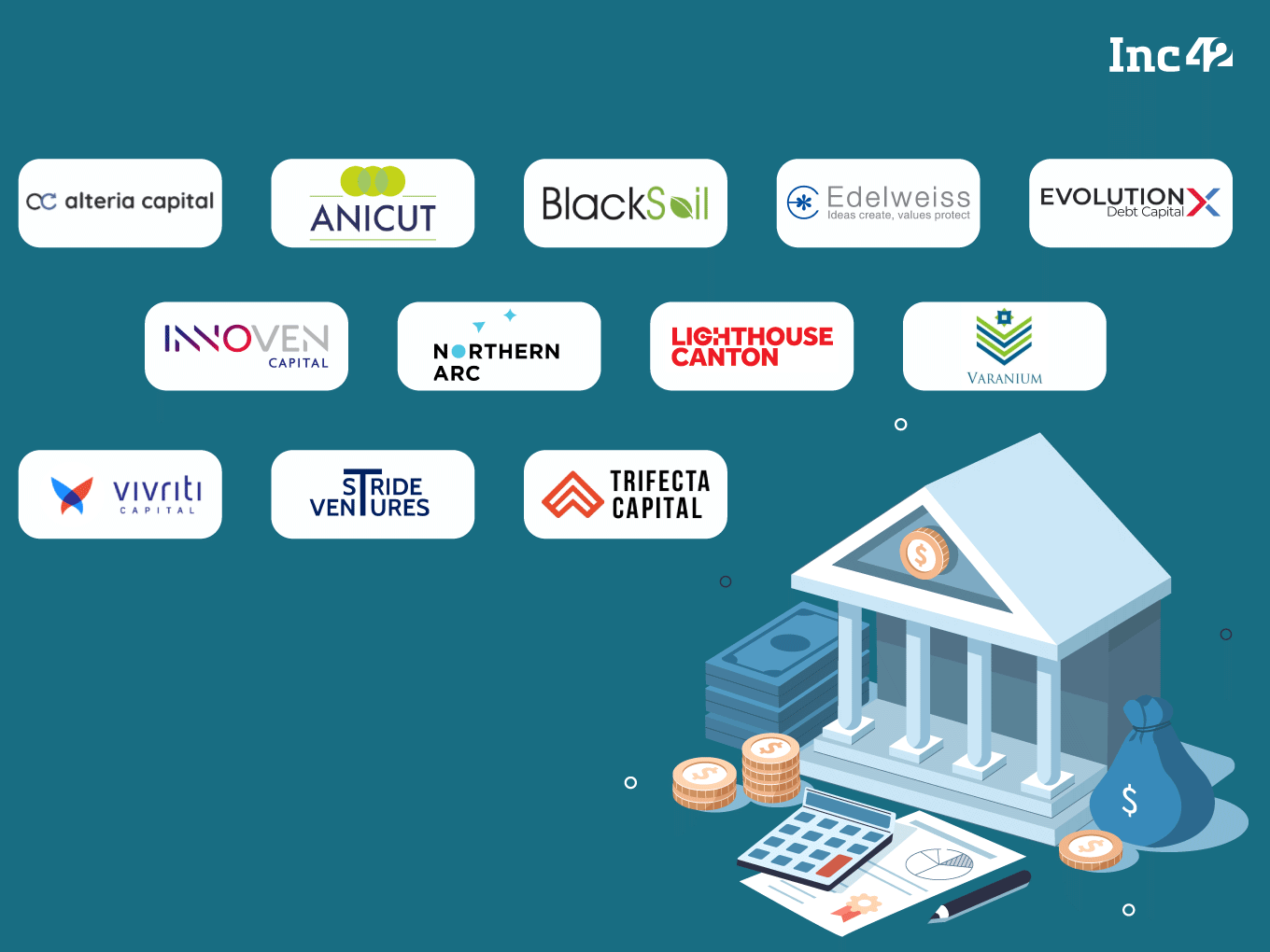

Most Active Venture Debt Funds For Indian Startups

As the Indian startup ecosystem continues to face a funding winter, the number of equity deals has significantly declined since last year. Consequently, many entrepreneurs are compelled to turn to debt as an alternative funding option.

According to Inc42’s Startup Investor Landscape Report 2023, debt funding investment deals grew by 16% between 2017 and 2022. Today, there are over 50 venture debt funds in India, and more than 200 startups have raised debt funding since 2015. In addition, Inc42’s H1 2023 Startup Funding Report found that between January and June 2023, Indian startups raised a total of $260.7 Mn in debt funding.

During the first half of the 2023, debt funding accounted for almost 4.81% of the total $5.4 Bn raised by the Indian startups, against only 1.48% during the second half of 2022.

