Decoding SEA Fund’s Investment Thesis, Deeptech Play & Value Creation Goals

In November 2022, Bengaluru-based early stage venture capital firm SEA Fund announced its INR 250 Cr Fund II and marked its first close at INR 30 Cr.

A Category II alternative investment fund (AIF) registered with the Securities and Exchange Board of India (SEBI), it targets to raise 60% of the corpus at the second close, likely to be completed by March-April 2024. The second vehicle is expected to reach a final close by the end of 2024.

At the LP (limited partners) level, the VC firm currently has an 80:20 investor ratio, with 80% hailing from India. However, it aims to take the ratio to 75:25 by the final close of Fund II.

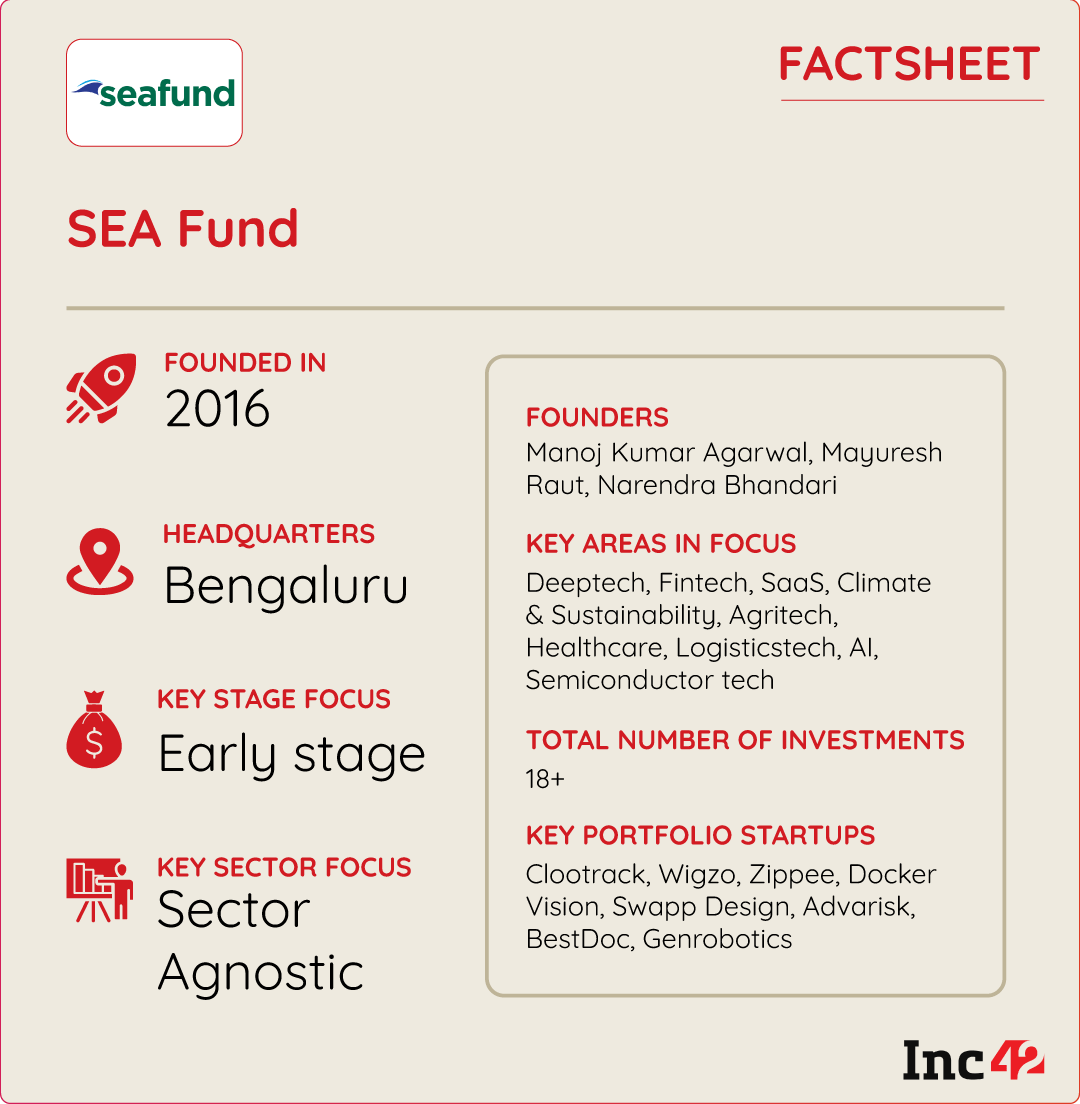

SEA Fund was set up in 2016 by Manoj Kumar Agarwal, Mayuresh Raut and Narendra Bhandari. It is primarily sector-agnostic, and the second fund focusses on startups from various industries but with significant involvement in deeptech play.

