs increasing their exposure in the Indian stock market, Bhargava highlighted that HNIs tend to diversify their holdings across geographies given various political and regulatory uncertainties and said that some of them are coming to India by choice and some by default.

“You see an Indian market that offers many growth opportunities. You see a very deep and liquid market, you see a stable government. You see high-quality entrepreneurs and businesses being formed… That’s when the HNIs think this is where I should put my money in next,” he added.

On the other hand, retail investors have also started increasing their exposure to the Indian stock market. From the comfort of trading online, even on mobile phones, to an increase in the number of household brands going public (like Zomato, Paytm, Mamaearth), a number of factors have played a role in increasing the participation of retail investors in the market.

Some experts also opined that a lot of time, retail investors get carried away by the buzz and end up applying for all IPOs rather than doing a quality or valuation check. Nonetheless, the increasing appetite of retail investors has provided a major boost to the new-age tech IPOs.

Besides direct investments, retail investors are also increasing their investments in mutual funds, which has led to higher IPO subscriptions.

“In the past, a majority of IPOs would be subscribed by foreign investors. Today, it’s the domestic institutions that subscribe to a large part of the offerings. And behind the domestic institutions are the domestic retailer investors that are putting in money via SIPs into mutual funds,” said Bhargava.

Considering the factors mentioned above, it seems that 2024 will be the year of IPOs of new-age tech startups. It will be interesting to see if 2024 turns out to be another 2021 or even better in terms of startup IPOs.

The post 8 Startup IPO Predictions For 2024 appeared first on Inc42 Media.

No comments