With such numbers it will not be wrong to say that the Indian venture debt funding landscape looks quite promising.

It is to be noted that many investors find debt funding to be financially beneficial and secured as there is a regular inflow of the repayment until the predetermined amount is paid off. Such benefits and prevailing funding crunch paved the way for the debt lenders to nurture their businesses, leading to the increase in numbers.

In this article, Inc42 presents a list of some of the most prominent venture debt funds in India. This is not an exhaustive list or ranking of any kind and we have arranged the funds in an alphabetical order. We will keep adding more names to this list.

Alteria Capital

The fund was started in 2017 by Ajay Hattangdi and Vinod Murali, who served Silicon Valley Bank India on various leadership positions.

Headquartered in Mumbai, the venture debt fund claims to have funded 90 startups. Some of the notable startups it backed are BharatPe, Cars24, Spinny, Dunzo, Dealshare, Lendingkart, Stanza Living and more.

It participates in funding rounds between Series A to Series D, while the ticket size ranges between $100K to $15 Mn, and for the debt recovery, it allows a period of 12 to 36 months.

A stage agnostic fund, in March this year, extended debt to Bengaluru-based Jumbotail that operates in food and ecommerce B2B business, to help the startup build deep sourcing capabilities and AI-driven technologies to drive higher customer wallet share to grow its net revenue by 100%.

Grand Anicut Fund

Founded in 2016 by Ashvin Chadha and IAS Balamurugan, the fund participates in both equity and debt funding rounds. Grand Anicut focuses on investing in Indian startups operating in sectors other than infrastructure, real estate, and media.

Based out of Chennai, the fund counts startups like ASG Eye Hospitals, Azure Hospitality, SUGAR Cosmetics, Milky Mist, WOW Momo, Lendingkart, and many more under its structured debt portfolio.

With an Asset Under Management (AUM) of INR 1,600 Cr, it claims to have made 39 investments across 16 sectors and made 15 exits so far.

BlackSoil

Founded by Mohinder Pal Bansal, BlackSoil claims to be an alternative debt platform that majorly sources funds from HNIs and family offices. It supports the growing startups, which are underserved for their debt requirements by traditional banks and financial institutions.

Since its inception in 2016, it has served as a sector agnostic fund but segregates the portfolio into growth companies, financial institutions and supply chain partners. In each of these sectors, it has invested over INR 1,500 Cr, INR 450 Cr and INR 950 Cr, respectively, to date.

Its portfolio comprises startups like TVF, Yatra, Dunzo, Blusmart Mobility, MobiKwik, Infra.Market, and DeHaat, among others.

In April this year, BlackSoil raised $25 Mn in funding from multiple banks, family offices, corporate treasuries, and high-net-worth individuals.

Edelweiss Financial Services

Edelweiss is a prominent financial service provider that offers a range of services, including home loans, business and SME loans, and corporate credits. With a vast client base of 2.1 Mn, Edelweiss serves its customers through a network of over 300 offices spread across India. The company also has a strong presence in all major cities in the country, supported by a network of sub-brokers and authorised individuals.

Established in 1995 by Rashesh Shah, Edelweiss specialises in providing unsecured business loans ranging from INR 3.5 Lakh to INR 50 Lakh, with a maximum tenure of four years. Additionally, the company offers secured loans against property, with loan amounts ranging from INR 10 Lakh to INR 10 Cr and a tenure of up to 10 years.

Last year, it launched a debt fund of INR 3,000 Cr for Indian startups. Its portfolio comprises startups like THB, Ola, and Tonbo.

EvolutionX

Founded in 2021, EvolutionX is led by Rahul Shah, Serene Kee, Daphne Wong, Sakshi Shah, and Saurabh Jain. It is a growth stage debt financing platform, which has been jointly set up by DBS Bank and Singapore’s sovereign wealth fund Temasek.

The Singapore-based debt financing firm offers financial support to tech startups across Asia, with a focus on regions such as China, India, and Southeast Asia. A sector-agnostic firm, EvolutionX supports startups hailing from consumer, education, fintech, healthcare, logistics, industrial development, among others.

EvolutionX announced its maiden investment in November 2022 as it backed API Holdings which owns healthtech startup PharmEasy. Its latest investment came in June this year when it invested INR 200 Cr in Lendingkart.

Over the next two years, the debt financing platform aims to offer term debt facilities with ticket sizes in the range of $20 Mn to $50 Mn, along with warrants or convertible instruments.

Innoven Capital India

Started in 2008, the fund operates out of Mumbai. Led by a number of industry experts, the fund claims to have invested over $800 Mn in 200-plus startups.