With an average ticket size of INR 2-5 Cr, SEA Fund II has already made early stage investments in five startups, including Docker Vision, Swapp Design, Simactricals, Evhicle and Red Wing. It aims to expand its portfolio and fund a total of 20 startups, which are building category-defining businesses.

“For instance, we will look more at neobanks under fintech or startups on the fintech infrastructure side. For climate tech, there could be solutions using blockchain or robotics. As for [sustainable] mobility, we are not looking at anyone making an electric vehicle (EV) or assembling and putting together the parts. We are looking for people in core solutions such as fast wireless charging or automated swapping technology. Robotics, semiconductors, drone logistics and cybersecurity are other areas we are exploring,” said Agarwal in a recent interaction with Inc42.

SEA Fund has made as many as 18 investments, of which 13 came from its first vehicle, a micro fund with a corpus of INR 25 Cr.

Fund I invested in 13 active startups across sectors such as SaaS, fintech, IoT (hardware), edtech and media tech. Advarisk, Bestdoc, Genrobotics, Clootrack, Inc42, Wigzo, Zippee and others were part of Fund I. Five of them are now gearing up for Series A, but two startups have already secured Series A funding.

Invest Right To Create An Impact: Reveal SEA Fund Founders

Agarwal emphasised that the three partners got together and brainstormed before they came up with an effective investment thesis that would create an impact.

“Our initial thought was how to engage with the startup ecosystem, which was growing and seemed to be growing in the right direction. So, the aim was never to give just money but to work with each startup closely,” he said.

During his journey spanning 30 years or more as a corporate executive, entrepreneur and investor, Agarwal also realised that many founders have good ideas. But they are not essentially [successful] entrepreneurs as they are young and do not understand the intricacies of building a business. A thorough understanding of the ground realities is critical to lay the foundation of a successful business.

“You may have the best product. But if you cannot manage [your business] or sell the product, you won’t be able to grow, and you won’t survive. And we thought there were areas where we could help,” he added.

The trio put together a fund structure to pursue their vision and started investing in 2018. Among their initial bets were a host of startups such as Inc42, Wigzo, Clootrack and more. The idea was to fund early stage entities where they could get involved seamlessly, without any friction.

“When you talk to the founders of our portfolio startups, you will realise how closely we work with them. I enjoy talking to them, but that doesn’t mean I should invest. You can’t invest in all of them; you only invest in some startups,” said Agarwal.

SEA Fund’s Core Investment Thesis

The fund primarily targets pre-seed to seed-level investments in homegrown startups. Its overarching goal is establishing a foundation for follow-on investments and putting nearly 50% of the corpus in follow-on rounds.

“Ideally, 75-80% of these startups would receive follow-on funding. We also aim for a second follow-on in at least 40-50% of the cases. Our second follow-on funding in good startups, can extend up to $2 Mn (INR 16.67 Cr),” said Agarwal.

As SEA Fund II is looking for startups specialising in core solutions, it will explore API-based offerings and other complex/transformative technologies. This approach would guarantee a cohesive and aligned investment strategy throughout the portfolio, emphasising disruptive technology play, he added.

Essentially, the overarching theme focusses on technology-driven solutions, ranging from medtech to insurtech to climate tech and anything and everything in-between. However, the VC firm does not prioritise segments like consumer tech or pure play D2C startups selling to end customers.

Exits & Future Bets

SEA Fund II aims to make at least two to three new investments in FY24, with a focus on climate, semiconductors and mobility. The VC firm also eyes follow-on investments in its portfolio companies.

The VC firm already had three successful exits from Genrobotics, Clootrack and Wigzo Technologies.

“We are now planning a few more exits from Fund I, either in March or June next year [2024]. As we continue to raise our second fund, we are seeing a huge interest in the Indian EV landscape even from LPs,” said Agarwal.

He further emphasised that the fund would continue its tech-focussed journey and stand out by creating unique value for startup founders in India.

[Edited by Sanghamitra Mandal]

The post Decoding SEA Fund’s Investment Thesis, Deeptech Play & Value Creation Goals appeared first on Inc42 Media.

No comments