It backs early and growth stage startups in the technology business. Other than India, it also operates in China and some parts of South East Asia.

Through the 12 years of investing business, it has garnered 35 unicorns, including Myntra, OYO, BYJU’S, PharmEasy, and many more.

Other than these unicorns, it has also supported startups like Faasos, Chaayos, Dailyhunt, mSwipe, etc.

Lighthouse Canton

Founded in 2014 by Shilpi Chowdhary, Lighthouse Canton operates as a wealth manager across the Asia Pacific region. It launched its India business and offices in New Delhi and Bengaluru in 2020.

Headquartered in Singapore, the fund aims to deliver systematic, resilient, and diversified strategies to help investors grow, manage and protect their wealth. According to the founder, Lighthouse is “a new-age global investment group with the ecosystem of a technology startup and the culture of a seasoned financial institution”.

Lighthouse focuses on SMEs, growth and early stage startups, and real estate businesses. However, it also offers wealth management services to corporates, ultra-high net worth individuals, family offices, and founders.

Earlier this year, it led a debt funding round of INR 24 Cr in lendingtech startup LoanTap.

Northern Arc

Founded by Kshama Fernandes in 2008, the debt fund claims to have a base of over 400 investors. According to its website, the fund has enabled a funding of about $15 Bn since its inception.

It analyses data and technology to offer credit services to emerging startups and small businesses across multiple geographies and segments. It claims to be present across 657 districts in 28 states and 7 Union Territories in India. To date, it has disbursed over 6 Mn loans to retail customers across individuals, households and small businesses through its partners.

In April this year, it participated in a debt funding round of cloud kitchen startup Rebel Foods.

Stride Ventures

Launched in 2019 by Ishpreet Gandhi, Stride Ventures is headquartered in New Delhi and claims to have made 100 investments till date.

Stride Ventures has raised a total of $314.1 Mn across three funds. In May, it announced the first close of its third fund at $100 Mn. The fund, which has a target corpus of $200 Mn, has received backing from several institutional investors, including banks, insurance companies, and family offices.

Stride Ventures counts HomeLane, MyGlamm, Spinny, Infra.Market, Blusmart Mobility, and Tender Cuts among its portfolio startups.

Trifecta Capital

Founded in 2015 by Nilesh Kothari and Rahul Khanna, Trifecta provides equity as well as debt funding to startups. In addition, it also offers financial advisory services to its portfolio startups.

Trifecta focuses on startups from industries like consumer services, consumer brands, ecommerce, mobility, edtech, agritech, among others.

Startups like Atomberg, BharatPe, Aqua Connect, BigBasket, and Biryani By Kilo are part of its credit portfolio.

Varanium Capital Advisors

Varanium primarily advises high-net-worth individuals (HNIs) on investment solutions. Varanium made a big splash in the venture debt space in July 2023 as it announced the first close of its maiden debt fund with a target corpus of INR 250 Cr and a greenshoe option of INR 50 Cr.

The venture debt platform is led by Nawal Bachhuka, principal of the venture fund at Varanium, whose prior experience includes Aditya Birla Finance.

The debt financier claims to manage $1 Bn in assets across multiple asset classes. It aims to back around 100 startups in India through revenue-based financing and traditional venture debt.

The primary focus of Varanium is to back startups from the D2C, SaaS, B2B ecommerce and fintech industries.

Vivriti Asset Management

Vivriti Capital was launched in 2017 by Aniket Deshpande, Gaurav Kumar, Irfan Mohammed, Soumendra Ghosh and Vineet Sukumar. It is a tech-enabled marketplace that connects capital markets investors with institutions, small enterprises and individuals.

In 2019, it launched Vivriti Asset Management, a fund management company that entirely focuses on medium-sized enterprises. With a combined AUM of $730 Mn, Vivriti manages a diverse portfolio of 250-plus mid-market enterprises across various sectors.

In May 2023, it announced the launch of Vivriti India Retail Assets Fund (VIRAF) with a $30 Mn investment from the International Financial Corporation (IFC). With this, Vivriti aims to scale investments in securitised debt securities with MSE-backed assets.

Last year, Vivriti Capital raised $30 Mn in a Series C funding round from TVS Shriram Growth Fund III, a private equity fund managed by TVS Capital. It said that the funding would be used to focus on the mid-market debt space, bringing global and domestic investors to mid-sized enterprises at scale.

This is not an exhaustive list or ranking of any kind and we have arranged the funds in an alphabetical order. We will keep adding more names to this list.

One fund has been removed from this list. Apologies for the error.

The post Most Active Venture Debt Funds For Indian Startups appeared first on Inc42 Media.

No comments